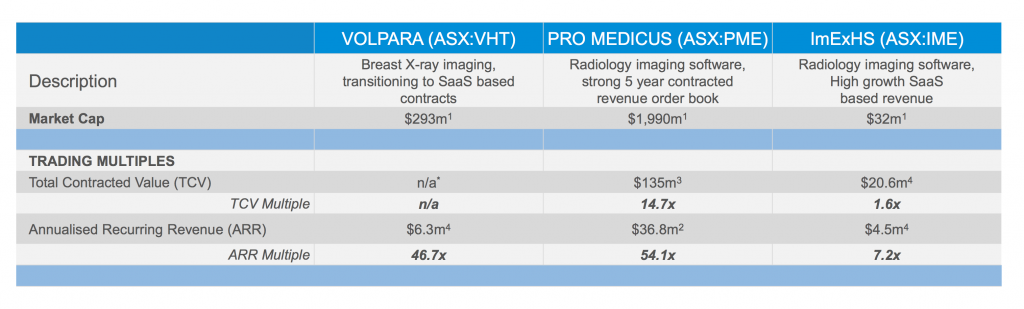

One small company that I get asked about quite often is a small Colombian radiology software and service provider called ImExHS (ASX: IME). The reason I get asked about this a lot is because the company deliberately compares its valuation to Pro Medicus (ASX: PME), as you can see below, in a slide from a presentation it gave.

Analysts and investor relations outlets then use this invited comparison to argue that ImExHS is ‘cheap’ relative to Pro Medicus. Today was the last straw, when I received an email claiming “Indeed, PME serves as a useful peer comparison in terms of what valuation the market can ascribe to these types of businesses.” Let us examine this statement.

Comparing ImExHS (ASX: IME) and Pro Medicus (ASX: PME)

Today, I’m going to explain why PME and IME have virtually nothing in common, other than the fact that the end users of their software are radiologists. Let’s start with the product.

According to the company’s own submissions, IME primarily serves the Latin American market. It makes much ado about its sole Australian client, but when I looked up the business it seemed that the contracting party is owned by two radiologists and at best serves less than a dozen aged care facilities as a mobile ultrasound provider. So the business seems to be the tiniest of the tiny; and it’s not clear why it would even have need of a comprehensive PACS/RIS.

It seems likely, then, that the client was won because they simply wanted the cheapest bit of software attainable for their extremely low volume operation. It would be interesting to know how much they pay IME. One radiologist, who has had experience with half a dozen different RIS systems, said that IME appeared far behind even 3rd tier PACS systems such as CDN and Synapse in Australia, and that he found it difficult to get in touch with any salespeople for a trial.

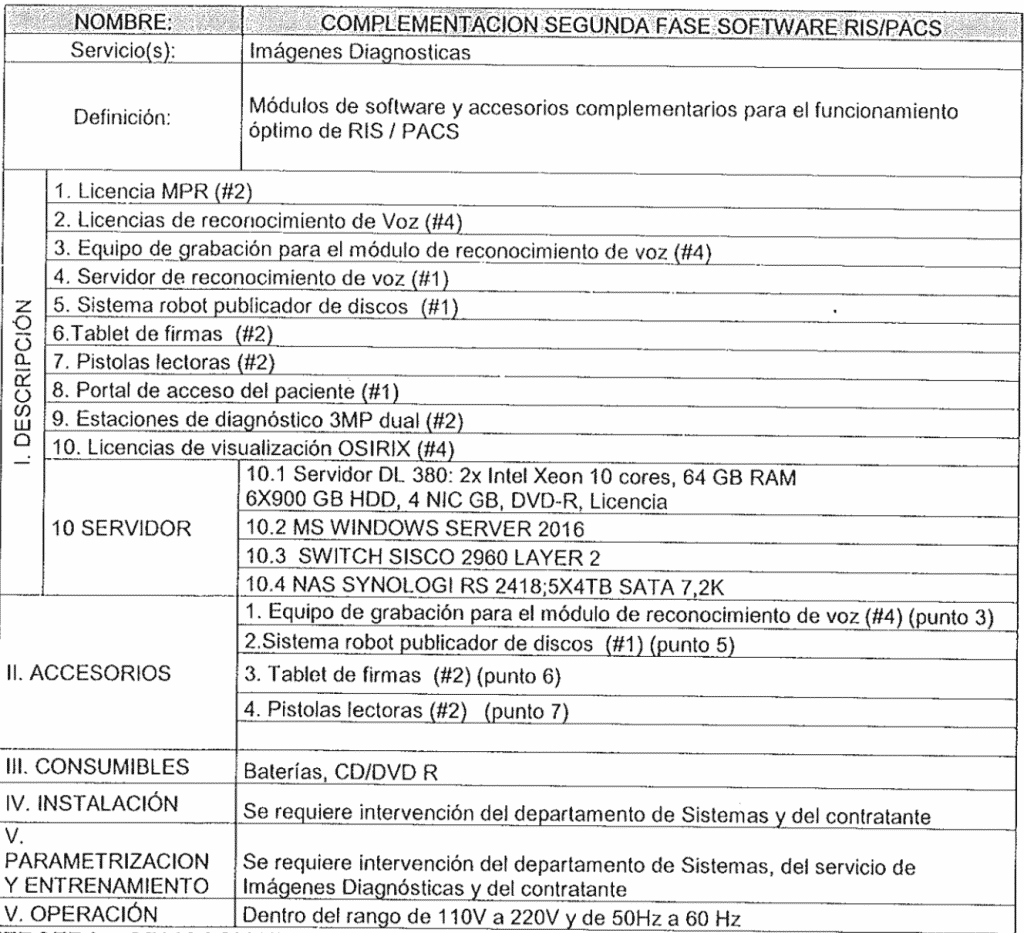

If we look to the company’s latin american business, this hospital contract give some clue as to what the company actually provides in Colombia:

It’s hard to know for sure, but it looks to me like ImExHS is actually reselling Osirix as part of its package. Osirix is an old DICOM image viewer which is a very widely used piece of medical software, which gets the job done but little more.

In comparison, with its Visage viewer and Visage RIS, Pro Medicus serves the largest private radiology networks in Australia and as such processes more scans than any other private company in Australia. Its main value add is that it can process high scan volume extremely quickly and allows radiologists to view studies faster than competing products.

In the USA, Pro Medicus serves some of the largest hospital systems in the world with its viewer and vendor neutral archive systems.

In the past, large private radiology practices have had delays in processing scans due to the large file sizes. These large file sizes (only getting larger) also make it slower to download and read the scans, which is where Visage comes in. Pro Medicus is able to charge a premium for Visage because it allows radiology practices to do more scans per radiologist per day, effectively increasing revenue for the relatively fixed (and high) cost of the radiologist’s salary.

Given this is the value add, Pro Medicus has a relatively small addressable market because it is only able to price the way it does to organisations that are making an investment in future profitability (and charge high prices per scan). For this reason, the USA has been the most successful jurisdiction, while in Australia the company has limited itself to private practice.

Most government healthcare systems don’t have the appropriate incentives in place to see purchases of products like Pro Medicus sells, though they have had some success in Germany.

As a result of this, Pro Medicus is able to unusually high EBIT margins of around 55%. This is possible as a result of two factors: 1) Premium pricing for its own intellectual property and 2) Scale.

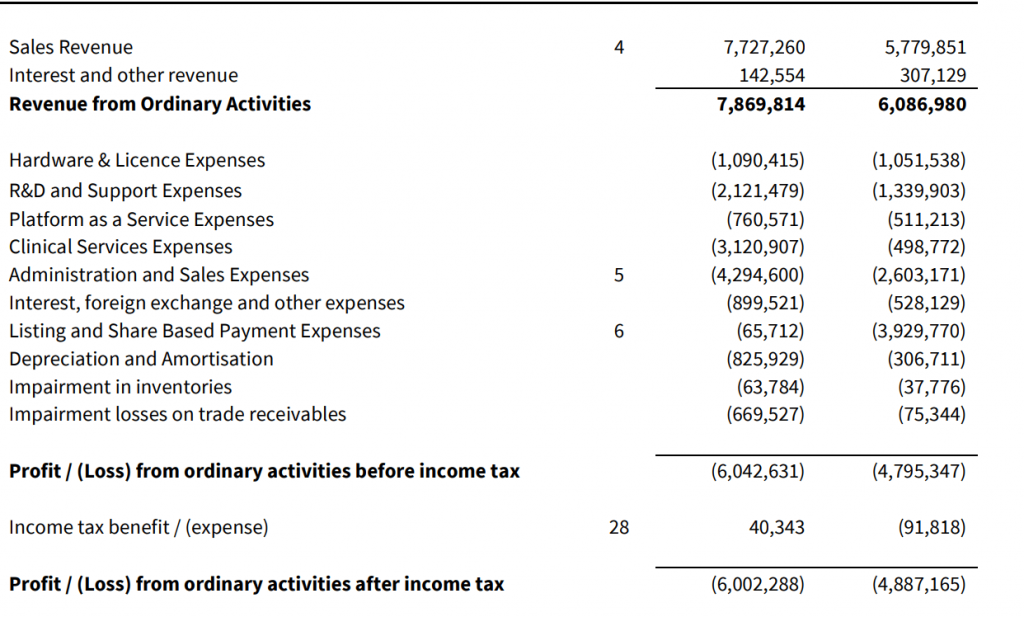

IMEXHS Ltd (ASX: IME) possesses neither of these attributes, as a business. Indeed, we can see below that its revenue brings a litany of other expenses:

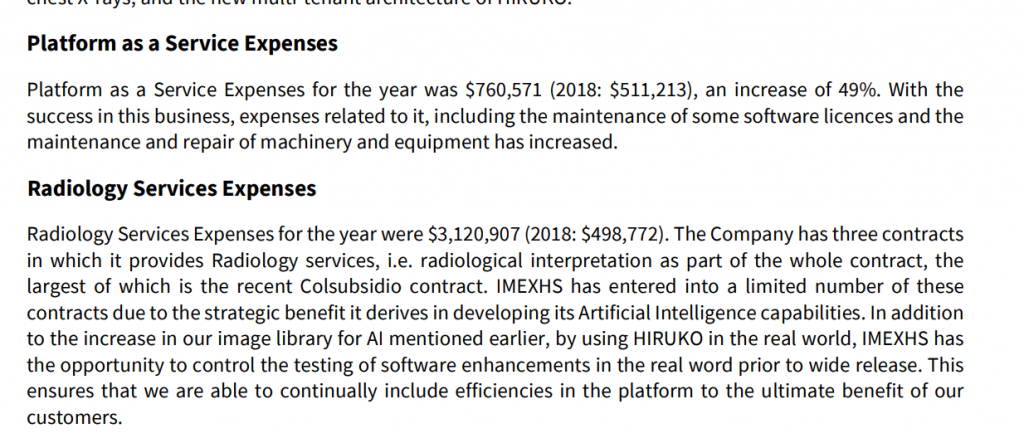

First, we have the “Hardware & License” Expenses, being 14% of revenue. Second we have the “Platform as a Service Expenses”, being another 10% of revenue. And finally we have “Clinical Services Expense”, also known as the “Radiology Services Expense”. This is an absolute cracker, because it shows that ImexHS isn’t really just a software company at all.

As you can see, the company is actually providing “radiological interpretation as part of the whole contract.” The these radiology services — which have nothing to do with software — constitute a whopping 40% of revenue.

With this in mind, you have to ask yourself why anyone would claim that PME — which purely provides software and vendor neutral archiving to radiology clients — is a good comparison with IMEXHS, which pays 40% of its revenue for the provision of radiology services.

One obvious fact is that the attempt to liken IME with PME will help support the share price by encouraging people to buy shares in the company. What the buyers do not realise is that the businesses are not very alike. At best 60% of IMEXHS’ revenue is related to software and services, although the screenshots above provide that quite a bit of that is simply on-selling software or hardware for which IMEXHS must buy a licence.

A more apt way of comparing the companies might be to compare their profitability, though we are not gifted that opportunity given that IMEXHS has never made a profit as a listed company. In any event, given their current revenue mix, there is virtually zero chance that IMEXHS (ASX: IME) could ever achieve anywhere near the sustainable profit margins that PME has.

Will We See More IMEXHS (ASX: IME) Share Price Promotion?

In recent times, there has been regular director buying of IMEXHS shares. Throughout the course of IMEXHS as a listed entity, it has repeatedly compared itself to higher quality software companies that earn revenue almost completely by providing IP that they themselves have developed.

In my experience, these markers (comparisons with higher quality peers and insider buying) often precede increased company spending on investor relations, though that of course remains to be seen.

I myself have been personally attacked for questioning the value of IMEXHS shares (and if the board is reading this, I do hope they look up the Streisand effect before threatening me).

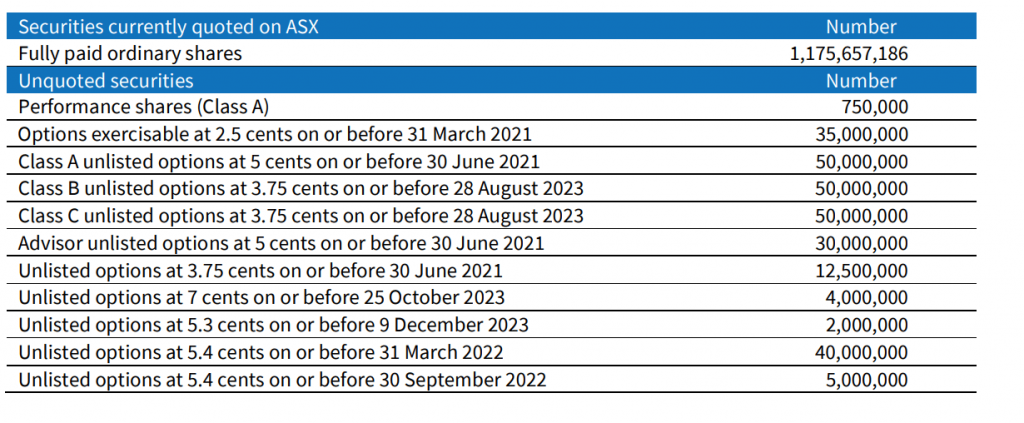

I also note that tens of millions of options in IMEXHS shares exist with exercise prices ranging from around the current price of 2.5 cents per share to 7c.

In my opinion, this company will, at some point step-up the promotion of its “ARR growth”. As a result the suggestion that it is “cheap” compared to “peers” like Volpara (ASX: VHT) and Pro Medicus (ASX: PME) will be relentlessly pushed by all those who have a vested interest in the IME share price.

Given the lack of sophistication in the ASX, I expect that IMEXHS will be able to continue to raise capital from investors for many years to come. The more investors focus on revenue over losses, the better for the company. The simple story that promoters can tell about ImexHS is compelling. It may not matter that a little research suggests its business is of low quality, and in no way comparable to PME.

For various reasons, various parties have an incentive to repeat the “good story” ad nauseum. It has been going on for months if not years.

One way to play it would be to buy shares and simply monitor the hype created around the stock. As more and more investors believe that this company somehow emulates Pro Medicus, the share price should rise and holders may be able to sell to a greater fool. But that doesn’t sound particularly attractive to me. Ultimately, I have no view on the stock itself.

My point is simple:

IMEXHS (ASX: IME) serves very different customers than Pro Medicus, in very different ways. Its revenue is will generate lower EBIT margins as it comes with much higher expenses and as such comparing its revenue multiple with Pro Medicus is not useful.

Furthermore, I think it is completely misleading to describe IMEXHS as having “high growth SaaS based revenue” when a large part of its revenue seems to be passing on software licensing, hardware costs, and even providing radiology services.

For now, I’ve wasted enough time on this company, but at least I’ll have somewhere to point people when I’m inevitably asked about it in the future.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer. The author owns shares in Volpara and Pro Medicus.