Yesterday Ecofibre (ASX: EOF) released its financial results for the 6 months to December 2019, and thereby confirmed its place in the pantheon of serial early reporters on the ASX. EOF was also one of the first reporters in the August results season (actually late July if you don’t mind) and regularly releases its quarterly cashflow (“4C”) reports in the first half of the following month (not in the brown-coloured deluge that marks the last few days of each 4C season).

Yesterday’s HY20 results followed hot on the heels of the December 4C released in mid-January (also discussed below). Before we dig into the half year results, it’s worth first taking a moment to summarise industry developments over the past few months since our last update on the old Ethical Equities website in October.

FDA: Woah, hold your horses!

On 25 November, the US Food & Drug Administration (FDA) released a consumer update in which it announced that it had sent warning letters to 15 companies in that market for illegally selling CBD products in a manner which violated the Federal Food, Drug & Cosmetics Act. More specifically, these companies had been marketing CBD products to treat diseases and for other therapeutic uses (i.e. well in advance of scientific evidence to support the efficacy of CBD), and/or marketing CBD products as dietary supplements or food additives (before the FDA had declared that it was safe to do so).

An update had been expected from the FDA for most of 2019 as industry operators, consumers and consumer groups sought clarification on regulatory guidelines including labelling requirements, dosage limits, product inclusions, permitted distribution channels and other parameters needed to frame a regulated market. This update did not however provide the clarification or timetable for which stakeholders had hoped. Further, the FDA highlighted very brusquely the serious potential side effects of CBD use and issues of unproven medical claims and unknown quality of CBD products available in the marketplace. The FDA reiterated that it is still illegal in the US to market CBD as a dietary supplement or to add it to food for sale, and that it will continue to conduct investigations into CBD safety before providing a further update.

A key issue here is that very limited medical research has been conducted into CBD to date – precisely because it has only just been legalised. Selected research programs have commenced into the potential benefits of cannabis, however these studies are going to take time and it feels like a definitive go/no-go decision on widespread cannabis use and sale is unlikely until 2021 at the earliest. Another potential issue might be arriving at definitive dosage limits (or even a universal dosage limit) – it is entirely possible that, based on the way that CBD interacts with the human endocannabinoid system, different people may require different dosages and/or have different tolerance levels to CBD.

The warning letters (and implied threat of legal action), tone of the FDA update and lack of a timeline for a regulatory framework spooked the market and sent cannabis stocks further spiralling. Here in Australia, Elixinol (ASX: EXL) and Cann Group (ASX; CAN), which both had nearly halved since the end of September, halved again over the next 4 weeks.

As if it were not already apparent, the euphoric bubble stage for cannabis (the Peak of Inflated Expectations in the famous Gartner Hype Cycle below) is long over, and as suggested in our last Ecofibre piece, on the old Ethical Equities website, the cannabis sector has entered the Trough of Disillusionment.

The FDA update has deferred mass adoption of cannabis to a future indefinite period, and when a regulatory framework is introduced at a later stage, growth is likely to be more controlled and less hyperbolic than has been the case over the last 12-18 months.

EOF December 2019 quarter cashflow and the comparative woes of the less-disciplined Elixinol (ASX: EXL)

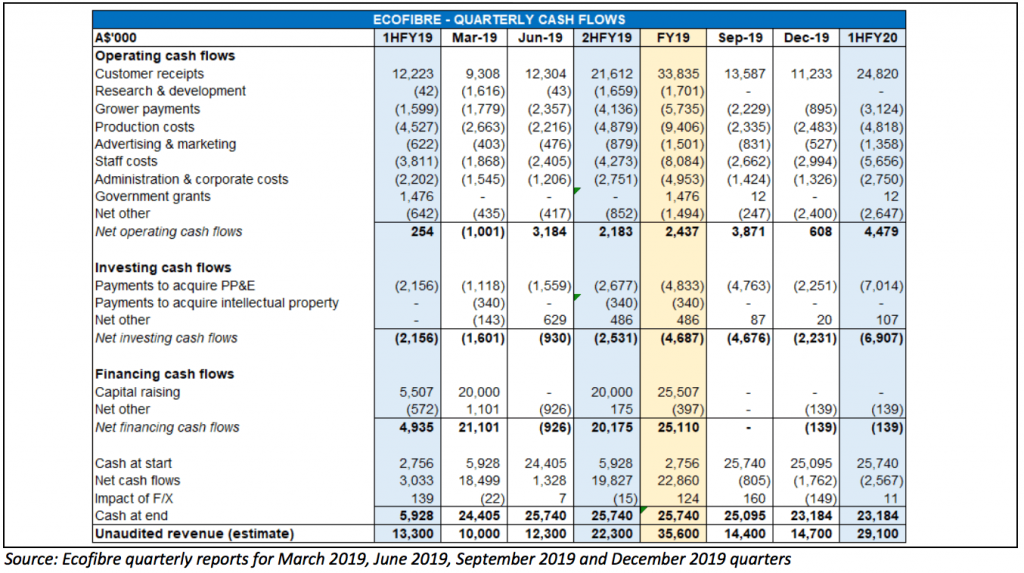

Ecofibre’s December quarterly cashflow report revealed another solid quarter with the company generating another quarter of positive cashflow – unlike the vast majority of its ASX-listed peers. The $2.4M of “Net other” in the Dec-19 period below includes a $1.2M US income tax payment plus a $1.2M cash reserve transferred to a new credit card provider for the US business – so underlying cash flow generation was stronger than it appeared.

Customer receipts declined by $2.3M versus the September quarter, and management iterated that the company is undertaking the strategic shift from a direct-to-pharmacy distribution model (which has underpinned growth to date) to servicing wholesale suppliers to the pharmacy channel. Management say this has created a temporary lag between sales and receipts in the December 2019 quarter, which is expected to normalise in the current March 2020 quarter.

Furthermore, the company has already signed up several large distributors and buying groups. This will in turn expand the number of pharmacies carrying the Ananda range going forward (although the company will be unable to report accurate pharmacy numbers in future as a result of this shift to wholesalers).

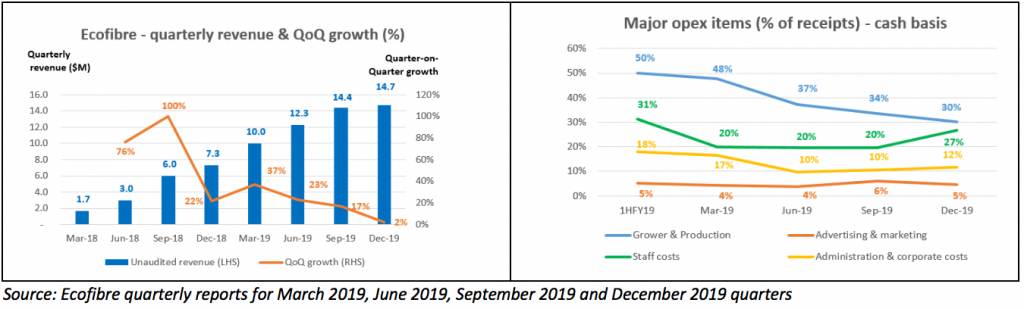

The accompanying management commentary heralded 106% growth in revenue over the corresponding Dec-18 quarter – which is accurate – but looking closer it is clear that growth has slowed materially over the past few quarters – as indicated by the chart below left.

We discussed competitor Elixinol’s problems at length in our last note on that company in late September on the old Ethical Equities website. In it, we stressed that Elixinol had become very high risk due to its accelerating cash burn as it pushed ahead with rapid geographic expansion on multiple fronts and significant accompanying inventory build.

The negative FDA update further exacerbated Elixinol’s woes – adding to the already murky general sentiment in the sector at a time when Elixinol’s cost base had expanded materially in advance of its planned global assault. Elixinol’s financial statements for its financial year ended December 2019 are going to be very uncomfortable reading. In an effort to halt the cash haemorrhaging, Elixinol has recently announced the fire-sale of its Australian hemp foods business and will also exit its nascent Australian medicinal cannabis operations. This is likely to cause material write-downs which will exacerbate what would have been a significant operating loss for the company in any event. Making matters worse for Elixinol shareholders, recently resigned founder and former CEO Paul Benhaim has flagged his intention to sell ~11M of his ~55M shares before 8 January 2021.

Ecofibre’s growth path has been considerably more controlled and less scattergun than Elixinol’s. The chart above right demonstrates Ecofibre’s comparatively superior cost control, even as it prepares for the launch of the Hemp Black business in the June 2020 quarter (more on that later).

Of course, part of Elixinol’s problem has been the enormous increase in competition in 2019 as a flood of new operators entered the market in search of a quick buck. The wet blanket thrown over the industry by the FDA means that the hemp market is now grossly oversupplied in the near term and that the previously anticipated explosive growth in demand has been postponed indefinitely. Hemp prices have plunged by more than 75% in the last 6 months, according to a Bloomberg article from last week. I was unable to find a source for hemp biomass pricing that I didn’t have to pay for – but it looks like the bubble has burst!

The Ecofibre first half results commentary alluded to irrational competitor behaviour – which will no doubt mean that short-term operators have been dumping product into the market, desperate to get anything from their inventories. We expect that this inventory overhang will continue for quite some time in the US market (where Ecofibre generates the vast majority of its revenues) – and while the company has positioned itself as a differentiated premium quality operator in that market, these competitive headwinds are likely to place a ceiling on growth in the short term.

Ecofibre Ltd’s 1H FY2020 Half Year Results Analysis

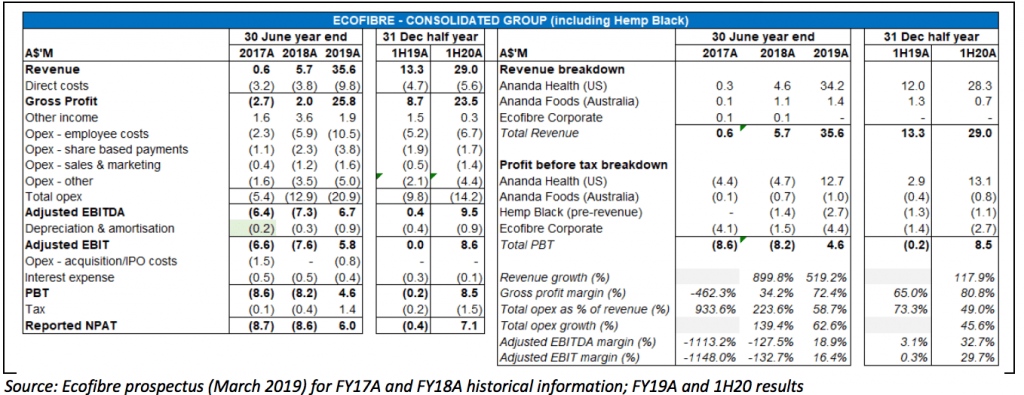

Ecofibre had previously flagged that half-year NPAT was likely to be above the $6M achieved for full-year FY19, and the company delivered a nice ~$1M beat against that guidance in the results announced yesterday – with 1H20 NPAT of $7M on $29M of revenue (+118% vs 1H19 – though as noted above growth has slowed significantly over the last two quarters).

The US business continues to be the growth engine for the company – generating 97% of total 1H20 revenue and increasing gross margin from 66% in 1H19 to 82% (and driving the overall impressive margin increase from 65% to 81% above). Management has focused on production and supply chain efficiencies and “pricing disciplines” to drive margin improvement – although further material increases in profitability are unlikely given the expectation that the shift from direct to wholesale distribution will dilute margins.

The Australian Ananda Foods business went backwards in the Dec-19 half from a revenue perspective – albeit off a low base and notwithstanding new contracts picked up with Woolworths (its Macro private label) and its New Zealand-based Countdown chain, and also the independent IGA network in Australia. These new contracts are expected to drive growth in this division over 2H20 and into FY21, and Ecofibre guided that the Australian operations are expected to break even for the June 2020 half.

Interestingly, the investor presentation noted that the Tasmanian production facility is progressing towards the high British Retail Consortium Global standard – which will enable Ecofibre “to supply any major retailer or manufacturer globally”. Clearly, management are focused on the End Game and taking the deliberate and necessary steps to build a long-term sustainable business for the future.

It’s worth saying that Ecofibre is probably “best in class” at this point – certainly amongst its ASX contemporaries – but that is arguably not that big of a statement given the self-inflicted wounds at Elixinol and the generally sub-scale loss-making nature of the other ASX cannabis stocks.

Hemp Black: Finally, more detail from EOF

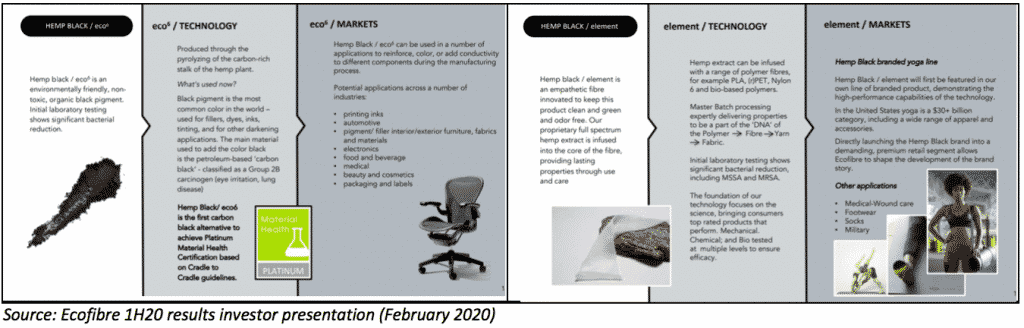

The most interesting part of the half-year results and accompanying investor presentation released yesterday for me personally was the first meaningful amount of detail about the Hemp Black business to be launched in the June 2020 quarter. The investor presentation devoted 8 slides to explaining the Hemp Black concept and its vision for growing the business. Management’s strategy involves the development of industrial and retail products, as well as co-branding with selected partners, bulk sales of manufacturing inputs and potentially also the licensing of Hemp Black IP to other manufacturers. The target end markets for each of the Hemp Black product ranges include:

- Hemp Black eco (feedstock): environmentally friendly non-toxic carbon black pigment for industrial use in printing inks, furniture, fabrics and materials, food & beverages packaging, beauty & cosmetics, electronics, automotive and medical applications [below left];

- Hemp Black ink: a waste by-product from the eco product above, this anti-static blank ink can be used in analogue textile printing;

- Hemp Black origin: odor-free carbon-infused fibre to be used in high performance and “smart” textiles (enabling moisture management, temperature regulation and other features);

- Hemp Black element: odor-free fibre also endowed with bacterial reduction properties, and to initially form the basis of a branded range of athsleisure products, but later to be focused on medical wound care and footwear [below right];

- Hemp Black nano: lightweight breathable fibre with water repellent and wind resistant properties – likely to be used in outdoor gear and medical/wound care applications;

- Hemp Black hide: environmentally friendly alternative to leather which uses 90% less energy to manufacture – huge potential target market in apparel, travel goods, footwear, furniture and apparel; and

- Hemp Black fusion: high performance fibre likely targeted at the medical, apparel and military sectors

Two of the eight slides are reproduced below to give a flavour of the strategy behind the Hemp Black concept, but we encourage readers to check out the investor presentation themselves in order to more fully appreciate the vision for this division.

The Hemp Black processing facility is on track to be completed (on time) in April 2020 with the equipment operational by June. While the first revenues from the athleisure wear range (above right) are expected to be generated in June, it won’t be until FY21 that we’ll be able to better understand the revenue and earnings potential from this new division. Management have flagged that the company has already entered into partnerships with customers “across a range of applications and industries”. I look forward to watching the commercialisation of this business over the remainder of calendar 2020.

Closing thoughts

Despite the share price horror endured by the broader cannabis sector, Ecofibre has held up comparatively well – although it has declined by one-third after touching a new all-time high of $3.90 in late November.

At current levels of close to $3.00, EOF has a market capitalisation of ~$950M and is trading on a forward P/E of close to 60x (annualising 1H20 EPS – which arguably makes sense instead of assuming 2H-on-1H growth, given quarter-on-quarter growth has slowed). This is clearly a fairly rich valuation at this point, but ascribes no value to the Hemp Black business – which I believe will be a meaningful generator of revenue and earnings from FY22 onwards.

I continue to be optimistic about the cannabis thematic more broadly (see our background industry report on the old Ethical Equities website). As in our prior coverage Ecofibre remains my preferred ASX cannabis stock – but I must temper expectations for the time being until the US regulatory picture becomes clearer. As a high quality player seeking to operate (and thrive) within the confines of the FDA’s narrow (for now) playing field, Ecofibre management believe the company is well placed to grow market share and benefit from the difficult short to medium term conditions in the market. There is however a “shakeout” coming (and arguably, it has already begun) as lower quality temporary competitors will seek to monetise their inventory and exit the market.

And so we should continue to expect continued volatility in the Ecofibre share price over the medium term as the cannabis sector works its way through the Trough of Disillusionment – the length of which is of course unknown at this present time. I view Ecofibre as a long-term portfolio cornerstone and am cautiously optimistic about the potential of Hemp Black, and may add at a lower valuation.

Disclosure: I (@Fabregasto ) hold shares in Ecofibre and will not sell for at least 2 days after the publication of this article. As disclosed on Twitter, I sold my Elixinol holding in late October to redeploy funds into more promising ideas, and continue to view Elixinol as a high risk speculative investment at this juncture given strategic missteps in that business over the past 12 months.

Articles like this one show how and why our contributors invest, and share our research along the way. We are not aware of your circumstances and these articles are in the nature of an investment diary. They are not intended as a recommendation and do not constitute advice.