This morning, software and service provider Energy One (ASX: EOL), reported its results for H1 FY 2023. Given that this half was the first full half contribution of the acquired CQ Energy service business, it was no surprise to see record half year revenue, which came in at about $20.6 million. This article builds on, and should be read in conjunction with, our past coverage of Energy One. You can see how Energy One has grown its revenue over the years, in the chart below.

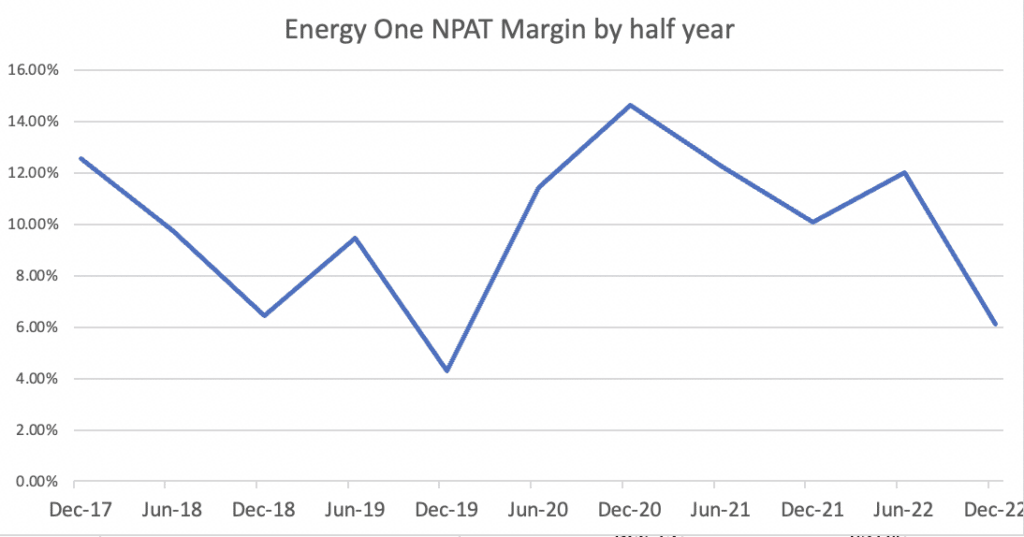

Unfortunately for shareholders such as myself, H1 FY 2023 saw statutory net profit margins fall from 10% in the prior corresponding period to just 6.1% in this half, hampered in part by unspecified “one-off costs”. As a result, Energy One made a statutory profit of $1.26 million, down on $1.46 million in the pcp. Backing out these supposed one-off costs, the company gives us a “comparative net profit before tax” of $2.65 million (down 4% on the pcp).

If we applied the standard 30% tax rate to this figure (keeping in mind the prior period had an unusually large tax bill that was expected not to repeat), then we’d get a normalised net profit after tax of about $1.855 million. However, we can’t rely on this, because we don’t know exactly what costs were added back to get the $2.65m figure.

In these results, Energy One reiterated its FY 2023 guidance of revenue in excess of $44M, and (normalised, I assume) EBITDA of $12.5M. The $5.9m normalised EBITDA in H1 FY 2023 therefore implies around a 47% to 53% first half to second half split. Applying this to the normalised net profit after tax of $1.855m, it suggests a normalised full year profit after tax of around $3.9 million, putting the stock on about ~32x this estimate of normalised FY 2023 earnings, at a share price of $4.20.

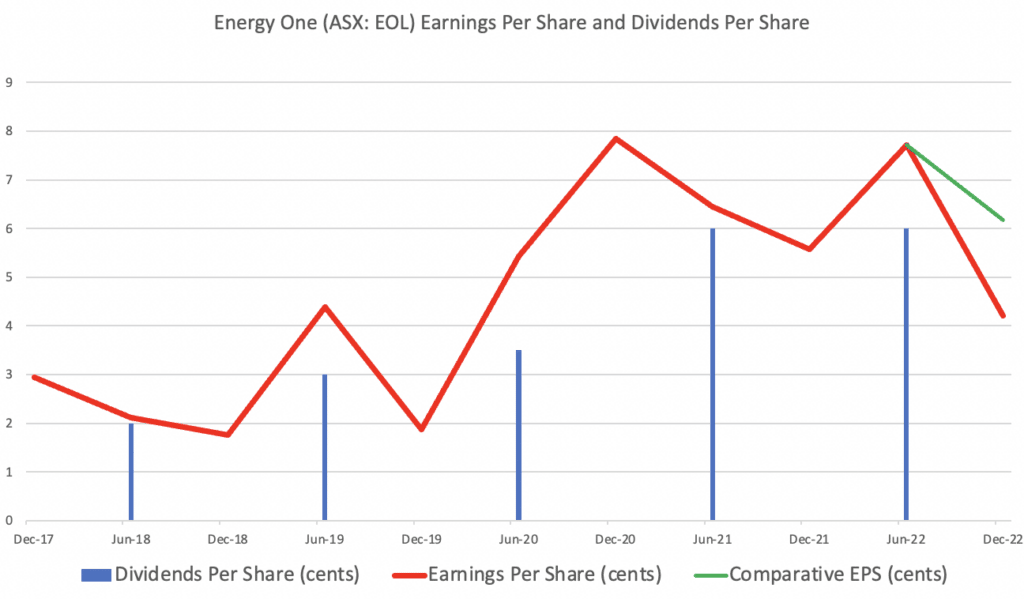

Either way, when it comes to statutory earnings per share, this result was a weak one, as you can see below.

This statutory result is definitely a bit lower than I had expected, and the net profit margin is notably below the normal range. Even so, based on management commentary, the margin should rebound in future periods. A key question for management is whether they can get net profit margins back up to 10%. It should be possible, but there are no guarantees. I’ll update this paragraph after the conference call if we get more information on this.

During H1 FY 2023, Energy One has increased its expenses to chase future growth. It is developing new products, integrating and rebranding its acquisitions, and (now) paying interest and finance costs ($790k in H1) in order to enable acquisitions. But as long as that growth does come in time, shareholders will likely be rewarded.

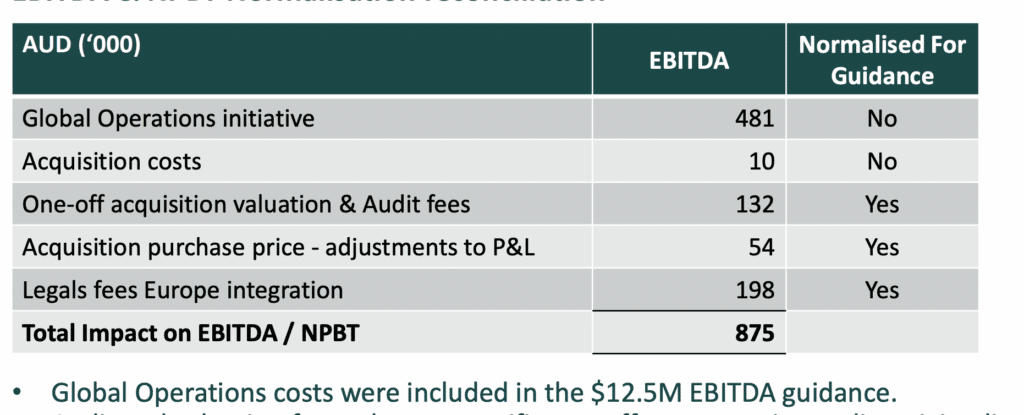

It is also important to note that we simply don’t know what the excluded one-off costs are, because they have not been specified. I asked Energy One CEO Shaun Ankers about this today and he suggested that we talk about it tomorrow on the results presentation, which will have a slide about this reconciliation. Therefore, I’ll update this paragraph tomorrow once we have more information.

Update: Monday 27 Feb.

The presentation slide included this breakdown of the one-off costs.

The biggest contributor to the one-off costs was the Global Operations initiative, which is really a collection of costs. These will be spread out over FY 2023, and FY 2024, according to the company, and total $3m to $4m. I asked for more detail about this on the conference call and the Energy One CEO explained that these costs included the cost of moving people around (such as from Europe to Australia), “really putting in place frameworks to leverage and scale up so we can deal with many customers”, getting cybersecurity certifications and trying to standardise the look and feel of dashboards.

The company expects these costs to increase in the second half (reaching around $1.5m for the full year).

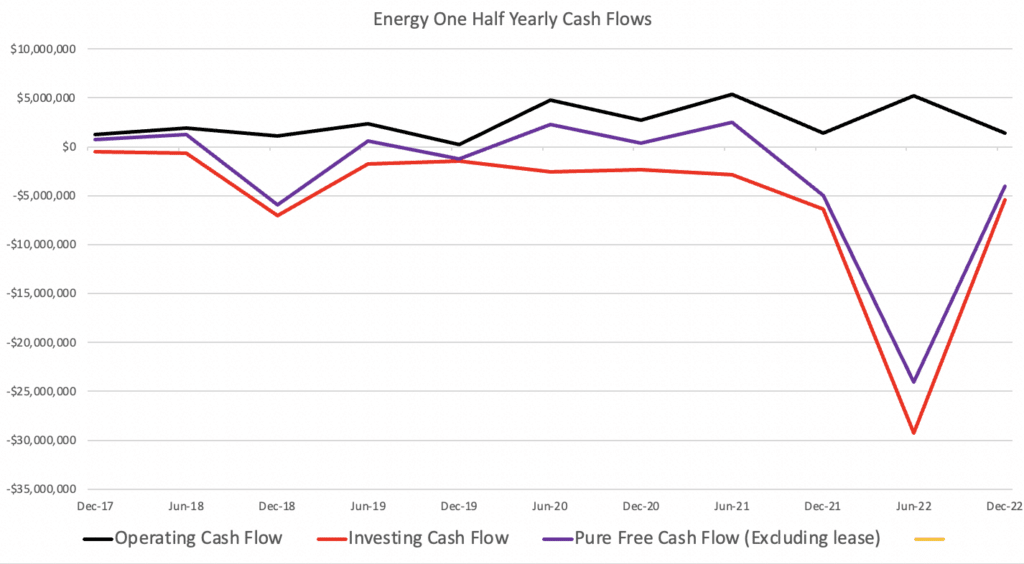

Energy One Cashflow And Balance Sheet

The H1 FY 2023 Energy One results were fairly weak on a cashflow basis, as you can see below. While the bulk of the CQ Energy consideration was paid in H2 FY 2022, this half still had around $2.5m of deferred acquisition payments. At the same time, you can see from the black line on the chart below that the second half is usually stronger in terms of cash flow from operations.

Meanwhile, the balance sheet has $2.1m in cash and almost $22m in borrowings. Obviously, this is not ideal, and it would be much better to have a strong balance sheet. However, one of the directors is “legendary insolvency figure” Ian Ferrier, and Energy One borrows at quite low rates (3% last year, presumably somewhat higher now). That said, the company has a fair bit of debt, and it would arguably be logical to cut the dividend in order to reduce debt.

Energy One Outlook And Business Quality

Even backing out one-off costs, this result was pretty uninspiring since the normalised profit before tax was actually down slightly.

There are a few reasons for this. One is that the company has been investing in scaling up its business, which can be seen in the sharp increase in employee expenses (which also, obviously, are up due to the acquisition of CQ Energy). This apparently includes the expense of actually relocating staff from Europe to Australia.

The other negative contributing to this result is that “the first half has been impacted by the timing of project revenue, but those timings are expected to resolve themselves in the months ahead.” While margins are lower on project revenues, those revenues are also lumpy, so can definitely boost profit in any given period.

While the company is still planning to spend another $2.5m to $3.5m to build out its 24/7 energy trading capacity, it is good to read that “European customers have agreed to have some operational services provided out of Australia. In doing so we are now covering a European night shift, from Australia.”

In terms of product development, the company says it is “about to go live with a large multinational customer using our battery bidding solution,” and that “we have a proof-of-concept underway for a major European utility.” Any future revenue from these products is uncertain, and we know the sales cycle is long (so don’t expect anything next half).

You could argue such statements are only hopium, and that may be so, but at the same time Energy One has launched quite a few new offerings, over the years; with considerable success, overall. Based on past performance, these organic growth expenditures do lead to profit growth. For now, management has stated they expect a lag between the investment in new products and services, and profits flowing from them, which seems reasonable enough, though it does come with the usual risk that Energy could build it… but the customers don’t come.

I can’t form my opinion on these results until we have more details about the “one-off expenses”, so I’ll update this paragraph tomorrow. For now, suffice it to say that while this half is a bit disappointing, it seems most likely that the thesis is still on track.

Update 27 Feb: I think the outlook for FY 2023 is pretty muted as Energy One invests in growth. Unfortunately, this is an expansion plan which does require some investment before seeing revenue, let alone profits. Overall I think the strategy makes sense, though, and it is well in keeping with the long term thesis. In the short term, though, it means there will be downward pressure on profit margins.

The key question for me is there is some reason why net profit margins can’t return to 10% any time soon. The industry might be getting more competitive, or demand might be weaker than expected. On the other hand, the commentary suggests that one-off costs and investment in growth has hampered the result this half, but the overall margin expectations of the business haven’t changed in the longer term.

As you can see below, the company has historically kept margins between 8% and 10%, with a few outliers. Zooming out, even modest revenue growth of 10% per year, and lifting margins back over 10% seems pretty achievable given the strong track record of revenue growth and the historical profit margins. If margins do bounce back in future periods, then the current share price weakness may very well be looked upon as a buying opportunity.

Disclosure: the author of this article owns shares in EOL and will not trade shares in EOL for at least 2 days following the publication of this article. Please keep in mind the author may buy or sell shares after this date. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter