I’ve had a lot of reader interest in the recent Eroad (ASX: ERD) quarterly, in large part because the share price dropped as a result, falling from around $5 to around $4.50. Let’s take a look at the results from a few different angles, to explain why I’m not concerned about the company.

[Edit July 27, 2021: Please note that 6 months after publishing this article, the share pice has rebounded ~40%, and now sits at $6.31. Click here for our most up-to-date Eroad Coverage.]

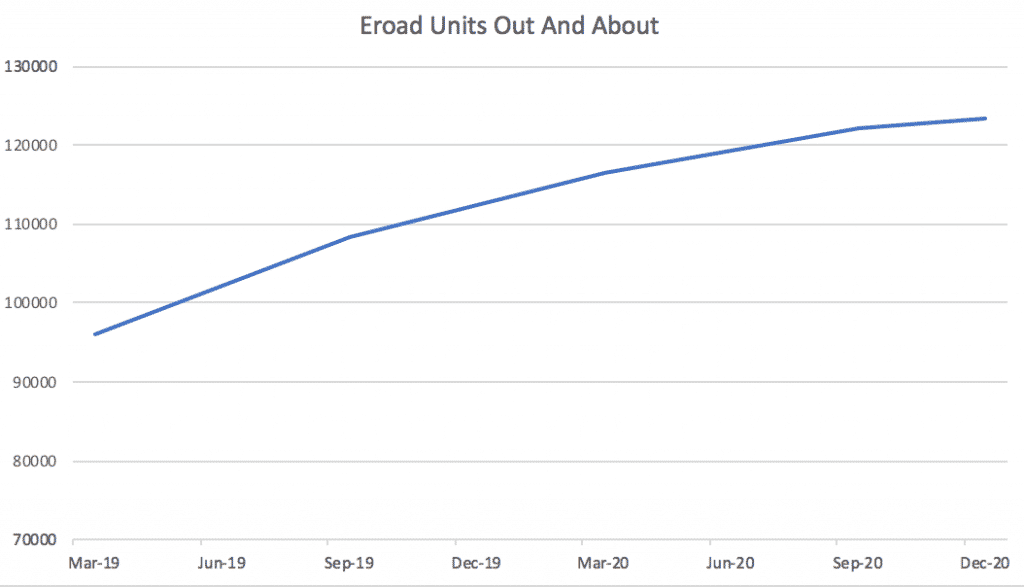

First, why did the share price fall? Well, as you can see in the chart below, the rate of unit growth slowed. That means fewer trucks or other vehicles were added to the network, in the most recent quarter. You can see what I mean in the chart below.

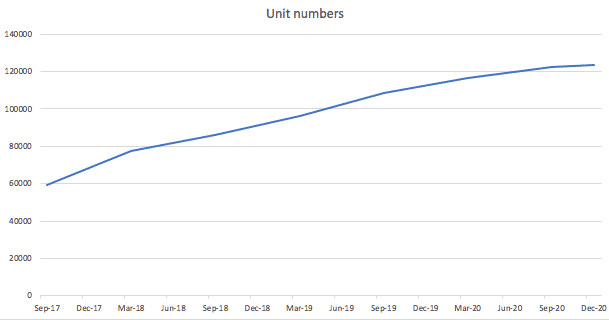

At the risk of seeming trite, the zoom implicit in the chart above is a visual representation of the recency bias. Zooming out a little further we see the arc more clearly, indicating that the company needs to kick start growth in the USA to change the narrative to being bullish.

Unfortunately for shareholders, the USA is currently failing to fire. To quote the announcement itself, “Conditions in North America were challenging during the quarter, due the widespread second wave of COVID-19 across mainland America and the unrest and uncertainty surrounding the US Presidential election. Over the quarter, EROAD experienced an overall decline of 39 units. Sales of 942 units were offset by returns of 981 units which were predominately due to COVID-19 impacts.”

Now this is key to understanding whether these results really are disappointing. It’s simply not clear from the announcement how COVID-19 caused 981 units to be returned. Did the customers go out of business?

It would be good to know the details of how coronavirus has impacted customers. However, it is not hard to believe the explanation. As Transport Topics News wrote in June:

“After an initial surge in consumer demand in the early days of the pandemic, freight volumes weakened dramatically in many sectors of the transportation industry after states issued stay-at-home orders beginning in late March, shutting down large swaths of the economy.“

“Many retailers, manufacturers, restaurants and other businesses temporarily closed down or slowed production while Americans adhered to social distancing guidelines to reduce the spread of the highly contagious coronavirus, which had taken the lives of more than 100,000 Americans as of late May.“

In my opinion wise analysts are always skeptical of excuses, but it may be that eRoad is also suffering for being new to the ASX. Many marginal buyers have appeared in Australia in the last few months, pushing the price up considerably at its apex. Now, the re-rate is over, the paper hands have departed. The momo is no mo’.

So where does that leave us?

Well, to my eye:

- Dominant growing business in NZ

- revenue run-rate ~$37m or $35m AUD

- $370m market cap at $4.50 AUD per share

- Struggling challenger business in USA

- No progress this quarter.

- Has come a long way though, generating more than $10m revenue per year.

- Non-hypey management team trying with aligned incentives

- Option for hyper-growth if regulatory stars align

Basically, these four points are the pillars on which my Eroad investment is built. A reasonable mind could definitely look at Eroad and say “I want that cheaper” or “I want to see USA growth before buying at current prices”.

However, I am already a holder with a decent position. And I am not inclined to trade either way right now. I am not feeling overly concerned about these results or the pricing of the business, but it is part and parcel of small cap investing that you adopt the risks the business faces.

There is a very real risk that Eroad won’t be able to build a good business in the USA. Some companies do, others don’t. As an investor in Australian and New Zealand companies I have on average been rewarded by backing good quality companies having a go overseas. It’s not without risk but it’s a risk I will take time and time again. I’m inspired by good Aussies and Kiwis making good products (preferably medical or software) and selling them around the globe. I say Eroad fits well into my strategy.

Please remember that these are notes on two companies not a recommendation. This article should not form the basis of an investment decision. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer. I own shares in both the companies mentioned.