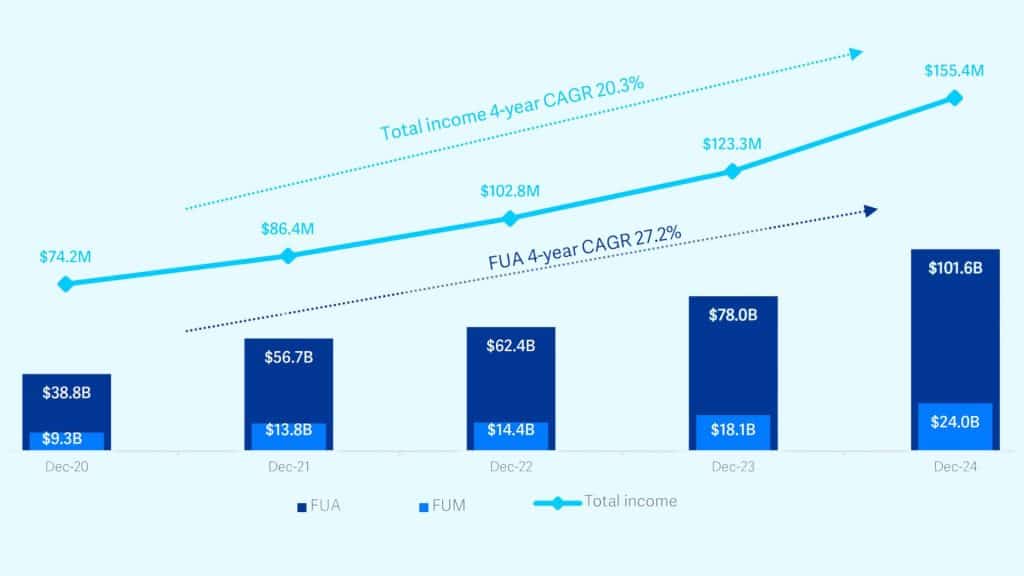

Netwealth (ASX: NWL) continues to cement its place as a leading wealth management platform, reporting a blockbuster half-year result. The company posted $8.5 billion in net inflows, an 80% year-on-year (YoY) surge, bringing funds under administration (FUA) to a record $101.6 billion. Profitability also climbed, with EBITDA margins expanding to 50.2%.

Despite these impressive figures, the market reaction was muted – down -0.28% to $31.72 – suggesting that strong growth was already baked into expectations. So with legacy players like AMP, Colonial, and BT haemorrhaging funds, can Netwealth sustain its momentum?

Key Growth Drivers

Netwealth continues to punch above its weight, capturing $8.5 billion in net inflows this half, driven by adviser migrations and growing demand from high-net-worth (HNW) and institutional clients.

Netwealth growth in FUA, FUM, and revenue

Netwealth’s competitive positioning has led to 100 basis points (bps) of market share gains over the past year. As legacy platforms like AMP, CBA/Colonial, and BT experience outflows, Netwealth is capitalising by offering a modern, tech-driven alternative that resonates with advisers and investors.

This led to a 26% jump in revenue to $155.4 million, driven by both transaction and management fees. Net profit after tax rose ~47% vs the prior corresponding period to $~58 million, with net margins rising by over 5 percentage points to 37.1%.

(Continues below)

Want to learn about A Rich Life’s number one small-cap growth stock with a market capitalisation under $300m? Join the waitlist to become a supporter of A Rich Life and you’ll receive a free special report about this under-the-radar small cap that could see profits soar in the years ahead.

Join The Waitlist To Become A Supporter, And Receive Our Free Special Report Directly To Your Inbox

The Short-Term: Expectations Not Excessive

The median FY25 earnings-per-share (EPS) forecast from 15 analysts is 44.3 cents (per Morningstar). Given EPS was 23.4 cents in the first half, this implies a second-half EPS of 20.9 cents – 10.7% lower than H1.

Considering history, this looks conservative. Over the past five years, second half earnings have exceeded the first half in every year except FY21, with an average increase of ~9%.

If second half revenue remains flat, full-year EPS would be ~47 cents (~37% YoY growth). If revenue grows 9% vs the first half, EPS could hit ~49 cents, representing a ~43% YoY increase.

Despite the strong numbers, Netwealth’s share price barely moved post-results. While six brokers (Morgans, Macquarie, Wilsons, Bell Potter, Jefferies, Barrenjoey) have revised their price targets, most remain close to or below the current price. Overall analyst ratings lean neutral to negative.

Putting all this together would indicate that expectations may not be as lofty as they’d seem from a simple glance at the PE ratio.

The Long-Term: What Could NWL Look Like in 2030?

FUA has grown at a steady 13-14% per half-year in recent years, and if this pace continues, Netwealth could reach $389 billion FUA by FY30 – surpassing the current FUA of the industry’s largest player today, Insignia ($223 billion). Given superannuation inflows, an ageing population, general market growth, and continued gains in market share, this projection doesn’t seem unreasonable.

As a reference point, the combined FUA of the top 10 platforms is just over $1 trillion today. So while ~$400 billion in FUA might seem too high by today’s standard, even assuming a conservative 10% growth in industry FUA would put the market at $1.6T by FY30.

My rough projections for FY30, based on historical trends, but accounting for the maturing business were:

- Average Platform FUA of ~$345 billion for FY30 (~28% p.a. FUA growth)

- 26bps platform revenue margin

- Average Managed Accounts FUM of ~$108B (35% p.a. FUM growth)

- 4bps revenue margin on MA FUM

- NPAT margin of 35%

- PE ratio of 45x.

Based on these numbers, that would put NWL at a market capitalisation of ~$14.1 billion for FY30, or an 84% premium to today’s price. That implies a return of ~13% p.a. between now and 2030.

As the saying goes, all models are wrong, but some are useful. So don’t treat these as a prediction, but a way of understanding what the current price implies.

In my opinion, these are the biggest upside and downside risks to the model:

- Revenue margin: Platform revenue/FUA has been trending down, but the rate of decline has slowed to 1.7% per half-year over the past two years. If this continues, 26 bps by FY30 is reasonable. But I suspect it may flatten out further as the business matures.

- FUA growth: Sustaining 13-14% growth per half-year may become more challenging as Netwealth scales.

- NPAT margins: Given a significant portion of the cost base is fixed, NPAT margins could expand as the business matures.

The Managed Accounts and Funds Management businesses are difficult to understand as their FUM is disclosed as a combined number, and revenues are grouped together (possibly with other items) under “other income”. As such these numbers have high levels of uncertainty, but only account for a small portion of the overall value.

A Family Affair

Michael Heine founded Netwealth in 1999 following the sale of his previous business to ING. Michael’s son, Matthew, joined Netwealth soon after, and the pair acted as Joint Managing Directors from 2016 until 2022, when Michael retired from day-to-day operations, but remained on the Board. Matthew is now Managing Director and CEO. The Heine family retains ~49% ownership.

Personally, I like family owned and operated businesses as it ensures a long-term focus. Matthew has proven himself to be a capable leader, and the effectively controlling stake makes it nearly impossible for any hostile takeover.

Is NWL a Buy?

On the plus side, the business boasts a long and consistent history of inflows and growing market share. Margins are attractive, and any expansion in revenue margins for the Managed Accounts business could have a significant top-line impact. It also seems that analysts may be underestimating growth in the second half, meaning potential upgrades in the short term.

The obvious risks include:

- Increasing competition from new entrants and smaller players

- Potential fee compression in the long term

- Revenue remains tied to market movements.

While Netwealth isn’t screaming “buy” at the current price, it remains a high-quality business with strong long-term potential. To paraphrase the Buffett cliché, I’d prefer to own a high-quality business at a fair price, than an average business at a low price.

I’ve watched Netwealth from the sidelines since its IPO and I’ve continuously underestimated it. I don’t plan to repeat the mistake. I plan to open a (small) position two days after this article is published. If the price becomes more attractive in future, I may look to increase my holding over time.

Disclosure: The author of this article does not currently own shares in NWL, but intends to purchase NWL shares no less than 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Ethical Investment Advisers Pty Ltd (ABN 26108175819) (AFSL 343937).

Want to learn about A Rich Life’s number one small-cap growth stock with a market capitalisation under $300m? Join the waitlist to become a supporter of A Rich Life and you’ll receive a free special report about this under-the-radar small cap that could see profits soar in the years ahead.

Join The Waitlist To Become A Supporter, And Receive Our Free Special Report Directly To Your Inbox