This morning one of the best quality small ASX financial companies, Fiducian (ASX:FID) reported earnings of 38.7 cents per share in the Fiducian 2021 financial year results. At the current price of $8.53, that puts the company on a price to earnings ratio of around 22, which isn’t too demanding, given its long term history of earnings growth. With today’s record dividend announcement, the company now trades on a yield of 3.1%.

Fiducian Group is a financial planning and funds management business. It makes its money through financial planning fees, funds management fees and funds administration fees. As part of this, Fiducian owns financial planning software (FORCe), an on-line reporting tool (Fiducian Online) and a platform administration system

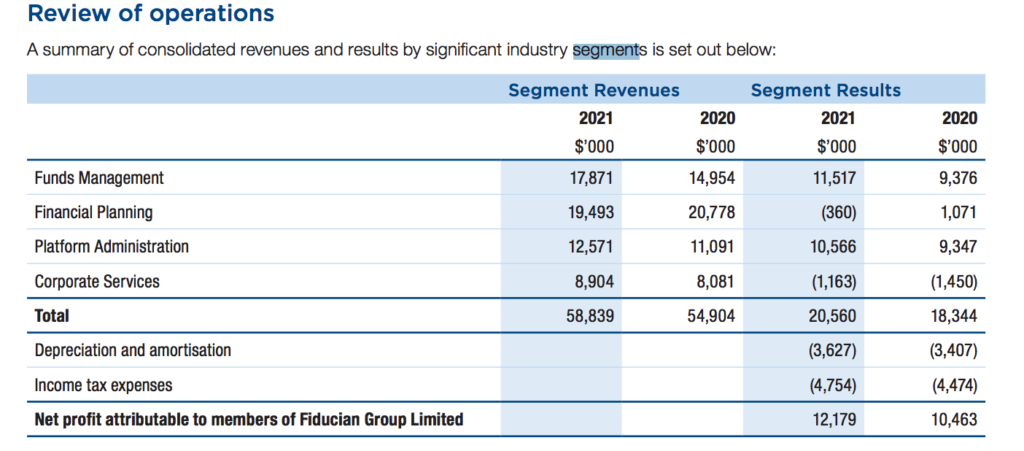

(FasTrack). As you can see below, the funds management fees and funds administration fees are the main contributors to profitability.

The company has no debt and over $19 million cash. Its profit result of $12.2 million was backed up by free cash flow of about $14 million, suggesting that the company’s earnings are of very high quality. Free cash flow roughly matched profit in FY 2020, as well, so this is not a one-off win for Fiducian.

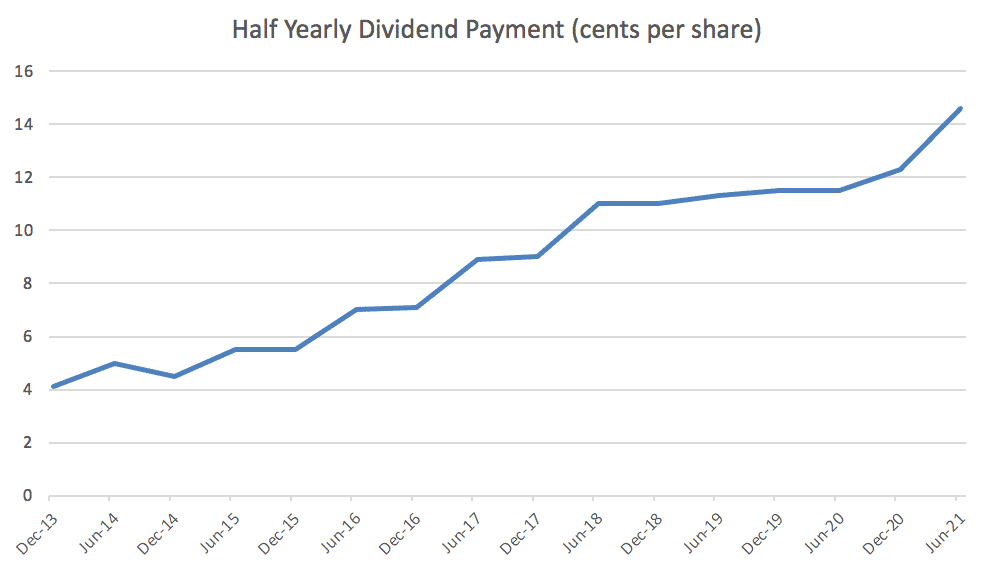

In fact, Fiducian is quick to point out that it has a long history of paying the cash it generates directly to shareholders. You can see below how it has consistently increased its semi-annual dividend payments.

Inderjit (Indy) Singh OAM Founder of Fiducian Group

I first started following what was then Fiducian Portfolio Services (ASX:FPS) back in 2013, when the share price was around $2.20. One of the reasons that I looked at the company was that it was founder lead, and today its founder, Indy Sing, is still the executive chairman. Notably, he still owns around one third of the company. From my research a decade ago, it’s clear that many Fiducian planners also own shares in the company. Notably, one of the directors was buying shares at the end of last year, just below $6.

Fiducian Group (ASX:FID) Has A Scalable Business

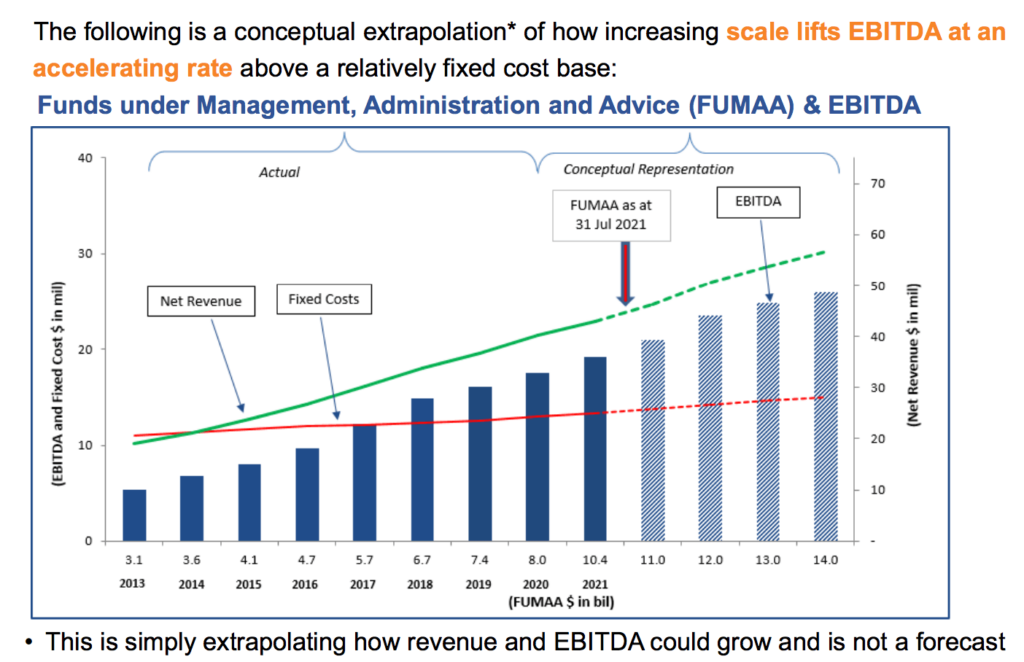

Even though Fiducian shares have done very well over the years, I believe it’s not too late to start following the company. The reason for this is that it has clearly shown a strong track record of growth, and leadership have clearly shown a respect for shareholders, through increasing dividend payments and accurate communications. On top of that, the funds management/administration/advice business is very scalable. The slide below from the company’s presentation demonstrate how (theoretically) profits can now grow faster than revenue, thanks to operating leverage.

Are Fiducian Group Shares Attractive?

Generally speaking, I’m not a big investor in funds management businesses, and I don’t own shares in Fiducian Group at the time of writing. One of my reasons for not investing much in funds management companies is that they are leveraged to overall markets. That’s means if markets go down, then so too will the asset base on which they charge fees.

Having said that, I believe Fiducian is a high quality business and arguably, it’s only gotten stronger through the pandemic. The executive chairman said that while he expects in-person meetings to resume once covid is under control, “video conferencing, which is low cost and more efficient, will now be more widely used.” That probably means each financial adviser can do more.

At the end of the day, Fiducian makes a lot of money from its “manage the manager” funds. Essentially these funds add a layer of fees, which is how Fiducian makes money. From the look of their performance, and growing assets under management, most clients are happy with the service they are receiving. This kind of business is very scalable and profitable, and the company can grow incrementally by purchasing smaller financial advice businesses. With multiple growth levers, I think that Fiducian Group probably still has a bright future in front of it, and remains an under-rated small cap ASX stock.

I do not currently own shares in Fiducian Group (ASX:FID), but I have in the past, and these FY 2021 record results are consistent with my view that it is a high quality business, well worth watching.

Please remember that these are personal reflections about a stock by author. I don’t own shares in Fiducian Group though may buy some in the future. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.