This post is not financial advice, and you should click here to read out detailed disclaimer.

Financial services business Fiducian Group Ltd (ASX:FID) released a typically upbeat set of half year results last night. Revenue increased 13% to $27.8 million, statutory net profit after tax (NPAT) rose 7% to $5.4 million and the company declared an interim dividend of 11.5 cents, up from 11 cents last year.

| Dividend Paid Date | Cents Per Share |

| Mar-15 | 4.5 |

| Sep-15 | 5.5 |

| Mar-16 | 5.5 |

| Sep-16 | 7 |

| Mar-17 | 7.1 |

| Sep-17 | 8.9 |

| Mar-18 | 9 |

| Sep-18 | 11 |

| Mar-19 | 11 |

| Sep-19 | 11.3 |

Fiducian reports underlying NPAT (UNPAT) in addition to statutory NPAT which I think gives a truer reflection of the performance of the business. UNPAT was up 13% to 6.4 million in line with revenue growth. The key difference between statutory NPAT and UNPAT is that the latter excludes amortisation from acquired intangibles. I think this cost can be excluded since Fiducian will not need to incur a capitalised expense in the future to preserve these assets.

Statutory earnings per share (EPS) rose 7% to 17.1 cents while underlying EPS improved 12% to 20.4 cents mirroring NPAT growth and demonstrating that profit uplift was not at the expense of share dilution.

The balance sheet remains strong with $12.8 million in cash and no debt compared to $11.8 million last year. This was despite $3.6 million of dividend payments during the half.

Fiducian usually expects to achieve operating leverage as its cost base is relatively static. This did not happen this half with EBITDA margin steady at 32% for four main reasons.

- Additional salaried financial planners due to acquisitions made since the start of last financial year.

- Additional staff for product distribution and recruitment of financial planners

- Additional audit requirements for financial planners as a consequence of the Royal Commission into financial services

- Higher insurance premiums as a consequence of the Royal Commission

The first two should lead to revenue growth in the future so can be considered “good” costs. Despite the latter two, “other expenses” (which likely includes these costs among others) fell from $3.7 million in the prior corresponding period to $3.2 million in the first half of this year. There was an unexplained $0.6 million allocated to “other payments” under investing cash flows, but this is unlikely to relate to audit or insurance costs.

Fiducian derives revenue from three sources being funds under advice (FUA), funds under management (FUM) and funds under administration (FUAdm). Combined, these rose 11% to $8.2 billion over the half and have more than doubled over the past five years.

Funds Under Administration (FUAdm)

FUAdm increased 8.3% to $2.23 billion over the period. Broadly speaking, this part of the business is an investment administration platform similar to those sold by listed peers Hub24 Ltd (ASX:HUB) and Netwealth Group Ltd (ASX:NWL). It differs from these other businesses in that it primarily serves salaried and franchisee financial planners under the Fiducian umbrella whereas they sell to external planner groups. Fiducian does also offer a “white label” product to external groups and FUAdm has risen to a modest $28 million as at 31 December 2019 for this business segment. Encouragingly, management is expecting higher total FUAdm inflows in the second half compared to the first half of this financial year.

Funds Under Management (FUM)

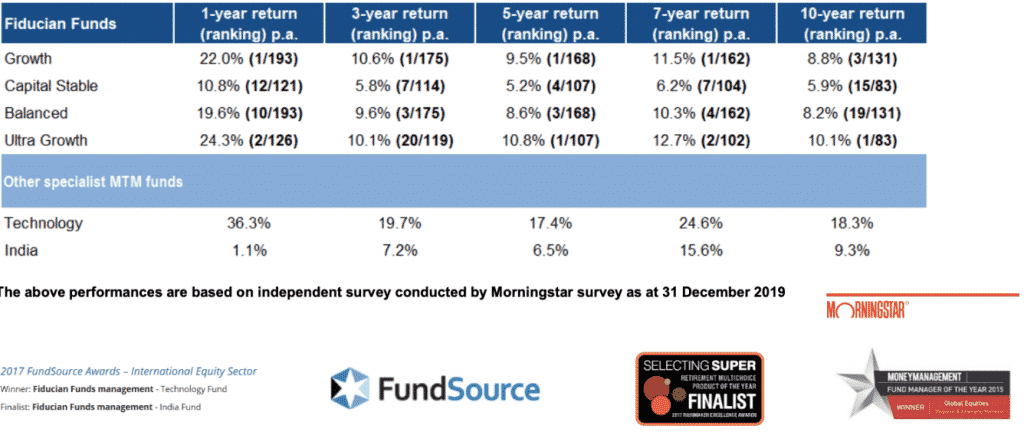

FUM increased 8.8% to $2.83 billion during the half. Fiducian operates a “Manage-The-Manager” system rather than investing client funds directly itself. This approach reduces volatility and has not come at the expense of inferior performance (as can be seen below).

Funds Under Advice (FUA)

FUA rose 14.6% to $3.14 billion, with almost all of that growth due to acquisitions ($355 million FUA), in particular the purchase of MyState Retail Financial Planning Business.

Verdict & Valuation

Fiducian is a roll-up company that is also growing organically. It achieves revenue synergies by cross selling platform and fund management services to the clients of the financial advisors it acquires. We can expect Fiducian to deliver a strong second half in financial year 2020 as it converts much of the $355 million of FUA acquired in the first half to FUAdm and FUM.

Vertical integration is a controversial model in the financial services industry because firms that employ it have a vested interest to push clients into their own products regardless of whether they are in the client’s best interests. There is a risk that Fiducian could be impacted by adverse regulation, but ultimately the investment performance it achieves for its clients leads me to conclude that it is doing nothing wrong.

The stock trades on a forward price to earning ratio of 14 based on my forecast UNPAT of $13.5 million for the year. This assumes UNPAT of $7.1 million for the next six months versus $6.4 million for the first half of the year. This should be achievable given the cross sell opportunities from recently acquired FUA assuming no market meltdown. I think Fiducian stock is reasonably priced for a compounder, even one that is subject to market cycles.

The author holds shares in Fiducian, and does not intend to trade them for the next couple of days. This is an investment diary and does not consider your circumstances, is not intended to be financial advice and is certainly not a recommendation.