This is just a short note to acknowledge that I clearly erred to buy Fastly (NYSE: FSLY). I am sorry.

Just over a year ago, I wrote my first article about Fastly, explaining, in short, that I preferred it to Cloudflare because of its strength in enterprise customers. I saw (and still see) large internet companies as driving the majority of volume for CDNs like Cloudflare and Fastly.

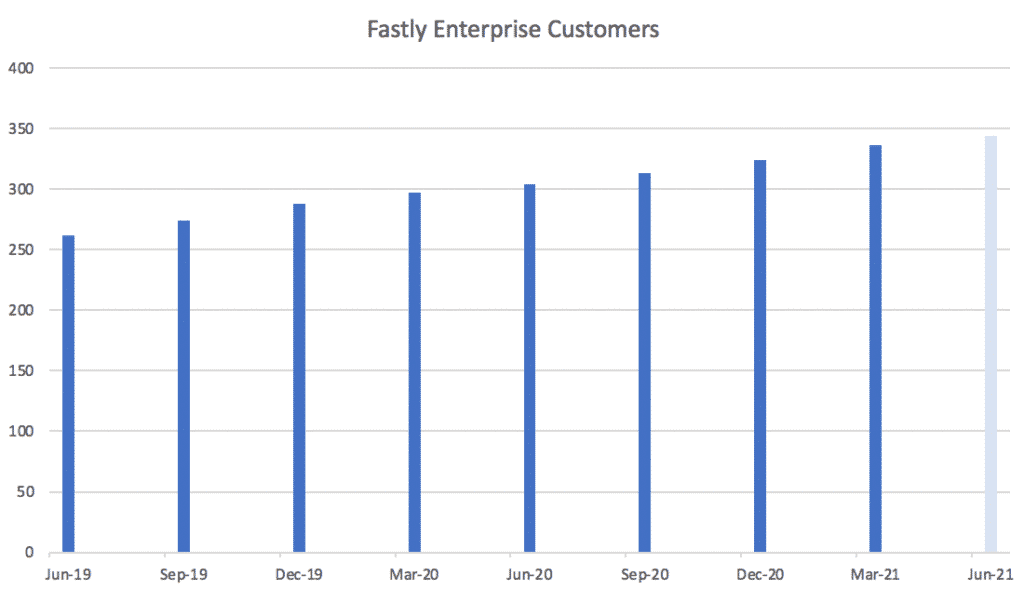

And as you can see below, even when I adjust the final datapoint down to exclude my estimate of large customers added by the acquired Signal Sciences, Fastly does continue to gain traction with large customers spending over $100k per year.

However, while that part of the thesis has held up, it turns out that the competence of the people running the Fastly business is much lower than I thought.

First of all, I was convinced that the founder was a technical leader of high quality. However, in hindsight, it takes more than a technical leader to run a world beating company. I should have realised that it was a risk factor that the founder had stepped aside from the CEO role.

The current CEO, Joshua Bixby, has been in the role since early 2020 and does not inspire confidence. First of all, the company missed guidance. In hindsight, that was the time to sell, but I gave Bixby a pass for it.

Second, the CFO resigned.

Third, Fastly had an outage event, which caused it to lower guidance (again).

Fourth, one early seed investor in Fastly has been openly calling for the CEO to be shunted, and it seems like he’s become a lightning rod for unimpressed employees.

Only thing more embarrassing than Fastly being the leader of decelerating growth is the lack of plan to fix it.

— Bryce Roberts (@bryce) September 15, 2021

Shareholders are sure to see some shuffling of the deck chairs, but don’t be fooled. There is no plan.

Sometimes nice guys really do finish last $FSLY #byebyebixby https://t.co/wfTQT3pE1a

You really can’t make this stuff up:

— Bryce Roberts (@bryce) September 30, 2021

Got a call from a Fastly exec today who was trying to resign but their boss had just resigned so they didn’t know who to tell that they’re resigning.

As the saying goes- the impact of bad culture and leadership are felt gradually then Fastly

Basically, it has become clear that the CEO of Signal Sciences would be a better leader of Fastly than the non technical CEO Bixby. Meantime, the founder of Fastly, Artur Bergman, and the CEO, Bixby have been selling shares at between $40 and $50. There is some evidence (unconfirmed) on social media that the CEO of signal sciences is unhappy with Bixby’s leadership.

@AMPeters06 liked this comment. There are obviously deeper leadership issues at @fastly. Honestly, I believe it is rooted in the incompetence of Bixby. The Street simply does not believe him because of bad governance. Time for him to be fired. Abdiel Cap will turn activist. $fsly https://t.co/FSIvL1cyEe

— BobbyBonillaDay (@BobbyBonillaDa1) August 5, 2021

Quite frankly, if I had any power to influence things, I’d be calling for Bixby’s resignation, too.

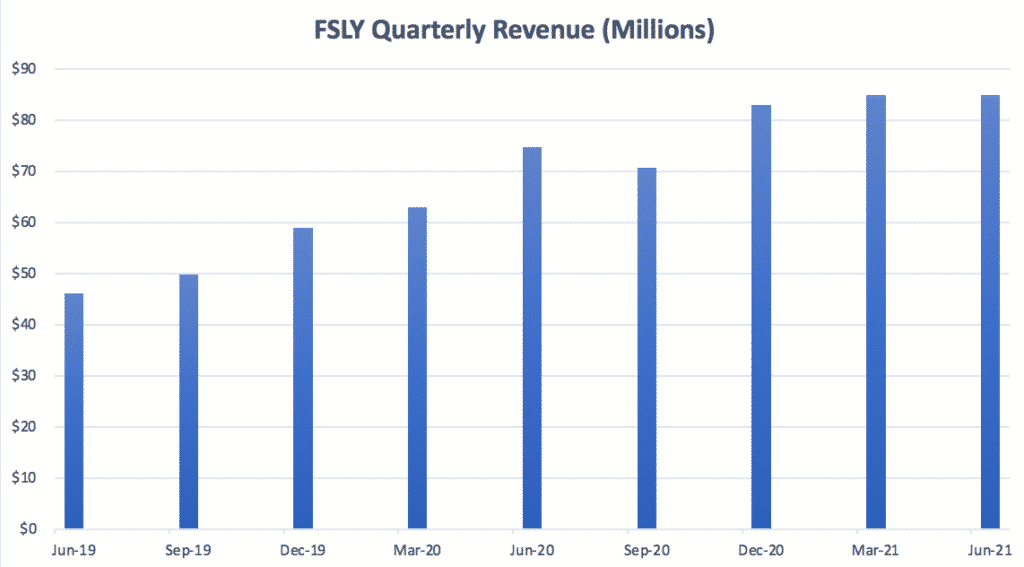

You see, despite winning new large customers, Fastly failed to grow its revenue in the last quarter, because existing large customers are spending less. Indeed, one of the top 10 customers, potentially Amazon, removed all their traffic from the Fastly newtork in response to the outage. While Amazon traffic has reportedly now returned to Fastly, it just goes to show that Fastly’s halo as a ‘must have’ for top websites is looking dusty.

The Fastly Thesis Is Badly Damaged

As an investor, I look to invest only in companies with top notch management. In my view, the near entirety of my mistake with Fastly comes down to two factors:

- Overestimating the CEO.

- Underestimating the willingness of large Fastly customers to stop using the service due to flaws with it.

As I said in my last article on Fastly, I should have held Cloudlflare, not Fastly.

Now, with new information pertaining to the competence of management, it may be time to take action.

I am very hesitant to sell out of a long term thesis due to potentially temporary problems, such as an inadequate CEO. However, I have taken the decision to sell at least half my Fastly shares.

My US stock portfolio has plenty of extremely resilient, well run businesses like ServiceNow, Salesforce.com, Alphabet, Atlassian, Unity Software and Crowdstrike. Once I sell my Fastly shares, I’ll look to redeploy my capital into one of the big US tech businesses that is kicking goals, probably Cloudflare, Datadog or Digital Ocean (the latter of which I already hold).

However, I won’t be in a rush to sell all my Fastly shares, as I see this as a potential turnaround, and the tailwinds remain in place. I will probably sell some of my Fastly shares before their results later this month, and some after, in November. I may hold on to some Fastly shares for longer term, in hope of a management clean out, but suffice it to say I think that some of the other companies above are more attractive.

Please remember that these are only incomplete reflections on a stock by the author, who currently owns FSLY shares but is planning to sell them in the near future. This article should not form the basis of an investment decision. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.