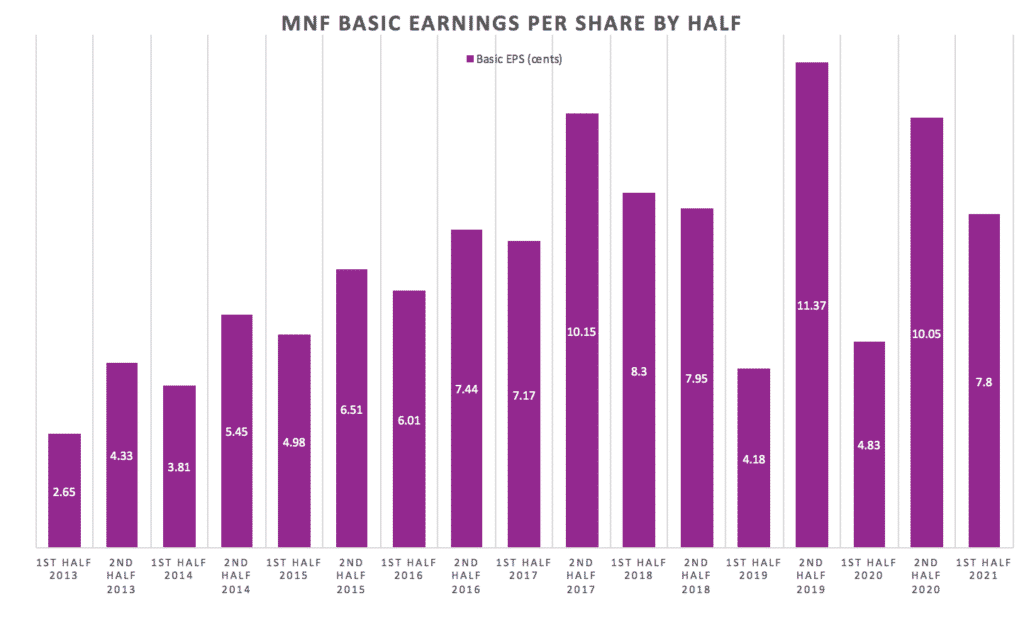

Wholesale online telecommunications provider MNF Group (ASX: MNF) saw its share price pop 14% after it announced a half year profit of $6.6 million up 79%. However, earnings per share growth was less impressive, up 62% due to dilution from the capital raising at $5, in November 2019.

You can see how MNF Group’s earnings per share have fluctuated over time, in the chart below.

MNF Group guidance for $40m to $43m in EBITDA implies a stronger second half (as usual), since it did almost $20m in EBITDA this half.

If EBITDA converts to NPAT at the same the same rate as it did in the first half, then the skew to the second half may be less than usual. I think it is reasonable to expect no more than 19c in earnings per share for the full year. This sits below analyst estimates per CapIQ, which currently range from 20c to 23c.

Happily, even taking into account lease payments (which are now in financing cash flows) the company produced a strong $9.2m in free cash flow. On the call the company said they are aiming for 100% EBITDA to operating cash conversion, so I would not expect terrible cashflow next half, though it may well be weaker than this half.

The dividend was increased to 3.3c per share, putting the stock on a trailing yield of about 1.4%. I would expect an improvement in the second half to boost that yield, but I doubt the stock is going to pay more than about 2% at current prices.

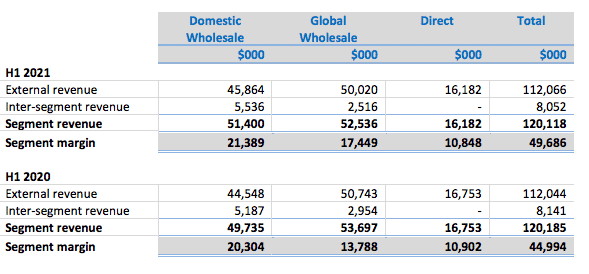

As a reminder, MNF Group has three segments.

MNF Group Direct Segment

The direct segment sells VOIP services under its own brands. That’s mostly flat, as you can see below. Notably, the company has sold Pennytel, its mobile brand, to Macarthur Telecom. It looks to me like Pennytel was a failed initiative.

Companies like Pennytel and Macarthur are customers of the domestic wholesale division, and from time to time they go out of business. This provides an opportunity for MNF to buy the business on the cheap and in the case of Pennytel, MNF Group tried to reinvigorate it years later. I have no issue with the MNF divesting Pennytel and I would not be surprised to see MNF buy another failed customer in the future.

MNF Group Domestic Wholesale Segment

The domestic wholesale segment has formerly been a star performer, because it grows as long as its small retailer clients grow revenue (whether or not they reach critical mass for profitability). This half, the segment was uncharacteristically pretty flat, as you can see, above.

On the call, the company said that after consolidating the recently acquired Inabox with MNF, the company still has “well over 500”. On my numbers, simply combining the number of domestic wholesale customers with the number of customers Inabox had, should have left us with over 600 customers. Therefore, there has been some sort of consolidation over the last year or a reduction in numbers. This is likely due to some of the customers going out of business and fewer new customers taking their place. I would also not be surprised if some of the Inabox numbers pre-acquisition were on the generous side.

In response to this situation, MNF said:

“The [domestic wholesale] segment’s modest performance is attributed to the reduction in business activity due to the pandemic, with small-businesses (the main end-user pool for this segment) deferring investment decisions during the period. The Group expects this segment to return to overall double-digit revenue growth as domestic business certainty is restored post pandemic.”

MNF Group Global Wholesale Segment

Finally, the star performer this half was the global wholesale business. This business allows international UCaaS, CPaaS and CCaaS vendors, software and app developers and global telecom providers to connect to Australian telephone numbers and the like. This could be to send a simple text message as part of 2 factor authentication or to allow you to call an uber driver without giving away your phone number. We don’t know all the customers here but according to the presentation they include Twilio, Zoom, Microsoft and Google.

Obviously, these companies are making increasing use of MNF’s connectivity services and the company was keen to tout a net revenue retention rate of 115% from its top 10 customers, highlighting how its growth is leveraged to these communication platforms.

One thing to keep in mind is that MNF had typically dealt with smaller players in its domestic wholesale business. In contrast, this global business has them dealing with some of the world’s largest companies, who have plenty of market muscle should they choose to use it.

MNF Group Balance Sheet

At the end of December 2020, MNF Group had about $52m cash and $30m in debt, with the ability to borrow another $30m if necessary. I would not be surprised to see another acquisition out of the company at some point, which has almost constantly acquired in the telecommunications space, over the years.

One of the biggest risks is that MNF Group buys too many “melting ice cube” businesses, trying to stack then on top of each on top of the other, but constantly having to stack faster to make up for the fact that the acquired businesses are ex-growth. I don’t think that is happening, but a single year of no acquisitions — with good organic growth — could go a long way to help the MNF share price.

The reason for this is that the company is increasingly highlighting its recurring revenue and indeed its number one highlight in its press release was “recurring revenue rose 15% to $55.7 million”. While there is no doubt that much of MNF Group’s revenue is recurring, and even more is reliable (but not guaranteed), I’m not sure that it is particularly useful to value it on a multiple of revenue.

What is the MNF Group P/E Multiple?

At the current share price of $4.80, MNF trades on a multiple of about 26 times trailing twelve month earnings per share. This is far from absolutely outrageous, but not obviously cheap. Personally, I hold a small parcel of MNF Group shares and I intend to hold them for longer.

In an optimistic scenario, MNF Group would earn 22c in earnings per share in FY 2021, and could trade on a P/E of 30. This would take the share price back to all time highs of over $6. In a pessimistic scenario, we could see as less than 18c in earnings per share and a P/E ratio of 18 or less. That could see the share price drop below $3 again.

To me, this sort of upside/downside analysis means that I am not currently buying shares but still holding as the real upside could come by taking a longer term view. If the domestic wholesale business does grow again, and the global wholesale business keeps growing, then the company could achieve record earnings per shares in the next few years. I’m keen to participate in that (potential) story as a shareholder (albeit only a small holding).

This article is not financial advice, it is general in nature, and our disclaimer is here. The author owns shares in MNF.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.