Mayfield Group (ASX: MYG) is one of those curious little companies that seem to have a finger in every electrical pie – power infrastructure, telco networks, testing equipment, and even data centers. Its recent results and contract wins point to a business with momentum, but scratch the surface and you’ll find a few complexities worth keeping an eye on.

For context, in our past coverage of Mayfield Group, we looked at the company’s exposure to demand tailwinds arising from data centre infrastructure and green energy growth.

Mayfield Group Ownership: Long-Term Holders, But Potential for a Selldown

Ownership is heavily concentrated. Private equity firm Nightingale Partners owns 44.6% of the business. Normally, that sort of holding would raise some red flags – PE firms can be trigger-happy when it comes to sell-downs. But Nightingale has played a long game here, backing a management buyout in 2012 and making only a token disposal since listing.

Former CEO Alan Steele still holds 13.7% of the company, although he’s trimmed his stake over the past couple of years. The vendors of ATI Australia (acquired in 2021) hold a further 5.4% combined, but have no board representation.

While there’s no immediate sign of a selldown, it’s something investors should keep in mind.

That being said, I do like to see a board that’s well aligned with shareholders. So for me, that positive outweighs any risk of a potential selldown from large holders.

Mayfield Group’s Business Units and Client Base Explained

MYG is essentially a holding company with four operating businesses:

- Mayfield Industries – custom switchboards, kiosks and electrical infrastructure (comparable to Codan)

- Mayfield Services – services business supporting energy, industrial, and infrastructure projects (think UGL or Downer)

- ATI Australia – telco networks and critical power solutions (operating in similar terrain to Ericsson or Nokia)

- Power Parameters – power quality, calibration, and testing equipment (shares territory with Schneider Electric and ABB).

They’re not household names, but they do have some serious clients – the big three iron ore miners, Santos, APA Group, various state and federal government departments, police, and data centre operators.

While none of the businesses on their own has a particularly deep moat, their combination offers a somewhat differentiated, integrated local solution. That’s worth something – even if their competitors are global Goliaths.

MYG Financial Results: Revenue Up, But Costs Bite

FY24 EBIT rose 23%, but NPAT fell due to the commencement of tax expense recognition. The company still has $4.5m in deferred tax assets, which it is drawing down – no cash tax is being paid yet. But it does affect reported profit.

H1 FY2025 saw revenue rise 34%, but consumables costs ballooned 52%, leading to flat EBIT and a fall in NPAT. EBITDA, EBIT, and EBT all declined. Most other costs grew more slowly than revenue – suggesting some potential operating leverage, if (and it’s a big if) consumables return to trend.

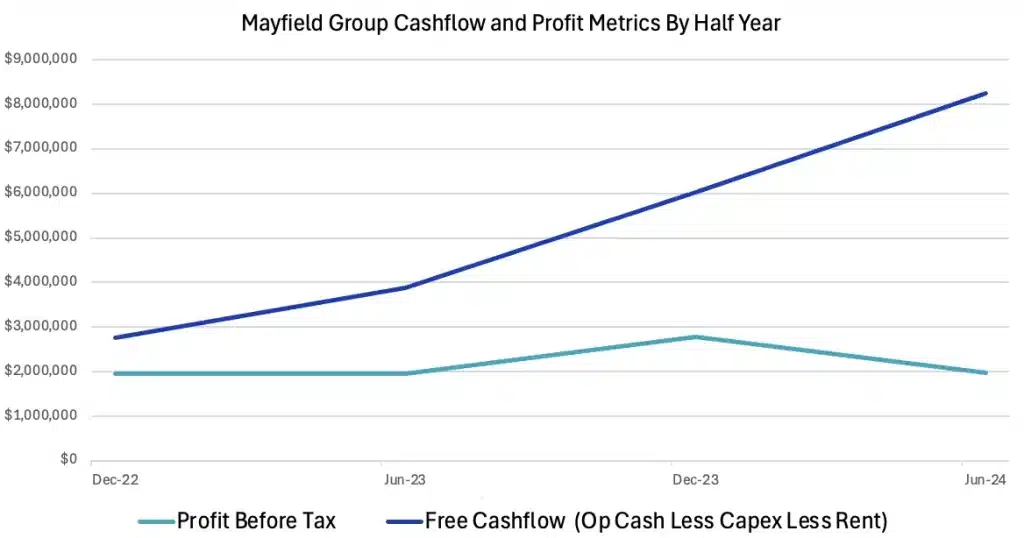

The standout negative was free cash burn of $3.1m for the half. A large jump in trade receivables ($5m) distorted the picture. My guess is there was a chunky invoice that hadn’t been paid by 31 December. If so, FCF could bounce back in H2. It’s definitely something to watch, but historically, Mayfield has produced solid FCF in excess of profit before tax – as shown in the chart below (taken from the MYG article linked earlier).

The good news? Balance sheet is clean – net cash, minimal debt. They even paid a special dividend recently.

Mayfield Group Outlook: Strong Pipeline of Contract Wins

Mayfield announced multiple new contracts in early 2025. As well as the $20m data centre contract (18 power distribution centres) announced today, it also announced a $20m CWO REZ project, plus $15m in new work from NextDC and Lotus Creek Wind Farm in January.

Total contracted work now sits at $108m, spanning FY25 to FY27. Management also issued guidance in February that FY25 revenue would exceed $100m with increased EBIT. You can view the full financial results and announcements via Mayfield Group’s ASX page, or check Market Index for a summarised financial snapshot.

Mayfield Group Stock Valuation

MYG Earnings have historically been quite lumpy, making it difficult to draw strong conclusions about future earnings, but we can at least try some back-of-the-envelope calculations.

Assuming H2 looks like H1, and using an 8% EBITDA margin (in line with FY23 and FY24), NPAT for FY25 comes in around $4.3m. That puts the stock on a PE of ~22x at the current market cap of $98.2m – not cheap.

But if you assume margins improve to 9% (potentially due to relatively lower consumables costs) and revenue rises to $110m (a not unreasonable scenario given contract wins), that brings PE down to ~18x, and PBT multiple to ~12.6x. More palatable.

Why I Like The Mayfield Group Share Price

Mayfield has some clear positives: strong client base, net cash, contract momentum, and exposure to structural tailwinds like electrification and data centre growth.

On the other hand, the big jump in consumables costs and weaker-than-usual free cashflow are real negatives. Nonetheless, if those measures normalise in H2 – and the company continues to convert its pipeline into revenue – this could be a rewarding niche infrastructure play.

For now, I’m planning to take a small position at least 2 days after this article goes live. If I see improving margins, a healthier cashflow profile, and more contract wins in future updates, I’d consider adding further. On the other hand, weak results could disrupt my cautiously optimistic perspective.

See my IPD Group (ASX: IPG) H1 FY25 results analysis for a detailed look at a comparable electrical infrastructure company.

Disclosure: The author of this article does not own shares in MYG and will not trade shares for at least 2 days following the publication of this article. The editor of this article, Claude Walker, does own shares in MYG, and will not trade shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Ethical Investment Advisers Pty Ltd (ABN 26108175819) (AFSL 343937).

Join The Waitlist To Be Emailed Our Free Special Report (Check Your Inbox)