It is I hope auspicious that I have chosen Fastly (NYSE: FSLY) as my first US tech stock to cover on these pages. It has my attention because the share price has tanked more than 31% in about 3 trading days, and is now trading under $80 per share. I bought a teeny-tiny portion more shares yesterday (with the spare cash in my US brokerage), and have transferred some more money to my US brokerage with the intention of buying more Fastly shares. To explain why, I need to explain what Fastly is.

A short history of Fastly

Fastly was founded way back in 2011 by Artur Bergman, a developer who had originally experimented with the website Wikia, looking at ways to use distributed caching to serve pages to readers more quickly. The obvious way to do this was to cache content closer to the actual users (or edge of the network) in a content delivery network (CDN). However, this lead to challenges because CDN providers treated them like a black box, making it hard for in-house development teams to understand why certain problems occurred. These basic CDNs were better than nothing, but were still frustrating for developers and not always optimised in the way they functioned. Bergman had an obsession for low latency web products and was thus inspired to start Fastly.

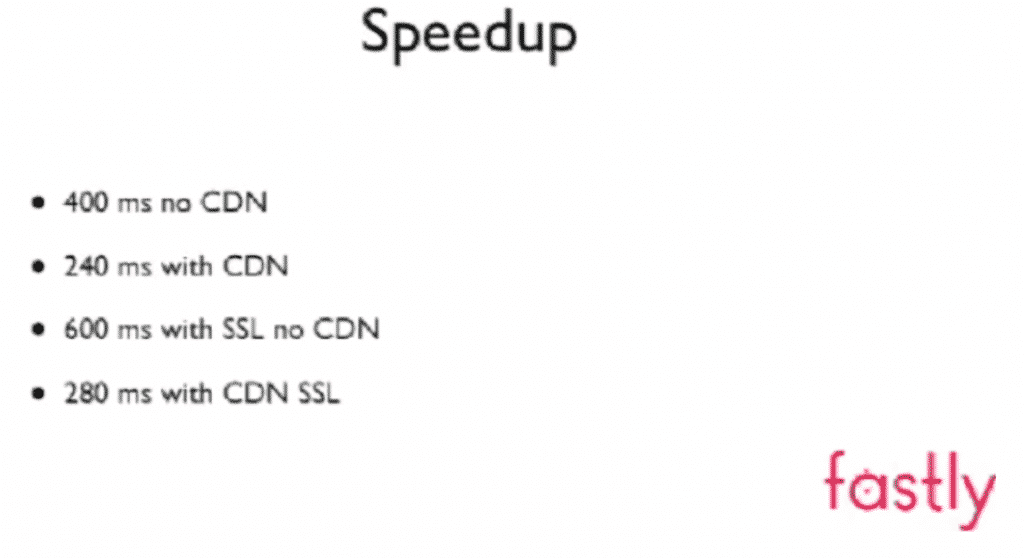

You can get a measure of his passion for the issue by watching this video from 2012, but the screenshot below gives you an idea about the sort of speed gains he saw as possible using a properly configured CDN.

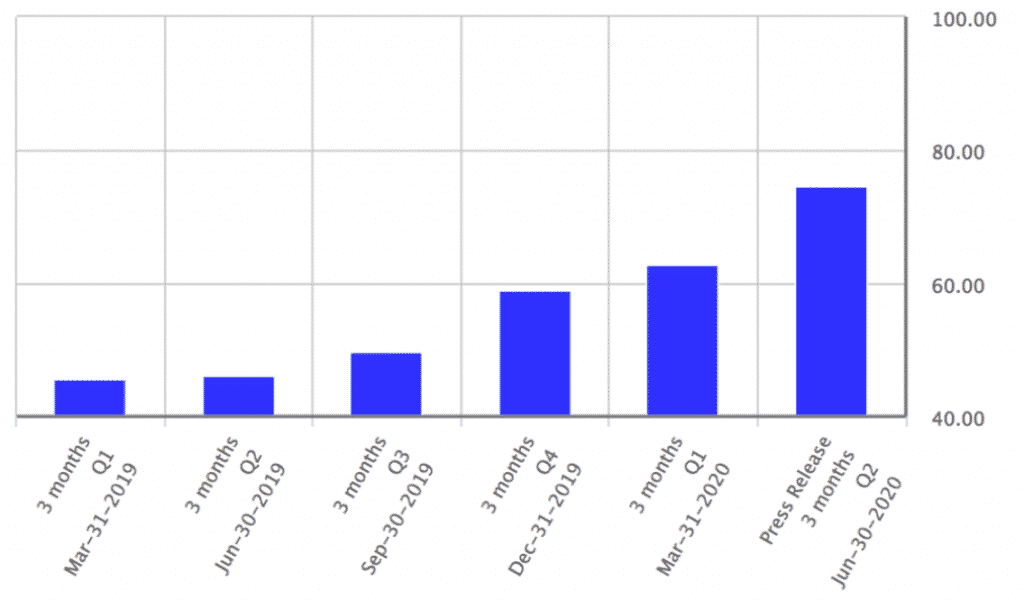

Fast forward to today and Fastly is the right product at the right time. With high profile clients like Shopify and TikTok, and fast revenue growth, Fastly shows all the hallmarks of having a product advantage. It had a net retention rate of 138% in the last quarter, up from 130% in the prior quarter. Its revenue is on a tear, in part because of the increasing importance of digital interactions during the coronavirus, but also prior to that.

Fastly Q2 2020 Quarterly Report Good, But Conference Call Causes A Crash

In the most recent quarter, Fastly beat estimates, upgraded guidance, reported 7 new enterprise customers and reported record quarterly revenue of US$75 million. That’s all good news, but the bad news was that it disclosed that TikTok accounts for 12% of its revenue, and it could instantly lose 6% of its total revenue if TikTok is banned in the USA. Worse still, one could safely assume that this customer was growing quickly, so its loss will be a notable setback. And finally, even if Microsoft does buy TikTok, it is possible they will move it on to the Microsoft owned Azure Content Delivery Network (CDN), even if the product works better with Fastly.

Current guidance is for up to $300m in revenue for the full year, which calls for a roughly flat quarter in Q3 before a strong increase in Q4, to around $87m per quarter. If it does manage $300m in revenue, then it will have grown revenue at 21%, and trade on trade on an enterprise value of around 26.5 times revenue. However, even if it grows more slowly over the next 5 years, it’s very easy to see the company doubling its revenue due to the powerful combination of winning new customers and increasing revenue from existing customers.

Every indication is that this doubling should be massive for the bottom line. For example, Fastly increased quarterly revenue by about 60% on the prior corresponding period, in Q2, but gross profit increased by 80%. On top of that, this massive growth was achieved while spending just 4% on revenue on capital expenditure to expand the Fastly network. While this is an unsustainably low level of spending, it shows that the potential for growth exists within existing assets, and that fast growing revenues over a partially fixed cost base can and should see massive operating leverage in time.

Why I Like Fastly Shares

For me, Fastly (NYSE: FSLY) falls into my basket of high growth meme-stocks, but I hold a special affinity with it. Shortly after the company listed, I put it on my watchlist because of the indications that it sold its services on the basis of quality rather than price. As you may know, high organic growth tech companies with a top notch product offering are more attractive to me than high growth products reliant mainly on scale. That’s because the gap between entering hyper-growth and hyper-profitability is compressed where a company can compete based on its IP more than anything else.

I can’t be sure that Fastly does have a product that is better than other CDNs, but the passionate founder, hugh progress in recent years and long term tailwind convince me that the bet is worth taking. For me, a key metric to follow is the number of enterprise customers. That’s because in the current oligopolistic neo-liberal world order these large companies will become stronger and stronger over time and take more market share from smaller companies. Enterprise customers account for almost 90% of Fastly’s revenue and in any event, if Fastly wins that part of the market it will benefit from both scale and reputational advantages. You can see how enterprise customer numbers have grown in the chart below.

An Epic Play With No Guarantees But Extraordinary Meme-Stock Potential

The really exciting part about Fastly is that it is supporting a new open source technology for building portable applications known as WebAssembly (WASM). Because so many players are required to popularise a new way of doing things, this is an open source project across multiple organisations. Indeed, the founder of the wildly popular Docker tool (which will be familiar to anyone with the slightest iota of development experience) has joined the revolution, and said that “Webassembly on the server is the future of computing.”

If Webassembly takes off, Fastly will benefit because more developers will be able to make the most out of their newest product Compute@Edge, and understand it better, because “To power Compute@Edge we use Lucet, our open-source WebAssembly runtime and compiler which, naturally, runs WebAssembly modules.”

This strategy could build competitive advantage by positioning Fastly’s technology at the cutting edge of content delivery. We can already see evidence of this in the land-and-expand revenue growth but if WASM takes off I think Fastly will be in a better position. Of course, we don’t know if WASM will really take off.

This post is not financial advice, and you should click here to read our detailed disclaimer.

Ultimately, I am keen to make Fastly a core position in my portfolio, and the main thing holding me back is the fairly high share price. I already own a decent position in Cloudflare (NYSE:NET) for similar reasons. Ultimately, if you believe edge-CDN is the future, then it’s hard to resist owning the companies that are riding the wave. I think that the chances of Fastly being worth at least $4b (ie, about half its current market cap) are very high, and the potential of it being one day worth $20b or more, is quite reasonable. The company currently has plenty of cash and if it can keep up its growth rates without raising more capital I suspect shareholders will be on to a winner.