Yesterday, Nanosonics Ltd (ASX: NAN) released a subdued set of results for FY 2022 with revenue growing 17% to $120.3 million but net profit after tax dropping 57% to $3.7 million due to operating expenses outpacing revenue growth. Gross margins also fell slightly from 77.98% to 76.38% but remain relatively high on a historical basis. Operating cash flow came in a tad lower from $7.3 million to $6.7 million, resulting in Nanosonics entering negative free cash flow for the first time since FY 2015 as capital continues to be deployed to develop its latest flexible endoscope disinfectant solution, CORIS.

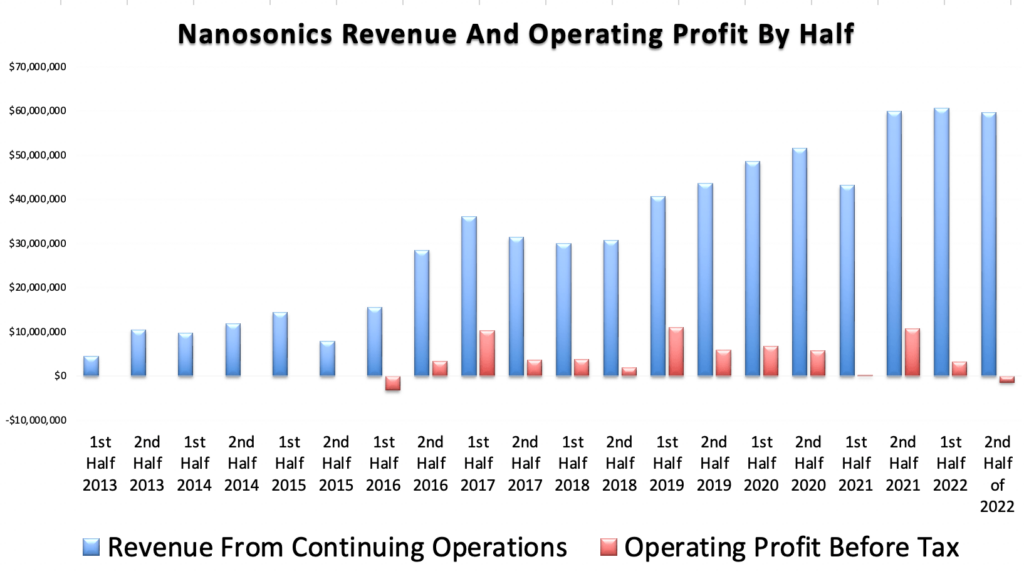

In the FY 2022 Nanosonics results, the revenue growth rate was mediocre relative to historical growth rates. However note that recent supply chain challenges along with rising inflation have not helped. As you can see below, the second half was weaker than the first half and the company made its worst profit before tax result in years; but that was still only a loss of less than $1.5m.

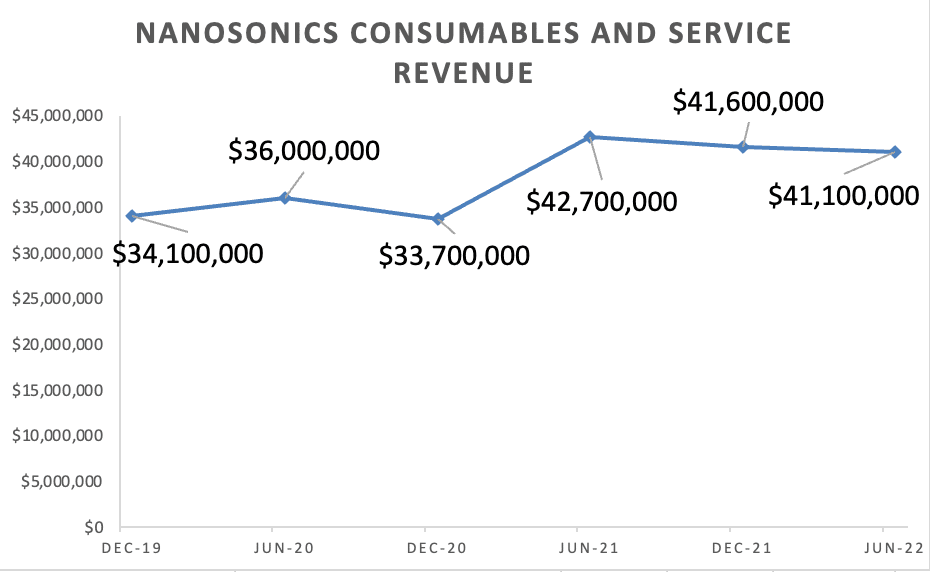

The ultrasound probe disinfectant business has been covered by Claude many times before but his piece in June provides an overview of why he expected these results to be weaker than FY 2021. Essentially, the second half was impacted by the revised North American sales model and GE Healthcare’s de-stocking. This impacted the higher margin consumables and services revenue, below.

The number of Trophon installed units lifted by 11.59% to 29,850 across the globe. This was largely driven by the North America region helped by small above-average growth rates in Europe, the Middle East and Asia Pacific. As for revenue, North America jumped by 20%, Europe & Middle East lifted 4% and Asia Pacific went backwards by 12%. The fall in revenue in the Asia Pacific was due to a major one-off upgrade of 200 units with I-MED Radiology Network, the largest customer in Australia in FY21.

In terms of the types of revenue, capital revenue was the biggest contributor to growth, with a 41% increase to $37.6 million. Consumables revenue went up 7% to $70.3 million and services revenue rose 17.53% to $12.4 million.

What Do These Nanosonics Results Tell Us About Nanosonics’ Pricing Power?

Falling gross margins prompt us to wonder about Nanosonics’ pricing power. CEO Michael Kavanagh did note on the earnings call that Nanosonics experienced favourable price movements. This likely shows how mission-critical Nanosonics’ ultrasound probe disinfectant solution is.

As expected, there was a lot of discussion about the transition of Nanosonics taking control over of the distribution and direct sales from healthcare equipment distributor GE Healthcare. The CEO noted this has been completed and the direct salesforce is in a sound position to reap the benefits from a direct sales team model over the future, highlighting that the sales team was responsible for 91% of the sales in North America in the last quarter of FY22.

On this point, one analyst asked whether GE Healthcare is still playing an active role as a reseller as advised previously by management. Kavanagh assured this was the case and noted that even in an event where GE Healthcare sourced the client, the sales would still be recorded on Nanosonics’ books. The same analyst then responded with a particularly insightful question, “What is the incentive for GE Healthcare to the sale of Trophon and what are they making on that sale?“. To this, Kavanagh said, “comes down to the customer’s requirements and confirmed there is no financial incentive unless GE transact themselves and we’ll sell to GE at a price where they could make a margin.”

My initial view on the change in the relationship between GE Healthcare and Nanosonics was negative because my thought process was tunnelled to GE Healthcare’s point of view. I thought Nanosonics’ solutions was becoming less favourable as GE Healthcare found alternative solutions, which can still not be ruled out. When you invert this, it makes sound commercial sense to bring the sales process in-house because the direct sales force is much more incentivised to not just make the sale but also generate ancillary revenue from services.

The change also strengthens Nanosonics’ business as it becomes less dependent on GE Healthcare, which Claude flagged in his aforementioned piece.

Management previously advised that such a transition will drive improvement in gross margins yet this went down for FY22. Analysts on the call were perplexed by this and I daresay perhaps impatient. I think it’s still too early to accurately evaluate the impact of the GE transition. It’s definitely an area that should be monitored closely.

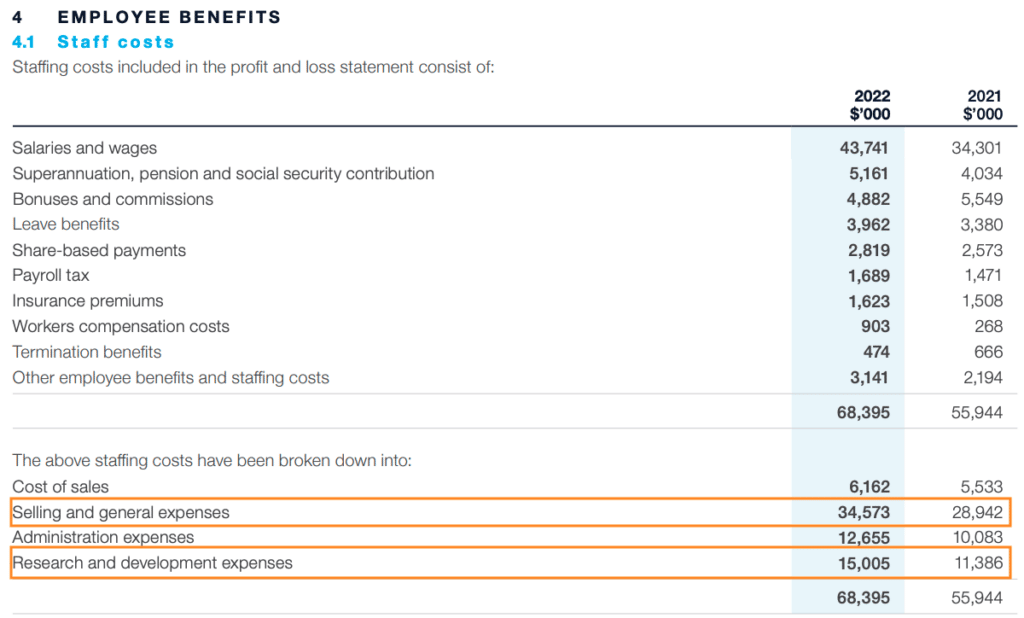

As we have previously expected, Nanosonics experienced a weak second half due to the GE transition as it lifted spending on sales recruitment and R&D. The below snapshot shows these were the two biggest drivers as part of the overall lift in employee expenditure.

Such expenditure is necessary given that Nanosonics is building a direct sales force in North America and striving to develop an industry-leading endoscopy probe disinfectant solution. Kavanagh flagged its new solution will likely produce similar operating margins as its ultrasound disinfectant business.

The Coris technology seems to be progressing well as management is targeting its first introduction for calendar 2023, which will likely be in Australia and/or Europe.

The destination that management is painting involves Nanosonics potentially becoming two times bigger as Trophon provides the foundation and Coris is the sweetener on top. However, I do have concerns about whether Nanosonics will be able to withstand disruption pressure.

The Competition Risk For Nanosonics

In my initial deep dive into Nanosonics last year, my primary reason for not investing was the growing disruption force that is Germitec, which sells the Hypernova Chronos. This technology uses a different way to carry out high-level disinfection, so rather than being chemical-based like Nanosonics, Hypernova Chronos uses ultraviolet rays or essentially heat to disinfect, offering a chemical-free alternative.

The Hypernova Chronos was awarded the highly prestigious 2020 Prix Galien International Award, which is considered the equivalent of the Nobel Prize in biopharmaceutical research and medical technology research. Investors are starting to take notice of this cutting-edge technology with Germitec announcing a financing round of 11 million Euros in May. This capital will be used to drive international expansion, in particular obtaining FDA clearance to commercialise the Hypernova Chronos in the USA.

The debate about which method is superior is still out in the open but a recent study shows evidence that ultra-violent high-level disinfection may have the upperhand. In an article published in the American Journal of Infection Control in March 2022, research revealed that products like Hypernova Chronos is more effective in killing spores (certain cells that produce bacteria) but there is no process in place at the FDA to test and approve. This doesn’t mean much until Germitec can obtain formal FDA approval but such studies provide soft indicators, and it appears Germitec is going in a positive direction.

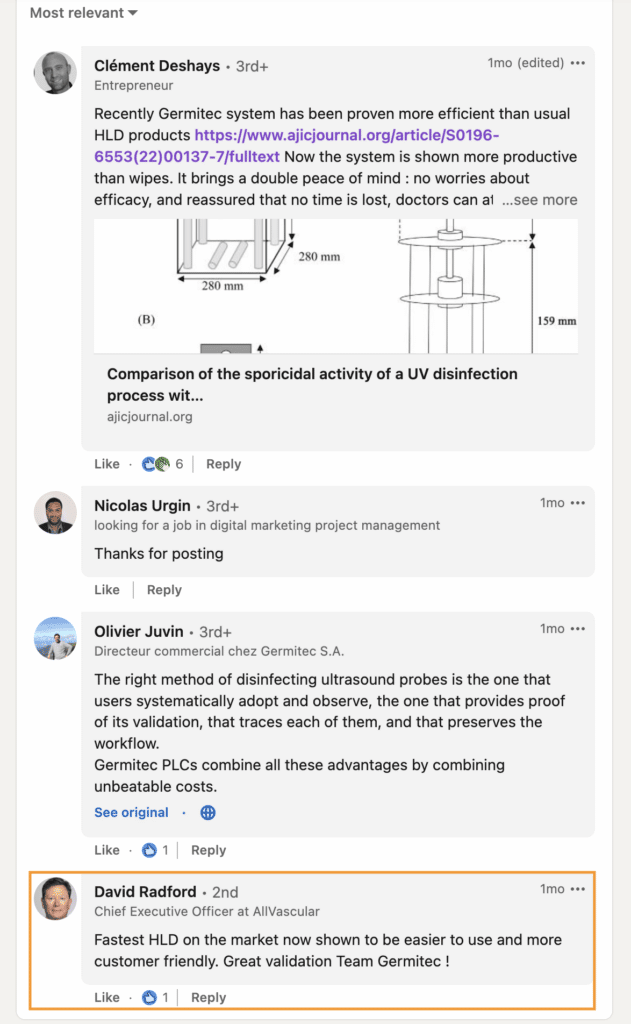

Further, there are a few professional industry players advocating or expressing their support for technology like Hypernova Chronos. Check out the screenshots of some LinkedIn posts below.

These people are experts in their respective healthcare fields, in particular Don Marcello, who works at Clinical Technology Inc, a supplier of new and innovative medical technologies across the Midwest in the United States.

In light of growing concerns that chemical-based solutions may become out of favour over the long run, I was fortunate to submit the last question on the call. I asked management an open-ended question on the disruption risk, “What do you see as the biggest threat to Trophon and traditional chemical-based high level disinfection methods?”

Kavanagh responded as follows:

“I think we’ve moved away from the more toxic solutions through our hydrogen peroxide solution, being very environmentally friendly …. I think there’s the hydroperoxide being broken down to oxygen and water in a cycle, and it’s only a very small amount that’s used per cycle. … so we don’t see a major disruption towards a more environmentally friendly chemistry because chemistry has certainly numerous benefits over alternative mechanisms. I mean, for example, you can’t have heat-based with sterilization because a lot of these medical devices just would not survive the high temperatures and high pressure required like in older class, et cetera. So we’re not seeing — we’re certainly not seeing any major disruptions associated with moves away from chemistry as long as that chemistry that’s provided is environmentally sustainable.”

On one side of the coin, Kavanagh’s comments eased my angst but on the flipside, I wonder if management is being a little complacent. It’s difficult to tell based on these comments alone, but the proof will be in the pudding once we get news on whether Hypernova Chronos obtains FDA approval. I’ll trust my Google alert system to provide this information!

What Does Nanosonics Share Price Tell Us?

Nanosonics has historically traded on a high multiple with the historical average price to sales multiple hovering at 11x. The P/S multiple is currently around this mark at 10.74x, so these Nanosonics results do not seem to have changed the market’s expectations much.

I would argue that the market is placing some value on the nascent Coris product. If Nanosonics executes with the new endoscopy product Coris, the current multiple will prove cheap. But I find the growing risk of disruption too hard to ignore, so I plan on keep monitoring FDA developments and the progress of Coris for now.

If you believe Nanosonics’ core Trophon business will likely be able to avoid the risk of disruption, any irrational drop in the Nanosonics share price driven by today’s results could provide a window of opportunity. In times of necessary capital investment for a new commercial opportunity, investors tend to become pessimistic because they tend to focus on the current hit to profitability rather than the long-term benefits of undertaking such investment.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author this article does not own shares in Nanosonics (ASX: NAN) and will not trade Nanosonics shares for 2 days following this article. Please note that the editor of this article, Claude Walker, does own Nanosonics shares and will not trade Nanosonics shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.