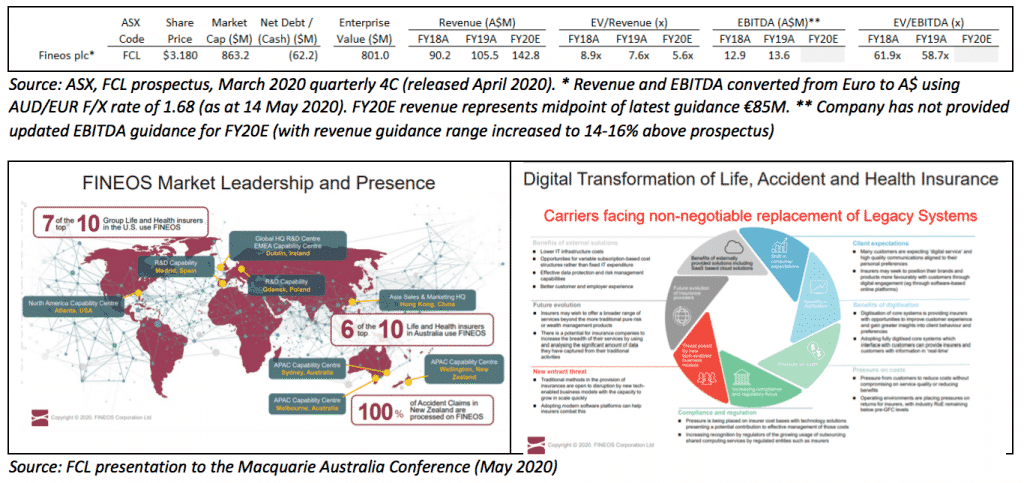

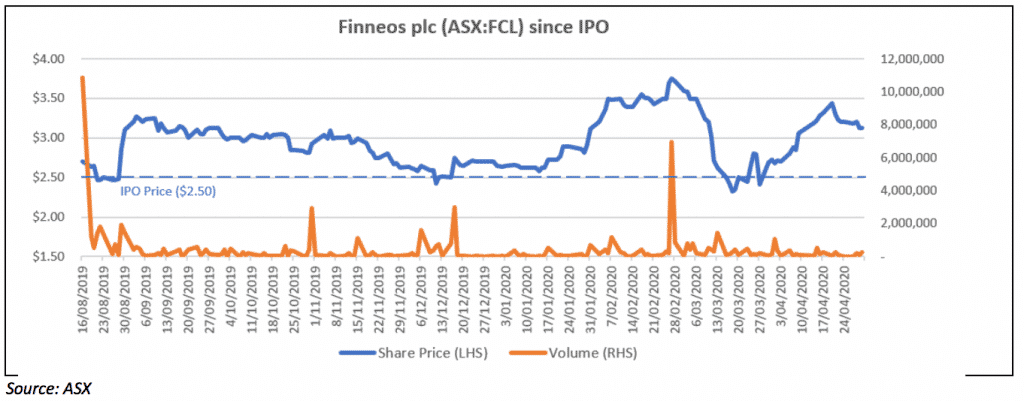

The last stock for A Rich Life’s Shark Week Software Week is FINEOS Corporation Holdings PLC (ASX: FCL), an Irish-headquartered insurance software company which listed on the ASX in August 2019. Longer term readers will already be familiar with this company. Although its shares have recovered since March, they still languish around 15% below all time highs, at $3.17.

What Does FINEOS Do?

FINEOS is a provider of core systems software to the Life Accident & Health (LA&H) insurance industry and serves more than 50 LA&H insurers in 8 countries – including many of the top 10 in both the US and Australia (a potential contributor to the decision to list on the ASX).

The company was founded in 1993 as a consulting and services business but pivoted to software in 2003 with the launch of its flagship FINEOS Claims product – focused specifically on LA&H claims management. The story is that the company identified this as a significant gap in the market because it had spent a decade advising clients in this sector.

As we are seeing with many other industries, there are a number of key structural drivers for the increasing penetration of SAAS within the LA&H market:

- With the insurance sector being disrupted by new digital entrants, there is pressure on insurers to modernise their technology systems – in order to both better compete with these nimbler upstarts and also to improve the customer experience. Many major LA&H players operate with clunky legacy IT systems which were developed in-house decades ago and which have not kept pace with changing customer preferences or business needs (including the ability to undertake complex actuarial calculations on huge data sets for quantifying risk and tailoring insurance products);

- Increased competition and rising compliance costs are compelling insurance companies to lower operating costs (while still maintaining high customer service standards) in a bid to protect margin. The transition from clunky internal legacy systems to modern cloud-based software achieves this aim and also transfers the risk burden to these external providers, while at the same time allowing insurance companies to allocate capital to other uses (i.e. and not spend it maintaining legacy systems); and

- Switching to cloud-based SAAS models from external software providers enables insurance operators to benefit from faster product upgrades and enhancements, utilise the new suite of predictive analytics tools to assess customer profitability and risk profiles, and of course improve security, business continuity planning and disaster recovery.

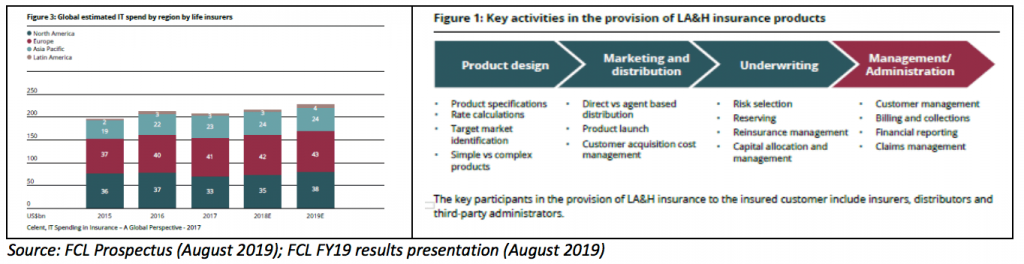

The Life, Accident & Health (“LA&H”) Insurance market and the FINEOS (ASX:FCL) platform

According to fintech market research firm Celent, total IT spending by LA&H insurers totalled ~US$100B in 2017 – of which ~55% is estimated to have been spent internally and ~45% on external services and software vendors (such as FINEOS). The total global value of life insurance premiums was US$2.7 trillion in 2017 per the Swiss Re Institute, with the US accounting for ~21% and China, Japan and the UK combined representing a further ~30% of the market. As such, the ~US$100B of IT spend in 2017 corresponded to less than 4% of annual life insurance revenue.

More importantly, the global LA&H market grew at less than 1% annually between 2010 and 2017, and exhibited no overall growth between 2014 and 2017 with insurers failing to generate growth in policy premiums. With cost inflation, rising competition and negligible overall market growth (despite 15%growth in the world’s urban population between 2010 and 2017 (per the Worldometer website)), LA&H players are therefore likely highly motivated to protect their profits by stripping out costs – and outsourcing IT expenditure is an obvious lever to pull.

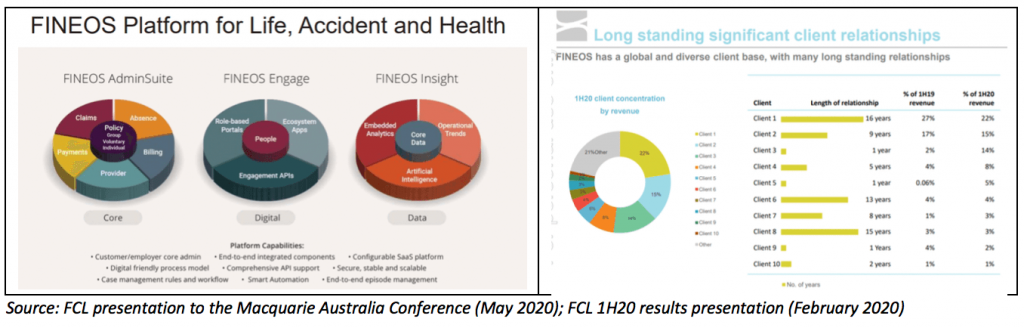

FINEOS’s software platform is centred on the insurance policy management and administration processes (above right). The platform has expanded since the launch of the FINEOS Claims product and following 5 years of significant investment in R&D (at a cost of ~€100M between 2015 and 1H20) now comprises three product suites as set out below left. Customers can adopt some or all modules depending on their requirements. The platform has been developed and designed for insurance companies of varying sizes, with the ability to scale to thousands of user per client, and the capacity to absorb a large number of transactions being processed by a large number of users simultaneously.

- FINEOS AdminSuite supports all core insurance functions and connects to the third-party technology and digital platforms used by insurance companies and their partners. FINEOS Claim manages the whole insurance claims process from start to closure and integrates with the Payments and Provider modules (which manage transactions with medical and healthcare providers). FINEOS Absence helps manage employee leave – and as we will see shortly, may be a key near-term growth driver for the company in the key US market;

- FINEOS Engage helps insurers connect with customers and business partners in real time; and

- FINEOS Insight provides data analytics to improve insurer decision making and processes more generally, and uses real-time dashboards to monitor KPIs and operating trends. The Artificial Intelligence capability is still under development – the intention there is that FINEOS’s extensive data repository will enable predictive LA&H AI models in the future with respect to the claims process.

FINEOS has nearly completed its transition from an on-premises model to cloud-based SAAS delivery, with all new software sales since July 2017 being priced on a SAAS model. As was typical before the emergence of SAAS, on-premises contracts comprised a higher initial upfront licensing fee, and then lower annual licensing fees over the remaining life of the contract.

Under new SAAS contracts, clients pay an annual subscription fee (indexed for inflation over the life of the contract) and based on the number of licensed users (for the FINEOS Claim module) or percentage of insurance premiums underwritten by the client (for FINEOS Policy and Billing). Revenue is therefore smoother year on year under SAAS pricing versus the previous on-premises model (which was forecast to comprise just ~2% of FY20E revenue per the prospectus). This is a positive, because it should see FINEOS revenue grow along with their clients.

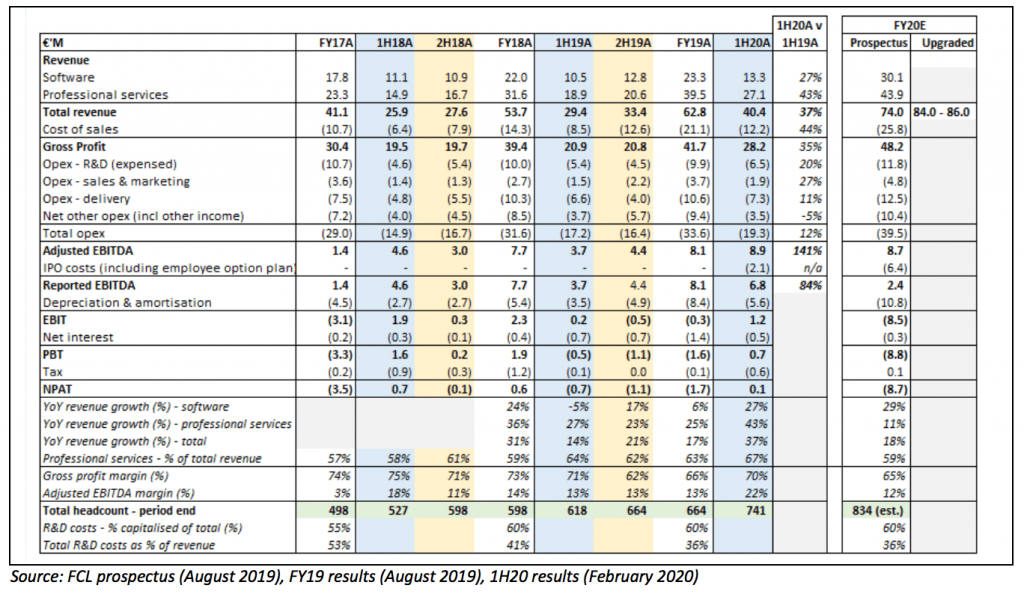

The largest component of FINEOS revenue however is the Professional Services fees – which are levied for various product implementation services for new customers, and also subsequent customisation and integration work. Professional Services fees by definition are lumpier and non-recurring in nature and for 1H20 comprised 67% of total revenue. As can be seen from the P&L table later in this note, this proportion has been increasing since FY17 (57%).

Following significant customer wins in North America over the past 18 months, that region has become the largest contributor to total revenue – accounting for 55% of 1H20 income (from 41% for 1H19, and 35% for FY18) – while the Asia Pacific generated 39% of 1H20 revenue (down from 53% in FY18).

FINEOS appears to be a beneficiary of evolving Integrated Disability and Absence Management (“IDAM”) legislation in the US – which is increasing demand for the FINEOS Absence (and also FINEOS Claim) modules as companies try to manage the changing employee benefits landscape. New leave programs are being legislated to commence in different US states at different times: for example, paid family leave coming into effect in Washington from July 2020, and paid family and medical leave commencing in Massachusetts in January 2021, Connecticut in January 2022 and Oregon in January 2023.

This evolving legislative regime clearly has the potential to impact companies operating in multiple states with differing benefit frameworks, and there will be a need to prepare systems well in advance of legislation taking effect – which should be a nice tailwind for FINEOS in this market over the next few years.

FINEOS does have a relatively high degree of customer concentration – per the pie chart above right – with the top 4 clients constituting ~60% of total revenue in 1H20. This can be a double-edged sword of course. If FINEOS were to lose (fail to renew) one of these customers, it would be a big hit, and this dynamic gives large customers a lot of power. However, we can see that 6 of the company’s top 10 customers (as at December 2019) have been with FINEOS for 5 years or longer. This appears to demonstrate strong relationships forged with these insurers ,and the embedding of the FINEOS platform within their ecosystems.

Fineos operational momentum and guidance upgrades

FINEOS has demonstrated good operational momentum since listing – which has already driven two upgrades to prospectus forecasts for the current FY 2020 year estimates (in addition to a small beat to FY19 forecasts shortly after listing):

- The FY19 prospectus beat (€1.3M at both the revenue (+2%) and EBITDA (+18%) lines) was largely driven by higher than budgeted Services revenue in connection with three 5-year US contract wins in the June 2019 quarter. These contract wins added €4.6M of annualised subscription revenue in FY20 (and were already included in the FY20E forecast), scaling up to €12.2M of annual revenue in later periods per management;

- The September 2019 quarterly cashflow released in late October heralded five new contract wins (of 5 years or longer) for the quarter and the company reaffirmed prospectus forecast revenue of €74M for FY20E (an 18% increase on FY19A revenue);

- At the AGM in December, FINEOS upgraded FY20E revenue guidance to a range of €80-€82M based on increased Services demand – both in connection with implementations for new clients but also higher levels of customisation for “existing Tier 1 clients who wish to embed FINEOS deeper within their operations”. The company signalled it would accelerate recruitment on both the software development and professional services delivery side, aiming to add an additional 100 people (an increase of 14% vs November headcount) before the end of June. FINEOS also flagged ~€5M of cost savings in relation to lower than forecast IPO costs (with selling down shareholders responsible for their own brokerage costs (which is typically the case anyway)) – which will positively impact FY20E; and

- In February, the company announced a new 5-year contract with Prudential Insurance Company – another Tier 1 (top 10) US insurer – which will implement the FINEOS platform to support its IDAM legislation preparation. At the release of 1H20 results later in the month, the company upgraded full year FY20 revenue guidance to €84M-€86M (an additional €4M above guidance provided 2 months earlier) – which included another IDAM-associated win with the Massachusetts State Department of Family and Medical Leave.

As detailed earlier, these new contract wins will increase the weighting of Services revenue as a proportion of total income in the short term, with recurring Software revenue taking longer to flow through.

Financial performance

FINEOS generated revenue growth of 31% in FY18 and 17% in FY19, and had projected further solid revenue growth of 18% for FY20E. As a result of the material increase in demand for Services in FY20YTD, the upgraded revenue forecast for FY20E now represents growth of ~35% vs FY19A (at the €85M mid-point). Non-recurring Services income has increased at a faster rate since FY17 than recurring Software revenue (which is ordinarily deemed to be of higher quality the former). Commentary from the company since the AGM in December suggests Software may be 5-10% lower than forecast in FY20E – but still representing ~15-20% Software growth versus FY19A – this reflects a mix of strong Subscription software growth combined with the continued winding down of the old model on-premises software.

To be fair, it is also true to say that the upfront implementation part of Services income is a good lead indicator of future increasing Subscription revenue – so while any valuation of FINEOS should not extrapolate current high growth rates of Services revenue ad infinitum, directionally the higher current Services revenue provides a degree of comfort around increasing Subscription income in the medium term. Finally, the tailwind in the US from IDAM may mean relatively elevated Services income from those customers for a few years yet.

As the company “matures” and is less reliant on winning new customers, we would expect Software revenue to eventually comprise the majority of FINEOS’s total revenue base – and this mix shift should have a positive gross margin impact (as Software GM% is likely closer to 80% vs something like 50-55% for Services). You can see below how GM% has declined since 1H18 as the proportion of Services revenue has increased over the last 2 years, and we would expect this effect to reverse in later years.

While the top line has been growing nicely over the past few years, NPAT has not been improving dramatically just yet. This is because FINEOS is making heavy investment in developing its platform – with the hiring of additional product engineers and creation of new product teams in order to accelerate the product development cycle and bring new product upgrades to market sooner. This is evidenced by growing expensed R&D costs above the line, and growing D&A (including the amortisation of capitalised R&D costs) below the line). A Rich Life readers will recognise this as fairly standard fare for fast growing software companies focused on building what they hope is a world class product.

FINEOS appears to currently have an accounting policy to capitalise ~60% of total R&D investment – an increase from 55% in FY17 but within the 50-70% capitalisation range we tend to see for software companies which are still heavily in development mode. As noted in the PKS Holdings note, this is permissible under international and Australian accounting standards, and reflects the creation of an asset from which the company will derive several years of benefit. FINEOS amortises capitalised R&D expenditure over a 5-10 year period depending on useful economic life each particular project (compared with 10 years for PKS).

Closing thoughts

As a reminder, this post is not intended to be financial advice, and you should click here to read our detailed disclaimer.

FINEOS estimates that of the ~US$45B external IT spend in 2017 (estimated by Celent earlier in this note), only US$10B of this was on core systems software and services – if so, FINEOS’s original FY20E forecast revenue of €74M (~US$80M) suggests less than 1% market share for the company currently.

As you might expect, FINEOS’s medium term growth strategy is centred around increasing its market share by winning new LA&H insurer clients in its main operating markets, upselling existing clients (to take on additional modules and products) and achieving its aim of making the FINEOS platform the de facto industry standard. The company could also expand into new geographic markets (with investment made in its Sales & Marketing team in FY20), and there are other adjacent insurance verticals which FINEOS could set its sights on (medical, dental and vision are three areas explicitly called out in the February results investor presentation. In addition, the AI capability now being researched in the FINEOS Insight suite may also be a potential game changer.

At current market price of $3.18 FINEOS is no minnow, with an Enterprise Value of close to $800M in Australian dollar terms. This is not super expensive from a revenue perspective – EV/Revenue of 5.6x for FY20E is in line with Damstra (first cab off the rank for Software Week) – but obviously earnings multiples are in the nosebleed category for the time being as the company sacrifices near term profitability for future revenue and profitability. The share price has held up relatively well (especially in comparison with many other software IPOs from the 2019 class) and currently sits 27% above the IPO price. The stock is relatively illiquid, with the CEO Michael Kelly and his wife holding a combined 64% of the company – which will make it more difficult for domestic institutions to build meaningful positions.

Commentary from management in the recent March 2020 quarterly cashflow report (released in late April) suggests that FINEOS has not materially impacted by COVID-19, indeed may benefit somewhat from the rollout of new “COVID-19 paid leave calculators” to US clients. While the company reiterated the upgraded FY20E revenue guidance from February, I would personally expect some potential risk to the downside in terms of new contract wins (arguably more of an impact on 1H21) and potential delays in Service contracts – to be determined over the next few months, but we expect FINEOS to be relatively resilient to COVID-19 given historically low churn levels (~2% in FY18, 0.3% in FY19) and the regulatory tailwinds (in the US especially).

There appear to be strong positive tailwinds heading into FY21 and beyond – including the migration from legacy internally developed systems toward external software providers, the long potential market share opportunity and favourable regulatory requirements. The company commented at the 1H20 results release in February that the US new customer pipeline was strong, buoyed by potential new clients keen to meet IDAM legislative requirements.

As a shareholder I will continue to track the company – in particular I will be keen to see Subscription revenue tick up in future periods, and I’m looking forward to initial FY21 guidance provided – presumably at the release of full-year FY20 results in August 2020.

_________________________________________________________________________________

Disclosure: I (@Fabregasto ) hold shares in FINEOS plc and will not sell for at least 2 days after the publication of this article.