This morning, infection control company Nanosonics (ASX:NAN) reported FY 2021 revenue of $103 million, up 3% on last year, and profit of about $8.6 million, down 15%. To understandable bafflement in some quarters, the market has reacted with boundless enthusiasm to this “flat and down” result, sending the stock some 25% higher during the day, to close at $7.35. This leads me to wonder whether now might be an opportune moment to take some profits, or whether it’s better to simply hold on. But before I get on to that subject lets take a look at the the results in more detail.

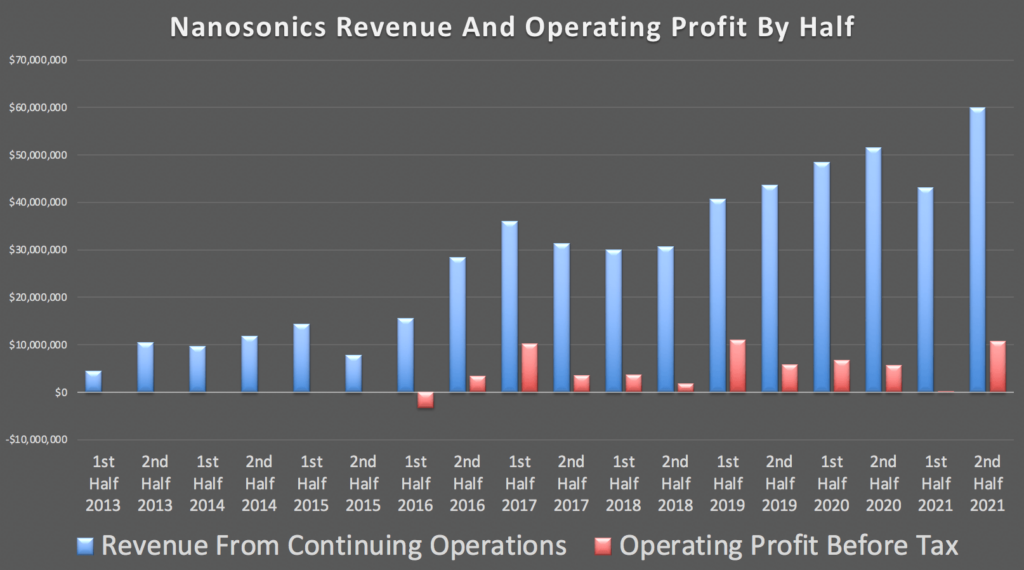

You can see our past coverage of Nanosonics here to better understand the business, so suffice it to say for now that the company sells its Trophon device as well as very higher margin consumables each time the device is used to disinfect an ultrasound probe. As you can see below, FY 2021 was a tale of two halves. The first half was hampered by both slower consumables usage, due to the pandemic, and slower sales of Trophon devices to GE Healthcare. Those of us who have been following the company for years know this is not the first time GE inventory management has caused lumpy results for Nanosonics.

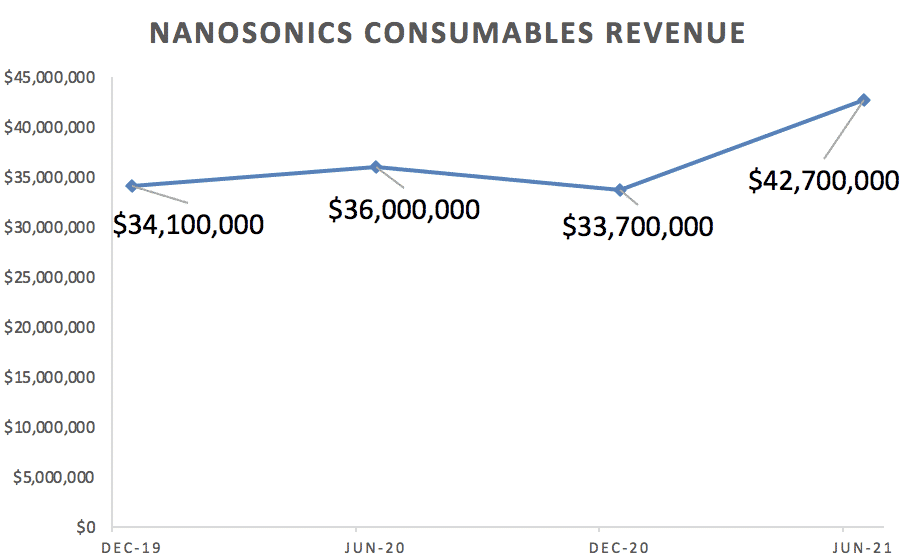

For the purposes of valuing the company, I keep a close eye on the consumables revenue. You can see below that Nanosonics achieved a record $42.7 million in consumables revenue, in the second half of FY 2021. This revenue has a margin over 80%, and is quasi recurring in nature.

Just six months ago, when I covered Nanosonics half year results, the share price was down 14%, and the mood was sombre. At the time, I said:

“The future value of the company rests on the return it may, or may not get from its investments in: a) Rolling out the trophon to grow recurring revenues, and b) Rolling out its second product to grow recurring revenues (Due FY2022).”

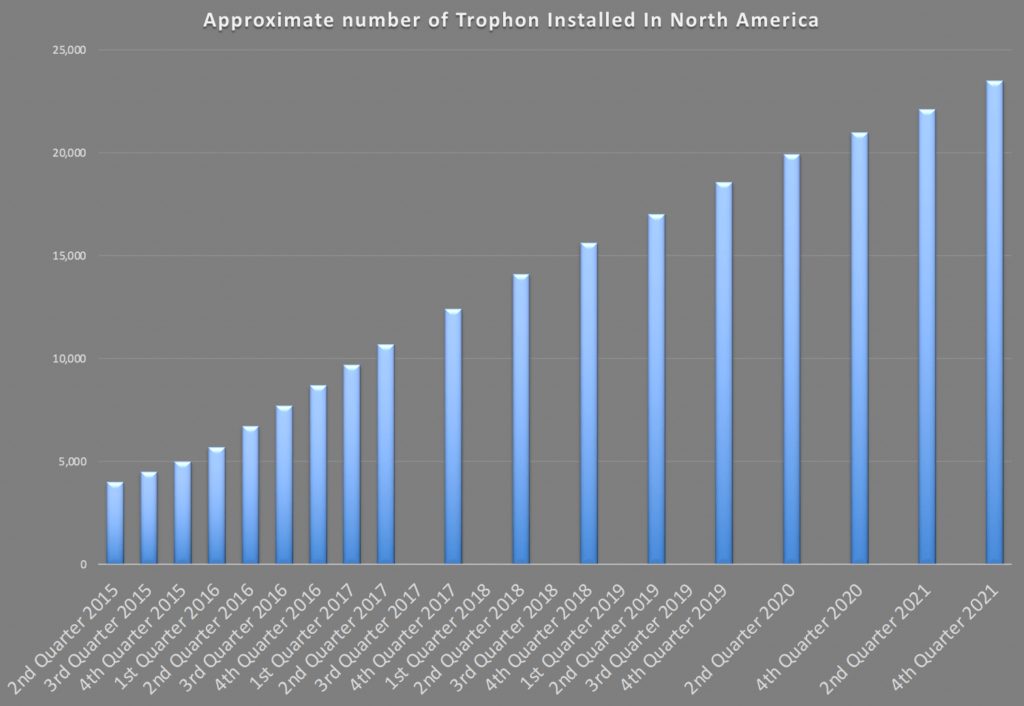

In the second half, the company has benefitted from an increase in ultrasound procedures but it has also continued to roll out the Trophon. In fact, it increased the North American installed base by 1360 units in the second half, which is actually an improvement on the preceding two halves.

Nanosonics’ New Product The Nanosonics Coris

Today’s announcement was a bit of a set back (again) when it comes to the new products. The company had previously said it would launch its new product in FY 2022, but today it pushed back the timeline for commercialisation until “calendar year 2023”. It had also announced its new Audit Pro scanner for tracking ultrasound probe workflows. Today, it announced its new endoscope cleaning machine the Nanosonics Coris. On top of that, the CEO said “We’re not going to stop with Audit Pro and Nanosonics Coris…”

The Audit Pro is a scanning device and browser based software for which clients pay a subscription. The Coris will be a machine plus consumable products. That means both new devices should generate high margin quasi recurring revenue, just like the Trophon. However, it’s not clear when that revenue will be significant compared to current revenues.

Nanosonics Trophon Total Addressable Market (TAM) Increased

Historically, Nanosonics has estimated that there was a market for 40,000 Trophon devices in the North American market, but this forecast had not been updated for many years. As a result of increasing use of ultrasound, and a number of other factors, the company today announced it now believes there is a market for up to 60,000 units in North America. This essentially extends its forecast growth runway.

I don’t think that’s particularly relevant to the share price, but it may help explain the 25% gain in price today.

Is The Nanosonics Share Price a Sell?

I have bought Nanosonics shares several times between $5 and $6 over the last year for reasons outlined in this article on 3 Fluffy Dog Stocks I’d Like To Buy. As I said in that article:

The company sold about 800 new units in the quarter which is a re-acceleration of installed base growth. What’s more, the company says that subject to the inherent risk with covid, they’re expecting a stronger second half. And this thought leads us to the potential short term signal. Could it be that the horror of covid has put all types of infection control sharper relief?

Clearly, there has been a reasonable acceleration of growth, and on the conference call the CEO confirmed that it would be reasonable to use the second half performance to ground expectations of what FY2022 might look like. That would imply revenue of around $120 million, and profit before tax of around $20 million. If we extended the analogy to consumables revenue, that would imply about $85m in consumables revenue.

I’m not sure that’s what will happen. It seems likely to me that costs will go up as the company continues to invest in R&D and looks to start selling its new products. In that sense, I’d expect a lower profit. On the other hand, I think that consumables revenue might actually be higher than $90 million, since it generally does go up as the installed base increases. Finally, it’s worth noting the company is expecting increased contribution from the replacement cycle, where it looks to upgrade clients using older versions of the Trophon 1 to Trophon 2. It’s not clear how successful they expect to be, but we’ll likely get a sense of that over the next year.

At the current share price of $7.18, Nanosonics has a market capitalisation of about $2.165 billion. As an investor, what I really care about is the recurring revenue, and I suspect that it will still be a few years before the new products start contributing to recurring revenue. The big question on my mind is whether the company can sustain its increased Trophon roll-out speed, because the pandemic has heightened the focus on infection control, or if that is just a temporary bump, and the Trophon roll-out will continue to slow.

It’s also possible that the product gains traction in Japan, where the company says it has “built a solid foundation and infrastructure as we work with relevant specialists and societies for the implementation of local guidelines.” However, like many of the growth initiatives discussed, that is not expected to benefit FY2022.

To my mind, the good buy price for Nanosonics increases slightly with this report, but not a whole lot, so it’s definitely out of my buy range now. If we assign a value of 20x consumables revenue to the consumables business, that would leave about $465 million for the rest of the company, which isn’t too bad, but doesn’t seem great to me. As a result, Nanosonics shares are above the price I would want to buy but below a price I’d feel eager to sell.

Rather, I am hopeful that as brokers upgrade their earnings forecast models to account for the new product, they will be forced to upgrade their price targets and that will send the stock higher.

I have previously said that “one potential short term sweetener [in the second half results] could be if there is some pend up demand for ultrasound procedures due to them being postponed during the height of the pandemic.” Today’s result is definitely a vindication of my thesis that Nanosonics was a good “re-opening trade”, as I’ve outlined multiple times, most recently in May, when I said I was buying the stock around $5.23.

In some ways, my re-opening thesis for Nanosonics has somewhat played out, and I can imagine lightening my position from here, especially if I’m offered a more optimistic price, closer to $8. On the other hand, I still believe this is a high quality business, and my holding isn’t too large so I am also content to let my winners run. Ultimately, I haven’t decided when I will take profits in this stock but these results were in line with my expectations, and consistent with Nanosonics being a very high quality razor + blade business model. Given its quality, there’s certainly a case for simply becoming a long term buy and hold investor in this stock.

Personally, I intend to research and write more about Nanosonics as I better understand its new products, and their potential. I also want to revisit the Trophon’s competitive landscape, given the the Trophon device patent only extends to 2025. These factors could cause me to change my view on the stock, but that will have to wait for another day, and another article.

Please remember that these are personal reflections about a stock by author. I own shares in Nanosonics at the time of writing, and will not sell them for at least 2 business days after publication. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

An aside from me: If you watch Ausbiz, and want to be alerted of interviews I do as they happen, you can follow me on Ausbiz. I do appreciate any follows on that platform, so if you do follow me; Thanks!

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.