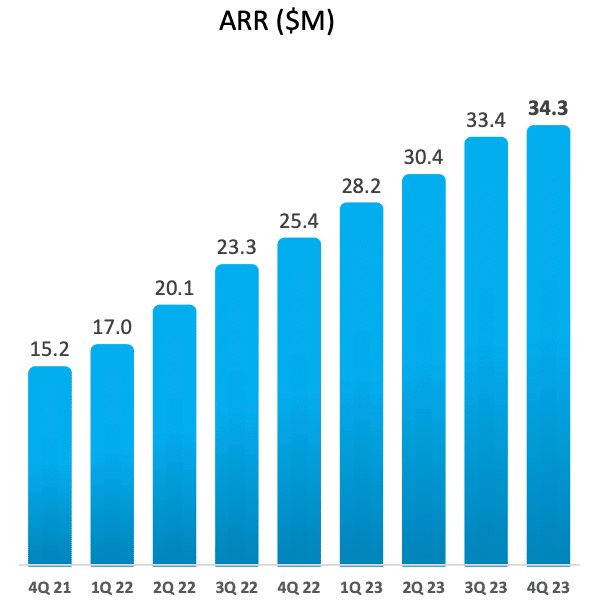

This morning, Dropsuite (ASX: DSE) released its update for Q4 FY 2023, disclosing disappointing quarter on quarter ARR growth of just 3%, as you can see below.

However, the mild silver lining was that currency changes impacted this growth rate negatively. In constant currency, growth was about 7%. Not amazing but not bad either, given that would annualise to over 30%. Therefore, I am not overly concerned about the lower growth this quarter.

That said, this was also a weak quarter for cash from operations and free cash flow. We can surmise (from disclosures around cash reserves) that free cash flow was cash burn of about $300k (since cash dropped from $24.6m to $24.3m over the quarter). When it comes to operating cashflow, the $270k produced in the quarter to December (Q4) was well below the previous quarter, as you can see, below:

However, this was not unexpected. As I said in my coverage of the Q3 FY 2023 Dropsuite results:

“The company was sure to highlight that this quarter benefitted from good timing; for example, some payments shifted a few days from last quarter (which was a bit weak) to this quarter. Therefore, while we can certainly rejoice in the positive longer term trajectory of Dropsuite’s operating cashflow, we should prepare ourselves for the likelihood that this was a somewhat lucky quarter (and operating cashflow may drop in a future quarter).”

Arguably, the most notable element of these results is that the company says that in FY 2024 it will be “Maintaining cashflow and profitability broadly in line with FY23 levels.” This is disappointing for me because I would like it if the company would commit to growing cashflow and profitability, every year, without fail.

However, the company wants to increase expenditure in line with revenues because it wants to invest more in R&D and Go-To-Market functions in order to sustain growth momentum. Given that Dropsuite has plenty of cash and has generated free cash flow of approximately $2m in FY 2023, my overwhelming view is that the management ought to be trusted to execute their growth strategy, even if it is a little more aggressive than I would prefer.

I would like to know what the precise additional expenditure on the Go-To-Market strategy entails and will submit that question to management. I hope it will be answered in the quarterly management Webinar, tomorrow at 11am.

Disclosure: the author of this article owns shares in Dropsuite and will not trade them within 2 days of publication. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter