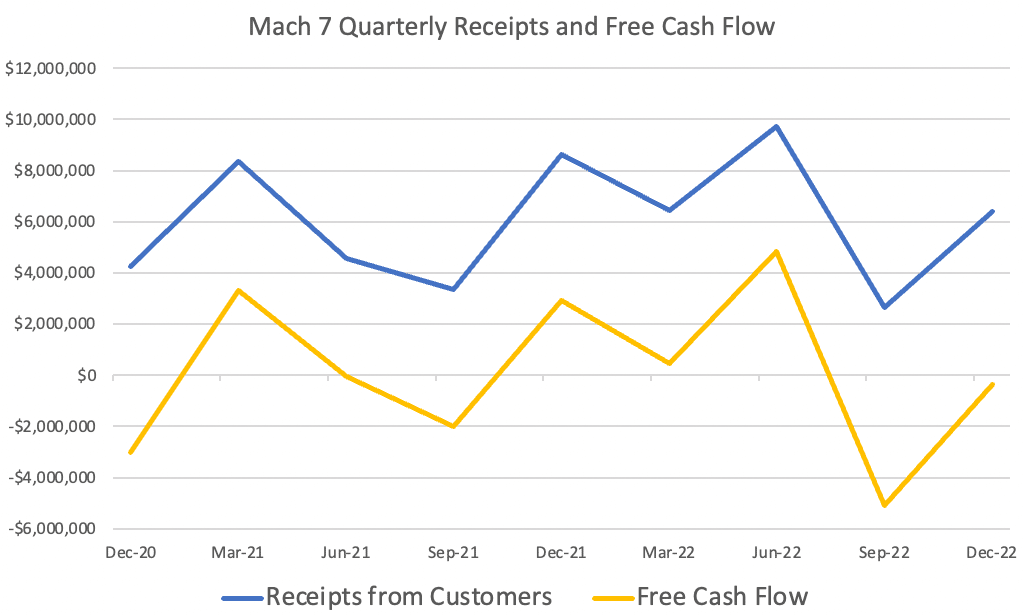

This morning radiology imaging software provider Mach7 Technologies (ASX: M7T) reported its cashflow for the second quarter of FY 2023. Receipts from cash flow were $6.39 million, and free cash flow was and outflow of $301,000. The chart below shows how Mach7’s receipts from customers and free cash flow can be quite volatile from quarter to quarter.

The good news for Mach7 shareholders this quarter was that the company reported sales of $22.4 million (a record result) and it “expects to remain operating cash flow positive for FY23 as it has in the preceding three financial years.” This suggests the company can fund itself from license sales, thus reducing the chance of a capital raising, despite loss-making status.

That said, the era of losses may soon come to a close. In H1 FY 2023 Mach7 expects revenue of $18.1 million and positive earnings before interest, tax, depreciation and amortisation (EBITDA). The $18.1 million revenue falls short of cumulative receipts from customers of just $9 million.

Questioned about this on the conference call, the new Mach7 CFO Dyan O’Herne explained that over 40% of the quarter’s revenue was recognised in December, and once a deal is signed they still need to invoice the customer and collect cash. Therefore, we could reasonably expect stronger cashflow inQ3 and Q4, depending on the payment terms of the recently signed contracts.

Sudden Departure Of Former CFO Steven Parkes

One slight concern I have about my investment in Mach7 was that the company announced on the 29th of December that the prior CFO Steven Parkes would leave the company on January 1. It said he left the company “to pursue other opportunities”. He had only became CFO in September 2021, so this announcement was a surprise, and therefore worth noting.

I asked about Parkes’ departure on the quarterly webinar, and didn’t get much detail, in response. The CEO did note that it was “a very mutual agreement” and the business is in good hands with the new CFO Dyan O’Herne, who has been with the company for several years.

Sign Up To Our Free Newsletter

Disclosure: The author owns shares in Mach7, and will not trade them for at least 2 days following this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.