This morning, asset management and truck tracking SaaS company Eroad (ASX: ERD) announced that it had signed a 5 year agreement with Ventia which is expected to see it install 2500 of its eHubo 2 devices in Australia. The eHubo 2 brings better safety outcomes (by tracking driver performance) and improved productivity to fleet managers, and is sold alongside dashboard software on a recurring revenue basis.

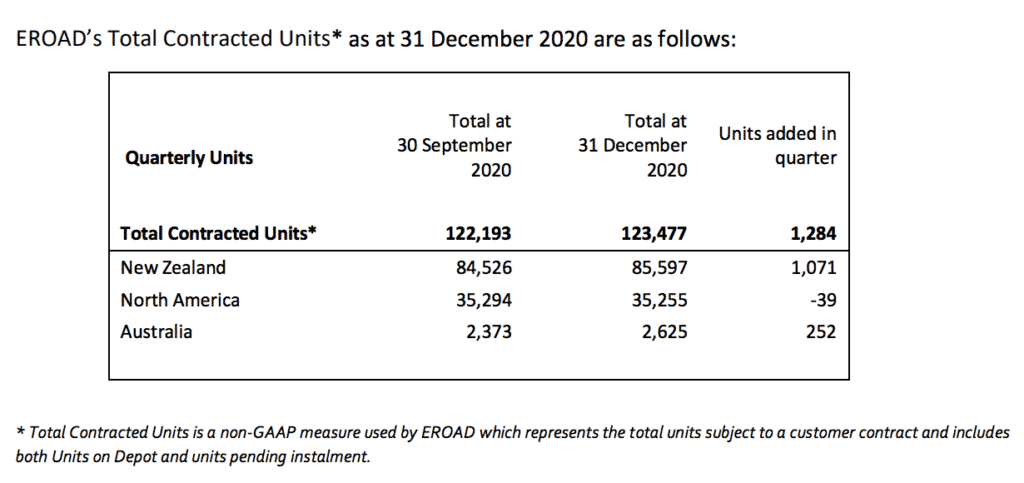

As at December 2020, Eroad had only around 2600 devices deployed in Australia, so this contract represents a near-doubling of its Australian business. This is important, since expansion into the US and Australia is core to the Eroad investment thesis. As you can see below, the vast majority of its devices are in NZ, where it is dominant in its field.

In recent months we have seen the Eroad share price fall around 20%, in part in response to languishing growth in the December quarter. While this contract announcement arrives later than I had hoped, it is good to finally see the company make better progress in Australia. As a reminder, regulation is a key driver for sales, and the Australian regulatory environment has been less conducive than the environment in NZ or the USA.

Today’s contract announcement also says that the new deal is expected to result in an additional 1,500 devices installed in NZ, so overall the company should increase its total contacted units by about 3.2% on the back of this deal. That’s not huge, and the significance of this contract win is arguably more to do with showing green shoots in the nascent Australian market.

This makes the claimed “remaining short to medium term enterprise pipeline of some 15-20,000 connected vehicles,” in Australia seem more achievable than ever.

For me, Eroad is intended to be a multiyear compounder. This will only occur if it successfully executes its growth plans in the USA and Australia. Obviously, if it gets anywhere near the market penetration in those countries, as it has in NZ, then I will be onto a winner.

One swallow absolutely does not a summer make, and this announcement does not change my valuation of the company. However, as a shareholder I will take this opportunity to note this positive waypoint on the company’s journey to international expansion.

This article documents some of the factors influencing a company’s share price, but the article is not financial advice, it is general in nature, and our disclaimer is here. Claude owns shares in ERD.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

Be the first to receive some of our exclusive hidden content by signing up to our free newsletter below.