This morning, Nanosonics (ASX: NAN) updated the market on its distribution agreement with GE Healthcare in North America, and disclosed that it would report $60.7 million in revenue for the first half of FY 2022. Initially, the market sold off the shares aggressively, with Nanosonics stock falling almost 20% to $4.21. However, since that time the Nanosonics share price has rebounded to about $4.65, reducing today’s drop to less than 8% at the time of writing.

We’ve covered Nanosonics extensively on this site, so this article will assume readers understand the business already.

The History Of Nanosonics And GE Healthcare Distribution Agreements

Originally, Nanosonics was just a small Australian company selling the Trophon device in Australia. Years ago, it signed an exclusive distribution agreement with GE Healthcare, which made GE Healthcare the only seller of Trophons and the associated consumables, in North America.

After some time, Nanosonics renegotiated the agreement to allow other distributors, as well as a direct Nanosonics sales team. This allowed the company to build a direct customer base in North America, though GE Healthcare was initially still the main channel. A couple of years ago, Nanosonics re-negotiated the agreement so that GE Healthcare would no longer be providing the consumables to the new customers it sold the Trophon device to. Rather, Nanosonics would distribute the consumables, for new customers.

The new deal today changes that. From now on, GE will transition all of its existing clients who buy Trophon consumables over to Nanosonics, who will now receive higher revenue for those products. In exchange, Nanosonics will also take over the installation, training and delivery of all Trophon devices. However, GE Healthcare will still retain its same margin on new Trophons it sells. This means that GE Healthcare will get more profits from selling Trophons, because it no longer has to worry about inventory or distribution. It just clips the ticket and does nothing else, when it sells one.

On the flip side, from now on Nanosonics will capture GE Healthcare’s margin for distributing the consumables, so that is a long term positive for margins.

Why Is The Nanosonics Share Price Down Today?

Today’s announcement discloses first half FY 2022 revenue of $60.7 million, and mentions that the changes to the distribution agreement will be a $13 million to $16 million drag on FY 2022 revenue, since GE Healthcare will run down its existing inventories of both consumables, and Trophon devices (and not order more).

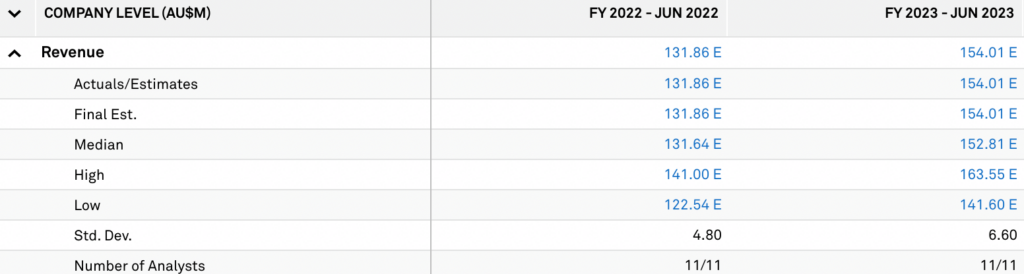

Analyst estimates for FY 2022 Nanosonics revenue range from about $122m to $141m, with the average being about $131 million. Prior to today, this seems reasonable, because it would mean the company would grow revenue by about $10 million half on half, for about $131 million in full year revenue. However, all else being equal a $16 million reduction in revenue would see the full year revenue sitting at about $115 million, about 11% below consensus estimates.

On top of that, FY 2022 will see increased costs as the company needs to expand its direct sales and distribution team from around 85 people to around 100 people, in order to cope with the extra sales responsibilities. On an annual basis, the company says that this extra volume might add around $4m in annual costs, but the CEO said on the conference call today that “we believe that will be more than offset from the revenue and margin improvements.”

Did The Nanosonics Share Price Drop Too Low?

Even before today, the gross margin on the consumable products was over 80%. In the six months to June 2021, the company generated about $42.7 million of this high margin, quasi recurring consumables revenue. Nanosonics has about 302 million shares so at $4.20, it has a market capitalisation of around $1.26 billion.

If we annualise the last 6 months of consumable revenue, then we get about $85 million for a full year, implying that if you valued the new trophon sales revenue at zero, the trophon upgrade revenue at zero, the cash on the balance sheet at zero, and the new products revenue (yet to arrive) at zero, then you would be paying about 15x high margin, quasi recurring revenue for the entire company.

Now, that’s just a very basic shorthand, but in my book, this high margin recurring revenue is actually of similar quality to the recurring revenue of many software companies. In fact, it’s higher margin revenue than many software companies. And on top of that, it’s growing.

On the other hand, the company made about $60m in revenue in the second half of FY 2021, so to achieve just $60.7 million in the first half of FY 2022 is disappointing. Combined with the one-off impact of the GE Healthcare inventory run down, FY 2022 is shaping up to be a disappointing year, before a stronger FY 2023.

It seems to me that in the short term, we should be prepared for share price weakness. It is quite possible that today’s update will lead some analysts to downgrade their forecasts for Nanosonics, because FY 2022 revenue is likely to be lower than expected. On the other hand, today’s news about the distribution agreement is actually “another important positive milestone,” as the CEO put it today.

Personally, I bought some shares below $4.30 this morning, and then sold them all for an average price of around $4.60, after the conference call. I have kept all of my core long term position, and plan to continue to hold.

Overall, today’s update makes me concerned that in the short term, the stock price may remain weak, because the results in FY 2022 aren’t as impressive as many analysts had hoped. On the other hand, I think today’s news is actually a positive for the company in the long term. I’d probably be open to buying more shares if the share price languishes, and that is probably possible given that FY 2022 isn’t shaping up to be a great year so far.

Unfortunately, Covid continues to frustrate the sales process, although the CEO did say that January is actually looking quite positive in terms of new installed base, implying that access is improving as the Omicron wave subsides. All in all today’s announcement doesn’t change my long term view that this company will one day make tens of millions of dollars per year in profit. However, we won’t see the benefits of the new distribution agreement until FY 2023, and the new products won’t make a meaningful contribution until well after that. One positive about today’s announcement is that it will give Nanosonics more direct relationships with hospitals, and that may assist the roll out of the new product.

The company will release its half year results on February 22, and we will learn more about the health of the business at that stage.

Please remember that these are personal reflections about stocks by an author. Earlier today I bought shares, then sold them, but I continue to hold Nanosonics in my portfolio. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.