When I last covered Nanosonics (ASX: NAN) for Ethical Equities (google it) I wrote, “At current share prices, I will be doing some selling for sure, but am unlikely to sell out completely. ”

By way of review, my thesis for holding the stock is that it has a powerful razor + blade model whereby the increasing number of installed Trophon EPR units (which decontaminate ultrasound probes) require consumable cartridges for every probe decontaminated. As the Trophon becomes the standard of care, it creates a quasi-recurring high margin revenue stream by locking hospitals in to using one of their consumable cartridges for every single internal use of an ultrasound.

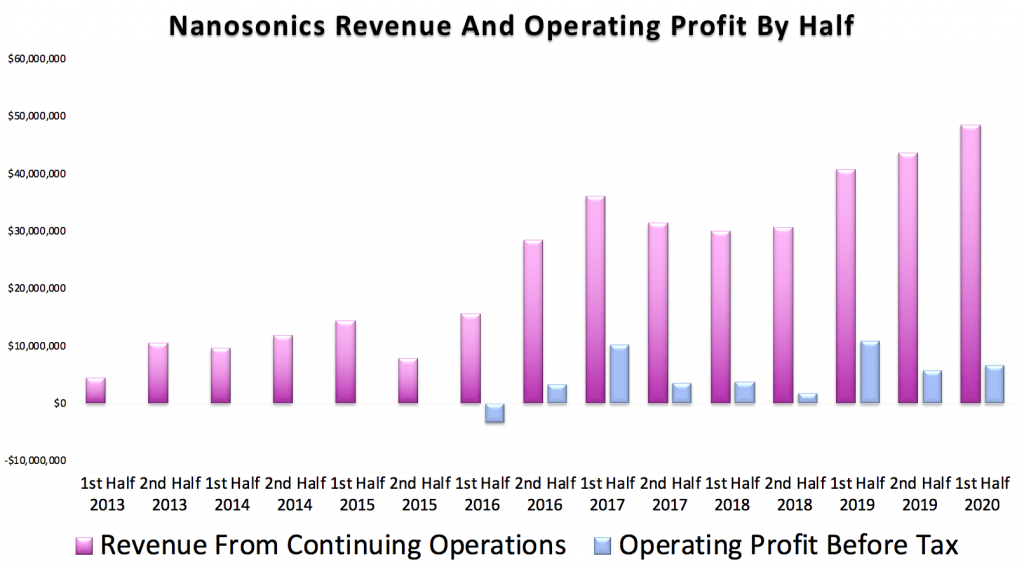

The market doesn’t really know whether to focus on revenue or profit for this stock but the company itself has been pretty ruthless investing into growth as a priority. This half, it reported revenue growth of 19% half on half, to about $48 million and a net profit before tax drop of 39%, to about $6.7 million.

The reason for the drop in profit was a sharp increase in operating costs due to “an increase in staffing costs associated with an increase in headcount globally as the Company focusses on continuing to grow and establish trophon as a standard of care with existing markets including direct sales in North America and market expansion activities in the Europe/Middle East and Asia Pacific regions.”

While these expansion activities haven’t yet borne fruit, it was very pleasing to see that the first units have been installed in Japan after a very long process to begin sales in that country.

As you can see below, the net profit before tax was nothing to write home about, although the revenue growth was really rather good considering that “Capital sales to the Company’s main North American distributor were down 24% on prior corresponding period due to timing of purchases in prior periods and the distributor’s inventory management”.

As you can see below, this is not the first time revenue has taken a hit because of de-stocking by the company’s main distributor, GE Health. If I recall correctly the company suffered a similar impact in 2018, which slowed revenue growth for a time and sent the (then heavily shorted) share price to lows of around $2.30.

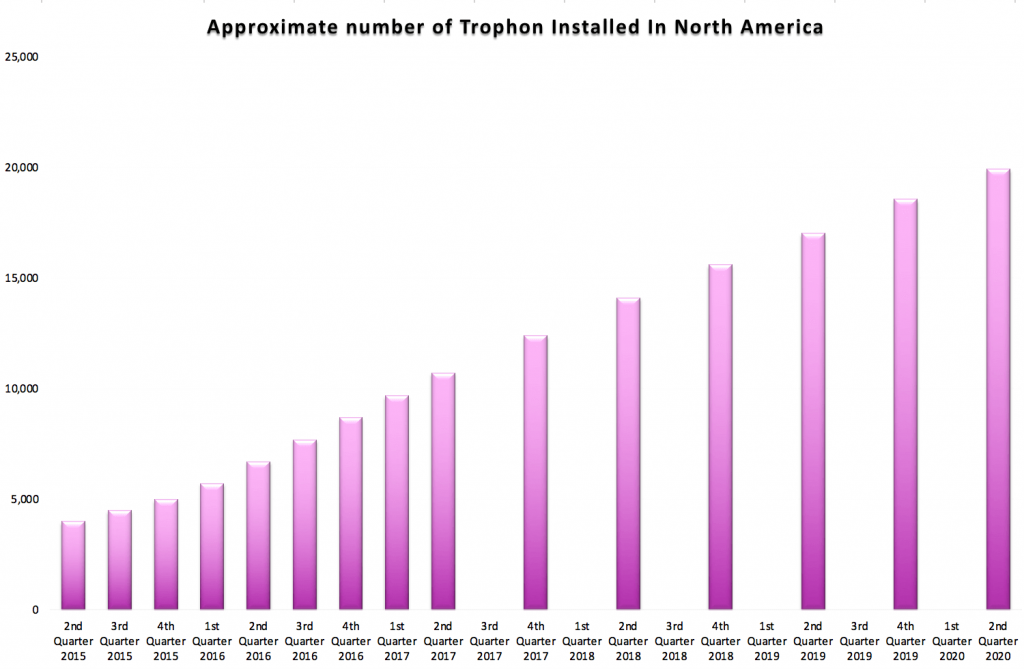

I think that there is a very real possibility short interest in the stock will rise again on the back of this result because the lumpiness of the growth can give the impression that the company is not really growing at all. This can be a powerful bear thesis for a stock that trades, essentially, upon an expectation of value at business maturity rather than by extrapolating linear profit trends (which is what the human brain feels most comfortable with). As a result, I remain of the view that I will sell some stock, but also retain some stock. I think that this result may well break the sociological phenomena which has allowed the company to sustain investors’ high expectations.

Having said that, a good guide of whether the business is creating value is the growth of its installed base of Trophon units in the US. These units lock in quasi recurring consumables revenue which (by the way) was up $40% on the pcp and 25% on the prior half, to $34.1 million. This reflects the new direct sales approach (but only partially explains the higher selling costs, some of which are associated with expanding into Japan.) You can see below that the expansion in the US is continuing, but the rate of expansion is slowing.

Probably the highlight of these results is the $10 million in free cashflow which was largely a result of decreased working capital arising from more efficient manufacturing. This leaves the company well positioned to invest in expansion of the Trophon and launch of its new product, given it now has $82 million in cash.

Interestingly, it has also announced that it has finally begun developing a strategy to enter the Chinese market. Once the coronavirus blows over, we may find that China is ready for improved disinfection protocols; and that would be a big boon to Nanosonics, although there are certain country-specific risks with expansion into China.

This is certainly not advice, but I do think Nanosonics is continuing to act like a well-run, valuable, and high quality business. I think it will probably have some stronger results in the next 12 months or so as the impact of the GE Health de-stock flows through, though I note that the market penetration in the US is slowing. All in all, I intend to reduce my holding in Nanosonics today but I still like it as a quality company and do have the stomach to hold some of my shares for the long term, even though I don’t currently consider them to be cheap.

Looking further forward, I think that the next game-changer for the company will be the introduction of its next product which, “Subject to technical milestones and timing of individual market regulatory approvals, the Company is targeting commercial introduction in FY21.” Clearly that’s a wishy-washy forecast but I do think that if the market ever prices the next venture at zero I would be tempted to take the other side of that bet.

If you’d like to receive a occasional Free email with more content like this, then sign up today!