The days before Christmas are generally pretty quiet on the ASX, but it was vaguely heartening to see two of my shareholdings report somewhat encouraging contract wins recently.

Duratec Wins BHP Wharf Contract

This morning, low margin repair and maintenance company Duratec (ASX: DUR) reported it had won a $48 million contract with BHP “to restore and repair for wharf structural remediation works at the BHP Berth C & D at Finucane Island, Port Hedland, Western Australia.”

The FY 2022 Duratec results show $310 million in revenue and just $7.76 million in profit, indicating a slim profit margin of just 2.5%. This suggests Duratec is a low quality business with minimal pricing power or competitive advantage. However, Duratec guidance for FY 2023 says it expects revenue “in the range of $420m to $460m, delivering a forecast EBITDA of $32m to $35m. These forecasts include an 8-month contribution from the recently acquired Wilson’s Pipe Fabrication business.”

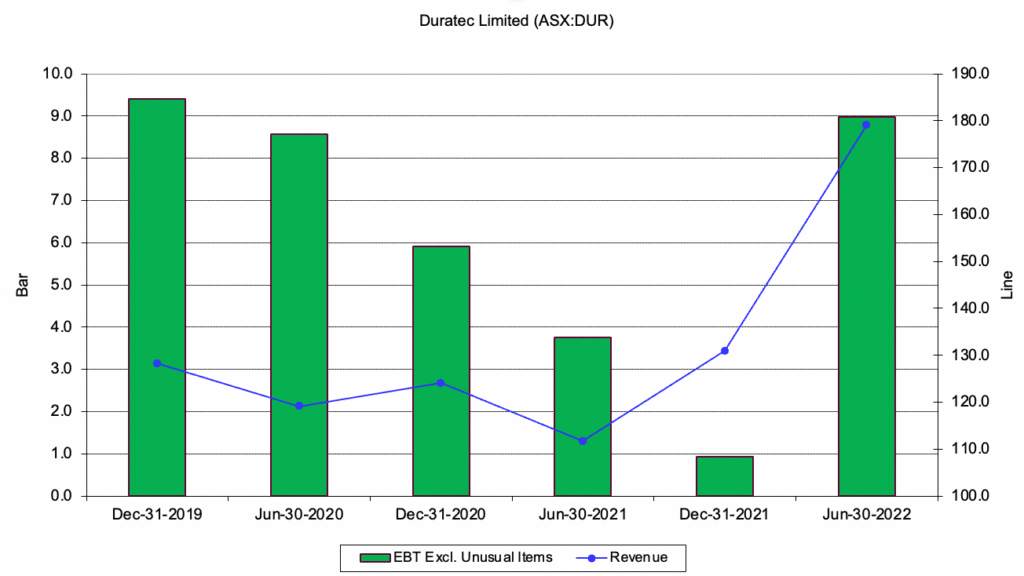

There’s no guarantee what the profit would be but one could reasonably hope for $10 million. If that were to be achieved, the Duratec P/E ratio would be around 13.3, given the market capitalisation at $0.545 is about $133 million. Of course the risk here is that profits can fluctuate massively, as you can see below.

I own shares in Duratec, but just a small position, since I’ve never been able to get comfortable with the risk that an accidental expense blowout could obliterate profit. I cannot escape the feeling it is picking up pennies (slight undervaluation) in front of a steamroller (potential for cost blow outs). But while I hold with low conviction, I’m happy to see another contract win today. Supporters can find our past coverage of Duratec here.

Alcidion Wins Contract Extension With Leidos For ADF

Yesterday, hospital workflow software company Alcidion (ASX: ALC) signed an extension to an existing contract with Leidos Australia for delivery of a healthcare knowledge management system to support healthcare services across the Australian Defence Force. The contract expansion is worth an extra $8.4 million over just under 5 years, implying an additional $1.7 million or so per year.

That’s hardly groundbreaking given Alcidion booked about $12 million in cash receipts last quarter, being an run-rate of over $45 million. However, it will add to the recurring revenue base. Alcidion isn’t yet profitable, but it is expecting positive EBITDA in FY 2023, and I am expecting a statutory profit in FY 2024.

It’s not hard to imagine Alcidion earning revenue of $70 million and profit of $7 million plus, in a few years, even allowing for continued investment in growth. That would only represent a profit margin of 10% which is hardly overly optimistic for a software company with decent scale. Of course even then it would be priced for growth given its current market capitalisation of about $178 million at a share price of $0.14. While I appreciate some might say that already prices in a lot of growth, I actually think it is probably likely to grow sufficiently to justify that price, and then some. As a result I am a shareholder.

As a shareholder, the main good news I take from yesterday’s announcement is that it means Alcidion’s largest customer is happy with them (so far), and wished to do more business with them. That’s an indication that the company has good capabilities in its field, and yet another small heuristic that suggests the company is of good quality. Readers can find our past coverage of Alcidion here.

Sign Up To Our Free Newsletter

Disclosure: the author of this article owns shares in both Duratec and Alcidion, and will not trade shares in these 2 companies for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.