As investors we are naturally interested in high growth high potential stocks that have considerable risks but also offer considerable reward. That’s all well and good, but I believe that defensive and conservative value investments still have a place in my portfolio as they bring thesis diversity and have the potential to perform even when animal spirits wane.

A relentless 20 page thesis may be convincing for many but a basic investment idea should stand up based on a few simple, testable premises. Here are mine for Ebos Group (ASX: EBO).

- Allowing for capital expenditure but dispensing with growth by acquisition, EBOS Group generates enough free cash flow to pay its current dividend, which costs the company $105.3 million per year.

- The company has a strong balance sheet that can be used to fuel growth, so the dividend will grow over time.

- At some point the broader market will come to have a greater appreciation for Ebos (ASX: EBO) shares, leading to a high probability of share price outperformance in a bear market and a high probability of positive absolute share price performance in a bull market.

In this post I will try to convince myself of these three points. But before getting into the nitty gritty, I must outline what Ebos does.

What Does Ebos Group Do?

Ebos owns the Terry White Chemmart brand of franchised pharmacies (numbering around 500) and is the main distributor for these pharmacies through its Symbion wholesale operation. Symbion is also the distributor for Chemist’s Warehouse and distributes to over 4,000 pharmacy customers in Australia.

While distributing to retail behemoths like Chemist’s Warehouse is a razor thin margin operation, it does provide valuable scale to this Australasian distribution businesses. That makes Symbion, with 10 warehouses around the country, the largest supplier of medicines to community pharmacy, public and private hospitals and health agencies. The ongoing profitability and success of this company is thus linked to our success as a nation. If it falls, we all fall with it.

Ebos group also has a large number of smaller operations, including retail brands, that make up its human healthcare and animal healthcare divisions. You can see how the gross operating revenue is split below (per the 1st Half of FY 2020).

Pharmacy (retail and wholesale): 49%

Institutional healthcare (day hospitals etc.): 24%

Animal care: 13%

Contract logistics (use of distribution assets): 9%

Owned retail brands: 5%

Nature of the Business

At its core, I see Ebos group as a low margin distributor and retailer. I think it should be low margin, because as an ‘essential service’ company, it serves society best (and creates the most value) by maximising efficiency. It should grow more by gaining scale than by increasing prices; and indeed regulation will prevent undue price increases. Since FY 2014, its earnings before interest and taxation margin has varied from about 2.6% to 3.3% which I believe is sustainable and reasonable.

For reference, the other distribution company I own shares in, Dicker Data (ASX: DDR) has seen its EBIT margin vary from 2.7% to 4%. In this game, margins are essentially determined by how efficient an operation is relative to its competitors; so it would be surprising to see anything much higher than about 4%.

Does Ebos Group Generate Enough Free Cashflow To Cover Its Dividend Without Growth?

For me, a conservative investment means that if I just hold shares in it indefinitely, I will get a decent payout. If Ebos cannot maintain its dividend at approximately current rates over the cycle, then this is not the conservative or defensive investment I am looking for.

In the last 12 months, Ebos group spent just under $110m in dividend payments to shareholders. At the current ASX share price of $21.09 (AUD) the company trades on a trailing yield of about 3%. Given so much of its profits are generated in Australia, the dividend is mostly franked, so the ‘grossed up’ yield after franking credits is about 4%.

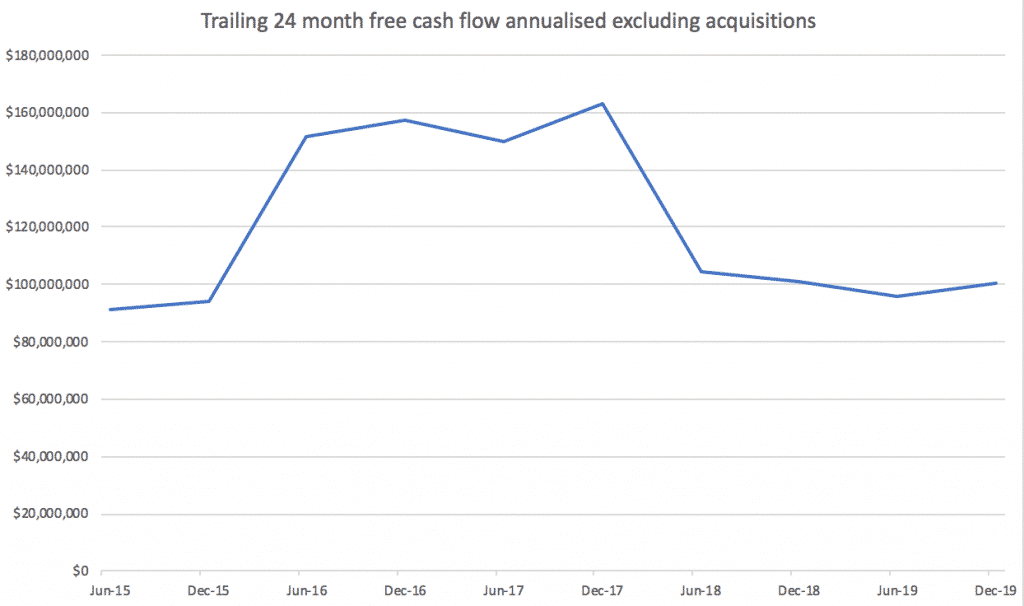

Ebos has fairly lumpy operating cashflow because of swings in working capital (that is, payables, receivables, inventory and the like). Therefore, I annualised its trailing 24 month free cash flow (calculated to exclude acquisitions). The period of elevated free cash flow was attributed to one large blow out in payables (a reduction in working capital which boosts cashflow temporarily). But what you can see is that excluding acquisitions the company appears to be able to consistently generate enough free cash flow to cover its dividend.

Does Ebos Group Have The Balance Sheet Room To Grow?

As you may recall, a key part of my recent attraction to companies like Ebos group is that — as a result of the pandemic — all large creditworthy companies have had very easy access to debt. Ebos currently has net debt of $392 million. Given its free cash flow generating abilities mentioned above, it’s pretty likely it could extinguish that debt with 4 years of zero dividend.

However, the company has about $666m in total debt. In the last half the company paid $12.3m in borrowing costs, which suggests a blended interest rate of about 3.7%.

That cost is likely to remain at those levels or lower, all else being equal, reflecting the creditworthiness of its business and the ongoing low rate environment. But what is clear is that the company can easily afford to borrow more money if it sees attractive acquisition or investment opportunities. Its existing size, rather than access to capital, is what is likely to constrain its growth.

Is The Share Price Depressed?

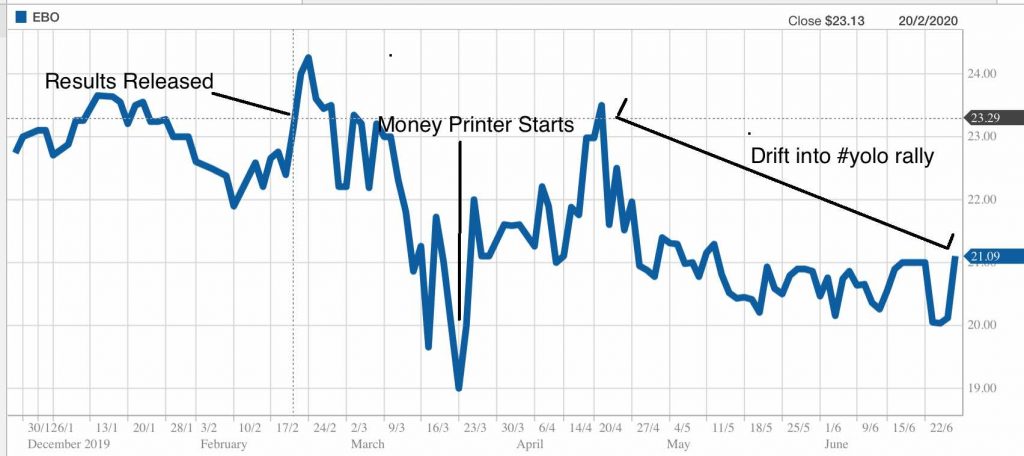

Despite initially trading higher after its first half results were released, Ebos soon crashed 20% (less than the market) during the covid sell off. However, unlike much of the market it is still trading about 12% below its pre-covid peak, despite stating that “since its 1H 2020 results it has continued to see positive momentum across its businesses through to the end of the third quarter ended 31 March 2020. Both the Group’s Healthcare and Animal Care segments generated solid revenue growth as a result of increased demand.”

In order to explain this share price weakness, one might look to the huge block trade sale pursued by Sybos, the original owners of Symbion (which is now a large part of Ebos’ business). To paraphrase a recent announcement:

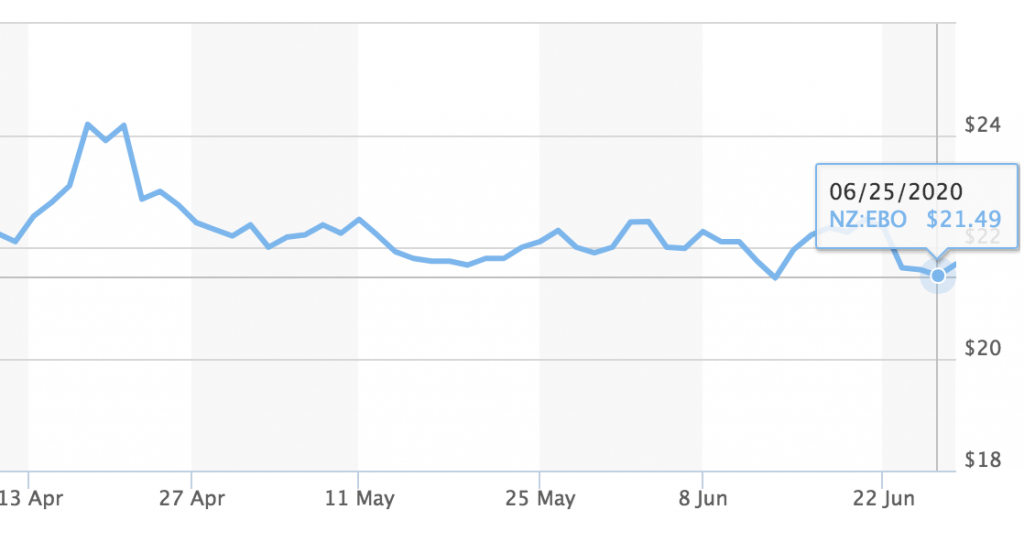

On 22 June 2020, Sybos entered into a block trade agreement Citigroup under which Citi will sell 15,000,000 shares currently held by Sybos for NZ$21.52 per share (or NZ$322,800,000 in aggregate). As you can see below, the share price (in NZD) is basically sitting on that price since April.

Essentially, the share price can’t move very far away from this price, because someone — most likely citigroup — has very very many shares they would like to sell at about that price. This is all the more powerful because Citi will buy those Sybos shares itself if it cannot sell them. So as long as Citi can sell at $21.52, it will make a nice profit. But its game is to sell — not invest.

Therefore, until those shares have found a home with long term investors who do not want to sell them, there is a weight (or ‘overhang’) keeping the Ebos share price down. The question is, will enough demand soak up those shares, and if so, when?

Well, one factor worth considering is whether Ebos Group can one day make it into the ASX 200. With a market cap of over $3b, it is certainly big enough. However, Ebos is listed on the NZ stock exchange, and trades much more often in that market. For example, in New Zealand, 2-4 million shares trade in a quiet quarter but in the quarter to March 2020, only about 250,000 shares traded on the ASX.

As a result of this, Ebos Group has not been included in the ASX 200 (with all the passive buying that would entail). Furthermore, since it is not in the ASX 200, fund managers that wish to index hug with that benchmark (that is, start by emulating it and simply make changes in weighting) will not be interested. Finally, some mandates simply do not allow people to invest in companies that are outside the ASX 200, or ASX 300, or ASX All Ordinaries. And EBOS has only just been included in the ASX All Ordinaries.

It is possible that the large sell down by Sybos will improve the liquidity of Ebos shares. Already, we have seen what I suspect is some of those shares trade on the ASX, given there were 1,386,020 shares traded on the ASX on a single day this week. I cannot predict the future but I think there’s a chance that liquidity improves on the ASX, and eventually the company joins the ASX 200. If that happens (and if the results of the company remain solid), then I think we will see a multiple re-rate from around 20 to around 24, which is what ASX listed comparable companies like Sonic Healthcare (ASX: SHL) trade at.

This post is not financial advice, and you should click here to read our detailed disclaimer.