This morning, Dropsuite (ASX: DSE) released its quarterly update for Q2 FY 2023, remembering it operates on a calendar year. Importantly, the market also reacted to the announcement by Microsoft that it would offer an archiving and backup service, sending the shares tumbling by more than 30%, at one stage.

On the quarterly conference call, the company said it did not expect any impact from the announcement by Microsoft. The core reason for this is that it offers a backup solution that is not stored on Microsoft’s Azure server, whereas Microsoft’s solution would be stored on Azure.

The CEO Charif El-Ansari implied that the main purpose for the Syntex platform was to “make it really easy for data to be pulled out of Microsoft 365 and make it available to be organised to apply AI”, and that backup and archiving was more of a secondary use case.

He said:

“We have always been an independent backup taking it from Microsoft and moving it to AWS so that it is a true backup. Microsoft will continue being very clear in their TOS they are not responsible for your data if you lose it… we will be responsible for it.”

This highlights once more what a huge disaster it would be if Dropsuite’s backup ever failed. But it also highlights a key reason the end customer might be convinced to use Dropsuite for backup, over the Microsoft-powered offering.

On top of that, the CEO argued that customers of the Microsoft solution would be paying “at least $5- $8 USD (per seat)”, whereas Dropsuite customers pay closer to $3. El-Ansari also reminded investors that “We estimate 80%+ are still not backing up”, so even if Syntex is chosen by some customers, there is plenty of room for all players to grow, without convincing new clients to change provider.

While El-Ansari acknowledged that Microsoft Backup are now including a restore service level agreement and charging separately for the offering, he argued that because it was stored on Azure servers, “this is not a true backup and disaster recovery solution.”

I’m not sure how powerful this differentiating feature is for Dropsuite. It’s not surprise they are emphasising it now. One cybersecurity professional I asked said he thought adoption of the Microsoft alternative would be good. Therefore, I think it’s fair to assume that this development will significantly reduce the total addressable market for Dropsuite.

I doubt that will impact the company in the short term, but it certainly may curtail growth in the medium term.

In contrast, the CEO said that the independence selling point is “something we lead with in every conversation”, and as a result he does not expect the launch of Syntex in September to impact Dropsuite.

My current thinking is that the Microsoft news is simply a reminder that Dropsuite operates in a competitive, growing market. Because of this there is a real risk that I am wrong to believe the company can sustain net profit margins of over 10%, when it reaches bigger scale. On top of that, actually competing with Microsoft is almost always undesirable.

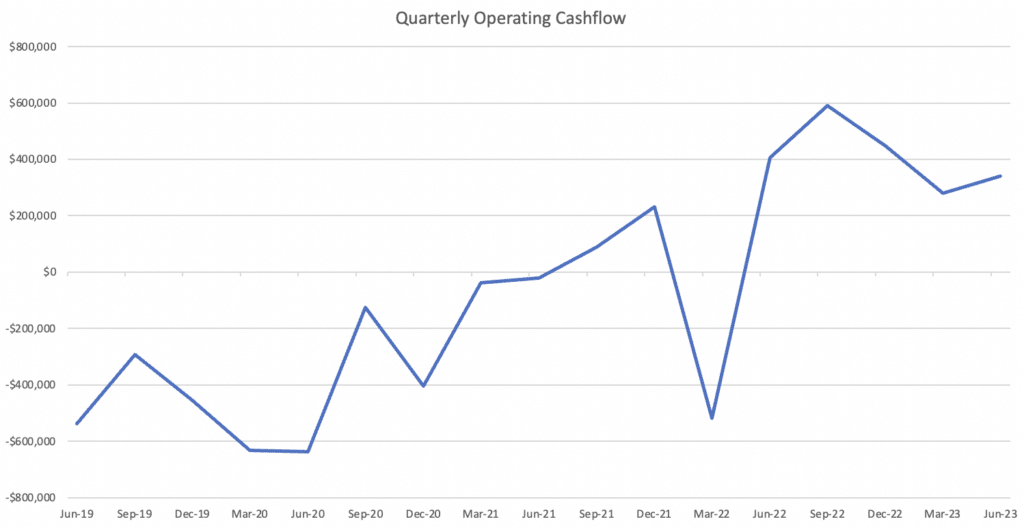

Turning to the numbers, Dropsuite reported ARR of $30.4 million, up 8% quarter on quarter, and operating cash flow of about $340,000. Gross margins were stable at 69% and the cash balance increased by about $300,000, to $23 million indicating solid conversion of operating cashflow into free cash flow.

As you can see below, this is the fifth consecutive quarter of positive operating cashflow.

While the ARR growth was solid, the incremental increase of $2.2 million was less than the last few quarters, and towards the bottom end of the range over the last couple of years. Therefore, it’s fair to say this quarter was slightly soft.

That said, the company has been investing in growing its MSP partner numbers, up by 285, and paying users up 63,000 to 1.08 million, a gain of 6%. The company confirmed that cash generation for the full year should be better or higher than the prior year, and that it would be profitable and expected solid growth.

Overall, on the current trajectory, it should take about 2 – 3 years for the company to double in size, at which point it would have around $55 million to $60 million in revenue. It’s pretty easy to imagine this business, earning over 10% net profit after tax. That’s would mean profit of around $6 million.

At the current share price of $0.275, the company has a market capitalisation of just under $200 million, implying a hypothetical P/E ratio of around 33 on a hypothetical profit of $6m. So that implies that the company needs to grow a bit faster than it did this quarter, to be confident of a good return over 3 years. However, if it keeps growing beyond $60m, at around its current rate, and doubles again, then it seems quite likely today’s prices would look very cheap. It might take 5 or 6 years, but if Dropsuite does reach over $120m revenue, with solid profit margins, I would expect a much higher share price than today.

To my mind, that’s plausible, and the company continues to invest significantly in growing its sales team in order to drive that growth. However, because Dropsuite needs to onboard MSPs to grow, and then wait for those MSPs to sell its product, there is a lag between hiring sales staff, and increased sales.

Overall, this quarterly result looked solid to me, but the news about Microsoft’s Syntex is a real negative. Given the increased share price, and the negative, I’m definitely more cautious of Dropsuite than I was before.

Therefore, I will continue to give further consideration as to whether I should move the company to Hold, on account of today’s news and the share price rise since the time of recommendation. I cannot yet be confident how significant today’s announcement from Microsoft actually is. Maybe nobody really knows. To my mind, there is a risk that MSP partners are attracted by the higher price point to Syntex, and therefore prefer it to Dropsuite’s solution.

However, for now, I still find Dropsuite shares an attractive speculation because the numbers keep moving in the right direction. It’s not obvious to me that Syntex will really kill Dropsuite’s growth, even if it does reduce its growth. There is a real possibility that the systemic differentiation (using AWS to store the data instead of Azure) is enough for Dropsuite to continue its sales growth.

With time, I could definitely see Dropsuite attract a lot more attention as a stock, given it is a growing, profitable business, operating in the cybersecurity space. There aren’t many of those on the ASX.

Please note that this advice is general advice only. I have not considered your investment objectives and this is not personal advice. The author owns shares in Dropsuite and will not trade shares in DSE for at least 2 days after publishing this article. This advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.