Magellan Global Fund (ASX: MGF) is a listed investment company (LIC) which means it is much worse than normal investment fund or ETF.

You see, normal investment funds will allow you to redeem your investment at (or close to) net asset value. Similarly, an exchange traded fund (ETF) will use a market maker to ensure you can trade in and out of your ETF at very close to the value of the underlying assets.

In fact, I would go so far as to say that the LIC structure is designed to turn investors into bagholders, because no matter how many investors want to sell their units, the manager of the LIC never has to worry about losing any funds under management. Rather, the investor must find a new bagholder to take their place. Somebody must hold the bag.

As an LIC, Magellan Global Fund (ASX: MGF) does not guarantee that unit holders can exit their position at close to net asset value, and they do guarantee that they will take a 1.35% management fee from now until forever. That means that even a popular, well respected LIC should trade at a discount to its net asset values; often around a decade’s worth of fees.

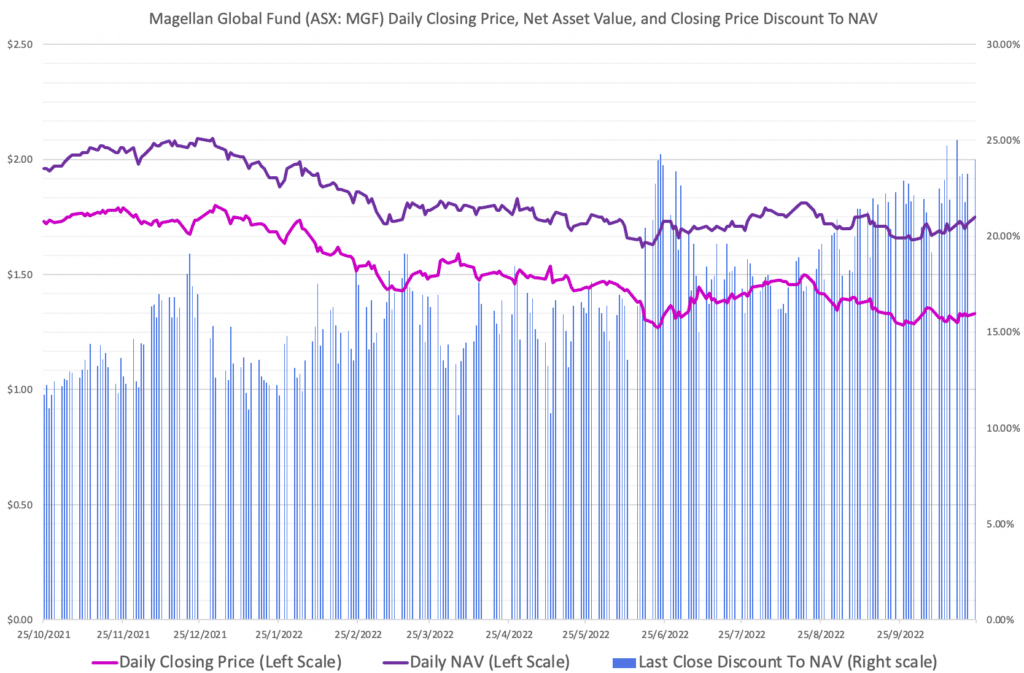

Last week, out of curiosity, I examined the history of the Magellan Global Fund’s net asset value (NAV) and compared it with the Magellan Global Fund Daily Closing Price, in order to calculate the standard historical discount to net asset value. As you can see in the chart below, the discount was previously around 12% to 15%, but more recently it has grown to more like 22%.

What is the Magellan Global Fund (ASX: MGF) discount to net asset value (NAV) today?

According to the Magellan Group website, the Magellan Global Fund (ASX: MGF) had a Net Asset Value of around $1.75 and its last traded price at the time of writing is $1.355. At that price MGF is at a 22.5% discount to its net asset value. If that discount were to reduce to just 18%, then the MGF unit price would be around $1.43.

Why Has The Magellan Global Fund Discount To NAV Blown Out?

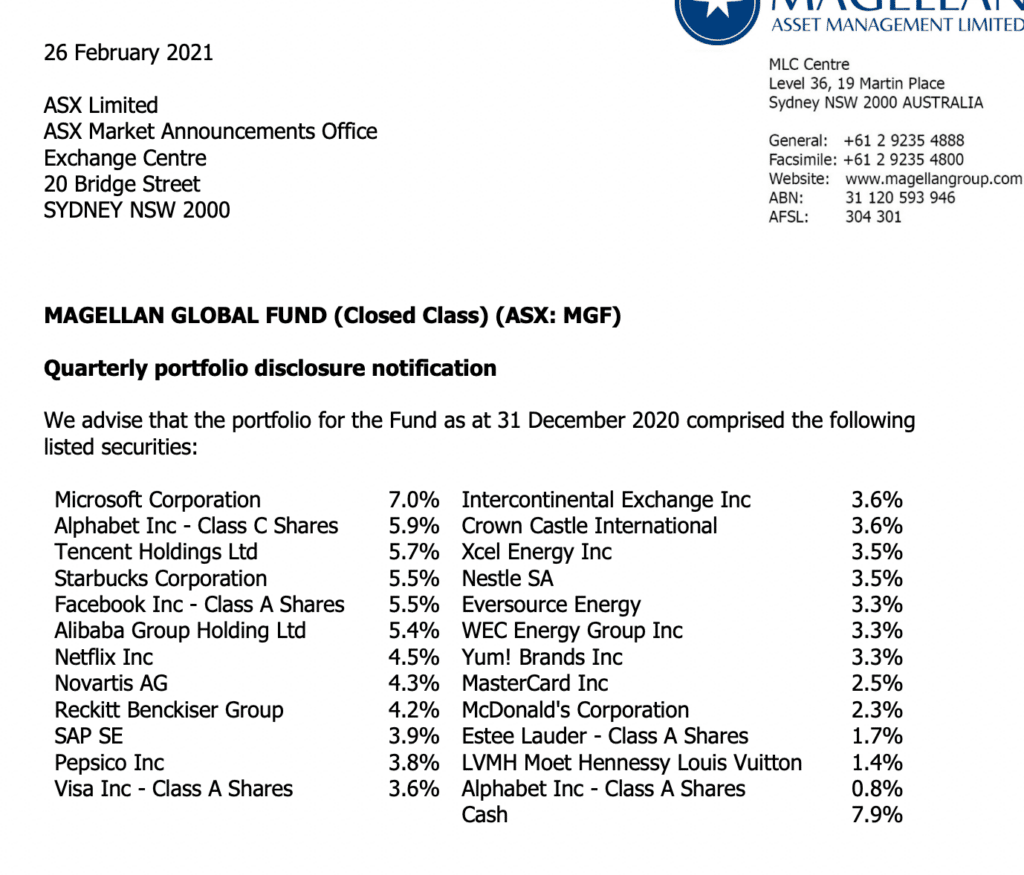

Way back on 26 February, 2021, Magellan Global Fund was very well respected by the market. On that day it had a NAV of $1.75 and traded at about $1.64, a slim discount of just 5.7%. Let’s take a look at how Magellan Global Fund was investing bagholder money, under former CEO Hamish Douglass.

As you can see, back on December 21, 2020, Magellan had a mixture of brands, bluechips and, quite randomly, two large holdings in high risk, speculative China based securities, being Alibaba Group and Tencent holdings. Between them, these high risk speculative stocks constituted over 11% of the fund.

As an aside, Alibaba Group is a Chinese company and all of its profits belong to the boss of China. He decides how much (if any) profits will be received by Western investors. Therefore it is 100% speculative based on China-America relations.

Anyway, as speculative stocks are wont to do, both these speccies have seen their share prices fall some 75% from the peak. Worse, though, Bagellan was portrayed as being a suboptimal place to park cash, given its tendency to invest in speculative companies that are not really appropriate for the set and forget Mum and Dad investors that Magellan Global fund can count as unit holders.

Since then, there have been a few changes at Magellan. In June 2022, the company announced a new CEO with Douglass to continue on in a consultancy role. This appears to have disappointed the MGF unit holders who previously invested, and you can see how the discount to NAV began to blow out, around then. I’m sure that this was also just a result of underperformance, and I would assume that the sell sentiment will continue until performance improves, at the very least.

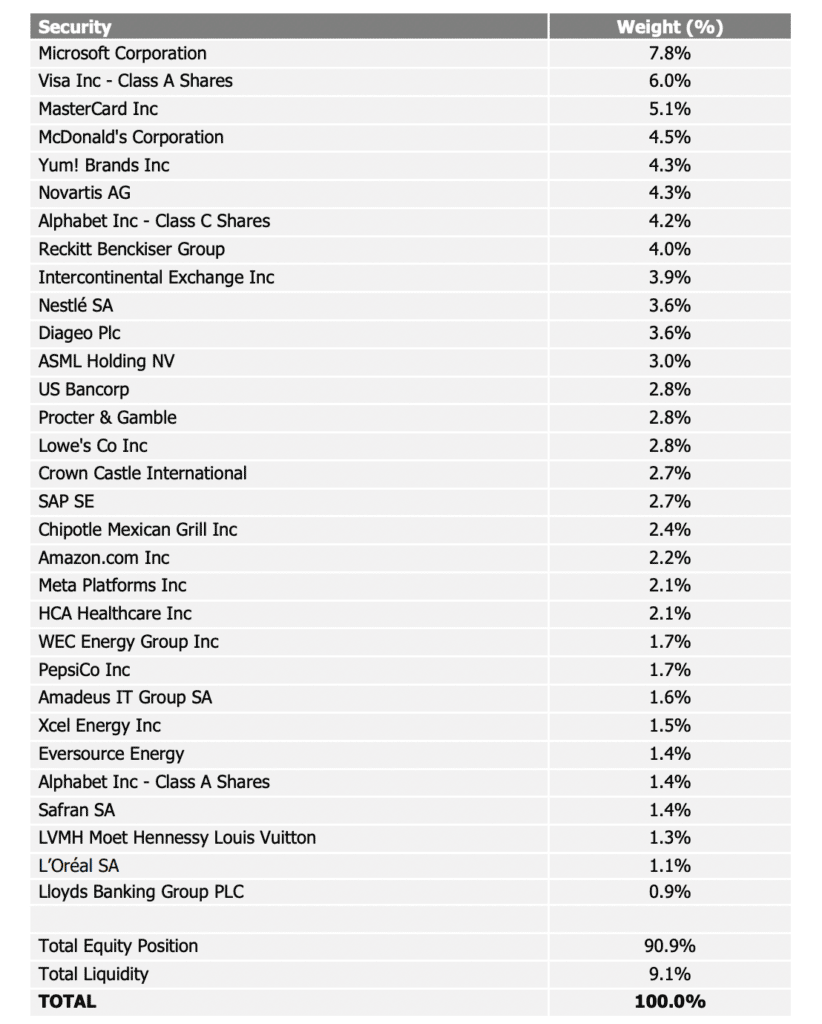

Importantly, though, the new folks in charge don’t seem so keen on yolo-ing unit holder funds at Chinese speccy stocks. You can see the new list of holdings from June 30 2022, in the screen shot below.

Above we see a list of mostly brands and bluechips. In fact, if I were going to come up with a diversified set and forget fund full of global mega-caps, I would have a fair few names from the list above. I’m going to venture a guess that performance over the next few years looks a bit better than performance over the last couple of years. But you can make your own mind about that.

Magellan Global Fund Buyback

Over the last year, MGF has bought back over 200 million units worth almost $350 million, but this buyback expires at the end of the month. Buying back units at a discount to net asset value, and then cancelling them, is an automatic way to increase NAV per unit. However, the disadvantage for Magellan is that it will have fewer units to charge fees on. Therefore, probably the most rational thing to do is not to buy back any shares, and simply harvest fees from the unit holders forever.

As a result, I think it will be interesting to see whether the buyback continues past November, but I haven’t found any statement to this effect. Given that MGF has been buying back its shares since early 2021, I would hope that it does. If it does, then that should provide a boost to NAV per share, given it can buy at a discount of more than 20% to NAV.

Of course, for all I know the discount will never close. I can’t guarantee it ever will, or when it will. However, sociologically, I figure that the discount is probably fairly harsh given that the portfolio itself should do fairly well over the longer term. Part of what hurt Magellan over the last few years was underexposure to the bubble stocks — and I doubt that would hurt them again in the near term.

Another nice aspect of MGF is that it aims to pay out around 4% of NAV as a dividend each year. Given you can buy the LIC for a discount of more than 20%, that improves the yield significantly (should the distribution continue).

Overall, I think that MGF is probably too cheap, and I might buy some units at a discount of 22% or more, with an aim of selling when the discount closes to around 17%. This would give me exposure to global bluechips and brands, plus a little bit of upside from the closing of the discount. However, I don’t currently plan on buying any units as I generally don’t invest in LIC structures, and so I’m pretty cautious to break my general rule. If I do buy shares, it would just be intended as a short to medium term play in the hopes that a shift in market sentiment will reduce the discount to NAV. For me the main long term game is to acquire shares in profitable high quality scalable growing businesses, when the price is right.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in Magellan Global Fund (ASX: MGF) and will not trade these shares for 2 days following this article. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance. The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.