Radiology imaging software provider Mach7 Technologies (ASX: M7T) today reported its quarterly cashflow for the quarter to June 30, falling well short of the expectations it set for shareholders just 3 months prior.

On 28 April, 2023, Mach7 said:

“While there was a net operating cash outflow of A$1.3 million in the third quarter, with scheduled cash collections and a strong sales order outlook, Mach7 expects to remain operating cash flow positive for FY23 as it has in the preceding three financial years.”

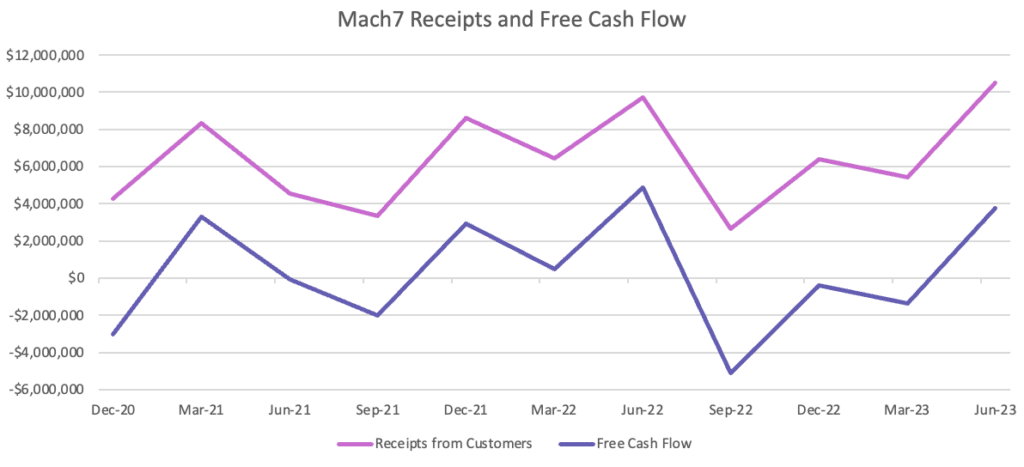

In the end, Mach7 has reported net operating cash outflow of about $2.8 million for FY 2023. If we also consider investing cash flows and lease repayment, then free cash burn was just over $3 million for the full year, despite generating free cash flow of around $3.8m in the final quarter, as you can see below.

Mach7 Misses Guidance

While the miss on operating cashflow is disappointing, I personally find it far more troubling that the company did not bother to update the market that it would fall short. It must have known for the best part of a month that it would not reach guidance.

For this reason alone, I would say that management does not have my confidence. To let the market know you would fall short on such a key metric is just a basic litmus test of shareholder communications, and in my view Mach7 has failed. On there quarterly conference call I will ask why they did not inform the market sooner that they would fall short of their expectation of positive operating cashflow, and include any response below.

I asked: “At the Q3 Results, Mach7 said “Mach7 expects to remain operating cash flow positive for FY23,” but Mach7 would have known this expectation would not be met for almost a month now. Why not mention this miss in any of the earlier announcements in July?”

—-

Update: 9.57am, Monday July 31, 2023

Rebecca Thompson, Investor Relations said: “We do have a cashflow reporting date which is the forum to report on cashflow…”

The CEO of Mach7 Technologies Mike Lampron said “Just with regards with knowing whether to hit it or not… had we received everything we expected to receive then we would have hit that number.”

However, this response seemed to ignore the question, which was why Mach7 didn’t inform the market after it knew it missed the cashflow guidance. The CEO’s response further undermines my confidence in management communications.

—-

Ironically, the Mach7 share price has virtually doubled from its lows, on the basis of new contract wins, even though Mach7 has missed cashflow guidance. On the other hand, fellow medical software company Alcidion had the decency to let shareholders know it would fall short of guidance at roughly the same time Mach7 was giving its (now missed) guidance. But in comparison to Mach7, Alcidion is at least operating cash flow positive for the full year.

When it comes to valuation, it is hard to compare Alcidion and Mach7 on anything other than revenue, while noting both companies can have somewhat lumpy revenue, quarter to quarter. Both companies have adequate cash, Mach7 with about $23.4m, and Alcidion with about $14.6 million.

At the current price of $0.125, Alcidion has a market capitalisation of about $159 million, or about 4x FY 2023 revenue of $40m. At the current price of $0.955, Mach7 has a market capitalisation of about $230 million. It didn’t announce its FY 2023 revenue, but it did announce sales orders of $40.3 million, putting it on about 5.7 times sales orders.

To me, it is completely baffling why Mach7 would trade at a premium to Alcidion, given it has missed its guidance and is still burning cash, whereas Alcidion is cashflow positive (if you exclude acquisition payments). However, I may be biased as I own shares in Alcidion, but have sold my Mach7 shares (well before these results).

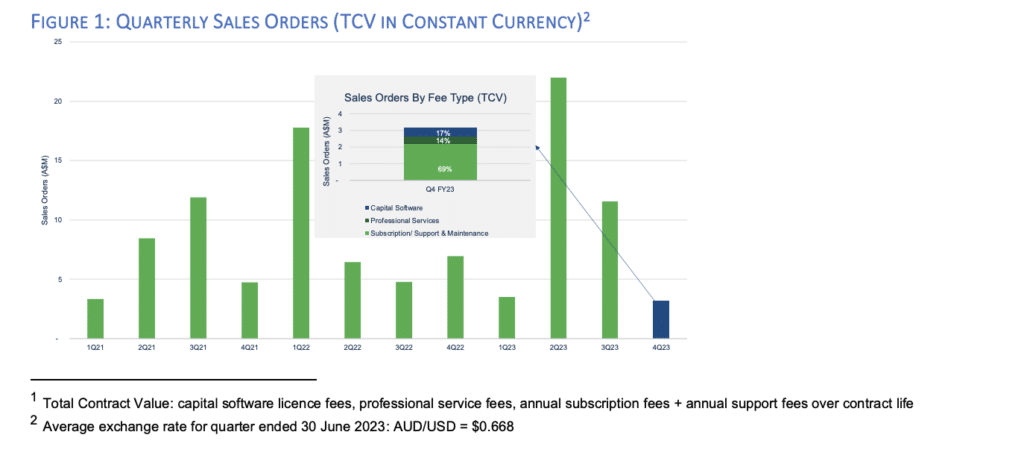

Mach7’s annualised recurring revenue actually declined during Q4 FY 2023 from $17.2m to $17m, and quarterly sales orders were as low as they have been in quite some time, as you can see below.

However, Mach7 signed VHA’s National Teleradiology Program early in the new quarter (Q1 FY 2023), and that is worth at least $11.7m up to almost $60m, with those sales orders to be recognised in future quarters.

Overall, Mach7 sits on the edge of being investible. Unlike Alcidion and Volpara the management team did not buy shares on market during the recent sell-down. In fact, when CEO Mike Lampron exercised 17c options back in September 2022, he sold shares at $0.57 to cover the mere $40k expense. W

I do not find shares attractive at the current indicative opening price of $0.96, and would probably take profits if I held. However, Mach7 remains well funded and operates in a favourable market where reasonably high margins should be available at maturity, so I could understand why some may choose to simply hold for the long term.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in Mach7 (ASX: M7T), and will not trade them for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.