Generally speaking (for example) you’ll see me writing about businesses that are high growth, have high profit margins, and have highly recurring revenue. But I also like to take a look at growing companies on high dividend yields. In the past, this heuristic has helped me find both Capilano Honey and Dicker Data. Importantly, heuristics don’t always work as a guide to investing, and I only really use them as a guide to what deserves more of my attention.

Invoice financing company EarlyPay (ASX: EPY) caught my eye because it demonstrates insider alignment, guidance upgrades, a high dividend yield, and smart fellow shareholders. EarlyPay provides invoice financing and trade financing, which is essentially loaning money to a range of small businesses. EarlyPay can then collect on the invoices offered as collateral, or take possession of stock if a borrower doesn’t pay.

Obviously, that’s not exactly an attractive business model, because EarlyPay runs the risk that they cannot recover their loans. However, before talking about the risks, lets look at the reasons I like it:

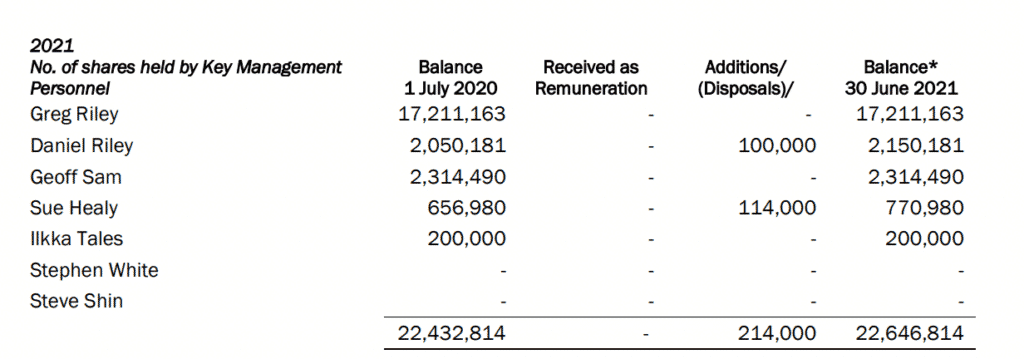

- Aligned board. One director bought $100k in November 2021 and you can see that the founder and Chairman, Greg Riley, and his CEO son Daniel own many millions worth of shares, as you can see below.

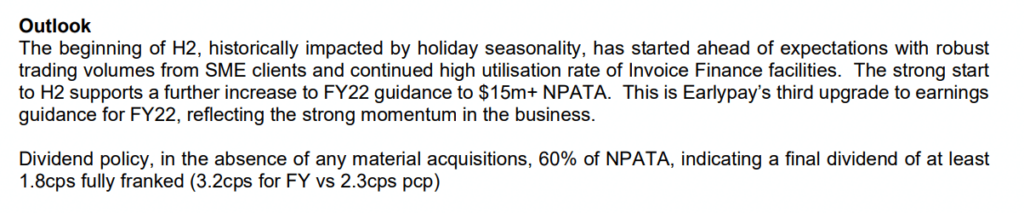

- Multiple profit upgrades. EarlyPay upgraded its guidance for FY 2022 here and here, and then once again in its most recent results, for the half year to December 2021

- High dividend yield. Based on the guidance above, EarlyPay is expected to pay at least 3.2 cents in dividends for FY 2022. It has just gone ex-dividend, paying 1.4 cents to holders, so in around six months, we could expect another 1.8 cents to be paid. At the current share price of 47 cents, that’s a yield of 6.8%, fully franked. Once you include franking credits, that’s a grossed up yield of 9.7%.

- EarlyPay has at least 3 micro-cap managers that I admire as investors. DMX Asset Management, Merewether Capital, and Westferry all own shares. I don’t need to see other investors I admire in a company to feel confident. And I certainly don’t just buy anything that I see someone I like own shares in. However, this grouping gives me a little bit of confidence because each is a long term investor who specialises in micro-caps. I suspect that like me, none of them are at their most confident investing in a finance company, hence why they would be more likely to own one that is paying a good dividend.

What Are The Risks With Earlypay?

The main reason that Earlypay shares deserve to be cheap is that they are in what I would consider to be a bad business; invoice financing. Basically, the way it works is that an accountant or an architect or a lawyer can sell their invoice to Earlypay. Check out the “case study” for a Plumber, from their website:

“Good plumbing is always in demand. How do you find cash flow to take on new contracts? A plumbing and gas business in Perth, has been helping local business by providing a range of services. These include gas installations, water and waste management, drainage and kitchen plumbing. They have been looking to increase their workforce and maintenance work, requiring a tailored cash flow solution to assist them. Upon referral from a broker, Earlypay provided an Invoice Financing facility, which leveraged their unpaid debtor book to give them access to the cash flow required to pursue their plans.“

Now, the long and the short of it is that Earlypay buys the invoices from whatever randoms are supposed to pay the plumber. They are the less informed buyer here. For example, hypothetically, the plumber may have slept with the client’s husband, and she may be unwilling to pay or contesting the invoice out of anger.

That may seem ridiculous, but you get the point. I don’t love the assets Earlypay is buying.

However, one gets some comfort from the fact that the leadership is well aligned and the listed entity (previously CML, and before that Careers MultiList) has existed for very many years. That isn’t a sign of success but it does mean that the leaders have stewarded a business for many years without blowing up, defrauding people, or coming into severe disrepute. That is especially valuable given investing in an invoice financing business is to trust the judgment of the people running it.

You can see the long term share price below (noting the business has pivoted a few times in its history).

At the end of the day, this investment diary note is to put on record my rationale for buying the stock. Basically, I have a lot of cash sitting on the sidelines at the moment, burning a hole in my pocket. I don’t want to give the impression I love the EarlyPay business long term, because I don’t. However, I do think a 6.8% dividend yield is a decent result that doesn’t bring too much risk.

Ultimately, if I saw insider selling, or if the yield dropped below 5%, I’d probably sell my shares in EarlyPay. Ideally, it will continue to outperform in terms of profit and achieve a higher multiple, allowing a quick profit.

Alternatively, I would hope that the aligned management might seek to enrich themselves via dividends, and help out all shareholders in the process. In that scenario it might pay off to just hold the Earlypay shares for the long term.

Obviously, there’s plenty more to think about with Earlypay than my standard long term investment. In particular, I believe that the company is exposed to the economic cycle in a way that means it could blow up. As a result, I wouldn’t want to tolerate an increasing level of defaults.

You can hear me talk more about EarlyPay in this Ausbiz interview.

Please remember that these are personal reflections about a stock by author. I own shares in EarlyPay, and will not sell any for at least 2 business days after publishing this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.