Northern Star Resources (ASX: NST) has posted a strong set of half-year results, with the company benefiting significantly from rising gold prices. The results highlight just how much leverage Northern Star has to the gold price, and with gold prices now significantly higher than during the first half, the company could be set for an even stronger second half.

Revenues Up, Profits Surge on Higher Gold Prices

For the half-year ended 31 December 2024, Northern Star reported revenue of $2.87 billion, up 28% from the previous year. Net profit after tax surged 155% to $506.4 million, demonstrating how higher gold prices directly translated into stronger earnings. The company’s realised gold price was $3,562 per ounce, consistent with the trading range of gold during the period. However, with the Australian dollar gold price currently sitting at $4,624 per ounce1, Northern Star is poised to benefit even further if these levels hold.

Cost Pressures and Production Growth

The company sold 804,140 ounces of gold during the half-year, up slightly from 780,785 ounces a year ago. All-in sustaining costs (AISC) rose to $2,105 per ounce, reflecting increased mining and processing costs, as well as higher royalties due to stronger gold prices. Despite these rising costs, the company’s profitability surged thanks to higher gold prices, with underlying EBITDA increasing 58% to $1.4 billion.

Growth Pipeline: De Grey Acquisition and Expansion Projects

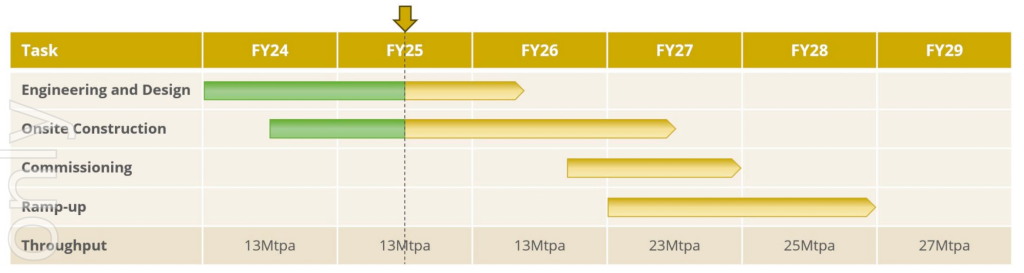

Looking ahead, Northern Star’s growth strategy remains firmly on track. The company is progressing with the $1.5 billion KCGM Mill Expansion Project, which is expected to improve production efficiency and output. However, this expansion has also had a significant impact on free cash flow, as major capital expenditures have been directed towards the project. While this investment is expected to drive long-term gains, it has weighed on short-term cash generation.

KCGM Expansion Project progress

Additionally, the proposed acquisition of De Grey Mining (ASX: DEG) is set to strengthen Northern Star’s production base, adding the large-scale Hemi deposit to its portfolio. With a mineral resource of 13.6 million ounces2, Hemi is one of the most significant new discoveries made in a tier 1 jurisdiction in recent decades. De Grey’s 2023 Definitive Feasibility Study projected a pre-production capex cost of $1.3 billion for Hemi3.

If approved by De Grey shareholders and the courts, the transaction is expected to be finalised in May 2025.

Capital Management: Bigger Dividends and Buybacks

Northern Star has been rewarding shareholders with increased capital returns. The company declared a record interim dividend of 25 cents per share (unfranked), up 67% from last year, representing 25% of cash earnings. Meanwhile, the $300 million share buyback program is 86% complete, reflecting management’s confidence in the business.

A Dirty Business

Gold mining remains a controversial industry, with significant environmental and social concerns. While some investors might shy away due to ethical considerations, others see gold exposure as a hedge against inflation and economic uncertainty. Northern Star’s strong financial position and growing production base make it an attractive option for those seeking leverage to the gold price.

Final Thoughts

Northern Star has demonstrated its strong leverage to rising gold prices, with profit growth far outpacing revenue growth. If the Australian dollar gold price remains near record highs, further increases in profitability should lie ahead. However, the heavy capital investment in the KCGM Mill Expansion Project has constrained free cash flow in the short term, and if the De Grey acquisition proceeds, Hemi will require further significant investment.

For investors looking for gold exposure, Northern Star presents a well-capitalised option with a clear growth trajectory.

Disclosure: The author of this article does not own shares in NST and will not trade NST shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Ethical Investment Advisers Pty Ltd (ABN 26108175819) (AFSL 343937).

Sources:

- GoldPrice.org. As at 13 February 2025.

- De Grey Mining, Mineral Resources & Ore Reserves (2024)

- De Grey Mining, Project Studies (2023).

Join The Waitlist To Become A Supporter, And Receive Our Free Special Report Directly To Your Inbox