The thesis for holding Medical Developments International (ASX: MVP) shares is that the stock provides shareholders with an asymmetric bet with significant optionality. I (@DownunderValue) believe that ASX:MVP stock presents an uncommon situation somewhere between ‘turnaround’ and ‘fast grower’, using Peter Lynch’s terminology. While the MVP share price has been down in the doldrums for some time due to significant operational (read: distribution) challenges, new management includes an All Star lineup from the Australia’s most successful global health company, CSL (ASX: CSL). While this is a risky bet, this article is going to outline why I think this is an asymmetric one at the current Medical Developments International share price of under $5.

MVP is a Melbourne-based medical devices and biopharma company. First launched in 1971 as a pure medical devices company, it listed in 2012 on the ASX and has since expanded into new areas under the auspices of the previous chairman David Williams (a well known banker/investor).

MVP’s operations can be separated into three components. Medical devices that notably includes Breathe-a-Tech spacer for asthmatics and a veterinary line of breathing and resuscitation devices; Penthrox a.k.a. “The Green Whistle” which is a non-opioid emergency pain relief; and Continuous Manufacturing that includes a CSIRO-partnership to efficiently produce generic drugs.

The MVP share price has fallen from over $10 to under $5, so lets look at why the narrative might be changing, around now.

Medical Developments International New Management Team Buying In

MVP has historically struggled with its operationalisation – this has resulted in slow growth in the global sales of its asthma medical devices, as well as very poor distribution and sales of its flagship Penthrox drug overseas. That said, Penthrox has been a success in Australia, where it is widely used. Australian sales of Penthrox have generated the majority of MVP’s profits over the years.

The stage for improved international performance may have been set in motion in October 2020 with the hiring of Brent MacGregor and Gordon Naylor. Brent and Gordon worked together at the Seqiris division of CSL, where they took it from a $700m revenue / loss making venture into a $1.2bn revenue / $150m EBIT business in short time. Furthermore, Mary Sontrop was brought on board in March 2021, bringing 28 years of operational experience at CSL including head of global plasma manufacturing. Richard Betts from Pact and Orica has also been brought in as a director with finance and governance experience in international manufacturing.

“Hiring Brent MacGregor and Gordon Naylor is like getting the band back together”

A change in management is not a necessary nor sufficient condition for a turnaround. However, I believe that the skills and expertise they bring are part of the missing link for MVP. Moreover, they have Skin. In. The. Game. The outgoing chairman David, who remains a non-executive director, sold $1m of shares to the incoming chairman Gordon as part of the handover process at $6.50 per share. This pattern of insider buying has continued with Gordon topping up two more times to the tune of more than $500k; Christine Emmanuel (non-executive director) participated in the capital raising in December 2020 for $100k at $6.50; Mary acquired around $100k in March; Robert Johnson and Leon Hoare (non-executive directors) have each acquired around $50k as recently as June. While the share price has ranged from $4-$11 since January 2020, there has been plenty of insider buying at $6.50 last year during the capital raise and sub $5.30 this year during the price pullback.

Medical Developments International Asthma Devices Business

I first came across MVP unknowingly when my daughtered was diagnosed with Asthma. As a small child, she was unable to use a ventilator directly. After popping into Chemist Warehouse, we bought a Breathe-a-Tech spacer for about $20. We have since bought several more (they get old and need replacing, they get lost, the school wants one as a backup, etc). At this price, it’s a no brainer: we’re not looking to replace something that works with something that may be slightly cheaper. We’re a sticky customer, and MVP’s product remains world class.

Breath-a-Tech was purchased in 2016 for ~$2m cash and $1.5m in shares from Avita Medical (ASX: AVH). While MVP do have other products such as masks and Breath-Alert Peak Flow Meters, the main driver of sales and growth is the Space Chambers. International sales have been growing quite strongly across Europe, Canada and the US. Notably, in August 2020 MVP signed an agreement with Walmart ($WMT) to produce a ‘white label’ spacer under their Equate brand to be sold through their 4,600 stores as of 2H21– this brings MVP’s distribution channel to a total 20,000 pharmacies in the US including Walgreens ($WBA), CVS ($CVS) and other major pharmacy chains.

While the medical devices have contributed around a third of MVP’s revenue historically, their performance has been relatively flat. Despite a Covid-19 injection in sales for FY20, no clear growth trend is discernable. Indeed, 1H21 results of $2.6m in revenue was down 40% on 1H20. MVP reported in their 1H21 results that they expect a boost to sales from Walmart’s initial orders in 2H21.

Additionally, MVP have around $700k of normalised annual sales from veterinary equipment. This is essentially larger versions of the respiratory machines for horses, cows, cats and dogs. While it’s only a small add-on to the medical devices, it also provides optionality with the potential for being sold off to fund other core activities.

It’s not clear that the medical devices business has a sustainable competitive advantage, particularly as there are multiple competing versions of spacers. But I believe if it can continue to generate free cash flow even with moderate sales growth, this can be redeployed into the global expansion of the higher margin Penthrox.

For valuation, I’ll use a x10 segment EBITDA for a ballpark estimate which essentially assumes slow to moderate growth. To normlalise the earnings I prefer to use 2019 as a low water mark rather than the inflated 2020 earnings, equating to around $7.5m. While perhaps not material, there remains some upside potential as international sales roll out, and 2H21 results are likely to provide more insight into the true valuation. In my view this is a conservative valuation of this segment, but Claude has prevailed upon me to keep it conservative given the patchy track record of this business line.

Penthrox, The Green Whistle

Penthrox (methoxyflurane) is colloquially referred to as ‘The Green Whistle’. You’ve probably seen it being used in footy, as players suck on it after a major tackle or trauma. It’s a non-opioid based analgesia (pain-relief) administered through an inhaler. Until 1974 it was widely used around the world. However, it lost appeal due to side effects that included damaging the kidney when taken at high dosage.

Around the world numerous analgesia options are available for trauma pain relief – typically intravenous opioids (codeine, morphine, methadone, etc). However, since 1999 over 450,000 lives in the US have been lost to the “opioid epidemic”, and many institutions fear litigation. Turns out, Australia has been using a non-opioid based alternative for over 40 years – gaining evidence of its efficacy and mitigating the issues of kidney disease side-effects through improved dosage and delivery.

Unlike many pharmaceuticals, the market for Penthrox is limited and concentrated: ambulances, hospitals, doctor’s offices, military, sports franchises, and anywhere acute pain can be found. This provides MVP with an advantage that it doesn’t need to market its product direct to consumers, but rather through a few larger gate keepers. While the pain management market is expected to grow by 3.8% CAGR from 2020-27 according to research, one would expect that non-opioid pain management may significantly beat this.

So, what went wrong for MVP? Penthrox is approved and licensed in 16 countries, mainly in Australia, New Zealand and Europe. MVP outsourced much of it’s European distribution to Mundipharma – ironically associated with Purdue Group / Sackler Family in the US who are behind OxyCotin, a drug that has supposedly fuelled the opioid crisis.

Sales growth in Penthrox has been lethargic under this arrangement – growing from around $9m in 2016 to $14m in 2019, and dropping slightly to $13m in 2020 as Covid reduced the number of traumas. However, MVP bought back from Mundipharma the European distribution rights in August 2020 and the Australian distribution rights in December 2020, poaching their lead European salesperson take an in-house role with MVP.

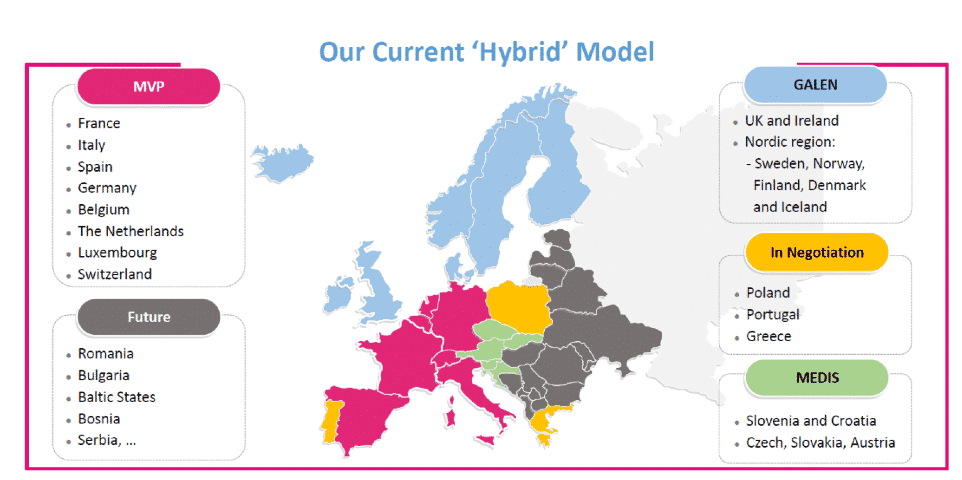

The image below from MVP’s 2020 Annual Report gives you an idea of their European sales model, though it is a little out-dated now, as some distribution arrangements have changed since then.

Much of the international success thus far for Penthrox has been in Ireland / UK (145 hospitals, 670 customers, 23% CAGR) and France (121 hospitals, 368 customers, 15% CAGR). Distribution with Galen has been extended from the UK/Ireland into the Nordic countries (Iceland, Denmark, Finland, Sweden and Norway; in-house distribution for Germany and Spain has begun in 2021; and a new arrangement with Medis has begun in Central Europe (Czech Republic, Slovakia, Slovenia, Hungary and Croatia).

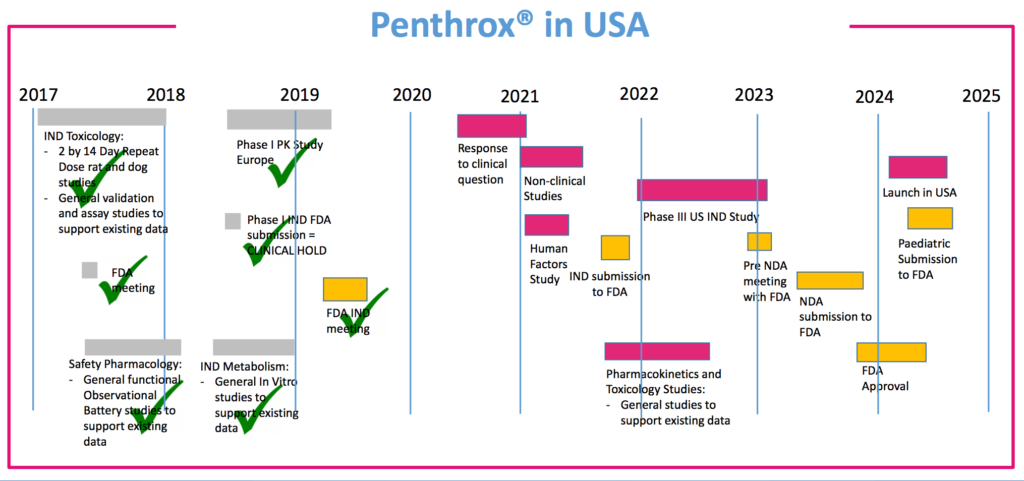

Major markets of China and the US are currently undergoing the approval process. These offer a significant potential market size of around $250m annually according to MVP’s own bullish estimates. If successful, this would account for around $150m of operating profit and $75m EBIT contributions. The US FDA approval process will require further evidence as part of a Phase 2/3 study, which wouldn’t be completed until at least FY24 and represents the most significant risk in the investment thesis. The reasons to be bullish however is that there are a large cohort of countries and medical boards that have now approved Penthrox; improved dosage will likely show up in the trials as resulting in substantially lower kidney disease (as has done in Australia’s 40yrs of real world application); and the political / health interest in overcoming the opioid crisis.

Valuing MVP’s Penthrox Business

To value Penthrox, I’ve used a rule of thumb of 3x peak sales ($250m for US as per MVP’s own reports) for a drug in Phase 3 trial. This has been gleaned from Joseph Edelman of Perceptive Advisors who specialises in biotech investing (a.k.a. Mr 41%, named after his returns). While Penthrox is not currently in Phase 3, it also has value from it’s Australian, European and other global distribution – and essentially the non-clinical studies should be a relatively straight forward process. On that basis, I’d argue Penthrox alone could be valued at $750m, though that is perhaps on the more optimistic side of things. Arguably, given the newfound recognition of the immense damage caused by opioid painkillers, such optimism is warranted.

On top of that, we know that the Penthrox Australia business can be profitable, making segment EBIT of $3m, in 2013. Given the profitability at that (smaller) national scale, it follows that if Penthrox gains similar penetration globally, profits could well exceed $30m. As the time of writing, the share price sits at $4.64 and the market capitalisation is $330m, so it’s clear that the stock is undervalued if it succeeds internationally. [Editor’s Note: At the time of actual publication of this article the share price was $4.99, and a market cap of ~$355 million]

We can also look at previous segment EBITA contributions. In 2019 this was over $5m from Penthrox, but dropped to $4m due to Covid in 2020. Most of this is derived from Australia, and so if the Penthrox business grows 15x as a result of successful international expansion, we’d get $75m of EBITDA. Again, using a x10 EBITDA we get to $750m valuation for this business, in the scenario where Penthrox succeeds internationally.

Medical Developments International And Its Continuous Manufacturing Technology

Continuous Manufacturing is a platform for developing drugs in a more cost-effective manner. It uses technology that produces drugs on a continuous basis, rather than making them batch by batch. It’s main applications would be in simple generic drugs (think: paracetamol, ibuprofen, diclofenac a.ka. Voltaren, lidocaine a.k.a. Xylocaine, etc). The US FDA has been advocating this for over a decade, though only recently has this become approached maturity.

The total addressable market is huge, as it can reduce costs by >25% on all large volume drug production. However, through my research, I could not identify any major manufacturers implementing Continuous Manufacturing. There have been some large ($50m+) investments in manufacturing plants have included the optionality of continuous flow. MVP has entered the space through a partnership with CSIRO as part of the push for advanced manufacturing. They initially were seeking to apply it to multiple drugs, though have since reduced it to Lidocaine and diclofenac (both still very large potential markets).

In their most recent report, the company said: “Lidocaine still stands as the most advanced process being developed under flow conditions, although access to specific equipment to support its scale-up has hindered progress.”

Nobody has really nailed this yet, despite all the support and promise. Therefore, from a valuation perspective I consider it worth $0, though it does provide some potential optionality and upside.

Investment Checklist

- Multiple revenue streams: Tick – including potential cash raises through divesting of non-core assets (veterinarian medical devices), as well as their normal revenue streams of medical devices, pharmaceuticals and possibly third-party manufacturing contracts.

- Free cash flow: Tick – Despite the CAPEX required for manufacturing, I think that even under trying conditions they have managed 5yr top-line revenue growth of 11.3% and the company has historically generated free cash flow from its Australian Penthrox business.

- Balance sheet: Tick – a capital raise at $6.50 in late 2020 has strengthened their balance sheet with an additional $30m, and they should be well positioned to finance their roll out from the medical devices free cash flow and cash until at least 2023.

- Management: Tick – with the new crop of people that are focused on distribution and manufacturing expertise.

- Insider ownership: Half tick – while the new management have been buying up, the previous chairman David Williams has sold down over the past 5 years from 30m to around 9m shares.

- Valuation: Tick – when valuing a potential fast grower I prefer to look at the potential market cap rather than historical financials. The current market cap of $330m ($4.75 per share, June 2021) seems well short of the upward potential, which I could see as a x5 bagger if Penthrox is rolled out in the US and elsewhere.

- Bear arguments: Share dilution of 40% since 2011 could continue if sales growth doesn’t eventuate within the timeframe; distribution challenges may persist; Continuous Manufacturing could be a drag on cash flow; international expansion may fail.

Overall, MVP looks like an asymmetric investment opportunity if you are patient and willing to take a bit of risk. You need to convince yourself that ‘getting the band back together’ will allow MVP to find international success. If it does, then I believe the stock price could be significantly higher in years to come.

Thanks for reading my debut article for A Rich Life. Special thanks to Claude Walker for his feedback on this article. If you enjoyed reading it, please do follow me on twitter @DownunderValue. I would be extremely pleased to receive your questions or feedback on that forum.

The author owns shares in Medical Developments International as does Claude Walker, who helped edit this article. Neither will sell any shares within 2 days of publication of the article though they reserve the right to buy more shares. This post is not financial advice, and you should click here to read our detailed disclaimer.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.