As regular readers will know, I think EML Payments (ASX: EML) is an interesting business to follow, because its business model should benefit from an inflationary environment. I am not a shareholder in the stock because of valuation risk, plus guidance risk, which has now come to pass.

Now, let me be clear. I did not foresee this downgrade, and I even considered buying shares in EML Payments, prior to this downgrade. I was wrong to even consider it.

Fortunately, my lack of confidence in the valuation meant I held off buying. The main reason I did not expect this downgrade, despite my low opinion of management, is because the company reiterated its guidance in mid-March.

On April 5, three weeks ago, I wrote:

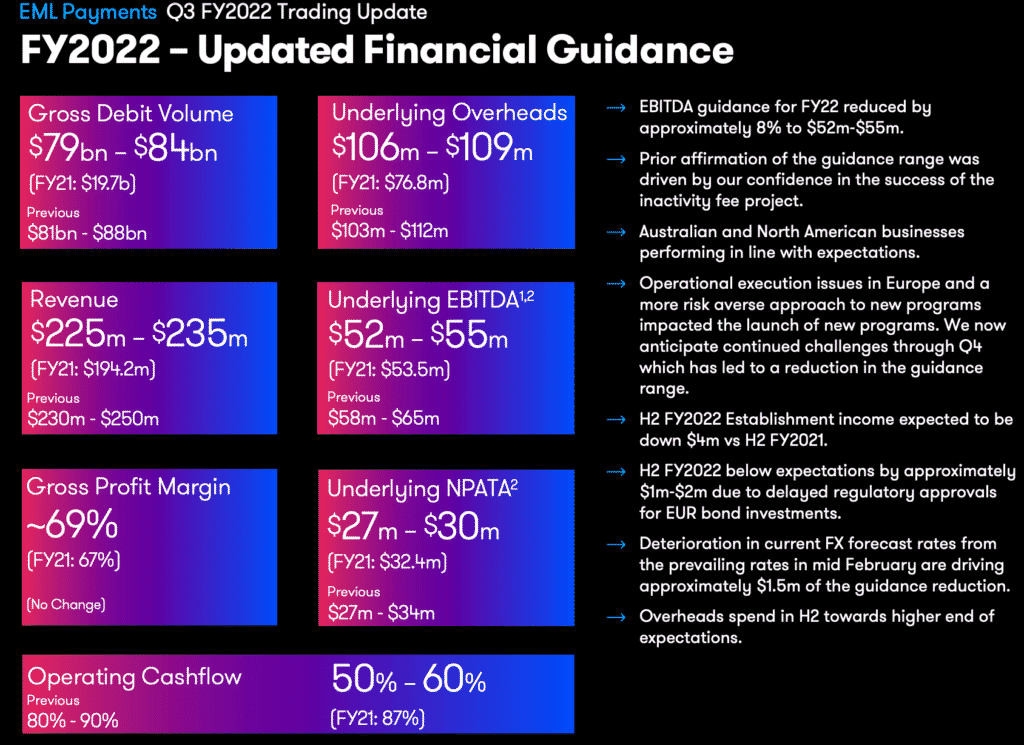

When it comes to the business, there is some risk that the company will not achieve its guidance for FY 2022. That said, on 16 March, 2022, the company reiterated its FY22 “revenue guidance range of A$230m – A$250m and FY22 EBITDA guidance range of $58 – 65m”. One would hope that half way through the second half, the company would know if it is falling short of guidance.

There is also some risk around the valuation of the stock. In the first half of FY 2022, EML achieved “underlying EBITDA” of $26.9 million, we can therefore expect another $31.1 million of “underlying EBITDA”, if it meets the low end of guidance. Even using this very spurious figure as a proxy for earnings (real EBITDA was just $14.2m), EML’s $1.08b market cap implies a multiple of 16.6 times underlying EBITDA, assuming the company meets the high end of guidance.

Due to my concerns about valuation, I don’t already own shares in EML Payments. That said, the fact that it is so well positioned in an inflationary environment makes me think it could add good diversification to my portfolio. After all, inflation was already heating up due to the end of lockdowns and high savings rates. Then, the Russian invasion Ukraine, happened, adding further to inflationary pressures. On top of that, parts of China are now in strict lockdown due to covid, and that is also likely to impact supply chains (and thus input costs) for many items.

EML Payments Chairman Sells Shares

Since I wrote those words above, we have received several bits of new information.

On April 12, the AFR reported that “EML Payments has gone a few rounds of takeover talks with Bain Capital, including a period of exclusivity that saw Bain given access to the company’s books.”

Subsequently on April 13, the company announced that “EML Payments Limited (ASX: EML) notes media speculation this morning in the Australian Financial Review regarding takeover interest by Bain Capital. EML confirms that earlier in the year it was in discussions with Bain Capital regarding a potential change of control proposal. Those discussions have now ceased.”

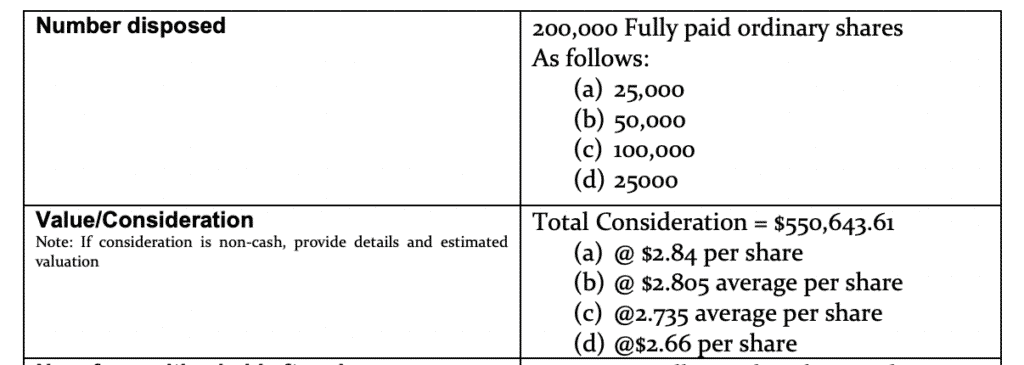

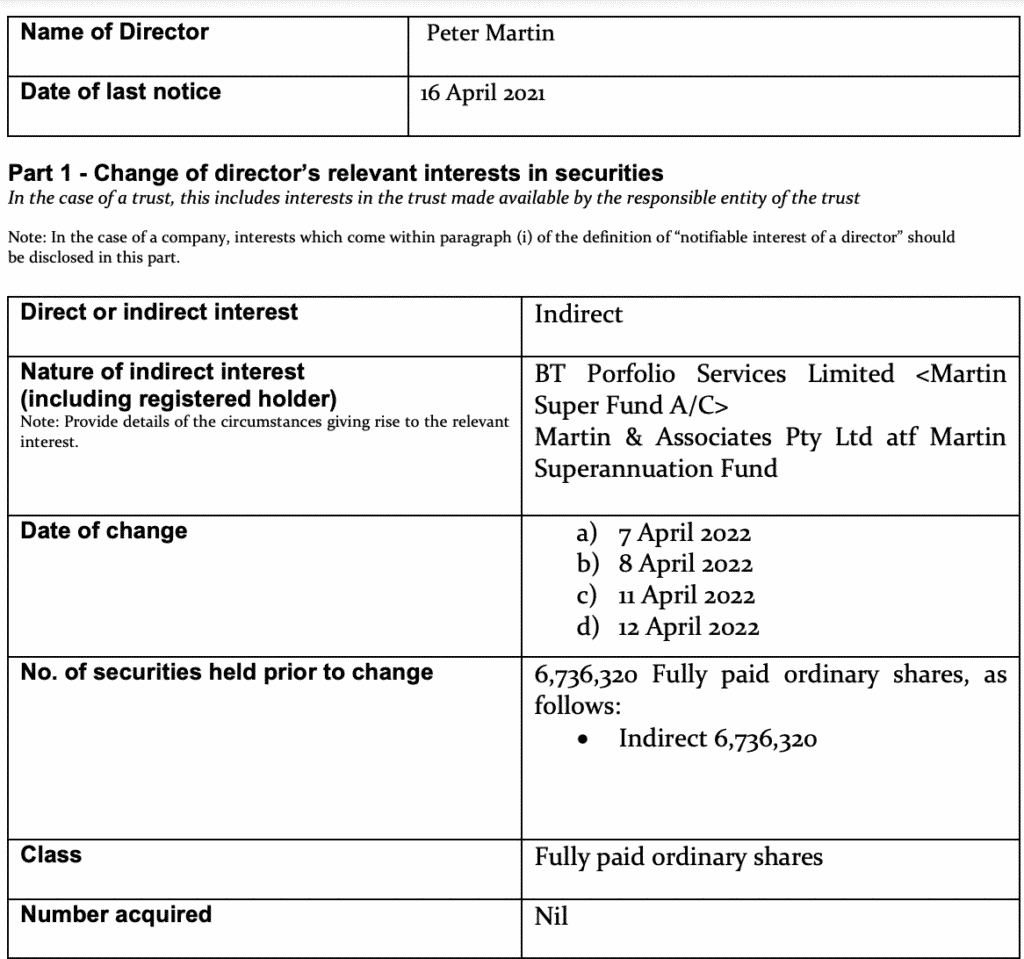

Subsequently, the company has announced that Chairman Peter Martin was selling EML shares from 7 April to 12 April 2022.

Now, I don’t know how long the rumours reported by the AFR were circulating, before the AFR reported them.

But I do think it would have been better if the company had informed the market about Bain’s approach to EML (and then the subsequent decision to cease discussions), rather than the Australian Financial Review.

Either way, someone did buy EML shares from the Chairman Peter Martin on April 12, just two weeks prior to the company issuing guidance downgrades to gross debit volume, revenue, underlying EBITDA and underlying NPAT, as you can see below.

The screenshot below is from page 9 of the “Profit Guidance” announcement today.

How Does the EML Payments Downgrade Change My View?

On the one hand, the share price is now much more attractive. It’s hard to argue that an 8% reduction in guidance (which I already considered rather questionable) deserves a 30% reduction in share price.

On the other hand, it takes a special kind of masochism to jump on board with a company that has such incredibly poor visibility of its business that in the time between 16 March (with roughly 70% of the year under their belt) and 26 April, (with roughly 83% of the year under their belt), they have to make an 8% reduction in full year guidance.

What kind of deterioration do you need to see in the 6 weeks or so between 16 March and 26 April, for the full year guidance to drop by 8%? Either the original guidance was poorly forecast, or the company is a rather fragile business, which can suffer sharp changes in trajectory in relatively short periods.

I have no idea if I will ever own EML Payments shares in the future. While I think the business has plenty of positives, I lack confidence in the corporate governance, given the well documented regulatory issues arising from the acquisition of PFS.

The devil on my shoulder says “it’s a good business, it will bounce back”, and the angel on my shoulder says “don’t invest in a company that exhibits both director selling and a profit downgrade.”

Perhaps both have valid arguments, but I’ll listen to my angel for now. After all, it’s worth keeping in mind this board has already made a questionable acquisition in PFS, which (it turns out) has required a significant increase in expenditure to mitigate regulatory risks.

As I have written before:

“Basically, it’s impossible to deny that the company didn’t really appreciate the significant risks inherent in the PFS business. It seems like the Irish central bank was concerned about whether the company might be inadvertently assisting in money laundering. This caused the regulator to place limits on PFS’ growth, and demand that EML bolster regulatory compliance measures within the business. This of course caused considerable additional expense to the company, much of which is ongoing.“

Ultimately, I still think EML Payments is well suited to an inflationary environment, and I wouldn’t be surprised if it does get taken over. Alternatively, perhaps a board refresh could improve the stock’s perception in the market.

Personally, I believe that EML Payments would benefit from a Chairman who spends more time ensuring guidance is conservative, and less time selling shares on market. Perhaps after this share price fall members of the board will be less inclined to sell shares and more inclined to ensure the company meets or exceeds guidance.

Edit 1:19pm 26 April: I have just been reminded that the company did forewarn that the Chairman would be selling shares, way back in May 2020. In foreshadowing his sale of shares in 2020, the company noted that “…he is likely to sell some shares each year… investors should not expect Mr Martin will give advance notice of future sales.”

This article should not form the basis of an investment decision, and my thinking may change at any time for any reason. This article is an investment diary valuable only for the cognitive process it demonstrates and you should cultivate our own thinking. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer. If you are seeking financial advice, which you should, you are in the wrong place.

Sign Up To Our Free Newsletter