One of the major systemic changes of our lifetimes is the electrification of transport systems. Fossil fuels have absolutely transformed our world, and they won’t go away for a very long time. However, oil is finite, often controlled by hostile forces, and electric cars are much cheaper to run, in a world where many houses have their own solar panels.

Electrification Of Transport Infrastructure Is Happening

Tesla may have started the electric car revolution, but they are followed by numerous other car manufacturers, such as Hyundai, Ford, Voltswagen, Nissan, Audi and even Porsche all have fully electric offerings. Where the right incentives are in place, such as in Norway, electric cars already make up the majority of new car sales.

Electrification Requires A Lot Of Copper

Now, all these electric cars use significantly more copper than internal combustion engine cars. And that’s just one example. As more and more of our power is distributed, we need more copper wires to transport it around. Absent any significant alternative, the general trend to batteries and distributed power generation increases demand for property.

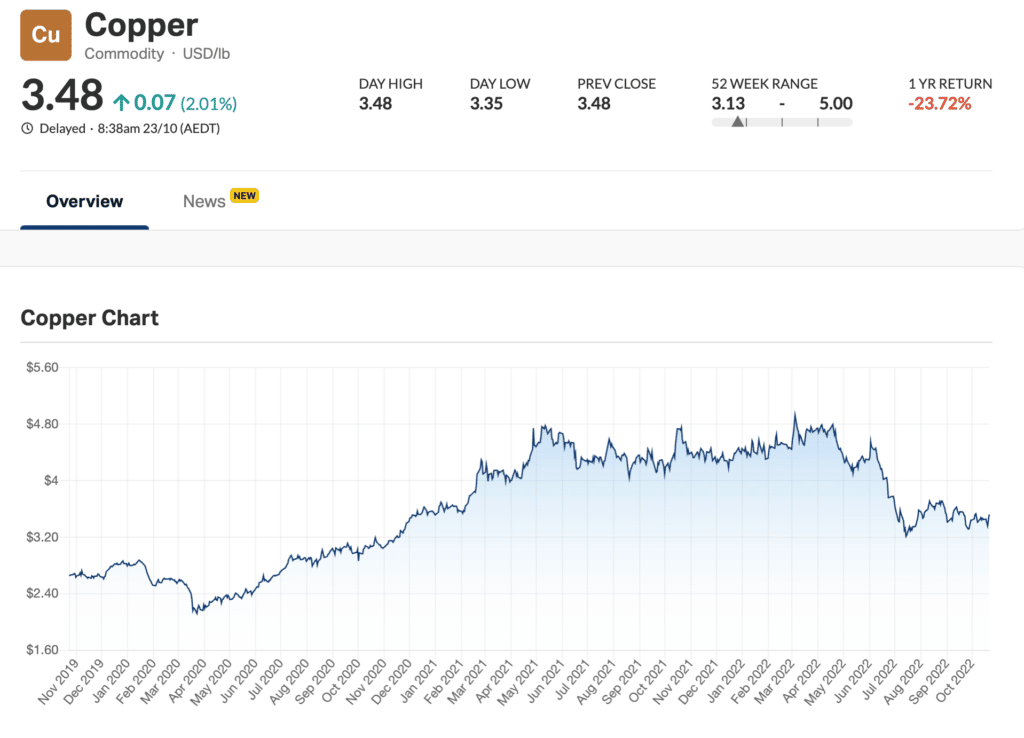

But The Copper Price Is Down

Over the last few years, the copper price has increased strongly, roughly doubling from USD $2.40 per pound to a peak of around USD $4.80 per pound. More recently, it has receded to around USD $3.50 per pound, which is roughly equivalent to AUD $5.50 per pound. Anecdotally, one reason for the decline in recent months is concern that Chinese demand for copper (in construction) will decline. More generally, copper is considered very pro-cyclical, so legitimate fears about a global recession are likely reflected in the weaker price for copper.

Recently, commodity trader Kostas was quoted by the Financial Times as saying:

“While there is so much attention being paid to the weakness in the real estate sector in China, quietly, the demand for infrastructure, electric vehicle-related copper demand, more than makes up for it… It actually not only cancels completely the real estate weakness, but also adds to their consumption growth increase.”

In the same article, the Financial Times commented that low visible stocks of copper observed recently “raise the risk of a sudden spike in prices should there be large drawdowns and a dash among traders to secure supplies.”

As a result of the electrification trend, lithium prices have more than doubled in the last 10 years. However, copper prices sit below peaks in 2006, 2011 and 2021. Arguably, we could see a strong increase in the copper price over the next few years, albeit probably not during a global recession.

Aeris Resources (ASX: AIS) A Leveraged Bet On Copper

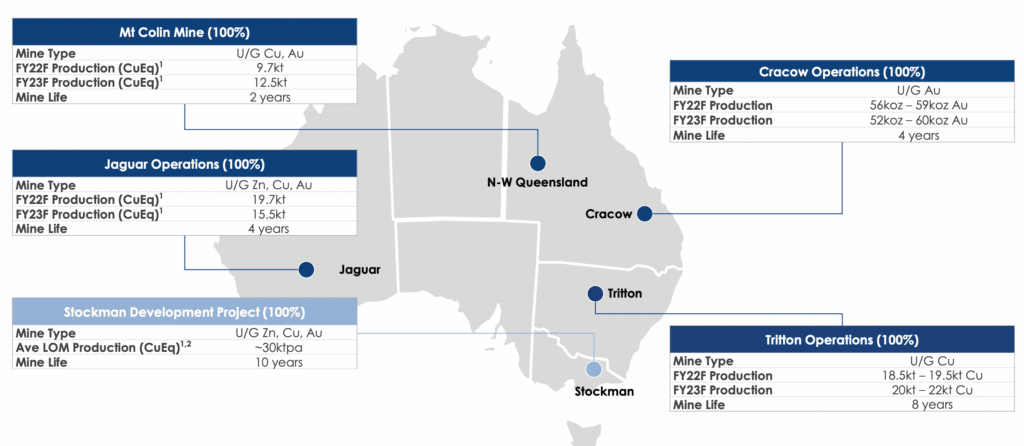

Aeris Resources is a copper, gold, silver and zinc miner which recently merged with Round Oak Pty Ltd, a company owned by Washington H Soul Pattinson (ASX: SOL). Aeris previously owned copper and gold mines, while Round Oak provided a copper, silver and zinc mine. You can see its major assets below.

In FY 2022, the all in sustaining cost (AISC) of copper production for Aeris was AUD $5.10 per pound “slightly above the top end of the guidance range (A$4.65/lb – $4.85/lb), primarily due to cost and labour market pressures, which are impacting the whole industry.” Meanwhile, according to company estimates, the AISC for the Jaguar and Mt Colin mines would be closer to AUD $3.50 per pound (though those mines may not last for long).

At the time of the merger, the company raised $117 million at 10.5 cents per share, equivalent to 73.5 cents per share post 7 for 1 consolidation. $80 million of this was paid to Washington H Soul Pattinson for the Round Oak merger, and WHSP also received shares as well as $154m shares at a price of 10.5 cents per share, giving it 30% of Aeris Resources.

WHSP has a long history of successful diversified investing, and the company puts it investment in Aeris in its strategic investments portfolio. My thinking is that this transaction by WHSP was timed to coincide with record copper prices, because it extracted cash from their Round Oak investment. However, I think it also shows that WHSP has confidence in the ability of Aeris Resources CEO Andre Labuschagne to manage the business well.

One of the main investors in the capital raising required to pay WHSP its cash was Paradice Investment Management, a market-beating small cap fund that I admire. They paid the equivalent of 73.5 cents per share, some 71% above the current share price. You can see in the chart below that the price of copper in AUD dropped not long after the merger deal was announced.

On top of that, Aeris downgraded its FY2023 guidance, in August, commenting:

“In previous ASX releases related to the Round Oak transaction, Aeris noted proforma group production of 63kt copper equivalent and EBITDA of $306 million for FY23. Under the price, cost and production assumptions used in the updated guidance in this document, FY23 copper equivalent production will be 57 – 71kt Cu eq and FY23 EBITDA is estimated to be $140-170 million. The 63kt copper equivalent production target previously advised is within the current guidance range however EBITDA is forecast to be materially lower.”

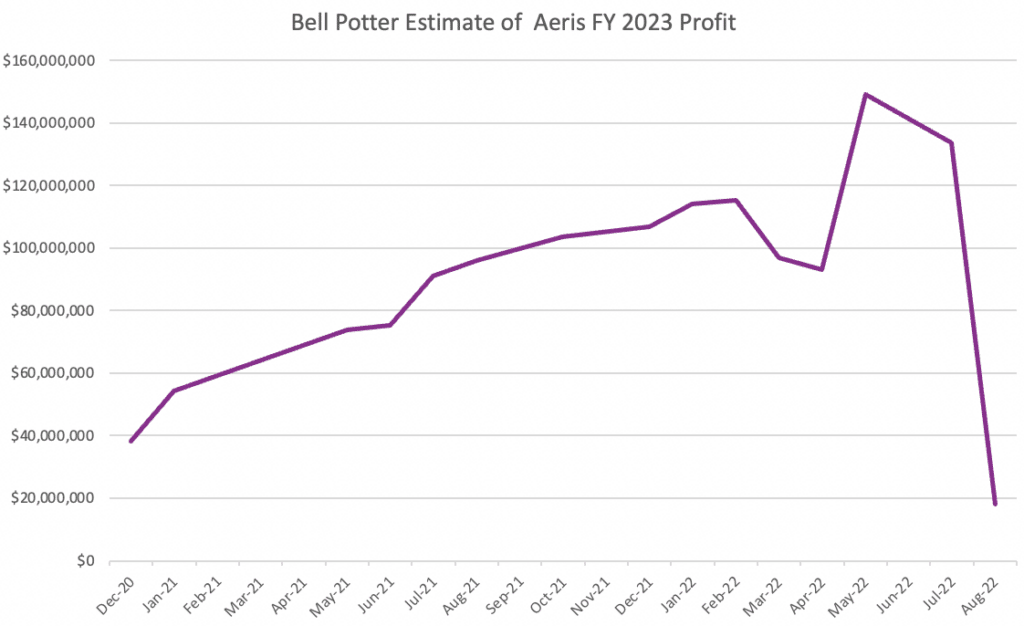

Now, I’m not exactly sure what this will equate to, in terms of profit. The only two broker forecasts I can see in S&P Capital IQ are Bell Potter, which estimates net income of $18m in FY 2023, and Ord Minnett, which estimates $46.6m. We could split the difference and estimate profits of around $30m.

At the current Aeris share price of $0.42, it has a market capitalisation of about $290 million. The company has $90m in cash, but you may as well ignore that, since it is still developing a number of projects, including the longer term Stockman Development program. You could argue that on around 10x earnings it is pretty fully priced, given that most of its mines won’t be functioning in 10 years!

However, I thought it would be interesting to take a look at the trajectory of the Bell Potter estimates for the Aeris FY 2023 profits. The merger with Round Oak was released in April, then the guidance downgrade was in April.

Suffice it to say that there is suddenly an awful lot of negativity surrounding the near term outlook both as a result of the disappointing guidance, but also because costs have been higher than expected, and copper prices have been falling. As a result, sentiment is low based on near term profits.

However, the reason I find Aeris interesting is that it stands to gain massively from increasing copper prices. You see, in FY 2022 Aeris had an AISC of $5.10 per pound. Now the AISC may decline a bit, but at present, it isn’t much below the actual price of copper being around $5.50 per pound. That means a 10% increase in the copper price, to around $6.10 per pound, would more than double the profit margin that Aeris currently receives on each pound of copper it mines.

On top of that, Aeris is investing heavily in expanding its copper reserves. The company says:

“Aeris will continue to invest heavily in FY23 in growth capital and exploration. Key growth capital projects for the Group include the Avoca Tank development and Constellation project at Tritton, the Turbo project at Jaguar and the Stockman feasibility study. Exploration activities include progressing the Kurrajong (Tritton) and Golden Plateau (Cracow) deposits to maiden Mineral Resource estimates and a follow-up drill program at the Barbara deposit (North Queensland).“

Essentially this means Aeris is betting even more heavily on copper, since Jaguar, Tritton, Stockman and Kurrajong are all potential copper greenfield or expansion projects.

Why I Think Aeris Resources Is An Interesting Way To Play Copper

- Smart money invested in the stock at 70% higher share price, suggesting operational competence.

- $90m cash means it can survive some degree of hard times.

- A modest increase in copper price could massively increase Aeris profit margins.

- Potential to increase mine life through development and extension of existing mines.

- Currently $290 million market cap, not included in the ASX 200 index, upside re-rate potential exists if it makes it into the ASX 200 in a few years.

- All its assets are in Australia, so I’m less concerned about political risk.

Over the next 3 years, I think that we could see a scenario where Aeris increases its production of copper, increases its runway for copper production, benefits from an increased copper price and then benefits from passive index funds buying the stock. The FY 2021 Aeris profit (pre-merger with Round Oak) of just over $60m gave us a glimpse of what is possible with higher copper prices.

Any large transition or change creates winners and losers. I think that profitable copper producers may well be amongst the winners from the electrification trend. As a result, I’m currently planning to make a small speculative investment in Aeris Resources, at or around the current share price of 42 cents per share.

Assuming I can buy the shares around that price, I would probably look to sell at least some of my shares if the share price increased back to around 70 cents being the price of the recent capital raising. I may also look to sell my shares if the copper price turns out to be weaker than I am expecting (potentially due to a global recession).

Edit, Monday 14 November, 2022: After a weak quarterly, and rising share price, I sold the vast majority of my Aeris holding for a short term profit (retaining a very small holding). Click here for all our Aeris coverage.

Disclosure: the author of this article does not own shares in Aeris (ASX: AIS) and will not trade these shares for 2 days following this article. The author is currently intending to buy some shares in Aeris if they are available at around current prices after 2 days, but makes no undertaking to do so. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.