On the morning of 26 August, IT distribution company Dicker Data (ASX:DDR) released its results for first half of FY2021, since it reports on a calendar year. Supporters can read my report on Dicker Data’s results here.

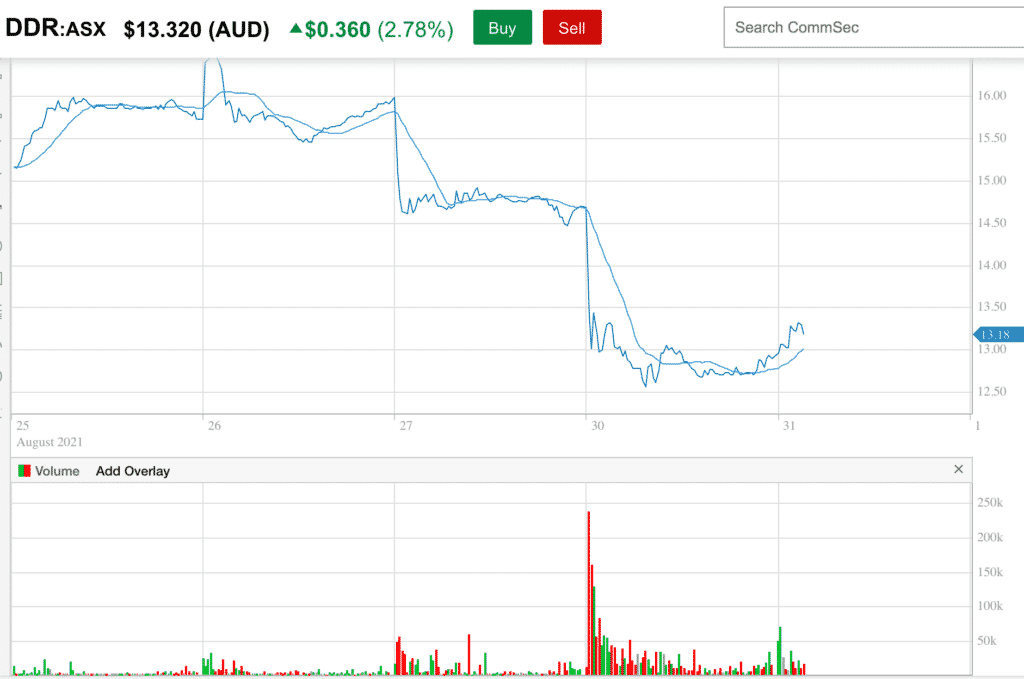

After the results, the share price remained pretty steady, but on the morning of Friday 27 August, it emerged that founder David Dicker had sold around $40m shares at a price of around $15.40 via Barrenjoey Partners who underwrote the sale. This triggered a sell off in the shares, potentially due to institutions anticipating that Barrenjoey would have to offload the stock.

Years ago, I recommended Dicker Data to the Motley Fool Hidden Gems service at around $1.60 per share, and subsequently, it was recommended by Motley Fool Dividend Investor. Subsequently, these two Motley Fool services issued sell recommendations for the stock, causing it to drop to around $12.50 by Monday 30 August. [The sell recommendation was on 27 August, but I’m not sure if it was morning or after market close].

Part of the reason the Motley Fool sell recommendation had such an impact on the stock price is due to the success of my Hidden Gems recommendation of the stock. A subscriber who spent just $5,000 on shares at the time of my recommendation would have over $40,000 at a share price of $14. Typically, we were seeing around $2m worth of volume go into our recommendations back then. If those investors had held on, they’d collectively have around $16m worth of stock. Yesterday about $26m worth of stock traded. Taking into account stock held by subscribers of Dividend Investor (which had a higher entry price), it seems likely to me that most of the stock held by people blind following Motley Fool recommendations would have sold yesterday.

You can see the massive volume dump on open. It is extremely obviously not the optimum way to close a position, but you can see that most of the volume went through in the first minutes of trade yesterday morning. This is consistent with Motley clients all reacting at the next available moment, and potentially setting limit orders to sell over the weekend.

Motley Fool’s rationale for selling can be more or less summed up as a response to David Dicker’s small sale of shares and a generous multiple of earnings. While I agree that Dicker Data trades at a reasonably generous multiple of earnings, I strongly disagree that David Dicker’s sale of shares is indicative of a negative view on the stock.

First of all, David Dicker uses his money to build race cars, so I’m sure he needs the cash to fund his expensive hobby. Life, after all, is for living.

Second of all, David Dicker still owns 33% of the company, and has his name on the door.

Third of all, the Chief Operating Officer of Dicker Data Vladimir Mitnovetski bought shares from the Motley Fool clients, so they are literally trading against an insider, not with an insider.

Fourth, David Dicker sold at $15.40, and Motley Fool clients sold at $13.

Fifth, as you can see from my account of my conversation with Vladimir Mitnovetski, the business itself remains healthy, even if the share price got too high.

Why I Bought Dicker Data (ASX:DDR) Shares This Morning

I already have a core holding of Dicker Data in my portfolio since it is a high quality company run by honest and competent management. While I wouldn’t usually be buying shares at $13, I have a short term trade thesis, as follows:

- The Barrenjoey overhang is weighing on the stock, and that is their problem. Once they manage to offload it, the overhang will clear, and liquidity may increase.

- Dicker Data is big enough for the ASX 200 but not sufficiently liquid. Once it becomes more liquid, it will be added to the ASX 200 and that will trigger index fund forced buying. I’d argue that will push the price up, though I don’t know if or when it will happen.

- In any event, most of the Motley Fool selling would be exhausted by now, so we should see the share price climb back up to at least $14, now that the ill disciplined selling is over.

As a result, I’ve purchased a small trading position in Dicker Data at $13, which I intend to sell at above $14. This should equate to a 7% return in a couple of weeks, but I’m comfortable with the trade because I consider Dicker Data roughly fairly priced anyway, given the longer term risk versus reward on offer. The ideal time for me to take profits would be if and when it gets into the index and triggers passive buying.

In my opinion, now is an unfortunate time for Motley Fool subscribers to simultaneously and emphatically dump Dicker Data shares on the market and so I have impulsively taken the other side of the trade, for now.

I heard a rumour that I was selling Dicker Data shares, so this article also serves to refute that absurdity. I am a happy long term holder of Dicker Data shares, despite the multiple, in keeping with my philosophy of being overweight quality management teams. I would not usually be buying at $13 (my buy price is a bit lower), but also don’t think that the sudden drop in share price from ~$15 to ~$13 was warranted by these results.

Please remember that these are personal reflections about a stock by author. I own shares in Dicker Data, just bought some today, and will not sell for at least two days after publishing this article. I reserve the right to buy more at any time. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Addendum, Friday 3 September: The share price rebounded above $14, on Thursday 2 September and so I sold my trading position (while retaining my core long term holding).

An aside from me: If you watch Ausbiz, and want to be alerted of interviews I do as they happen, you can follow me on Ausbiz. I do appreciate any follows on that platform, so if you do follow me; Thanks!

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.