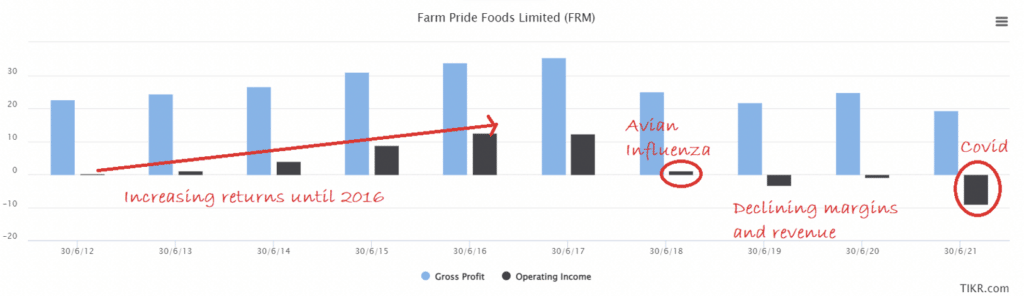

Farm Pride (ASX:FRM) was founded in 1937 and produces a range of eggs and egg products – particularly for the major supermarket chains. Back in 2016, it had a market cap north of $120m; revenue had cracked $100m; market share was ~11% and growing; gross profit had increased by 50% from 2012-16; and new product lines such as ‘frozen egg whites protein shakes’ were driving growth expectations into the future.

But then something happened. In six short years, they lost ~93% of their market cap, and now CEO Daryl Bird (the puns write themselves) is furiously selling off their assets to repay a mountain of debt. So what happened? ESG.

Changing consumer preferences

Chickens are extremely efficient at converting grain (chicken feed) into protein (eggs or chicken meat). The poultry industry took the industrialisation of protein manufacturing to the next level with intensive caged chicken production. However, consumer habits began to change as more people became willing to pay a premium for cage-free eggs.

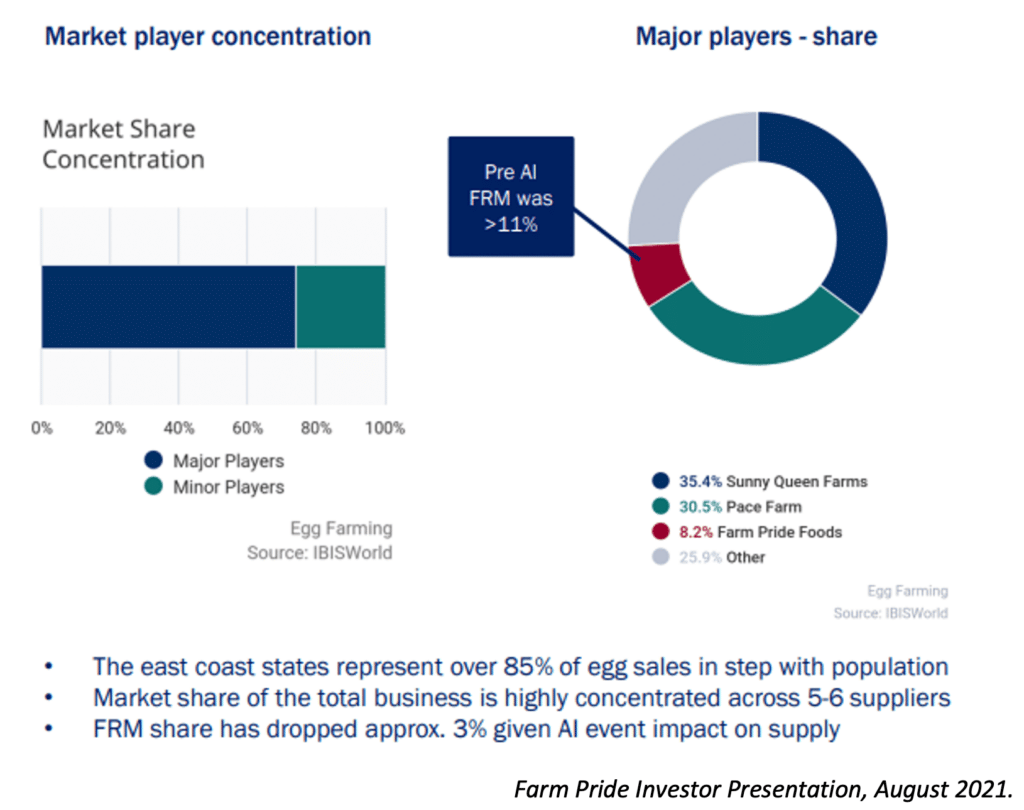

Josh, a 9-year-old boy, saw what Farm Pride couldn’t. He saw a huge opportunity to land and expand his Rainbow Eggs empire based on premium ethical free-range eggs. Josh now has contracts with the major supermarkets across Victoria, and he is just one of many ethical egg producers eating market share from Farm Pride and others. In fact, Farm Pride’s market share has dropped from 11% in 2017 to 8% in 2022.

Compounding this, the returns on caged eggs are much lower. Margins have continued to decline, exacerbated by avian influenza (2018) and more recently cost-price-inflation (current).

Farm Pride is now selling itself to the market as a turnaround story, but the market doesn’t believe it. They are currently trading at <$10m market cap with a hefty ~50% discount to net tangible assets as of 1H22 reporting. On one view of it, Farm Pride may be an inverse-ESG situation.

What Is Inverse ESG Investing?

Environment Social and Governance (ESG) investing – often used interchangeably with responsible investing, sustainable investing, or ethical investing – is a broad investment approach whereby investors consider factors of people, society, the environment, and financial performance when making investment decisions. The lack of ESG appeal in Farm Pride is arguably contributing to the current discount.

ESG investing has its fair share of detractors. Michael Mauboussin, author of Expectations Investing, recently discussed on The Investor’s Podcast that ESG investors have a smaller universe to consider investments, and mathematically should expect a smaller returns profile. He argues it’s not logical to invest using non-financial goals and to expect better financial outcomes. In fact, an inverse-ESG investment thesis could theoretically generate alpha. A lot of ESG critics on FinTwit point to Whitehaven Coal (ASX:WHC) as an example – clearly the antithesis of ESG investing which has performed exceptionally well since the Russian war on Ukraine.

Meanwhile, others believe ESG investments are ‘greenwashing’ – that is, overrepresenting the extent to which their practices are environmentally friendly, sustainable, or ethical. The Australian Securities and Investment Commission (ASIC) was so concerned about greenwashing, that it launched a review in 2021 and sought to remind Boards of their disclosure obligations, as well as the prohibitions of misleading and deceptive conduct.

Is Farm Pride (ASX: FRM) Deep Value Or A Value Trap?

The hypothetical investment thesis for Farm Pride above is that it is an overly complex “inverse-ESG turnaround” story. There’s a hypothetical world where Farm Pride creates deep value by improving margins with lower feed costs, develops innovative products with greater value-add, and can close the discount to NTA. But considering management still lags behind a now-19-year-old man, this could well be a deep value trap.

Farm Pride is a fascinating case study of blissful ignorance, market exuberance, and rational despair. Like the morals of an Aesop fable, “Not all ESG investments will go to the moon and not all inverse-ESG investments will go to zero, but ignore ESG at your peril”.

Disclaimer: As always, do your own research. I am not a financial planner. This investment may not suit your risk profile. I do not own any shares in $FMR or any other named entity. Questions and feedback always welcome. If you enjoyed this, please follow me on Twitter @DownunderValue

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. This article is not intended to form the basis of an investment decision. It is an investment diary intended to be valuable only for the cognitive process it demonstrates. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.