Parkway Corporation is an ASX listed company that provides a range of different water treatment solutions and products across Australia. Situated in Melbourne, they also have bases in Perth and Darwin thanks to some past acquisitions. Originally a mining exploration company, Parkway pivoted into water treatment solutions in 2021. From all impressions, the CEO of the company Bahay Ozcakmak looks to be the driving force behind this transition. The reason it is interesting is that it may well one day emerge as a viable profitable mining services business, which would be a big change from an unsuccessful explorer.

This company came onto my radar in March 2024 when they announced their 3rd acquisition in the water treatment industry, being Tankweld Australia. It looks as though this acquisition will provide the catalyst for a major step change in revenue and possibly a shift to profitability in the near future, but I will touch on this further later in the piece.

As demand for water continues to rise with Australia’s growing population and the expansion of water hungry industries such as agriculture and mining, I believe that over the long term, Australia is going to need to rely more heavily on alternative water sources. Parkway corporation’s business is in a good position to benefit from this tailwind, both through the existing water treatment solutions business, but also possibly through the innovative technologies they have developed that management believe could open up the business to a whole new range of revenue streams.

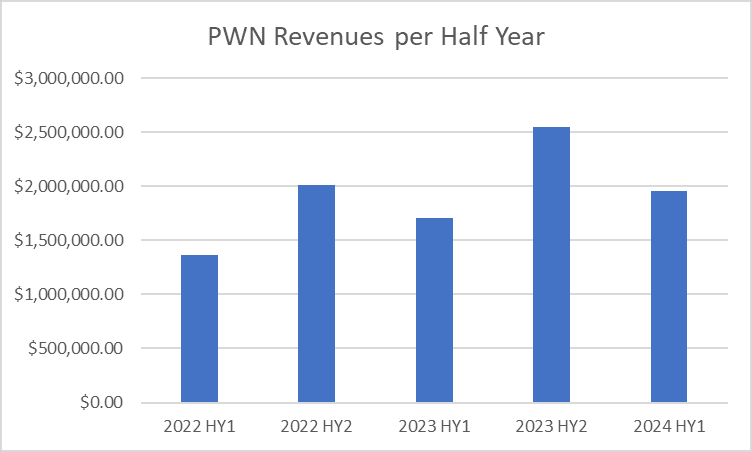

Since pivoting throughout 2021 with the acquisitions of Multiwet (Feb 2021) & Mawpump (Sept 2021), Parkway Corporation has grown revenues from $1.3m in HY1, 2022 to $1.95m in HY1, 2024. This sort of organic growth is impressive and represents a CAGR of 19.7% p.a. As you will note from the chart below, HY2 looks to be the stronger half historically for Parkway by about 50%, if they continue this trend, they are on track to do around $4.88m of revenue through the existing business in the FY 2024, which would be a 15% improvement on FY 2023.

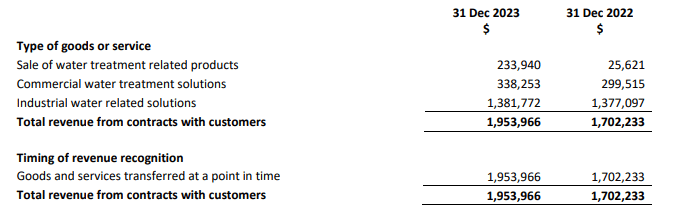

Looking further at the half year results, we can see that after stripping out the $533k government grant for R&D, Parkway Corporation increased their revenue 14.7% on PCP. At the same time, COGS increased $725k on PCP, a whopping 91.6%. This large increase was offset almost entirely by the fact that employee costs decreased by a similar amount. To me, this reflects the revenue mix shifting from 1.5% products in HY1 23 to 12% in HY1 24, but is still something to keep an eye on.

The company reported a loss of $468k for the 6 months to 31/12/2023, in comparison to a loss of $1.31m in the prior corresponding period, however if you strip away the R&D grant and add back the $300k impairment expense from HY1 2023, this is relatively unchanged on PCP. Cash flow was also weak, with an operating cash outflow of $1.3m for the period including lease payments.

Taking a deeper look at the structure of the business, Parkway Corporation has 3 main business segments, only one of which contributed to revenue in the latest report, being Parkway Process Solutions (PPS), this segment of the business provides industrial water treatment related products, services & solutions across Australia. Sitting within this segment are 2 subsidiaries, Mawpump which was acquired in September 2021 and is a Darwin based provider of pumps and industrial water handling related equipment.

The second of these subsidiaries is Multiwet which was acquired in February 2021. Multiwet is a Perth based water treatment business owned and operated by Parkway Process Solutions. Multi-Wet develops and sells a range of water treatment solutions including the Multi-Treat range, as well as a range of other specialty formulations including antiscalants, biocides, corrosion inhibitors & PH modification chemicals.

The second segment of Parkway Corporation is Parkway Process Technologies (PPT). This segment aims to commercialize a range of technologies developed for the treatment of various different types of waste water.

The first subsidiary that sits within this segment is the Queensland Brine Solutions (QBS) subsidiary. This part of the business aims to solve the problem of wastewater brought about as a result of producing coal seam gas (CSG) in Queensland through a patented end-to-end water treatment flow sheet. This 2 stage treatment aims to take the CSG brine & salts developed by producers as a by-product of creating CSG and turn it into fresh water and other on-sellable products. In their announcement dated 05/06/23, Parkway Corporation claims that this concept provides advantages such as:

- Avoiding the disposal of approximately 6,000,000 tonnes of waste salts into landfill.

- Eliminating enduring environmental risks associated with salt encapsulation (Business as usual)

- Significantly lower CAPEX and OPEX (estimated to be less than 30% of business as usual).

- Production of significant quantities of industrial chemical products from waste salts.

- Generation of substantial revenues, as opposed to disposal costs in the business as usual scenario

There are 2 different paths to commercialisation as set out in the ‘Major update on Master Plan concept’ announcement from 22/06/2023. The first option is to provide licensing to CSG operators to use the patented flow sheet, which would be a capital light option and bring about high quality revenue streams and would be my preferred option.

The second option would be that QBS would build, own and operate the new facilities required to treat the CSG brine and offer CSG operators long-term take or pay contracts with pre-payments up front to cover the CAPEX involved with building the facilities. I feel we can gain insight into the way in which Parkway wishes to commercialize this by looking at their latest acquisition.

When doing some research into this technology and whether or not it had any backing with experts in the industry, I spoke with a professor at the School of Chemical Engineering at an Australian University who advised that he had not heard of Parkway Corporation or anything about the process they are looking to commercialize. Whilst worrying, this isn’t a smoking gun, and more investigation would need to be done to gain further understanding of the likelihood of this technique becoming the coal seam gas industry norm. If it does go the way management is expecting, this could be a major blue sky catalyst for this business moving forward.

In March 2024, Parkway made the acquisition of Tankweld, a provider of engineering solutions for projects from early concept and design phases through to workshop fabrication, installation and commissioning. Consideration of $2.4m was paid for Tankweld, of which, $650k was cash up front, and a loan settlement of $1.75m. This looks like a very tidy price to pay for a company that generated $13.7m in revenue in 2023, and ‘normalized’ NPAT of $2m. I suspect the word normalized is doing some pretty heavy lifting here, but we won’t know until the earnings start to show in 2024 HY2 and beyond.

The important part of this deal for me is that the MD of Tankweld will continue on with Parkway for at least 4 years, tasked to grow revenues at 20% in year one, and 15% for years 2,3 & 4. If this is met, Tankweld revenues could be in the range of $25m by year 4. This dwarfs the current revenue run rate of the existing business of around $4.8m for 2024 FY.

Built into the sale are incentives for EBITDA margins of between 8-16%. If both revenue and EBITDA targets (of the higher 16%) are met, then Jeff Harley (Tankweld MD) stands to earn $1m in incentives for each year. If met, the Tankweld segment of the business would contribute the following:

To me, this type of acquisition structure facilitates good alignment between the old ownership and the new, and is a net positive.

The driving force behind the pivot to water treatment looks to be MD & CEO Bahay Ozcakmak who currently owns around 9% of the business which should bring about good alignment with shareholders.

I find investing in loss making companies a tough task, so to decide if $25m is a fair price to be paying for Parkway Corporation is difficult. For me, it is much easier to determine if there is a disconnect between price and value once the company shifts into profitability. There is a possibility that the Tankweld acquisition could tip Parkway into profitability in the next 6-12 months, and this, along with the good organic revenue growth being shown in the PPS segment and the blue sky of the PPT segment keeps me interested enough to keep Parkway Corporation on my watchlist.

Parkway today reported its quarterly cashflow statement for Q3, FY 2024. That revealed that Parkway Corporation has just $1.2m cash in the bank. The company said: “it should be noted that the reported cash balance excludes, i) undrawn grant funds, ii) the anticipated R&D rebate for FY24, and iii) other receivables.”

Furthermore, Parkway said “it expects to receive an additional R&DTI related refund for FY24, during the first quarter of FY25, further improving the working capital available to the Company to support operations and various ongoing growth initiatives.”

Parkway is evaluating several potential funding options. Parkway has received several indicative non-binding offers from a number of parties, to provide Parkway with a suitable working capital facility in the order of $3 – 5 million.

Parkway is at a crucial point in its transition. While it is not yet out of the woods, a viable and profitable water treatment group may well emerge in the future.

Sign Up To Our Free Newsletter

Disclosure: neither the author of this article nor the editor own shares in PWY and neither will trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).