Real estate agent Mcgrath Ltd (ASX:MEA) published its half year results earlier this week. The McGrath share price response was muted, largely because it had already moved up by almost 20%, earlier in February.

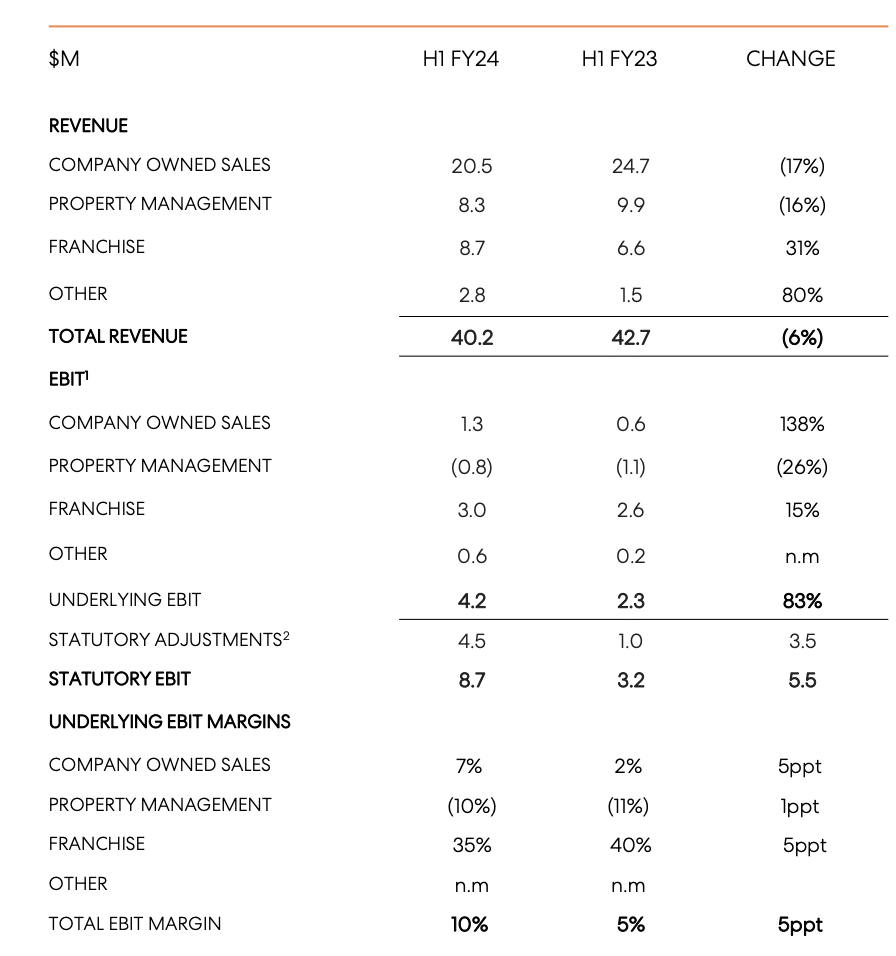

Revenue dipped 6% to $40.2 million, but the underlying business grew during the period. Company owned offices were converted to franchises with the effect of reducing reported revenue while underlying EBIT improved 83% to $4.2 million. Refreshingly, statutory profitability was ahead of the underlying figures with the difference attributable to one-off valuation gains – more on that later.

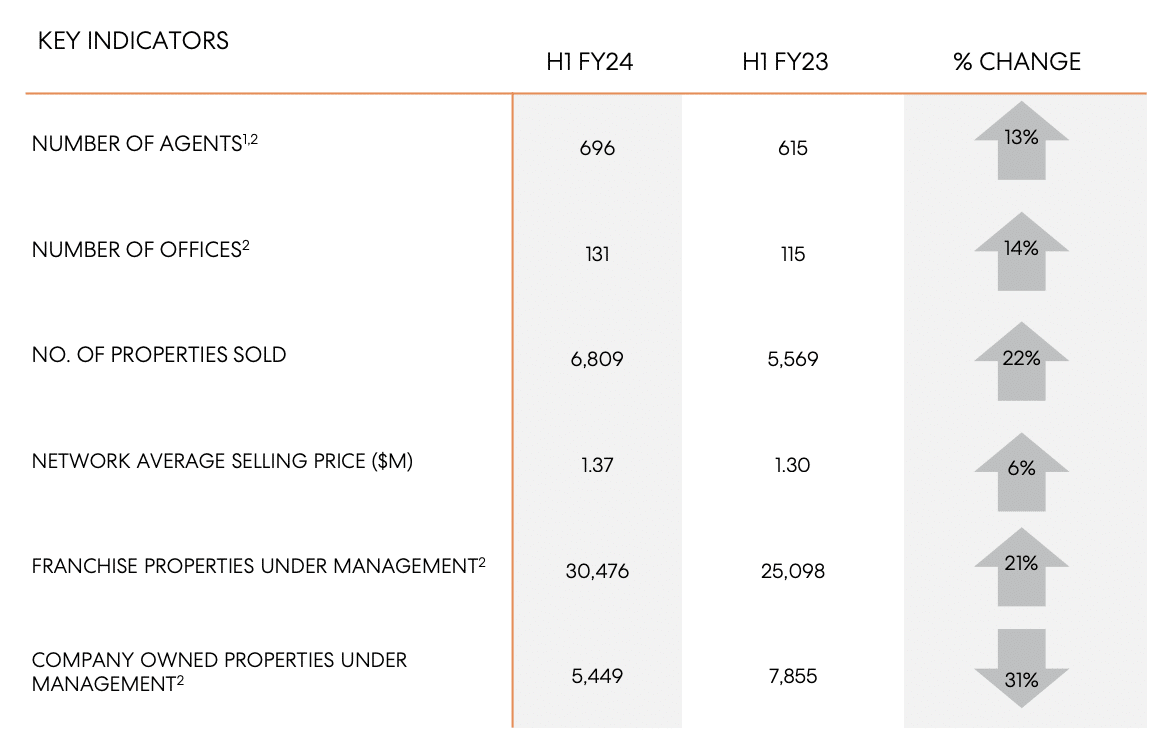

As can be seen above, key performance metrics show that the overall Mcgrath network grew significantly with only company owned properties under management going backwards. This was due to the sale of lettings books to franchisees and on a group basis properties under management increased 9% to 35,925.

The conversion of company owned offices to franchises along with the sale of the associated lettings boosted statutory profit before tax by $2.6 million during the period. Following a further one-off fair value adjustment on investments worth $1.9 million, statutory EBIT was up 283% to $8.7 million versus HY23.

The windfall from office sales led the board to declare a special dividend of 1.5 cents in addition to an ordinary dividend of 1.5 cents, itself an increase of 50% from last year’s ordinary dividend of 1 cent. Together, these dividends represent a fully franked yield almost 5.5%, on the current share price of 54.5cents, for just the 6 month period.

Not only does the sale of company offices generate substantial one-off cash receipts, but it also (arguably) improves the economics of the group by increasing underlying EBIT margins. You can see what I mean, below.

For example, there was a reduction in the number of company owned properties under management due to sales to franchisees, but this wasn’t such a bad thing, because losses from company owned properties under management reduced during the period by 26% to $0.8 million (see above).

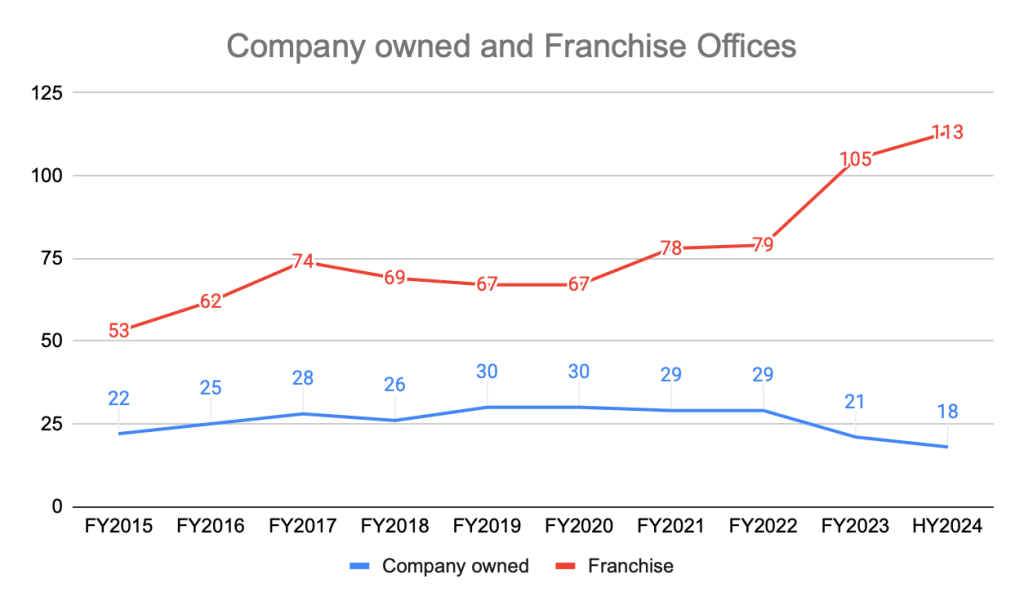

A more significant impact of transitioning to a franchise model relates to the company owned sales segment which has historically dominated group sales. Converting to franchise offices has the effect of stripping out fixed costs and reducing operating leverage, shrinking the impact of the property cycle on group profitability.

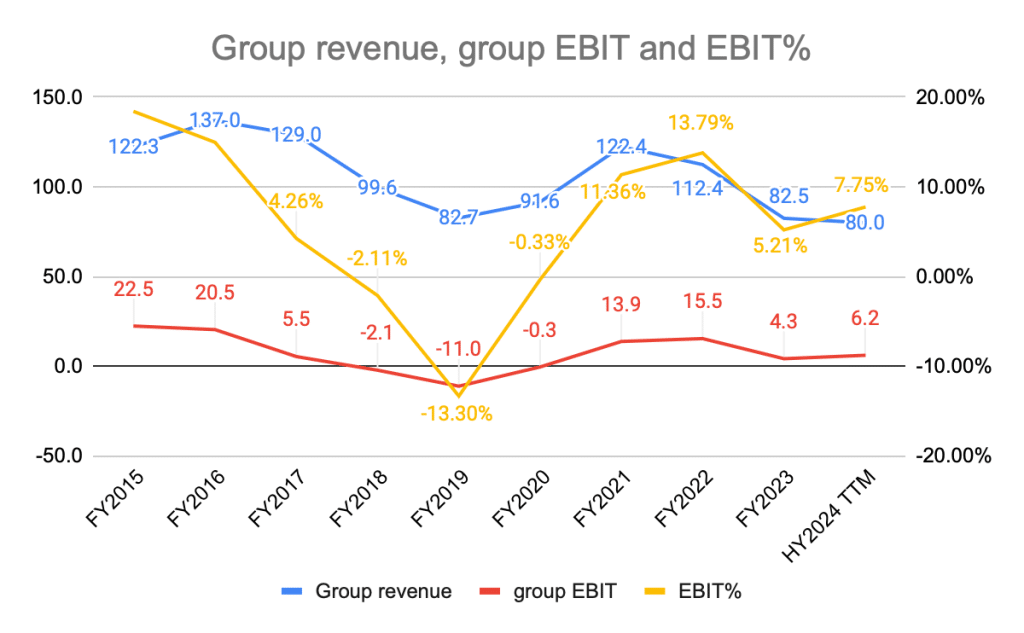

Mcgrath generated $80 million in revenue over the past twelve months delivering $6.2 million in EBIT. The last time revenue was this low was back in 2019 when the group lost $11 million at the EBIT line.

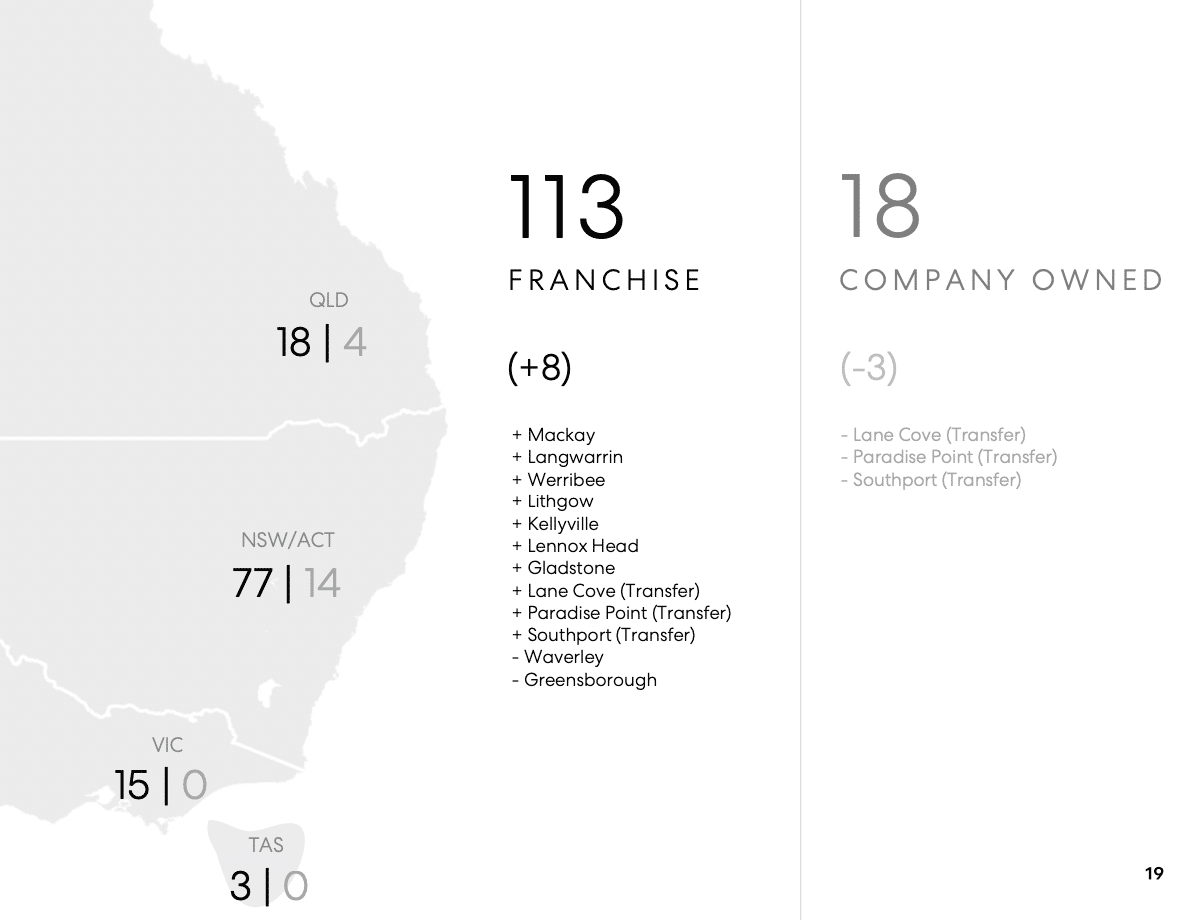

A key difference between now and then is that today company owned offices represent just 13.8% of the total network, down from 30.9%. In addition, the total network has grown 35% to 131 offices.

So whilst franchises are unlikely to generate as high group profits as company owned offices at the top of the cycle, they are also less likely to cause the group to swing into losses at the bottom.

Management is targeting an additional 115 new predominantly franchise offices over the next three to four years, which will almost double the size of the business.

This makes sense as Mcgrath is underrepresented outside of New South Wales and the ACT, as can be seen below.

Mcgrath’s accounts show a net asset balance of $53.8 million at the end of December 2023, but management reckons this is too low because it undervalues the company owned property management business by over $30 million.

This view is based on applying a valuation multiple of 3.5 times on annualised property management fees to give a total value of $39.7 million for this part of the group, versus a balance sheet asset value of just $7.3 million.

I agree with this argument in a general sense, given the recognition of a $3.9 million valuation uplift in FY23 and a further $2.4 million uplift during HY24 from the sale of company owned assets to franchisees.

Another interesting asset on the balance sheet is an $8.1 million stake in Honey Insurance which Deloitte recently named as the sixth fastest growing tech company in Australia. Honey offers consumers cheaper house insurance in return for installing sensors to monitor risks.

Then there is $26.3 million in net cash which provides plenty of ammunition for further special dividends and buybacks.

Management’s net asset estimate of 54.2 cents is almost identical to the share price at time of writing which gives investors like myself comfort from a valuation perspective.

Another useful data point is the trailing twelve month enterprise value to EBIT multiple which stands at roughly 10. This strikes me as good value given we appear to be just emerging from the trough of the property cycle and there is a decent growth runway ahead in the form of continued franchise rollout. Even if the impact of the property cycle on the MEA stock price is less than it used to be, a hot property market is still good for business.

Indeed, founder and CEO John Mcgrath had the following to say about the outlook for the group:

“We have seen good listing volumes to the start of the calendar year and we are in great shape to continue our momentum”

And,

“Our growth moving forward will be driven by increased agent productivity and more offices joining the group which will deliver increasing market share.”

If you would like to be among the first to receive articles like these, and even suggest small-cap mailbag articles yourself, then you can click here to join the waitlist to become a Supporter.

Disclosure: the author of this article Matt Brazier owns shares in MEA, but the editor Claude Walker does not. Neither will trade MEA shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.