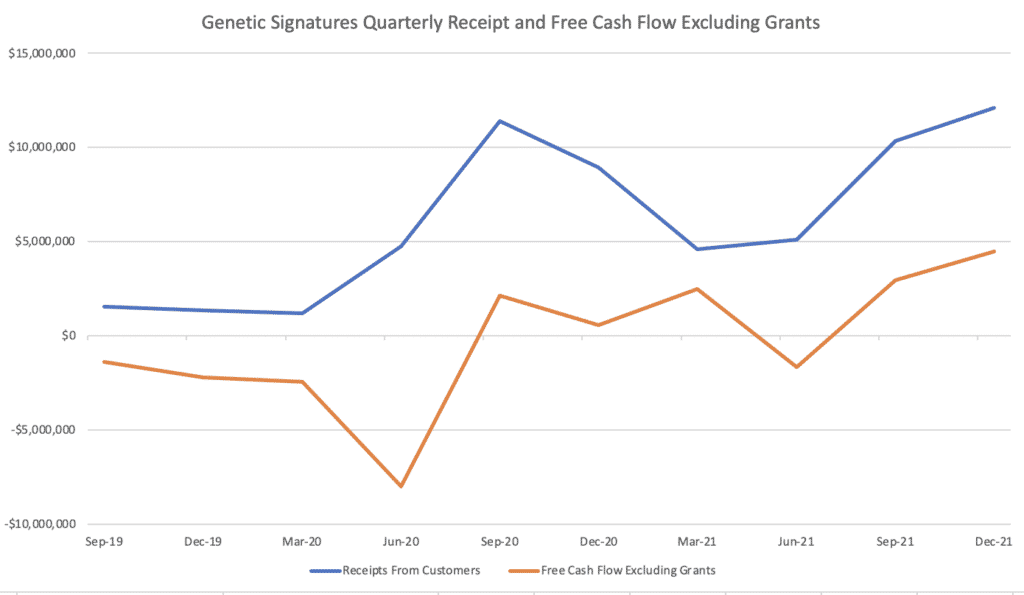

On Friday, PCR test maker Genetic Signatures (ASX: GSS) reported its quarterly results, showing record receipts from customers and free cash flow, driven by strong sales of covid testing kits in Australia. This has been driven by both an increase in testing, and declining efficiency of pathology labs, which now must run more assays per sample, because they can’t pool samples.

Public Pathology Australia chief executive Jenny Sikorski was quoted in The Saturday Paper as saying, “…laboratories were also pooling samples but only in small batches. That is no longer an option. This has contributed across the board to supply shortages in the assays and reagents used to conduct PCR tests”. If and when this reverses (because covid-19 is no longer prevalent in the community) demand for GSS covid kits will decline.

Until the next wave.

If you believe Omicron is the last wave, then Genetic Signatures looks overvalued. But will Omicron be the last wave? We don’t know, but I don’t see why it would be.

The company said that “testing numbers contracted early in the quarter after a stellar performance in 1Q FY22 but picked up dramatically again in December after infection rates rose with the Omicron variant outbreak. This has continued into the new year.”

This statement implies that the company remains a beneficiary of the current Omicron outbreak, even though PCR testing has been substantially replaced by rapid antigen testing. This makes sense, if the number of testing kits required per sample has increased, due to an inability to pool samples, because of high community prevalence.

Unfortunately, however, there hasn’t been any growth in the enteric sales kits, and the company has stopped selling covid PCR tests into the USA, where it only had emergency approval. On the other hand, the USA could be a great growth market once the company gains proper FDA approval for its Enteric test. The company said:

“Genetic Signatures has enhanced its sales team over the last 6 months and the team has been charged with establishing a ready market for the 3base® EasyScreen™ Enteric Protozoan product once it clears FDA, building relationships with KOL’s, and identifying other revenue opportunities.”

Success for this investment ultimately depends on the company’s ability to diversify away from Covid testing, into its other kinds of tests. In the meantime, covid testing is providing free cash flow to fund the company’s growth, without the need for dilution.

The company intends to spend $10m – $12m on developing a “a next generation sample to result instrument,” and it plans to spend up to $6m trying to get at least three products FDA approved. Fortunately, it has the money, with its cash coffers swelling to $37.5 million at the end of December 2021.

Fully diluted, Genetic Signatures has just under 150 million shares on issue, giving it a fully diluted market cap of about $215 million, at the current price of $1.45. Subtracting the cash, that gives us an enterprise value of around $180 million.

In an abstract sense, we can think about what Genetic Signatures might be reasonably capable of doing in a few years, once it has more of its tests distributed globally, including in the USA. Clearly, it would be possible to sustainably do about $50m in revenue, given that it can (arguably unsustainably) already generate that much revenue (because of covid).

These kind of medical products are usually quite high margin. A 20% profit margin would usually be easy enough to achieve (though in reality margins may be lower if the company continues trying to bring new products to market).

But the point is that it doesn’t take an amazing stretch of the imagination to see this is a $10m profit per year business, with growth to boot. At current prices, that would be a price to enterprise value of less than 20, despite being in a favourable industry with high margins and generally increasing demand.

Right now the market is assuming that the company will take a big hit because of a reduction in PCR testing. We can’t deny that PCR tests will reduce from historical highs, but I’m pretty sure the level of covid PCR testing will settle at somewhere well above what it was in 2019 (ie zero).

As I have previously explained, I do not think the market is giving Genetic Signatures enough credit for their historic achievements, and success in developing, then commercialising, novel intellectual property. At this point, I can’t have wonderful conviction in the stock, because I’ve only been following it for a couple of years, but I am certainly finding myself more impressed, over time. I could see myself adding this (as a small position) to my Self Managed Super Fund as an initial holding, if share prices persist at these levels or below. The problem is that the share price could go lower if revenues fall once covid testing drops off. Arguably, the time to buy is once the next variant emerges.

Please remember that these are personal reflections about a stock by the author. I own shares in Genetic Signatures and reserve the right to buy more at any time, though I will not sell any shares within 2 trading days of publishing this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.