Sequoia Financial Group (ASX: SEQ) is a small conglomerate of businesses operating in the finance and wealth management industry. As interest rates rise around the world, high multiple software stocks are falling, while simple small-caps on lower multiples seem to outperform. Last week, I took a look at a micro-cap worth a little less than $40 million, trading on around 15 times earnings. Sequoia is attractive for similar reasons.

Sequoia’s long term plan is to use cash from its existing businesses to buy other cashflow positive, profitable businesses, in the financial advice and wealth management industry.

At the current price of 70c, Sequoia has a market capitalisation of about $92 million, putting it on just 16.5 times earnings.

What Does Sequoia Financial Group (ASX: SEQ) Do?

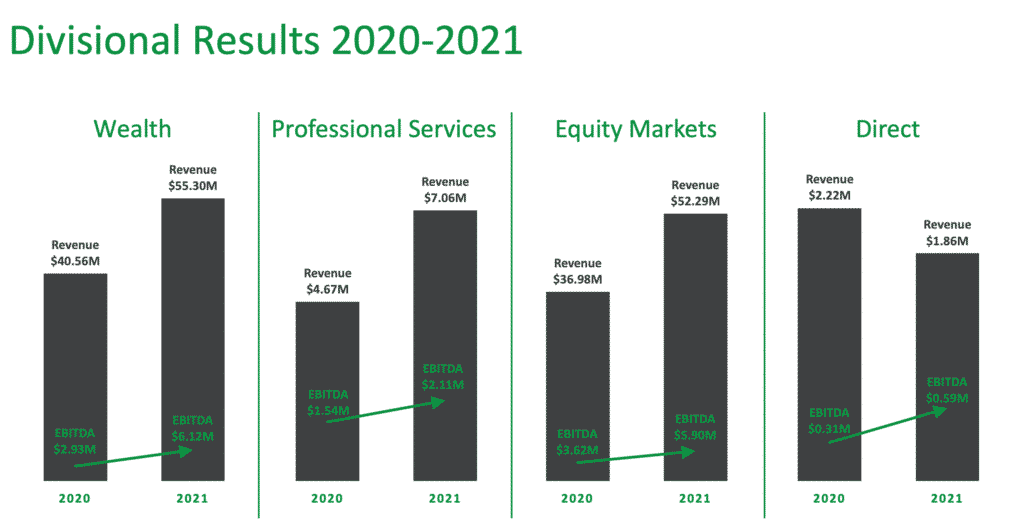

Sequoia Financial Group is in the business of buying other, smaller businesses in the financial industry, and merging them into the group. As you can see below, it has over 20 businesses spread across four divisions, being Wealth, Professional Services, Equity Markets and Direct To Consumer.

The Wealth segment is the largest segment, and is responsible for providing licensing and compliance services to financial advisors through Interprac, as well as providing financial advice and corporate services, through Sequoia Corporate Finance and Sequoia Wealth Management. It is mostly focussed on higher net worth clients, rather than the sort of client attracted to discount brokers.

The Wealth division is growing because the big banks moved out of financial advice, moving many advisors to a new licensee, without giving them much choice. As a result of increased regulation, the compliance cost to provide advice has gone up over time and many advisers have been leaving the market. This makes the remaining advisers in high demand, and impressively Sequoia has been able to grow the number of advisers it supports, by winning market share.

The company says it wins clients through a premium service the CEO of Sequoia Gary Crole was asked about whether advisers were locked in to their relationship with Sequoia as a licensee, and he was passionate about not wanting to lock in advisers through contracts, because he wants to retain them by providing a compelling compliance service to advisers.

The Professional Services business provides documents to accountants and includes general insurance, legal documents and SMSF administration. In August last year they expected this division to double revenue in 3 years, but at the AGM the company said it would occur twice as fast. The CEO says they are transitioning the documents business to generate ongoing fees from cross-selling payment terminals or registry software, for example.

The Equity Market division includes Morrison’s Securities and Bourse Data. The Morrison’s business is gaining market share, and is expected to grow revenue by 30% in FY 2022. Given the fact that Morrison’s can make money either by gaining clients or if those clients transacting more, this division should benefit somewhat from volatile markets. The division generates growing cash flows which Sequoia can then use to purchase new businesses, such as the legal services business Top Docs Legal, which the company recently added to its Professional Services business.

The Equity Market business is growing organically, and the CEO said that he’s expecting more than 35% EBITDA growth. Arguably, this business is fairly good quality since it is a volume based business-to-business operation. That means it benefits when its clients (financial advisers and the like) use their capital and effort to grow their own businesses. Based on guidance this business should do almost $8m EBITDA in FY 2022, and in a more optimistic market, could be worth almost as much as the entire market cap of Sequoia Financial Group.

Finally, the Direct business which is basically a discount broker (for the ASX only), plus the Finance News Network, which is a “independent news organisation” that does “digital communications and productions services for ASX-listed companies and managed funds.” I assume that means FNN walks the tightrope of trying to “independently” report on funds and companies, while simultaneously soliciting them for business.

Sequoia Financial Group Management

At the end of 2018, certain shareholders moved to get rid of long serving CEO Scott Beeton, who ended up resigning to be replaced by the then-Chairman, Gary Crole, who built the Interprac business, which forms a large part of the Wealth division today. He holds over 11 million shares, and recently bought a few more at 67c per share. He oversees the 104 employees across the group.

Fellow directors John Larsen, Kevin Pattison and Charles Sweeney all have relevant experience in finance and commerce, but none own what I consider to be a material shareholding (though each owns over 100,000 shares). Overall remuneration is generous but not outrageous.

Crole strikes a confident tone when he talks about the group’s long term strategy. He describes Sequoia as “the tortoise not the hare” and intends to continue to grow dividends even while keeping the majority of cash flows for opportunistic acquisitions. Sequoia has over $30m in the bank, but excluding client money, it had “shareholder cash and liquid investments” of around $17m at the end of FY 2021. Some of that money is required to be held for regulatory reasons, or held on trust for clients. The relatively modest pace of purchases suggests the company is a patient acquirer that will wait for the opportunities to come.

[The above paragraph edited to correct clarify that some of Sequoia’s cash is held on trust for clients].

I like this feature of the business, because it means Sequoia can take advantage of any market rout by (one would hope) making a more favourably priced acquisition.

On the other hand, one of the big risks is that the company would make a large acquisition, which might then fail, thus doing serious damage to the balance sheet for very little gain.

What does FY 2022 Look Like For Sequoia Group?

Sequoia Group typically makes better profits in the second half of the financial year, so the half ending December is expected to be a fair bit weaker than the half ended in June. According to management, the reason for this is that people maker larger superannuation contributions, buy more insurance, and are more likely to seek financial advice in the lead up to the end of the financial year. And this makes sense.

The company is guiding to at least 15% EBITDA growth for the full year, which would mean at least $13.2 million in EBITDA. Assuming EBTIDA converts to profit at the same rate as last year (it may well not), that would be profit of about $6.3 million.

The company has forecast at least $2.1 million in net profit for the half ending December 2021, and I am hoping we’ll see about $4.2 million in the second half, to bring full year profit to $6.3 million. However, this may be overly optimistic, since the company does amortise its various acquisitions quite aggressively, and if Amortisation is higher, then the ratio of NPAT to EBITDA may decline. If that’s the only reason it falls short of my forecast, I won’t be too upset, since amortisation does not impact the actual cash flow of the business.

In my view, the key reason to own Sequoia is if you believe in management. The acquisition led growth strategy relies on both alignment and good judgment, which I think is present here. The dividend will ensure that shareholders benefit from growth, eventually, even if the market doesn’t respond.

That said, if the company succeeds in its goal of always under promising, and over delivering, then I believe that eventually it will trade at a higher multiple than it currently does. There is certainly key man risk in the CEO.

Furthermore, I believe that in a sustained market sell-off, the business would be somewhat damaged, because when people feel scared and poorer, they may make fewer investments and set up fewer investment vehicles. On the other hand, the Sequoia business would remain completely relevant and its hard to imagine any existential threat. With the big banks vacating the financial advice industry, the stage is set for a new generation of independent businesses like Sequoia, and that makes it an interesting low multiple stock to follow. You could argue it represents a

“growth at a reasonable price.”

You can see Luke Winchester and I discuss Sequoia in the clip below, which aired on Ausbiz on Friday, February 4, 2022.

Please remember that these are personal reflections about stocks by an author. I own shares in Sequoia Financial Group. I will not sell any shares within 2 business days of publication but reserve the right to buy them at any time. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.

For early access to content like this, join our Free newsletter!