Towards the end of February 2022, school kid tutoring company Kip McGrath Education Centres (ASX: KME) announced a half year profit of $918,000, up 11.1% on the prior corresponding period, and revenue of $11.35 million, up 33%. The Kip McGrath Education Centres share price at the time of writing is just under $1 per share.

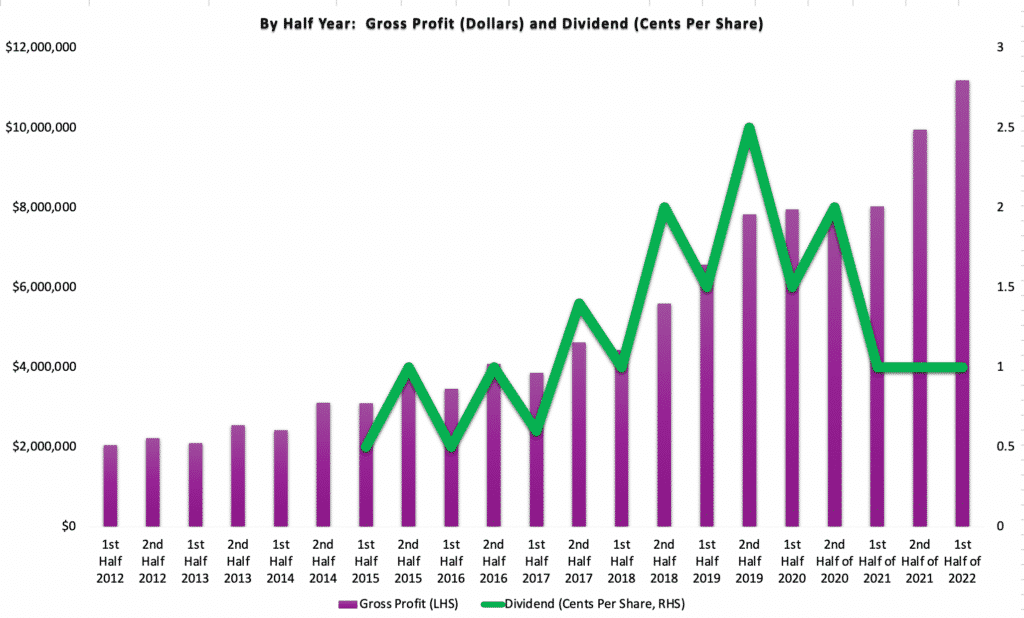

Historically, I have measured Kip McGrath’s growth through a combination of gross profit and dividends per share. I used gross profit because the company was gradually reducing its royalty payments and direct expenses, as it changed the way it accounted for revenue from franchisees. However, in this result the royalties, commissions and direct expenses are close enough to zero.

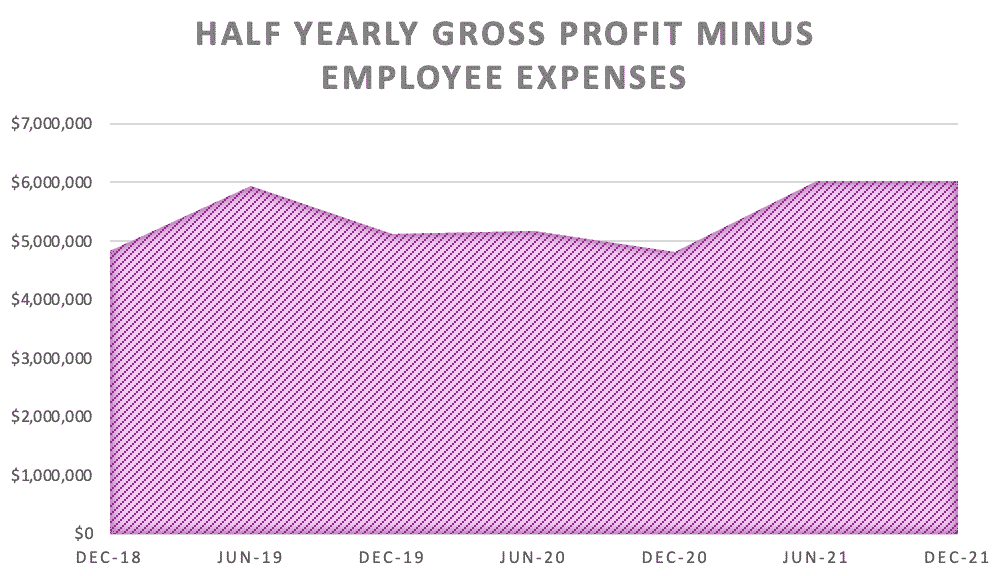

At the same time, the company has now generated over $2 million of revenue from corporate owned centres. This boosts gross profit, but comes with an associated cost for running the centres (predominantly employee expenses). As a result, this will be the last time I track gross profit, because clearly the more important metric will be gross profit, less employee expenses. You can see how that has been tracking, below.

Basically, what this chart above shows is how the expansion of corporate centres has impacted this metric, noting that the “new initiative” to build out a company-owned centre business was announced after the half year that ended in Jun 2019 (being the peak at the start of the graph). By comparing the two graphs above, you can deduce how the extra employee expenses came in ahead of the new gross profit, but now the gross profit is catching up.

During the half, Kip McGrath purchased 5 new centres and it now has 22 operational centres. It says that centres in “Sydney, Melbourne, Canberra and Newcastle [are] positioned well for pandemic related re-openings after challenging previous six months.”

The report said that corporate centres are still scaling and “have not contributed significantly to profit this half”. I asked CEO Storm McGrath about what this meant and he clarified that it means the corporate centres are generating a small EBITDA profit, which basically means they are still unprofitable, in my book.

However, it definitely makes sense that this business would take a little time to scale up. For example, sometimes a single employee who may be a teacher/manager, might work across multiple centres. On top of that, the lockdowns in second half of last calendar year 2021 would clearly have made it harder to grow these physical education centres. Storm believes that the corporate centres will be able to generate 10% EBITDA margins in the second half of FY 2022 (with around $4m revenue expected) and then hopes to achieve 20% EBITDA margins in FY 2023.

Personally, I would be surprised if FY 2023 sees a doubling of EBITDA margins from this business line (perhaps around 15% is more realistic). However, even if the company falls short of these aspirations, the corporate centres must contribute a genuine profit (not just EBITDA) in FY 2023, or else the strategy comes into question.

Moving on to the cashflow statement, it was great to see that operating cashflow remained well in excess of profit, at around $2.4 million. However, once you exclude a tax refund, and account for $2.6m investment on intangibles, the company did burn cash. Add in the acquisition expense related to the newly purchased corporate centres, and Tutorfly, as well as lease expeneses, and we saw total cash burn in the order of $1.7m

That’s not sustainable long term, but many of the expenses were non-recurring or optional. With net cash of about $8m, Kip McGrath has a mandate to spend on growth, so I’m not concerned by the cash burn.

When it comes to dividends, the CEO told me that “the dividend will go up with the NPAT but the ratio will probably come down to 50%… as we use the money to grow”. That means we may only see a yield of about 2% this year (though I’d hope for a bit more than that). It could be some years before we see a dividend of 4c per share again, though if the investment in growth pays off, it should happen.

Indeed, it’s not difficult to imagine the franchise business growing slightly (lets call it around $2.5m profit per year by FY 2024) and the corporate business contributing another $1m per year in NPAT. That should see profits of about $3.5m per year, compared to a market capitalisation of around $55m at a share price of $1. If that happens, then we should have a reasonably priced moderately growing company priced on around 15x earnings yielding a bit under 3.5%. Now, that outcome isn’t guaranteed, but I think that’s a fairly likely outcome.

On top of all this we have the “side hustle” in Tutorfly, which is roughly at breakeven. Unfortunately the founders there have left the business, and it is somewhat dependent on “covid catch up contracts” with Arizona schools. Now, when I spoke to Storm he was planning to head over to the USA to see if he can drum up more government business there. He was also exploring opportunities in other states (though many are less receptive). For example, Union Rules can make it impossible for a non-unionised teaching workforce to step foot into schools. For now, I’ll assume that Tutorfly doesn’t add much value. However, I do note that there is definitely some upside potential, and the Tutorfly founders remain shareholders in Kip McGrath.

Finally, I noted that the number of active centres (gold franchisees) dropped from 295 to 275. I asked the CEO about this and he clarified that they still have 295 gold franchisee centres but at the end of the reporting period 20 were closed due to covid. Therefore, I still think there is some upside as we are come out of lockdowns, probably for good.

Overall, I think that these were decent results showing a business recovering from a tough couple of years. I think the fair price is a bit (but not much) higher than $1, and given my confidence in the integrity of management, I’m happy to hold at this price. Kip McGrath Education Centres is a business I own mostly for dividends, so I’m slightly less enthusiastic about it given it will be paying out a lower percentage of profits. However, I think that it is likely that it will resume dividend growth in the coming years and that will justify the valuation. I could see myself topping up on share price weakness.

Please remember that these are personal reflections about a stock by author. I own shares in KME and will not sell any for at least 2 days after publication of this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.