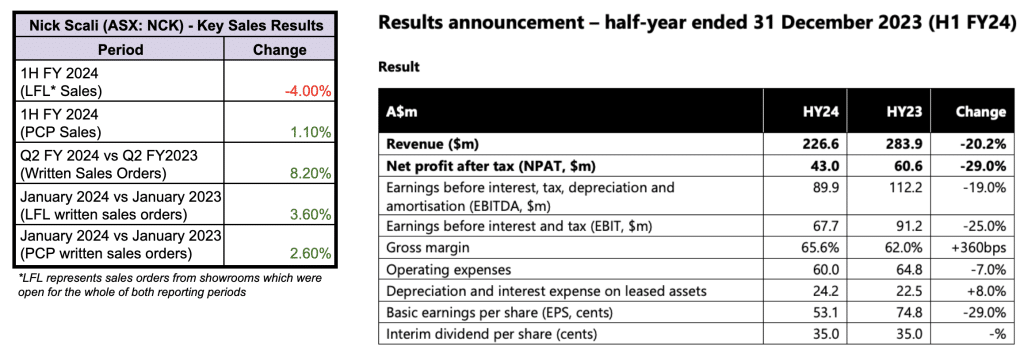

Australian and New Zealand furniture retailer Nick Scali (ASX: NCK) recorded a significant slowdown in its 1H FY 2024 results. Revenue dropped by 20% and net profit fell by 29%, however, Nick Scali guided such results at the AGM in October last year. Net profit was $43m, which beat management’s initial guidance of $40-$42m. Key sales figures in the last few months as seen below show a promising outlook. Management made a prudent decision to repay $20m of debt relating to the Plush acquisition, meaning Nick Scali is almost net cash positive.

Source: The table on the left is internally generated and the table on the right is from Nick Scali’s results announcement

Beating initial guidance, a stronger balance sheet and reasonably resilient trading results in recent months perhaps explain why the Nick Scali share price is performing so well today.

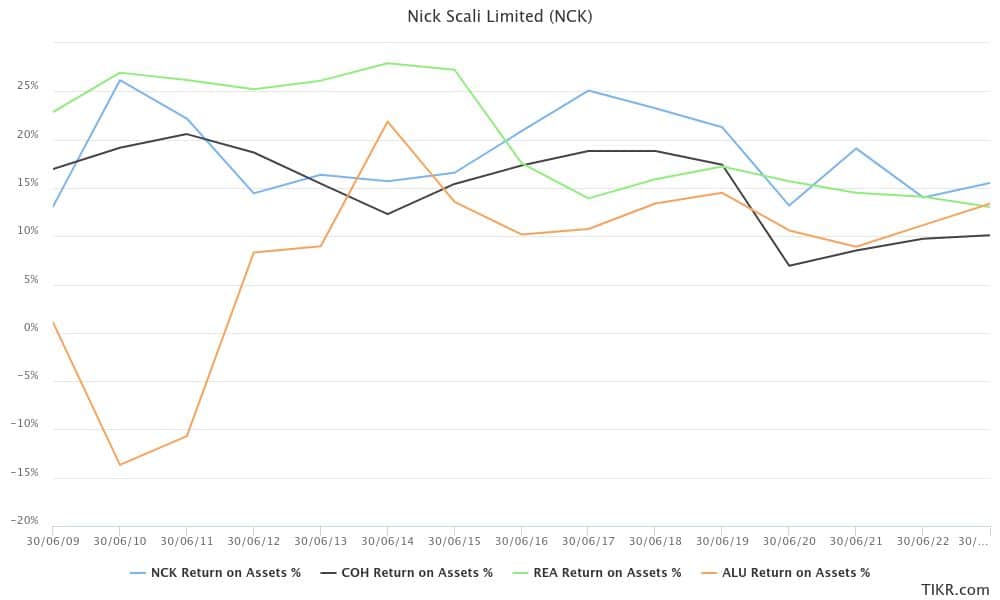

More importantly, is Nick Scali a sound investment opportunity? Nick Scali has no right to be mentioned in the same breath as quality ASX growth stocks like Cochlear (ASX: COH), REA Group (ASX: REA) and Altium (ASX: ALU). Nick Scali doesn’t possess your typical moats like intellectual property, network effect, or switching costs. Yet Nick Scali matches the return on assets of these quality names. Here’s why.

Artful Perception

Most people crave a bargain, particularly with ‘premium’ products. The more expensive and reputable a product, the greater the satisfaction. Nick Scali has mastered this art through luxury-styled advertisements and fancy showrooms. This is why Nick Scali can target more affluent customers in higher income tax brackets with price points higher than that of Freedom Furniture, Amart and Ikea.

The allure of a premium brand brings customers into the store but salesmanship brings money to the till. Nick Scali excels in this area better than most and revenue per employee rivals another quality retailer JB Hi-Fi (ASX: JBH) as illustrated below.

Source: Annual Reports

Nick Scali has managed to keep pace with JB Hi-Fi’s employee productivity despite having much less foot traffic as you can imagine. UK’s largest furniture and homewares retailer DFS Furniture (LON: DFS) holds 38% market share and has only managed to record between $350k to $400k in revenue per employee. But what’s so special about Nick Scali’s sales staff?

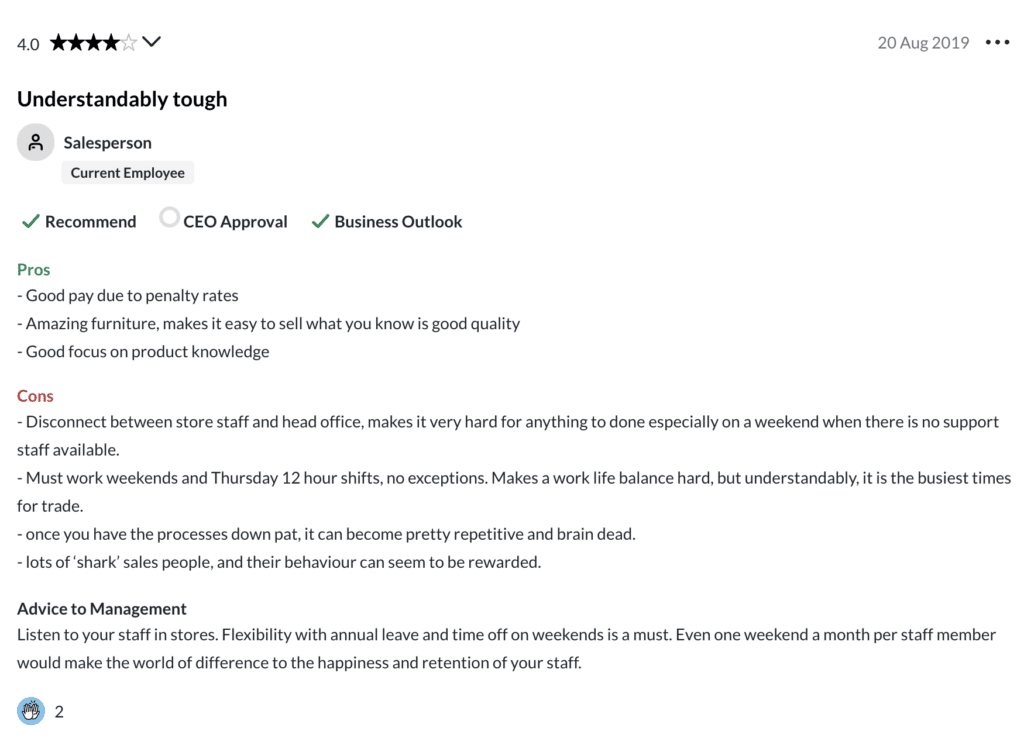

Relentless oversight is what sets Nick Scali apart. As bad as this sounds I think Nick Scali’s management team are more ruthless in squeezing every ounce of energy from its sales staff. A pitiful 2.8-star employee rating on Glassdoor reveals a highly competitive sales environment driven by uncapped commissions and zero flexibility when it comes to weekends and busy trading periods. The below balanced review of a current employee encapsulates these key themes.

Source: Glassdoor

Competitors Freedom Furniture, Amart and Fantastic Furniture possess much higher employee ratings, and this is likely due to greater flexibility and less cut-throat environments. Freedom and Fantastic Furniture are owned by a large conglomerate and Amart is owned by private equity outfit Quadrant. In contrast, Anthony Scali, the son of founder Nick Scali has led the business in the past 20 years and remains the biggest shareholder. I imagine greater skin in the game along with family pride have and continue to be powerful forces driving employee profitability as pictured below.

Source: Nick Scali Annual Reports

On a per-employee basis, Nick Scali’s employees have been able to consistently widen the difference between gross profit and employee costs reflected in the green shade. Promotional excellence and a shark-like sales environment could well mean this green patch widens over the long run. Another driving factor relates to innate human behaviour.

On The Move

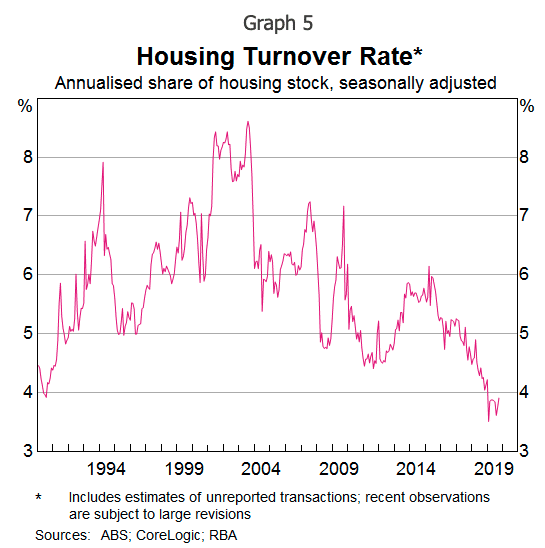

People generally only purchase furniture when they find a new home. Normally, this will only occur a handful of times but make no mistake, nearly everyone will move at least once. It’s a decision that is driven more by people’s lifestyle choices rather than macroeconomic factors. While the rate of turnover can very, one thing remains constant: households continue to form, disband, and relocate.

Source: RBA speech on housing and the economy 2019

In the last two decades, Nick Scali has only suffered a fall in revenue in FY 2009 (-1.7%) and FY 2020 (-2.1%). These falls interestingly coincide with steep declines in the housing turnover rate. As seen in the chart, the housing turnover rate is a volatile beast and will no doubt remain this way. However, I do have confidence the housing turnover rate will remain positive because humans will move homes for whatever reason whether it be for university, a relationship or to start a family.

Such innate human behaviour instils confidence in Nick Scali’s ability to remain resilient and grow through both challenging and favourable conditions. However, investors seem less confident.

At A Standstill

There is cause for pessimism though especially after Nick Scali’s AGM business update. Across the first quarter of FY 2024, written sales orders fell 5.4% compared to the same period last year and on a like-for-like basis, it was 6.7%. And store traffic dropped between 10% to 15%. However, recent sales activity as noted above has quelled a lot of the pessimism hanging around since mid last year.

At current share price levels, my discounted cash flow model bakes in revenue declines of 2% in FY 2024 and FY 2025 and meagre revenue growth of 2% for the remaining eight years. My model also suggests gross margins to fall to an average of 62% and operational expenses to maintain their historical growth rates. However, Nick Scali managed to produce a record-high gross margin of 65.6% and when asked about it on the 1H FY 2024 earnings call, Anthony Scali noted the Plush acquisition has contributed towards the increase. Seems like the big players are getting bigger and pushing over the smaller fish with recent insolvency appointments over Brosa and Custom Sofa Centre. The positive shift in gross margin may be structural.

Nick Scali is striving to add 22 Nick Scali showrooms and more than double the existing 43 Plush showroom footprint. Anthony Scali also flagged potential ambitions of expanding in the UK, a similar market dynamic to Australia. In light of these growth runways, I find it difficult to imagine Nick Scali will only grow at low single digits over the next decade.

After listening in on the 1H FY 2024 earnings call, Anthony strikes me as a patient, earnest and calculated capital allocator. When Anthony was pressed about the rollout of stores, he emphasised that their strategy is dependent on a mix of land or lease opportunities and timing. He was also frank in acknowledging that consumer demand is always hard to forecast.

Prior to these results. I was wary of the growing debt on Nick Scali’s balance sheet mainly brought about by the Plush acquisition but its great to see it close to returning to net cash levels.

I think this is a sound asymmetric setup where investors are paying for Nick Scali’s existing businesses and a small premium for its growth ambitions.

Disclosure: the author of this article does not own shares in Nick Scali. The editor of this article does not own shares in Nick Scali. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.