Recently, a friend of mine sent me a marketing from Motley Fool, who are advertising a special webinar, the “IPO Masterclass”, which is on tomorrow morning at 9am. It looks to me that this is a marketing methodology to sell readers the same Discovery 2021 small cap stock tips service that Motley were selling when they touted their number 1 X-Factor stock, back in January.

This time, though, Motley is recommending their “#1 ASX IPO to buy right now”. They gifted us some teasers, in the screen shot below.

Now, I don’t know what MF have recommended before, but I the other two hints reminded me of Adore Beauty (ASX: ABY), which listed in October 2020.

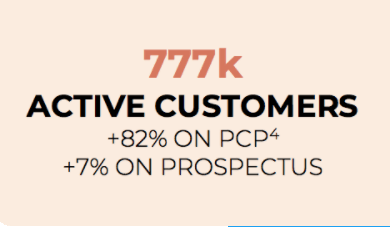

The screenshot above comes from Adore Beauty’s recent half year presentation. I consider 777k active customers consistent with “nearly 800k active customers”.

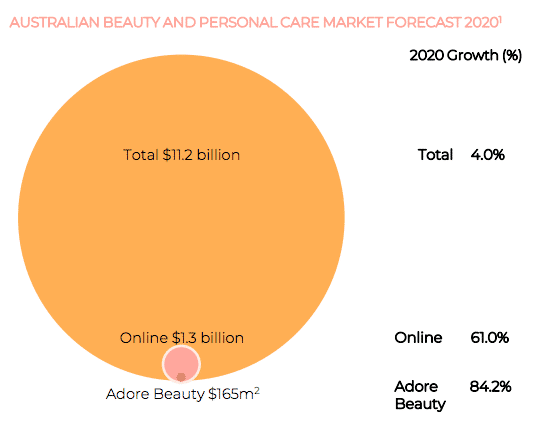

Second, Adore Beauty claims to be targeting a $11.2 billion “Australian Beauty and personal care market”, as you can see below.

Meanwhile, Adore said it had revenue of $165m in the 2020 calendar year.

Well, using my trusty calculatrice, I can confidently inform you that 67x $165m = $11.055 billion, which is consistent with saying that the company is targeting a “niche online market that is worth 67x its current annual revenues”.

My one bugbear here is that technically the online market niche is only worth $1.3b, and the overall nice is worth $11.2b, so it’s not a perfect fit. You could argue that actually the online market is only worth about 7.9x its current annual revenues.

However, I can’t find a better fit for the description on other recent IPOs.

For example, online retailer Mydeal has 813k active customers. Sure technically that’s “nearly 800k” but would Motley describe 813k as nearly 800k or more than 800k? I say the latter.

On top of that, I’d guess this marketing was drafted on Thursday or Friday last week. Well, on Thursday Adore Beauty had a market cap of about $506m. $506m x 22 = $11.132 billion. Again, if we accept that the “niche online market” is the $11.2 billion “Australian Beauty and personal care market” touted by Adore, then this seems to fit.

Now, there is no guarantee that Motley Fool is going to name Adore Beauty as their number 1 IPO stock to buy now, tomorrow morning prior to market open. However, based on a quick glance at this list of 2020 IPOs, I’m struggling to find a better fit for their marketing.

Probably Mydeal comes closest. It talks about “Online household goods represent a A$6bn market in Australia.” This is a good fit for the language Motley Fool uses. Mydeal’s Market cap is ~$260m, and if you multiply that by 22 you get to $5.7b, so it could fit on the market cap measure.

However, Mydeal did $21.2m revenue in the last half and $6.1m in H12020. It did $15.3m in FY2020 so its trailing twelve months revenue is around $30m. Well $30m times 67 is closer to $2b — which is not a good fit for the $6b posited. It just doesn’t seem to fit as well to me.

Therefore, as soon as I publish this article I’m going to buy some Adore Beauty shares, which I plan to sell tomorrow no matter what. While it’s far from guaranteed I will make money, I think there’s a good chance I can make around 10%. Ultimately it will depend on how many people tune in to Motley Fool’s webcast.

This is not advice. These are investment notes of mine; not a recommendation. I could have made mistakes in the notes. I am just about to buy Adore Beauty shares and probably already did by the time you are reading this. I plan to sell them tomorrow no matter what. This post is for the fun of it, and should not form the basis of any decision you make. Please read our detailed disclaimer.

Addendum at 3:38pm: I have just now done a small trade in the hope of making some dinner money by selling for a profit tomorrow.

I should note here that for many different reasons, I could end up losing some money. For example, stocks generally could sell off tomorrow, something could go wrong with Adore Beauty, or I might be wrong.

Ultimately, even if I lose money on this trade, it doesn’t matter. It’s just a joke, a silly thing. Don’t try this at home folks :p

In the last 20 days, Adore averaged about 170k shares traded, which is worth about $800k. Now, I have definitely seen Motley move share prices with that much liquidity before, but they would need to have like 400 – 1000 viewers for their webinar actually go out and blindly buy a stock to get any big move. These things are hard to predict, which is why I just always sell the next day basically. It could go either way but the odds are in my favour for a day trade (or overnight trade, in this case).