Electrical products distributor and services provider, IPD Group Ltd (ASX: IPG) listed in December 2021 and is one of few 2021 IPO’s that have seen a sustained increase in the share price. Given so many recent listings are speculative minerals explorers, IPD Group stood out for being a profitable small-cap distributor. As you can see the IPD Group share price has enjoyed a strong run since listing.

Although the IPD Group share price has increased ~144% since listing, IPD Group Ltd appears to have remained under the radar of many investors. This could possibly be due to it being a ‘boring’ industrial company. The company had net cash of $25 million as of 30 June 22 and is profitable. Although the share price has had a strong run, the company still still trades on a P/E of 21, which is not high for a rapidly growing company.

I like IPD because it is a boring under the radar company, but is exposed to high growth industries, such as electric vehicle charging infrastructure, data centres, and industrial control systems.

What does IPD Group do?

There are two parts to the business. Electrical products distribution and electrical services.

Electrical product manufacturers, (typically based overseas) use IPD to distribute their products in Australia. This accounts for the vast majority of revenue.

Complementing the distribution division is the services division. This division takes care of installation and commissioning, calibration and testing, maintenance, repairs, and refurbishment. The services division accounts for around 10% of revenue.

A Short History of IPD Group

IPD has been operating in Australia for over seventy years. It began as a division of English Electric, a company which specialised in the manufacturing of fuse links, switchgear, and overhead busbars. In 2005, management acquired the industrial products distribution business in a management buyout, forming IPD. Through organic growth and acquisitions, IPD has expanded its operations to nine locations across six states. IPD commenced outsourced operations in Colombo, Sri Lanka in 2010 to provide support services to its Australian operations, before establishing its own Sri Lankan subsidiary in 2019. The company then listed in December 2021. In 2022 it acquired Gemtrek which provides electric vehicle charging services.

One Risk Is That IPD Group Is Only A Recent Listing, So It Has Limited Track Record As A Listed Company

IPD raised $40 million when it floated in December 2021. $20 million went to shareholders selling and $20 million was from new shares issued. These funds were used to grow the business; $10 million went to capital expenditure and strategic acquisitions, $7.2 million went to support IPD’s future growth strategy, and the remaining $2.8 funded the costs of listing.

None of the directors sold shares in the float. David Rafter, Independent, Non-Executive Chairman owns 145,835 shares. Andrew Moffat, Independent, Non-Executive Director owns 833,022 shares, buying $126,412 worth of shares on-market last December. Michael Sainsbury, Executive Director, owns 1,265,479 shares and CEO Mohamed Yoosuff, Executive Director and CFO owns 11,244,480 shares and made an on-market trade worth $498,008 in December last year.

Of note, Washington H. Soul Pattinson and Company Ltd (ASX:SOL), which is an investment house with a solid long-term track record, owns 2.5 million shares in IPD Group (ASX: IPG).

The company released its first full year results since listing for the financial year 2022. It reported net cash of $25 million with no borrowings. Statutory revenue was $176.8 million, up 49.7% on the prior corresponding period. Net Profit After Tax (NPAT) was $11.1 million. A dividend of 3.7 cents per share was paid representing a 50% payout ratio. This is in line with the dividend policy to distribute 40% – 60% of NPAT. Growth was driven by acquisitions.

Will IPD Group Grow Earnings?

The core of the business is the electrical products distribution division, accounting for 90% of revenue, which IPD is looking to grow organically and through acquisitions. The services division only accounts for 10% of revenue, presenting an opportunity for growth in an area which complements the products business.

IPD is exposed to a range of industries, which diversifies the company’s revenue stream and provides exposure to industries experiencing tailwinds, such as renewable energy, electric cars and data centres.

The company will likely use acquisitions in these areas (as we saw with electric vehicle charging solutions company Gemtek). IPD Group will need to ensure it does not get acquisition giddy with the recent haul of cash from the IPO, and end up struggling to integrate the new businesses. Any high growth industry attracts competition, and large players can come to dominate a market which may lower profits in future.

A List of IPD Group’s Competitors

The company considers its main competitors in the products division to be other distributors or manufacturers who sell directly to end markets. These include but are not limited to Schneider Electric, NHP Electrical Engineering Products, APS Industrial, Eaton, Legrand and Hager Electro.

Within the services division, IPD believes that its main competitors are CIMIC Group, Nilsen, Stowe, Downer EDI Ltd (ASX:EDI), Southern Cross Electrical Engineering (ASX:SXE), Fredon, Grosvenor Engineering Group, Hirotec, ENGIE Services, Grosvenor Engineering, Arden Group, Johns Lyng Group Ltd (ASX:JLG), DCFM Australia, UMS and Campeyn Group. A number of these service providers source products from IPD. Editor’s note: Acting as a supplier to competitors is a potentially hazardous balancing act, and arguably a blemish on the investment thesis.

A competitor which is largely focused on electrical services work I have in my portfolio, Southern Cross Electrical Ltd (ASX:SXE) has been gaining plenty of work contracts over the past year, mostly in the buoyant infrastructure and resources sectors. Whether this is due to the company’s reputation, its pricing of contracts, the demand for work in the industry, or a combination of these factors is hard to say, but it is an encouraging sign that there appears to be demand for electrical services work.

Who Are IPD Group’s Suppliers?

IPD’s suppliers are typically overseas electrical and technology manufacturers looking to distribute in Australia. IPD has approximately thirty suppliers. The largest is ABB, accounting for ~26% of revenue. The next largest is Elsteel at ~8% and Emerson at ~5% of products supplied.

Source: IPD Group Prospectus

Having one customer (ABB) providing just over 26% of the company’s supplies presents the risk of ABB discontinuing with IPD Group and thus hampering IPD Group’s ability to provide its customers products they require. There is also the risk that ABB’s (or another large supplier’s products) could fall out of favour with the market and not sell as well.

Who Are IPD Group’s Customers?

IPD Group has over 4200 customers from a diverse range of industries including switchboard manufacturers, electrical wholesalers, electrical contractors, power utilities, original equipment manufacturers and system integrators. The average tenure of IPD Group’s top ten customers by FY21 revenue was 25 years, and no individual customer accounted for more than 13% of FY21 pro forma gross revenue.

Source: IPD Group prospectus

Risks facing distribution businesses

One major risk is supply chain fragility, as most of IPDs products are sourced from overseas. Presently the company has experienced an increase in costs of material and freight. Management is increasing inventory to cope with this. It is hard to know how long supply chain issues will continue for. Major economy China, which represents ~29% of all global manufacturing output, is continuing its COVID zero stance. The Russia-Ukraine conflict and inflationary pressures have all added to ongoing supply chain issues.

The risk of having offices overseas in a country that is not as politically stable as Australia is not unique to distribution businesses. It is worth noting, however, that Sri Lanka, where IPD has 100 employees working in a support capacity (approximately a quarter of its total staff) has experienced unrest starting in April when protesters stormed the Presidential palace over the President’s handling of a devastating economic crisis as reported here. Events like this and the economic crisis itself, have the potential to negatively impact operations.

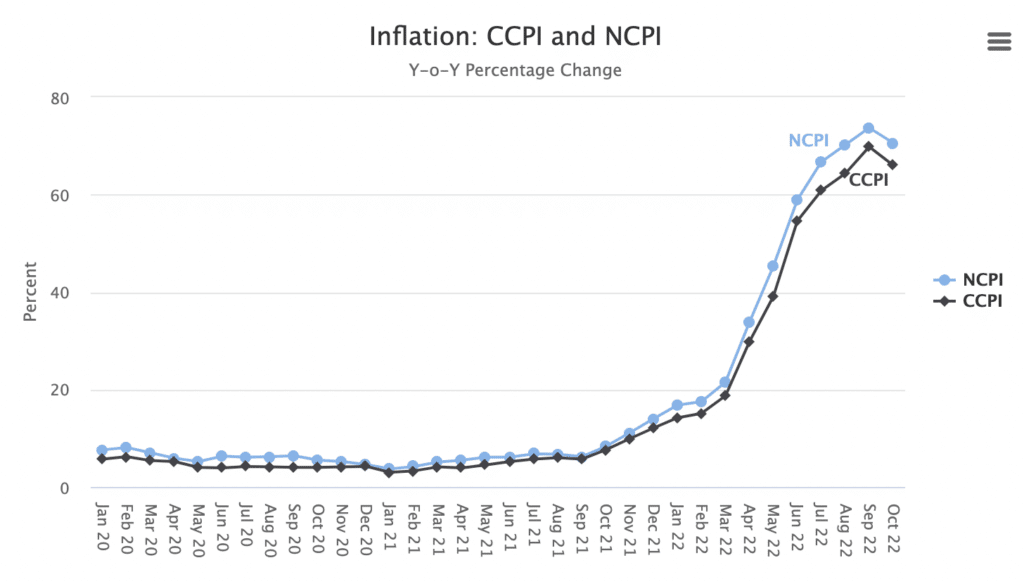

IPD sources many of its products globally, paying with Australian dollars. This means there is the risk that currency rate movements could negatively affect profits. The payment of wages to Sri Lankan employees also carries foreign currency risks. The Sri Lankan Rupee was devalued in February, which offset an increase in wages by IDP. Inflation in Sri Lanka is high at present. This could mean IPD may have to increase wages again to keep up with rising living costs, although the rate of inflation has decreased the last two months year-on-year. You can see the Sri Lankan Inflation rate below via the central bank of Sri Lanka.

Government Initiatives Potentially Impacting IPD Group (ASX: IPG)

The Australian government is encouraging commercial building owners and tenants to improve their energy use, reduce emissions, and invest in better buildings and equipment through the Trajectory for Low Energy Buildings plan. Commercial buildings are IPD Group’s largest end-market, and should drive demand for its electrical and automation equipment.

The rise in working from home, however, may result in less demand for commercial building space, in turn impacting on demand for IPD’s products and services. There is the possibility that offices of the future will likely be smaller, with multiple offices nearer workers homes instead of one big office in the centre of the city, and thus be easier to maintain energy efficiency. On the other hand, demand for warehousing as online shopping grows, may offset this.

The Australian Government’s $110 billion land transport infrastructure program over 10 years from 2020-21 will support construction projects across road, rail, ports, airports, and related infrastructure. Infrastructure accounts for 13% of IPD’s end user market.

Industry Trends Potentially Impacting IPD Group

Three other areas that account for a small part of IPD’s business but are expected to grow rapidly are electric vehicle chargers, industrial control systems, and data centres. IPD distributes ABB’s electric vehicle chargers and in April acquired Gemtek Group Pty Ltd, a turn-key energy management and EV solutions provider to expand its offerings in the electric vehicle charging market.

Data centres account for 4% of the company’s revenue, but there is rising demand for components and systems for data centres in a world that is increasingly moving online.

Industrial control systems are designed to improve the strength of a company’s cybersecurity relating to their electrical infrastructure. There have been recent high-profile attacks on companies like Medibank Private Ltd (ASX:MPL) and Optus, which will spur the government and private sector into ensuring its electrical infrastructure is secured against attacks.

Source: IPD Group FY22 report

Does IPD Group Stock Have Potential?

IPD Group is perceived by many investors as a boring industrial company, but it is one that is exposed to several growth areas. The company has a solid balance sheet, is profitable and pays a dividend. At the current share price of $2.93, trades on a P/E of under 21 and has guided to further growth, in its recent AGM update.

Having limited time as a listed company means there is not much public history for investors to go on, so we are yet to see how management will fare running a public company and integrating probable future acquisitions. Regardless of this risk, I believe that IPD Group has better prospects than most of the companies to hit the ASX recently, and I own some shares in the company.

Disclosure: the author of this article Chris Coe and the editor Claude Walker both own shares in IPD Group and will not trade them for at least 2 days after publication of this article. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter