Student placement and English testing provider IDP Education (ASX: IEL) recorded a strong report card for 1H FY 2024. IDP Education has overcome great pessimism due to concerns over growing competition in Canada and India. Competitive pressures in India remain but the extraordinary elevation of revenue from student placements propelled revenue and net profit growth of 15% and 19% respectively, relative to 1H FY 2023.

As you can see in the table below, IDP’s H1 FY 2024 revenue growth was driven by an increase in Student Placement revenue. English Language Testing revenue was down slightly and while English Language Teaching revenue was up, it was off a much smaller base.

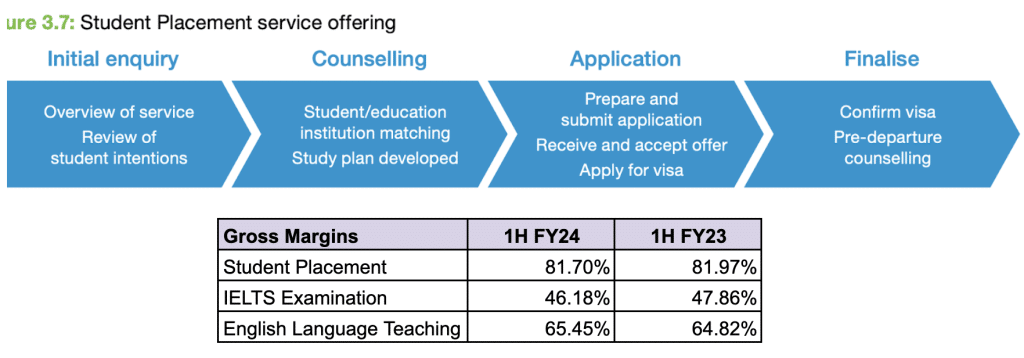

Let’s take a moment to consider how the company makes Student Placement revenue. IDP earns an application processing fee from educational institutions upon the successful placement of a student. The fee amount is dependent on the student’s country of origin, course type and the level of service provided by IDP as illustrated below. Rather than going it alone, IDP acts as a professional agent guiding people who ultimately want to study and land a job in a different country. Generally, the fee is a percentage of the first year of a placed student’s tuition fees but in some instances, it is capped or fixed.

Source: 2015 Prospectus & 1H FY 2024 Report

Student placement revenue also produces much higher gross margins as tabled above. The direct costs associated with student placements include commissions paid to third parties like agents, software providers or service providers that source students and a customer relationship licence fee for OSCAR. OSCAR is a student relationship management platform that ensures consistency in the services provided by IDP and captures key data across the network.

Attracting students seems to be the main prize across the student placement value chain. IDP is one of a few global agents that compete with a large number of smaller agents, benefitting from a highly fragmented market. As IDP captures more student placements, its negotiating muscle with educational institutions as well as third-party service providers will likely only strengthen.

It’s quite clear the IDP narrative has shifted to a student placement business but the IELTS examination remains a significant revenue pillar. Despite lifting average prices by 7%, English language testing revenue still fell by 5% due to a 11.5% drop in volume. This decline was primarily centred in India due to increased competition. The rest of the world pulled their weight as Cambodia and Taiwan reeled in strong contributions.

Notably, IDP’s biggest rival in India for English language testing, Pearson PLC, managed to increase its English language learning sales by 22% in the last quarter of the the 2023 calendar year. Pearson noted this was due to a backdrop of favourable migration policy in Australia and market share gains in India.

IDP has showcased a highly cash-generative and scalable business model. Expectations were ridiculously high between 2020 and 2021 where the forward price to earnings multiple wavered between 50x to 137x. However, after undertaking some strategic acquisitions, these expectations have deflated to more reasonable levels. Whilst the 2021 acquisition to penetrate the Indian market for English language testing hasn’t proven its wares, student placements may just be the pivot to unlock growth over the long term.

At a current share price of just below $22, I have the company on a forward PE multiple of around 32x. If my theory about its strong competitive position in placements is true, then IDP deserves a spot on your watchlist at the very least.

Disclosure: the author of this article does not own shares in IEL. The editor of this article does not own shares in IEL. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.