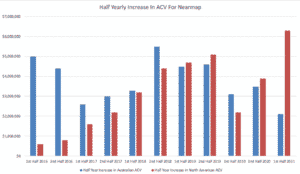

The Nearmap share price is up almost 10% this morning, after the company presented relatively strong half year results for the first half of FY 2021. Revenue was up 18% to $54.7 million for the half year, while the half-year loss was reduced to $9.4 million. As a company, Nearmap (ASX:NEA) tends to focus on its annualised contract value (ACV). While this does have some flaws as a metric, in the half year to December 2020, the company had a great deal of success increasing revenue from existing clients. This drove a strong increase in ACV, as you can see in the chart below.

Our research indicates that Nearmap does drive through price increases on a regular basis, and while this shows the utility of their services, it also opens the door for higher churn if they are too relentless with price rises. The CFO admitted that the reason for the low new customer contract revenue was because “we didn’t have any material new customer wins” in North America, this half.” One is inclined to look past this given covid has genuinely disrupted the whole of the North American society.

Nearmap Results Highlights For H1 FY2021

The best part of Nearmap’s results from a superficial perspective is that the company actually generated a little bit of free cashflow this half. However, this was only achieved because the company paid many employees 20% of their salary in shares during the year, as a response to covid. In reality, it seems the business is well and truly still burning through cash. On the upside, having raised $95 million in September 2020, Nearmap is well capitalised to continue its cash incineration with over $125m in the bank.

Is The Nearmap Share Price Overvalued?

As a reminder, this post is not intended as advice, but is merely a reflection of the positives and negatives currently impacting the Nearmap share price. Recently, short selling firm JCap released a short report on Nearmap arguing that the business was overvalued because the company’s expansion into the USA was failing, its accounting doesn’t give a good idea of the genuine free cash flow in the business, and because its tech was inferior. If you take a short term view, then these results should give you comfort.

Clearly, Nearmap’s clients are sufficiently attached to their offering that the company can make considerable advances simply by up-selling existing customers. That’s good news, but is sometimes a clue that growth is not as sustainable as some would hope.

Based on these results, Nearmap is in a strong position since it was actually able to generate free cashflow. However, given that the company is now back to paying employees completely in cash, it is almost certain the company is burning cash again already. On top of that, the company reduced its cash cost of image capture during the half year, in response to pandemic conditions. On the conference call, the CFO said that the cash cost of capture will bounce back going forward. As a result, it looks to me like cash burn will re-assert itself with a vengeance going forward.

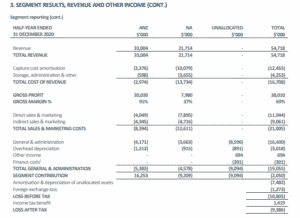

As you can see below, Nearmap has a profitable business in Australia. Even if we allocate half the unallocated depreciation and amortisation to the Australian business, it is probably making a net profit before tax of around $26m per year. In a hypothetical world where this was taxed, it would amount to around $18.2m per year.

If we applied a reasonably neutral 30x multiple to this number, then we would get about $560 million. At the current share price of about $2.35, Nearmap has an enterprise value of about $1,060 million. Under the hypothetical scenario above, that means investors are paying $500m for a loss making North American business, or around 15x revenue.

(Please note the above paragraph was updated to correct an error in the original version).

Overall, these results leave me non-plussed. While Nearmap doesn’t stand out as being particularly overvalued in the current market, it doesn’t seem particularly undervalued either. The current share price implies a lot is going to go right in North America, and despite the fact that Nearmap contests the degree of competitive threat implied by Jcap, it clearly does face serious competition in North America.

I believe many analysts are modelling the North American business on the highly profitable Australian business, despite the relative lack of major competition in Australia, for most of its operating history here. To me, then, risk skews to the downside with Nearmap. Having said that, these results were solid, at least in the short term analysis. Therefore I would consider Nearmap stock to be around fair value or a touch overvalued, without holding any strong view.

Ultimately, I suspect this business is lower quality than the market thinks, simply because competition is more serious in North America than people realise. Potential Nearmap competitors in the US include: Google Maps Platform, Maxar Technologies, Planet.com, Hexagon, Eagleview, Mapbox, Vexcel Imaging, and Sanborn. Having said that, the Australian business is in relatively good shape, with fewer competitors.

The author does not own shares in NEA, nor is short the stock. This post is not financial advice, and you should click here to read our detailed disclaimer.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.