Korvest (ASX: KOV) fabricates steel to manufacture cable and pipe support systems so electrical cables can safely travel through infrastructure sites like road and rail tunnels. In 1H FY 2023, Korvest managed to maintain strong results after a record half in 1H FY2022.

Revenue grew 2.7% to $52.95 million but net profit suffered a 35.8% drop to $4.52 million on a YoY basis. Operating cash flow reversed from an outflow of $1.38 million to $4.41 million inflow and free cash flow followed the same path from outflow of $2.34 million to $3.86 million inflow.

The historical Korvest results charted below suggest that the steel fabricator and galvanising business is the strongest it has ever been.

Korvest’s journey to an all-time high revenue and net profit in 1H FY2022 was a turbulent ride, to say the least. A number of external factors explain why.

Korvest Returns To Its Core

Prior to FY13, Korvest was also fabricating and manufacturing handrail and walkway systems for major construction and engineering sites under the business unit, Indax. However, Indax was sold off and around this time, Korvest acquired Power Step and Titan Technologies. This is what Korvest looked like from then until August 2021 when these two businesses were sold.

Power Step and Titan Technologies never lived up to expectations with management’s constant attribution of their lacklustre performance to the mining cycle as seen below. The cable and pipe support business EzyStrut is also exposed to the mining sector as mining exploration sites require cable support solutions.

Source: ABS – Private New Capital Expenditure On Buildings & Equipment By Industry

Given Korvest has gone full circle and refocused on its core business EzyStrut and galvanising, the company is now in a better mindset to improve in the areas that brought its initial success.

Whilst Korvest is now more focused on its core business, it remains a highly cyclical business.

The Korvest management team has performed exceptionally well given how prone the business is to factors outside its control. Korvest is not only exposed to external factors for sales but also key costs like inputs and energy.

On the demand side, it seems Korvest and its competitors are dependent on government spending on infrastructure, in particular, recent major projects like Melbourne Metro and WestConnex.

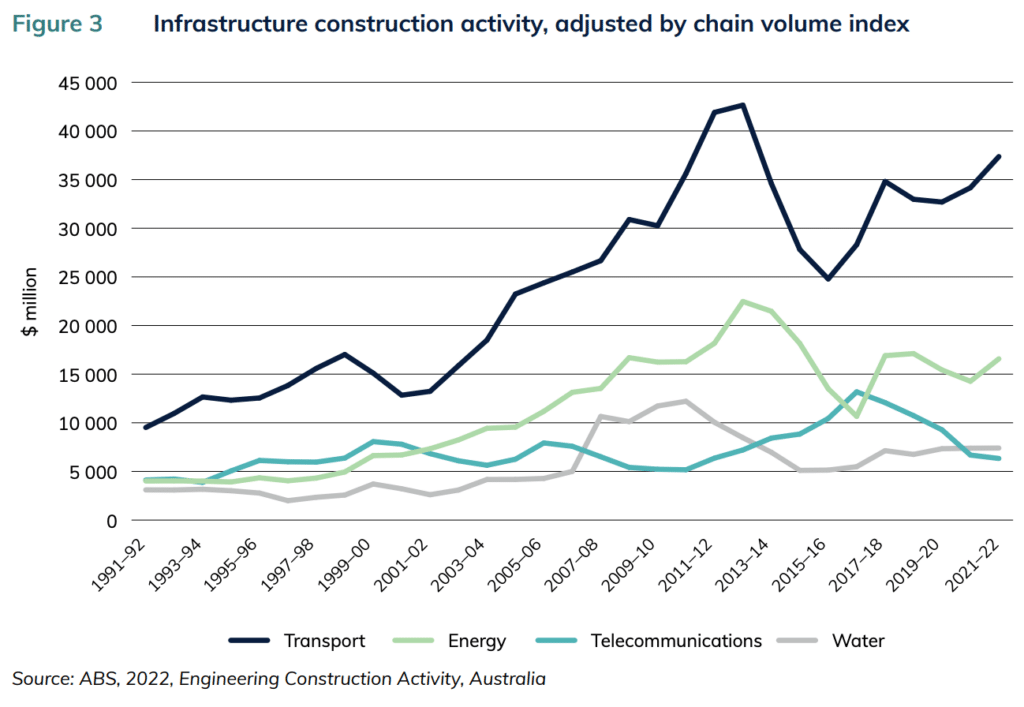

EzyStrut makes up a majority of Korvest’s revenue, contributing to 92% of FY2022 revenue, so this segment is the key driver. This segment has benefitted from record levels of government funding in infrastructure projects as illustrated below.

Source: Infrastructure Partnerships Australia – Infrastructure Budget Monitor Paper – February 2022

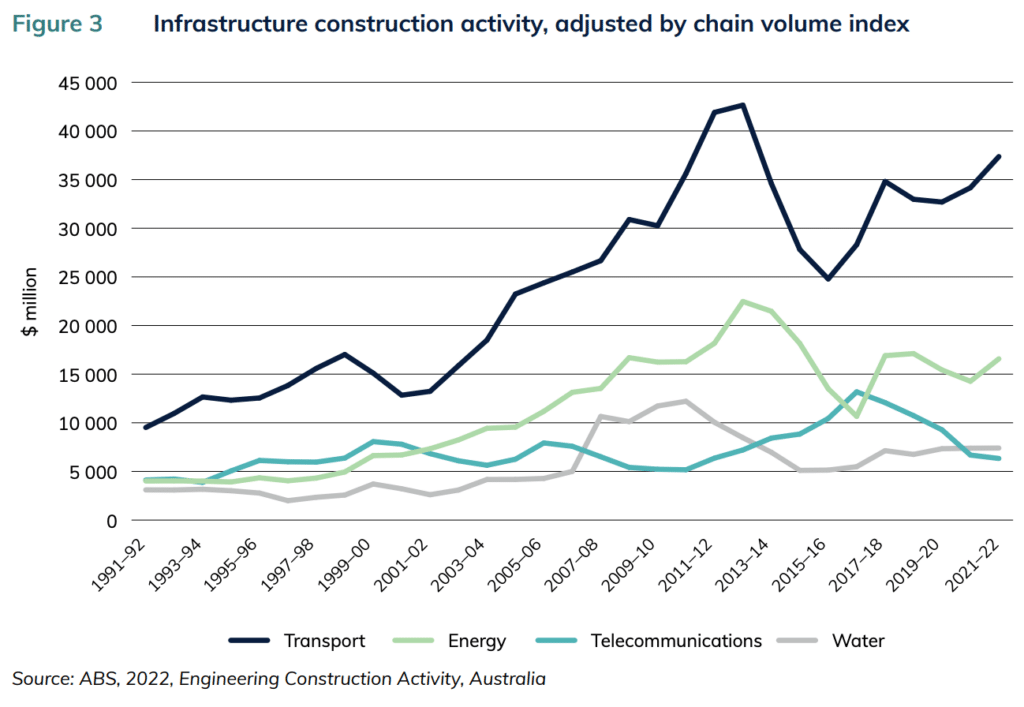

The amount of infrastructure construction activity probably provides a more real-time data trend as shown below.

Most notably, in Korvest’s 2022 annual report, management advised that the company generally supplies either one or two major projects but in 2022, four major projects were supplied. No wonder revenue is at all-time highs.

Korvest is also highly exposed to the commodity prices of steel and zinc, which has compressed margins. Whilst management has been successful in passing on price increases, gross margins hover at much lower levels than a decade ago.

The volatile nature of these outside forces makes it challenging to forecast Korvest’s future earnings. As such, Korvest falls very much into the fair-weather business bucket.

The nature of Korvest’s business also lends itself to opaqueness, making it rather difficult to keep a pulse on its progress.

Does Korvest Possess A Competitive Advantage?

Korvest and its main Australian rivals Burndy Cable Support Systems, Kounis Metal Industries and Adelaide Galvanisers all fabricate and manufacture the same cable and pipe support products.

Since there is little to no product differentiation, these businesses would need to compete on price, which is ultimately driven by superior operating efficiency. This could be achieved through different manufacturing methods or a more efficient workforce due to a stronger culture.

Out of the key players in the industry, Korvest is the only business listed on the ASX, so I’m unable to compare key margins and operating ratios to identify whether Korvest possesses a potential cost or cultural advantage. The most valuable information available lies in a few of the competitor’s websites like Kounis Metal Industries, which lists each project it’s completed and Burndy Cable Support Systems has a blog reporting key projects it’s working on.

Korvest’s management team has often cited competition as a key concern in a lot of their half-year and annual reports. For example, in 1H FY2017, management noted, “Domestic markets currently have excess capacity and as a result, orders are aggressively targeted by numerous competitors. As a result, this has resulted in a decline in margins.” Even when there was strong growth in the pipeline of infrastructure projects in FY2021, management advised, “Gross margins on major project work have been under pressure due to strong competition in the segment (EzyStrut).”

On a surface level, Korvest appears to be winning projects due to its long-standing reputation. A long tenure in the industry also means key relationships have been formed, which I suspect plays an influential force in winning tenders.

The more rocks I turn over, the more I realise how important it is to find situations where there is adequate information to reasonably monitor the quality of a business and its industry. Supply Network (ASX: SNL) is a good example of where there are listed competitors, providing opportunities to understand what it’s doing differently e.g. SNL’s delivery drivers are in-house whereas competitors use third parties. In the case of Lovisa (ASX: LOV), its main rival Claire’s is listed in the US and there is an abundance of other competitors where you can see their product range.

The presence of listed competitors also enables investors to monitor how other management teams think and plan for the future. This acts as another signal of how well a business and industry are performing.

Korvest Falls In The Too Hard Basket

There is a lot to like about Korvest, the management team is much more focused on its core and is riding an unprecedented wave of infrastructure activity. The business is debt-free and trading at a trailing P/E multiple of 9.9x. While recent results have been strong, it is hard to argue Korvest is a high quality business. A look at the history suggest it’s a tough business.

Korvest could be thought of as a fair-weather stock, since it operates in a commoditised industry where it’s difficult to ascertain sources of competitive advantage and forecast demand. Such a business can look cheap and pay good dividends when times are good, but could face significant challenges due to forces it cannot control.

Korvest may present a sound cyclical play, but I find very cyclical businesses too challenging, as an investor. I much prefer businesses that possess greater control over their destiny like these 6 ASX stocks curated by Claude.

Sign Up To Our Free Newsletter

Disclosure: the author of this article owns shares in Lovisa (ASX: LOV), and will not trade them for 2 days following this article. This article is not intended to form the basis of an investment decision. This article does not guarantee that the author will buy the shares of any of the companies above at any particular price. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.