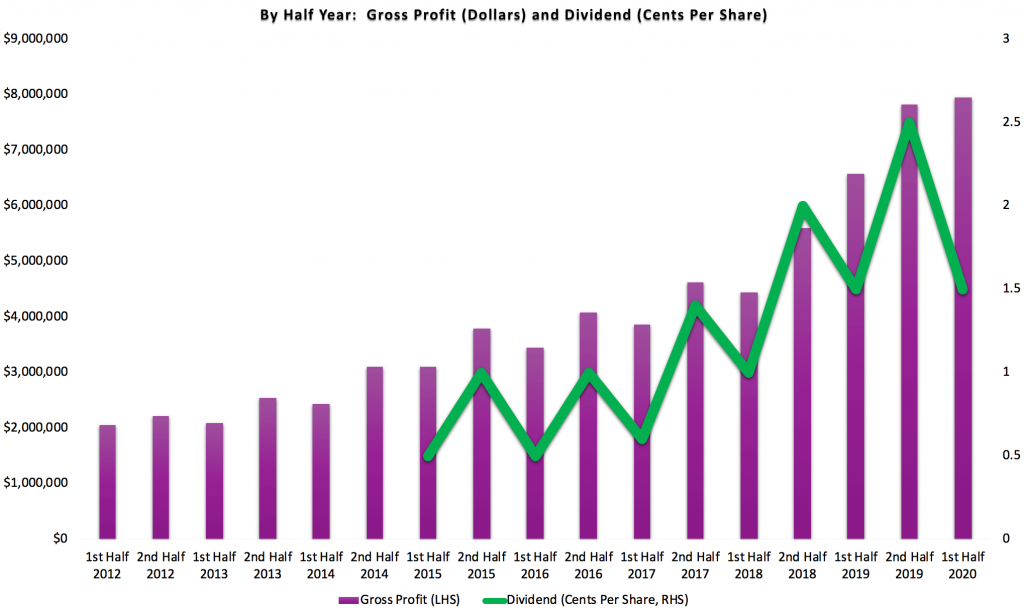

On Tuesday afternoon Kip McGrath Education Centres reported its results for the first half of FY 2020. Revenue was up 22% to $8.7 million but profit was down 8% to $1 million. Historically I have tracked gross profit as a good measure of underlying business growth and again — historically — the first half is usually weaker than the second half. You can see what I mean below:

In that context, it’s not too worrying that gross profit barely increased over the preceding half. However, the real drag on results was the sharp increase in operating costs. This would, in part, be due to the company’s decision to start running corporate centres. These centres would have higher gross profit but bring higher operating costs that reduce the net profit margin.

On top of that the company mentioned that “increased amortisation and depreciation expense following the acquisition of the Yorkshire and the Humber UK area developers” reduced profit. Usually, if profit was reduced by increase amortisation, we’d expect stronger conversion to free cash flow. However, that wasn’t the case either, because “The business is currently coming to the end of a 2-year build for all software to run the franchise and corporate centres.”

As a result, free cash flow was actually negative $1.5 million (and, for the record, operating cashflow was weak at around $1 million).

Overall these results paint a picture of a tough half where growth was sacrificed for investment in a more efficient and better positioned overall business. To quote the managing director:

“Over the next 12 months we will be rolling out our new systems for franchises and company owned centres. We have begun testing the new system in January in corporate centres ready for deployment after the April conference. We have invested significant money, time and effort to build what we believe will be a major enhancement to the current system. We expect to see significant improvements in administration time and student lessons. This will lead to continued growth for centres and online in the years ahead.”

That’s all fair enough, but it has to be remembered that not all of the company’s initiatives end up paying off. They first developed video tutoring software on a platform called Microsoft Silverlight (from memory), after it had already been half deprecated by Microsoft. They then had to rebuild in HTML 5.

The spend hundreds of thousands trying to sell their intellectual property to governments in other Commonwealth countries. Oh, and they once bet the company on the acquisition of a vocational education provider which promptly lost its license (that’s how the share price dropped to 6c).

Now, along the way they have also had some cracking initiatives. They’ve grown out to over 500 locations. They’ve moved franchisees to a fee structure that aligns them with the company. They’ve advertised effectively online. They’ve prepared the company for a future where online tutoring will be more important.

I don’t think that their corporate store initiative risks the company and I note that the CEO Storm McGrath has said that “The four corporate owned centres continue to grow and will soon become profitable. Start-up losses of this new business of $100,000 for the half were as per budget with expenses well maintained.”

When the results came out, the shares initially tanked to under $1.10, before finishing yesterday at $1.15. This is actually above my last valuation of the company, keeping in mind that the share price only really shot up to $1.50 because a newsletter recommended the stock.

Previously, I’ve opined that my buy price for the stock was just under $1. At that price, shareholders could reasonably expect to receive a dividend yield of about 4%, which should grow over the long term, albeit not every year if the company has a failed initiative or needs to invest a bit extra in technology or corporate stores.

Personally, I am not impressed by the fact that the company has got four corporate stores that are losing money and I’m not convinced they will become profitable any time soon because of the impact coronavirus is likely to have on the business.

I was disappointed that the company did not bother mentioning the coronavirus or anticipating the impact it will have on the business. Edit: Subsequently, the company released a slide addressing the virus and its communications with franchisees about it. I hope they are able to navigate this period, and transition as many lessons as possible to online, if required.

While the virus will not unseat the business long term, I would feel more comfortable if I knew how badly it could impact the business in the near term risk to the business. As a result of the coronavirus shut-down threat, I have approximately halved my (very oversized) shareholding. Some of that selling took place prior to the results, as disclosed here, although the majority I sold afterwards.

The main reason I sold after results is because I am worried about how the coronavirus will impact the business. Ultimately, if the share price does get smashed because of the impact on this year’s results, I could absolutely see myself increasing my position in the future.

This is certainly not advice or a recommendation, but at this point I’m thinking it would be hard to resist buying at about 80 cents, a forecast yield of about 5%. Of course, depending on the severity of the coronavirus epidemics (or pandemic) I may choose to be more greedy when others are fearful.

Ultimately, I take a lot of heart from the fact that gross profit is still moving in the right direction, and even if these results are less impressive than the last couple of years, they were still thoroughly respectable.