All in all, there is only a minority of investors for whom microcaps are a worthwhile pursuit. But for those investors who have the portfolio management abilities, they can be very worthwhile indeed.

The very illiquidity that makes microcap stocks hard to trade, is also what allows some microcaps to be (seemingly) very cheap.

Microcaps sometimes trade at a discount because you can get trapped in them. So while the amount of money any investor should risk in a micco-cap is relatively small, returns, when the investment goes well, can be relatively excellent. As a company grows, the liquidity of its shares can improve, increasing the multiple of earnings that the market will pay.

Furthermore, when a small company just becomes profitable, it is often not obvious what multiple it trades at.

For example, IT company Cirrus Networks (ASX: CNW) just reported a first half profit of $925k. The company says that it is “Well placed for continued strong growth for the remainder of FY 2023.”

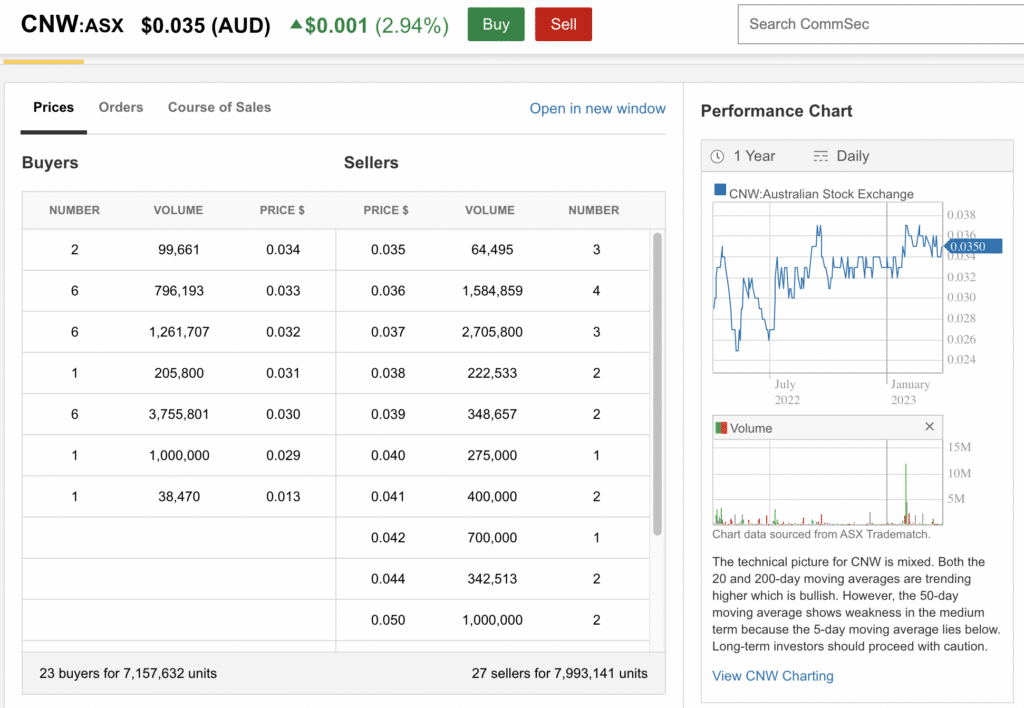

If that is true, then it would be quite reasonable to expect Cirrus can earn $2m in FY 2023. Given that it has cash of over $9m and a market capitalisation of about $32.5m at a share price of $0.035, its enterprise value is less than $25m. Even if its enterprise value was $25m, then that would be only about 12.5 times earnings.

In fact, if we ignored the cash completely, Cirrus would be on a P/E ratio of 16.25.

Of course, the potential upside arises if it continues to grow. This seems quite possible, since the company has only just become profitable, and now has cash to spend on acquisitions. Because it is so small, even a small improvement in profit could make it look very cheap indeed. If Cirrus Networks can grow a bit organically, and a bit by acquisition, it could end up looking very cheap at $32.5 million. So the question to ask is…

Is Cirrus Networks (ASX: CNW) at an inflection point?

Cirrus Networks is a small ASX listed IT product distributor and IT managed services company. It could be seen as being at the opposite end of the IT services pecking order from the likes of Data3 (ASX: DTL) or Dicker Data (ASX: DDR). Closer to Cirrus, we have all manner of managed services companies such as Cosol (ASX: COS), Soco (ASX: SOC) and CPT Global (ASX: CGO), as I previously covered here.

Cirrus Networks is interesting purely because it has recently self-proclaimed its turnaround complete, and has backed that up with a statutory profit before tax of about $1.3m and earnings per share of 0.099c.

Unfortunately, the company saw strict free cash outflow of about $84k. This weak cash conversion was supposedly due to seasonality in collections, and we should see a much stronger second half. It is not unusual to see a stronger second half in this kind of business.

In order to understand Cirrus, we need to first realise it consists of two businesses. The product business operates near enough at a loss, and generates near worthless revenues at current scale. It seems likely to me that the main value of that business is in order to be able to provide the solutions that its managed services business works with.

In my opinion, enterprise product sales aren’t worth much. However, the professional services and annuity services businesses can earn profit before tax margins of around 10%, when they are well run, and experiencing healthy demand.

As you can see below, in the first half of FY 2023, Cirrus Networks made about $17.5m in revenue from these sources. It’s not exactly clear what the net profit before tax margin would be given we don’t have the profit breakdown of each business, but my guess is the managed services business is running at a net profit before tax margin of between 5% and 7%. That seems reasonable for a business of this size.

The weakest part of the recent results was the free cash flow outflow (after lease repayments). However, Cirrus says that “our outlook for cash generation is 2H FY 2023 is strong.”

While CEO Chris McLaughlin only owns about $50k worth of shares, it was good to see fellow director and professional investor Andrew Waterworth buy around $13k worth of shares at just over $0.033. Waterworth owns around $1.8m worth of shares. Chairman Paul Everington also owns a meaningful stake, so I consider the board reasonably well aligned with with shareholders.

Only A Little Microcap

I only ever invest in micro-caps with money I am willing to have trapped in there, since bad news can leave shareholders without a buyer. Conversely, if good news leads to a strong share price rise, I usually think it’s wise to take some profits.

I have much to learn about Cirrus Networks, and this is simply a record of my initial impression; which is that Cirrus looks like good value at the current price of $0.35! However, as you can see below, the stock is quite illiquid. Looking back further, the Cirrus Networks stock price has bounced between $0.032 and $0.036 for about a year now.

Disclosure: the author of this article does not owns shares in CNW and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.