I currently have three major themes in my portfolio: core holdings, defensive (cash and gold), plus the social distancing beneficiaries.

One concern I have is that the sociological momentum that has driven markets up in recent weeks might be starting to fade. The meme of retail investors taking government stimulus payments to speculate on stocks seems to be reaching far and wide.

On top of that, there seems to be a bit of a narrative shift in the US, with widespread talk of a second wave. Of course, in most states they never really stopped the first wave and the infection is simply spreading slower than it would otherwise, so it may simply be the faster rate of spread in some places (that have opened up) driving the narrative.

On the other hand, the US federal reserve continues to want to accommodate capital, recently announcing is “is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.”

The event that I’m preparing for with my conservatism in my portfolio is (essentially) when fear of dying really takes hold in the US, forcing people to stay home off their own volition.

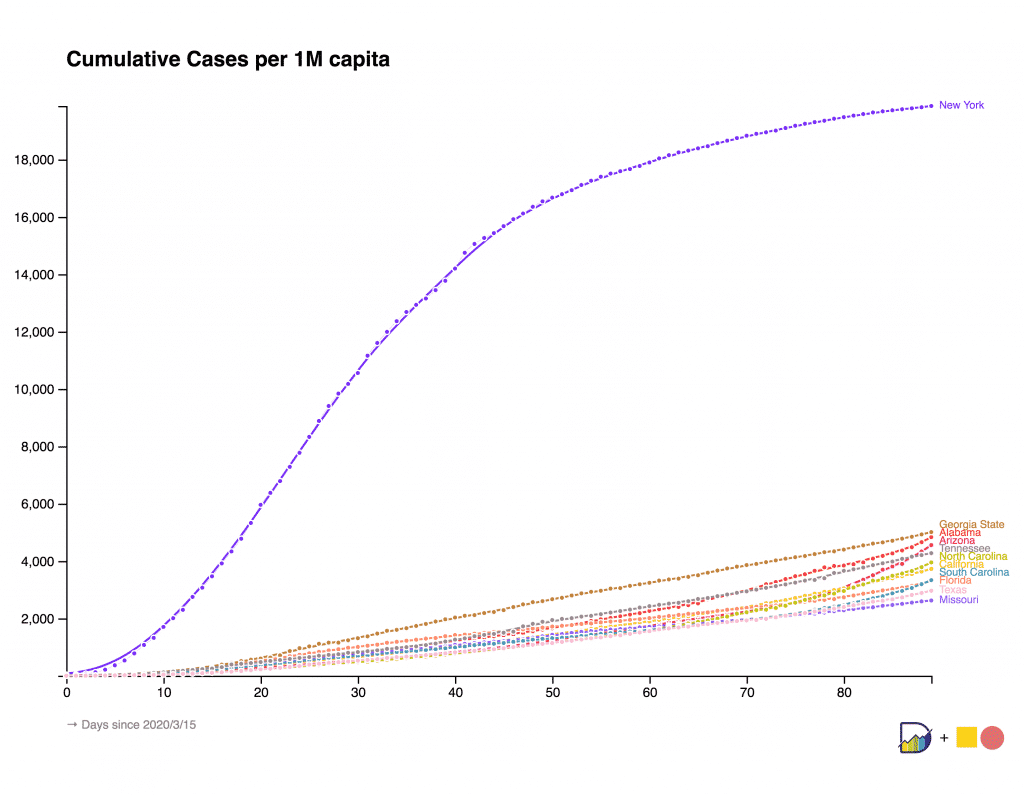

However, despite what we read in the press, even the States that are doing worst to control Covid would need to see their per-capita cases roughly triple to get to panic-stations level seen in New York in mid April. Make your own chart here by clicking this link.

Having said that, places like Alabama are getting close to the levels seen in New York in late March, so the news out of those states might get quite serious, quite quickly, depending on how well their hospital system can cope. One doctor from Alabama recently said; “We are seeing it in the hospitals. The hospitals are fighting pretty hard. We are at capacity, it’s really tough.”

As a result of this potential narrative change and interruption to the share price momentum, it’s time for me to more aggressively pursuing my rotation into more defensive healthcare and tech companies such as those mentioned here. As a result, today I sold my shares in Temple & Webster (ASX: TPW), and slightly trimmed a couple of other holdings.

I’ll be looking to deploy the proceeds into software and healthcare stocks.

$TPW retails furniture and household goods online, and I have no real affinity for the business. I think the risk versus reward is extremely favourable for a small investor like me, because I can (and will!) sell very fast if the share price momentum reverses in a meaningful way. pic.twitter.com/S1FE69ehw0

— Claude Walker (@claudedwalker) June 4, 2020

This post is not financial advice, and you should click here to read our detailed disclaimer.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!