Metallurgical bonding company Laserbond (ASX: LBL) recently reported its results for FY 2023, showing record revenue and profit results. Revenue was up 25.7% to $38.6 million, profit was up 31.1% to $4.76 million.

Due to the impacts of dilution, earnings per share was only up 22.9%, to 4.34 cents. As you can see below, the dividend remained steady at 0.8 cents, totalling 1.6 cents per share for the full year. That puts Laserbond on a dividend yield of 1.8% at the current price of 89 cents per share.

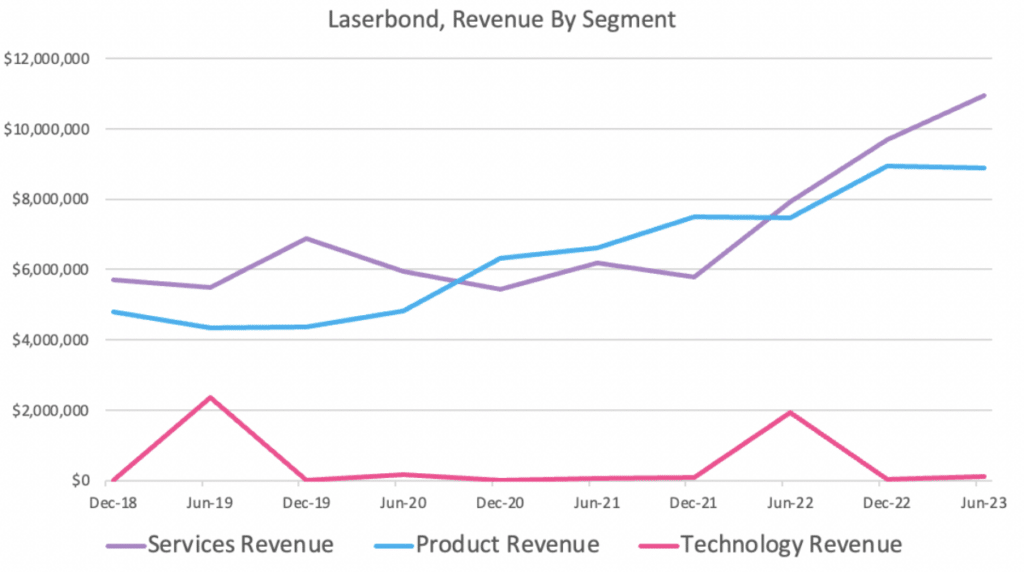

Prior to these results, Laserbond said “An increase in [product] revenue is expected through 2H23, with OEM’s returning to normal levels of demand after a period of inventory reduction”. On top of that, it also said, “the second half is expected to recognise revenue of approx. $3 million, primarily related to equipment sales to North America, and Curtin University in WA.”

Neither of these predictions came true, with product revenue down slightly, and technology revenue about $2.88 million short of the $3 million expected.

The company said ““After delays with revenue recognition of two equipment sales in FY23, FY24 has an estimated $3.2 million in equipment sales, to Curtin University, Swinburne University and the North American and Indian licensees.”

As you can see above, it was the services business that saved the day, with record half year revenue in the second half. The segment net profit after tax was up 128%, from $1.4m last year to just over $3.3 million. It now produces the majority of company profit, as you can see below.

Looking forward, the company says, that “another agreement with an Indian firm for a laser cladding cell was signed in June this year, while a potential sale to a large offshore original equipment manufacturer could also possibly generate revenue in FY24.” I’ll take that with a grain of salt given the delays to prior forecasted technology sales.

Regarding the products division, the company said, “EBITDA decreased by 9.5% on prior corresponding period. due to the cost pressures and their impact on agreed pricing. OEM product pricing has been increased to support a return to traditional gross margins.” Previously the company put through modest price increases in its services division, so I believe customers will accept the price rise.

That said, Laserbond previously noted it had “negotiated fixed electricity pricing across our four sites for a 2-year period until December 31, 2023.” One risk is that margins might take another hit when that agreement rolls off, in H2 FY 2024.

Overall, it was a good year for free cash flow, with operating cash flow of $7.7 million, up on $4.3 million last year, and free cash flow of $4.5m after deducting investment cashflows and lease repayments from operating cashflow. This mean Laserbond was able to significantly improve its balance sheet, as you can see below.

Notably, the company says “LaserBond carries no debt outside of equipment finance and facility leases,” and Equipment finance debt decreased 16% from $4.75 million to $3.99 million during the year.

While free cash flow of some 95% of net profit is unlikely to recur, it puts the company in a position of relative strength. Indeed, a strong year in FY 2024 could see the company well positioned to fund geographic expansion. That’s a risk, but also an opportunity.

The CEO said that there were opportunities to expand both in WA and in the USA, where products customers are showing interest in the services offering.

The problem with Laserbond is that growth (except for in the technology division) is very capital intensive. However, if the technology division can book some wins in FY 2024, that should put Laserbond in a stronger position to drive growth.

Overall, I would expect a stronger H1 FY 2024, since the CEO says that “LaserBond’s demand has shown no sign of abating.” I am happy to be a shareholder and may well end up accumulating more shares on any share price weakness.

Disclosure: The author of this article Claude Walker owns shares in LBL. He will not trade LBL shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.