Last week, lottery ticket reseller Jumbo Interactive (ASX: JIN) reported its results for FY 2020 showing revenue growth of about 9% and profit down slightly to $25.9m. The main reason for the poor profit result was a sharp rise in administrative expenses, which is partly a result of the Gatherwell acquisition, made during the year, as part of its UK expansion effort. On top of that, the company also expanded its employee base and increased corporate expenses. This is an area to keep an eye on, though it is understandable that expenses increased in FY 2020 as the company expanded overseas and re-negotiated its contract with Tabcorp.

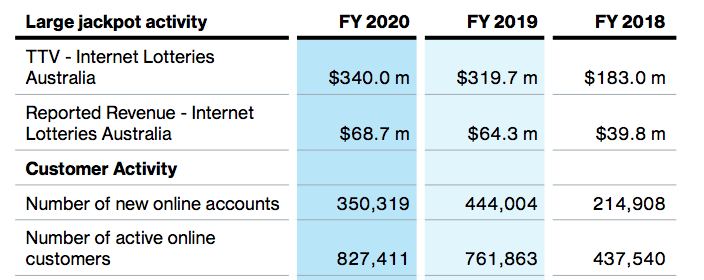

As you can see below, the underlying driver of growth for Jumbo — the number of active customers it has buying tickets over the internet has been steadily increasing. Note that FY 2020 saw lower numbers of new online accounts partly as a result of fewer big jackpots (which drive sign-ups).

As a result, it’s fair to say that the long term tailwind in favour of online lottery ticket sales is as strong as ever.

On top of that, the company also announced it had signed its previously announced deal with Tabcorp, which covers reselling arrangements for the next 10 years. As a reminder, Jumbo sells tickets to Tabcorp lotteries, in Australia, and will have to pay Tabcorp increasingly higher prices for the privilege over the next 5 years. That will allow Tabcorp to capture much of the growth, and slow profit growth for Jumbo shareholders.

But looking on the bright side, the scene is now set for increasing sales growth in FY 2021 because during the first few months of covid, “a larger percentage of new signups appeared from the 65 years and older category (peaking at 24% of all signups)”. The company says, “this trend is new to OzLotteries.com which has historically attracted a younger tech-savvy demographic.” This demographic is harder to drive online and tends to spend more, so that is a free kick for Jumbo.

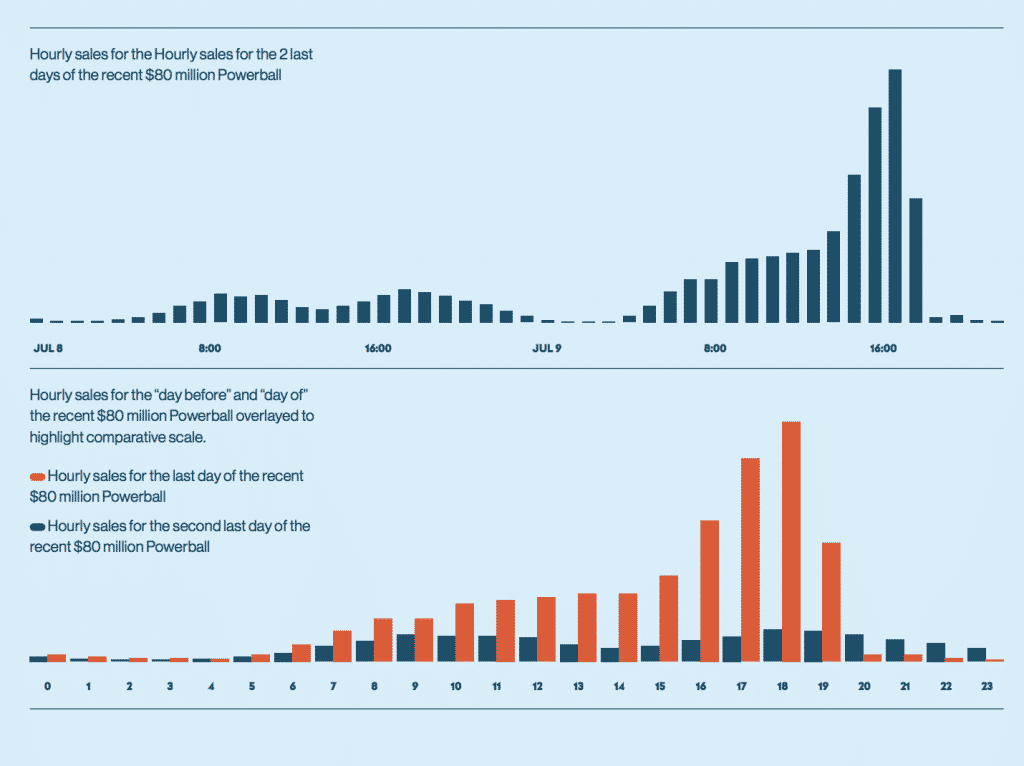

The cherry on top is that with 10 years of steady or growing profitability from the Australian reselling business quite likely, the company has plenty of time to focus on growing its SaaS “powered by Jumbo” business line. This relatively new offering aims to assist other lotteries with their own online offerings. As you can see below, selling lottery tickets online does come with its challenges and Jumbo says that “many charity lotteries have been missing out on sales simply because their systems were not able to handle peak loads reliably.”

Jumbo says they will target UK, USA and Canada with its SaaS offering, and that this offers a large enough total addressable market that one day Jumbo could probably justify its current market cap with this business alone.

Is Jumbo Interactive A SaaS Company?

Back in 2019, Jumbo Interactive was dubbed by one twitter wag as Jumbo Interbagtive because at a market cap of almost $2b, the market was apparently putting a SaaS multiple on the ~$65m in revenue the company could boast at that time. The catch, of course, was that Jumbo has barely any SaaS revenues today — let alone back then. The market was ahead of itself.

But that does not mean Jumbo Interactive will never be a SaaS company. Indeed, in the recent report, the company mentioned that it has SaaS agreements with customers with TTV of ~$140m and that this should generate incremental revenue of around $4.5m with incremental profit of around $3.4m. That implies that the net profit margins on additional deployments of the powered by Jumbo SaaS offering are very high indeed. Certainly, I would argue, that this SaaS segment does deserve a SaaS multiple.

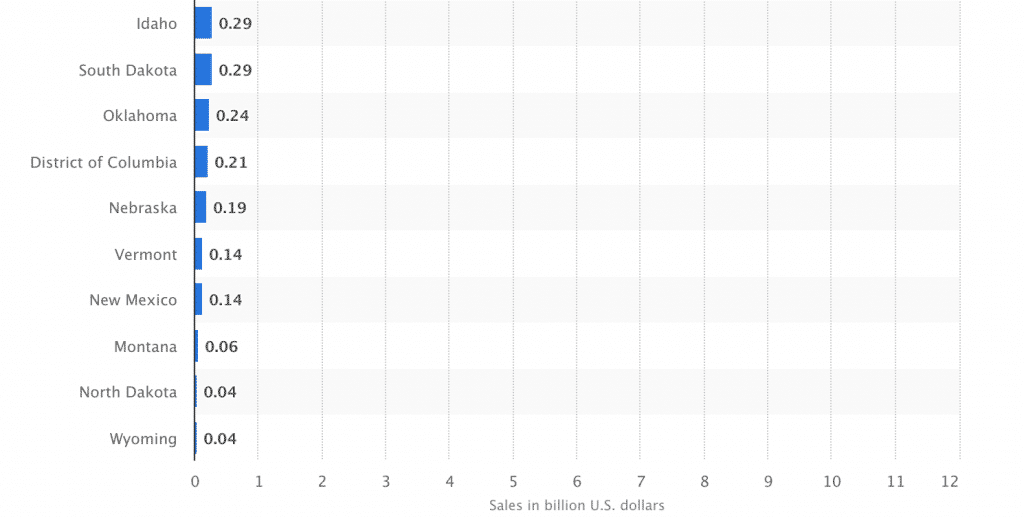

With the software suite already proven capable of driving multiyear growth in an online lottery reselling business (OzLotteries.com.au), there is every reason to believe that the company will succeed in selling it widely. The chart below from Statista shows the lottery sales in the smallest US states in billions of dollars.

If you ask me, management’s aim of adding $100m in TTV per year is fairly low. If it could just win a single state lottery, it could easily double that in a year. And a single larger state could be an absolute company maker.

In the US, Jumbo will market two offerings; iLottery, which “provides

lotteries with an integrated digital lottery channel”, and iRetailer, which “provides lotteries with a standalone digital channel that is self-sufficient and does not require operating cost or marketing budget to be diverted from the lottery’s main operations.”

The company says the “iRetailer model is focused on smaller US states or those states that have constrained or restrictive marketing budgets.” To me, this confirms that the company is targeting smaller US states and in my view, it can succeed doing that. But if it wins just one large state there is a lot of upside.

Is Jumbo Interactive Available At A Good Share Price?

In the last year, Jumbo made earnings per share of 41.5c, which means that at the current share price of $13.67 it trades on 32 times earnings. It has net cash and strong free cash flow.

At current prices, and factoring around 10% profit growth in the short term, it is not obviously cheap. However, if we factor in the potential long term transformation into a SaaS company then it could be very cheap. At current prices, I see the downside as somewhat protected. For example, I think it would find valuation support after a drop of 30% or a bit over, being a P/E ratio of about 20.

However, just a few more lottery wins for the SaaS offering could add hundreds of millions to the market cap quite justifiably. The company added $140m in Saas contracts in a single year, so 5 years could see $600m easily, and corresponding revenue of at least $15m, but probably more.

Even at that size, the SaaS part of the business could thusly command a market cap of $200m or more, which is more than 20% of the current market cap. And if there are a couple of bigger wins, the company could blow past that goal. A favourable outcome is not guaranteed but nor is much of a probability of success, in my view, priced in. So for me, Jumbo remains an attractive stock at this price and I am happy with my holding.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer.