Wealth platform disruptor Netwealth (ASX: NWL) recorded a slowdown in growth for FY22, compared to the exceptional results in the last few years. After reaching a high of $18.04 per share in October 2020, the Netwealth share price has slowly descended to $12.17 per share, despite the fact that the Netwealth business continues to win market share from its competitors.

In the FY 2022 Netwealth results, revenue grew by 19.4% to $169.5 million. However, a significant drive in hiring and investment in operations and IT infrastructure resulted in only a 2.7% increase in net profit to $55.5 million. Considering Netwealth has historically traded at an average price to earnings (PE) multiple of 77 and the current PE multiple is over 50, it’s fair to say the market expects higher profit growth rates. Major contributors to these optimistic expectations include the fact that Netwealth has very strong free cash flow relative to profit (almost 100% in FY22), no debt on its balance sheet, and a well-aligned founder running the business.

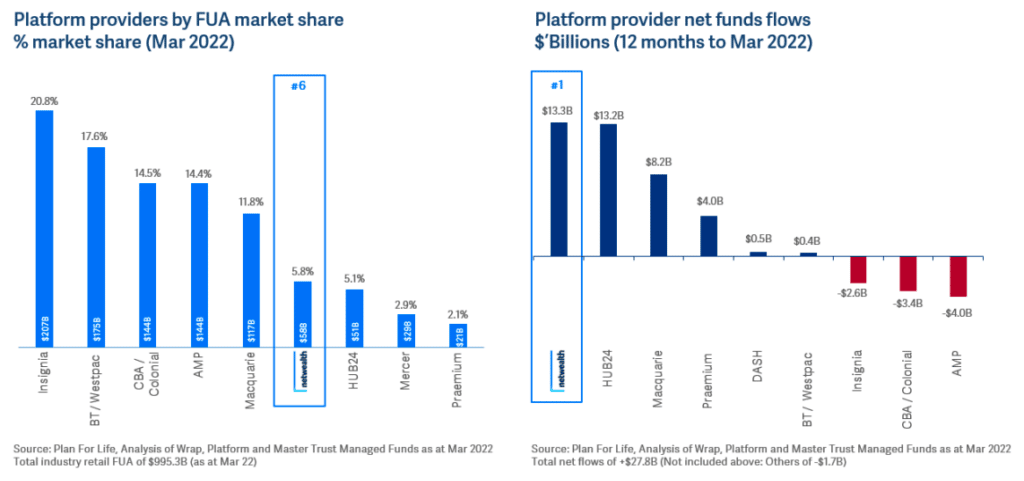

My initial thesis on Netwealth was pinned on its ability to displace the legacy and incumbent wealth platforms like AMP Ltd (ASX: AMP), BT / Westpac, CBA / Colonial and others. As you can see below, Netwealth and fellow rival disruptor Hub24 Ltd (ASX: HUB) have made massive inroads in the wealth platform market.

Whilst BT / Westpac has still managed to achieve net fund flows, it’s still lagging a fair way behind Netwealth, Hub24, Macquarie Group (ASX: MQG) and Praemium (ASX: PPS). In the last few years, a lot of the incumbents have pushed capital towards optimising and upgrading their wealth platforms, painting an extremely competitive landscape. I believe the market may be worrying too much about the threat of the incumbents striking back, let me explain why.

Superior technology and agility

Netwealth has consistently been awarded as the leading wealth platform provider by Investment Trends. In the latest annual platform report from Investment Trends, Netwealth claimed the top spot with 91.5% for its overall platform functionality. Hub24 was close on Netwealth’s heels at 91.1% followed by Praemium (89.3%), BT Panorama (85.1%) and Mason Stevens (82.6%).

I think Netwealth’s success is attributed to Netwealth’s constant aim to improve customer satisfaction by building a wealth platform with the best functionality. Netwealth makes money from administrative and transactional fees, so if more financial intermediaries like financial planners, wealth managers and stockbrokers use the platform, this means more money for Netwealth. Financial intermediaries want to use the easiest and most efficient platform to keep their clients satisfied, and a lot of this comes down to developing the most user-friendly technological platform.

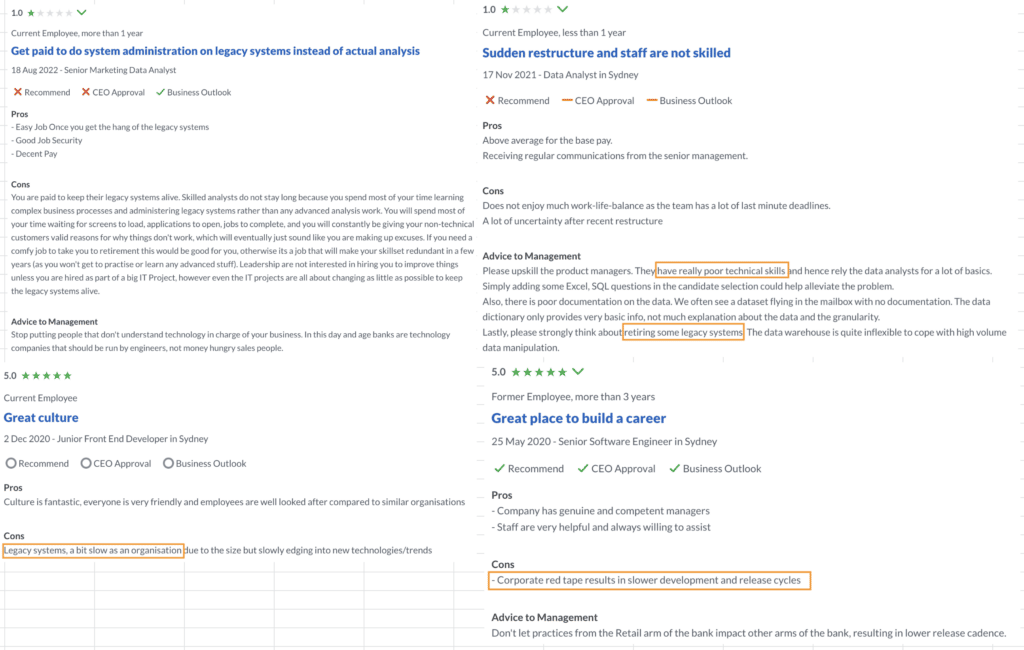

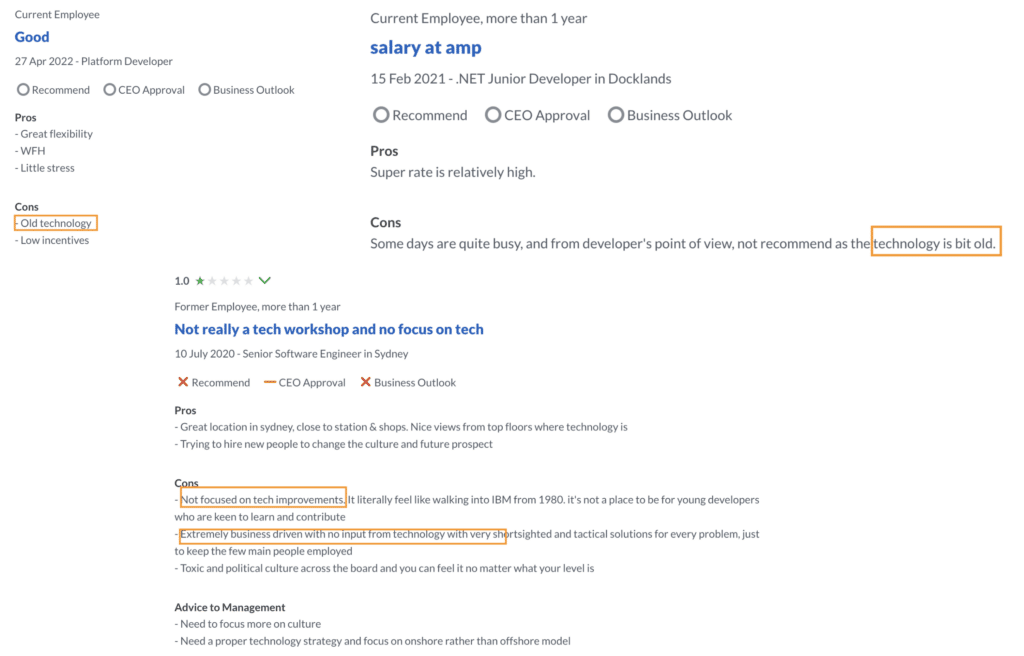

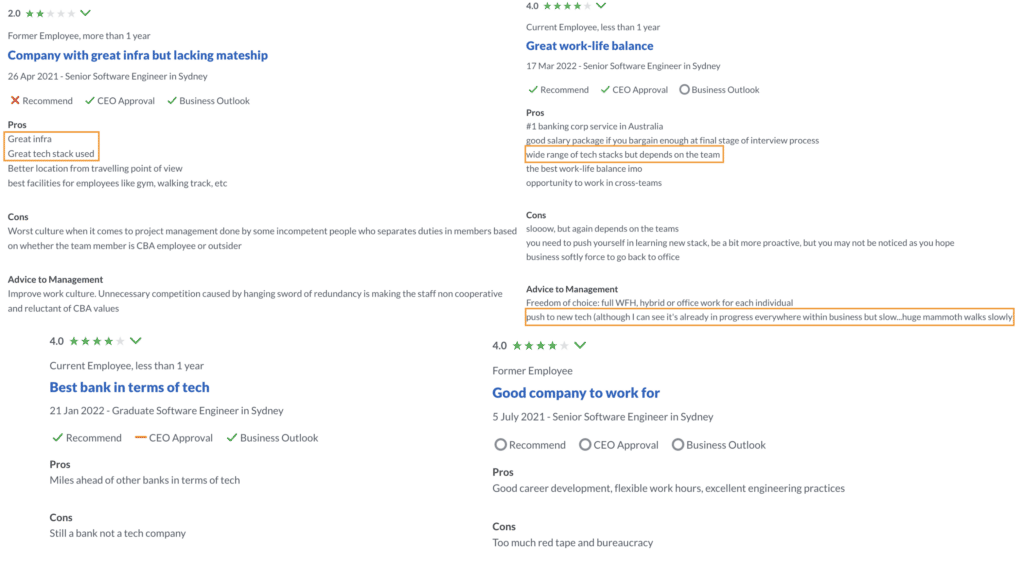

Netwealth’s biggest advantage over the incumbents is that its platform was developed using newer technology. The legacy infrastructure is still inhibiting incumbents from developing better technological solutions for financial intermediaries. I examined the software and data employee reviews across Westpac, AMP and CBA to identify any feedback or concerns regarding their legacy technology.

You can see some examples below:

As you can see from the reviews for both software engineers and data analysts, a lot of former and current employees highlighted legacy technology as cons. A lot of these employees also flagged that productivity was being hampered by red tape and bureaucratic structures within each organisation. At Westpac and AMP, no employees mentioned technology in a positive light in their reviews. However, quite a few CBA reviews reported its tech stack as being a positive, in particular the bank’s willingness to innovate and use new technology. But a lot of these CBA employees also echoed concerns about red tape and bureaucracy.

As for Netwealth, only two out of the 24 glassdoor employee reviews made reference to technology. One is a former sales manager, who noted Netwealth has great technology. The other review is by a former anonymous employee, who reported that the latest technologies were not in use. Unfortunately, there are no software or tech employee reviews from Netwealth, making it difficult to evaluate the quality of Netwealth’s technological infrastructure and solutions using this method. In any event, I believe the industry accolades that Netwealth has received present strong evidence of its technological prowess.

Netwealth Winning Market Share Comes At A Price

Becoming and maintaining the lead in technology comes at a cost to the bottom line. Even though legacy technology is still present amongst the incumbents, there are signs competition is improving, albeit at a slow pace. Therefore, it’s important to understand that Netwealth and other disruptors will need to continue investing capital to maintain and widen their technological advantage.

Netwealth cut its fees for the first time in the last eight years, highlighting the importance of price to financial intermediaries and clients stemming from the high level of competition. When competitors struggle to compete on technology, they can always compete on price. This doesn’t bode well for Netwealth, and the overall industry down the track. For example, AMP reduced fees for its wealth platform twice in the last 18 months to reel in financial intermediaries.

I think Netwealth and the wealth platform industry serve as an important reminder of why companies with pricing power are often in a better position to produce higher sustainable returns across the long term. Netwealth can continue to win market share but the rate of return on capital seems like it will diminish over the long run, as competitive pressures slowly increase.

Please note that I am currently a shareholder of Netwealth, and this article should not be read as indicating my future intentions in trading the stock. Indeed, this article focuses on the competitive positioning of Netwealth and is not intended as a commentary on the stock price. I will not trade Netwealth shares for 2 days following the publication of this article but reserve my right to acquire or dispose of Netwealth shares in the future.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Disclosure: This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any general advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.