We would first like to acknowledge the very real human cost of the pandemic tragedy and note that we are in no way excited by this terrible situation. Rather, we are keen to invest in the solutions.

This post is not financial advice, and you should click here to read our detailed disclaimer.

As you can imagine, over the last few weeks I’ve been trying to think of a company that could genuinely benefit from the coronavirus. But as it turns out, my favourite such idea was already on my watchlist.

I’m talking about a company called OpenLearning (ASX: OLL). Open Learning provides software that allows educators to create online courses and deliver them remotely. Initially, the company worked hard to help their clients build courses on the platform, and took a cut of the revenue from those courses. The problem with that model is that it discouraged universities from putting their most profitable courses online.

These days, the company is simply charging for their software, with pricing based on user numbers. That better aligns incentives, and encourages clients to deliver more of their courses online (especially the large very profitable core degree courses). You can see a brief overview of how educators create courses, below.

Importantly, the platform is designed to be more than just about content delivery. It also allows for staged interaction following a pattern of content delivery, question, answer, view other answers. This allows the course to keep students more engaged with interaction, and better replicates the classroom or seminar experience. You can see an example below.

When it last reported, OpenLearning has just $975,000 in annualised recurring revenue (ARR). However, its actual revenue throughout the year to December 2019 was higher, at $1.6 million. That’s because it makes revenue in three ways.

First, it sells the software as a service, for which it received $722,000 in 2019. Second, it still does sell some courses through its transaction based agreements in its market place. For that, OpenLearning received revenue of $248,000 in the last year, after deducting the revenue it passes on to course creators (a bit over 50%). Finally, the company also charges some clients service fees for help putting their courses on to the platform and it booked $589,000 in revenue last year for that.

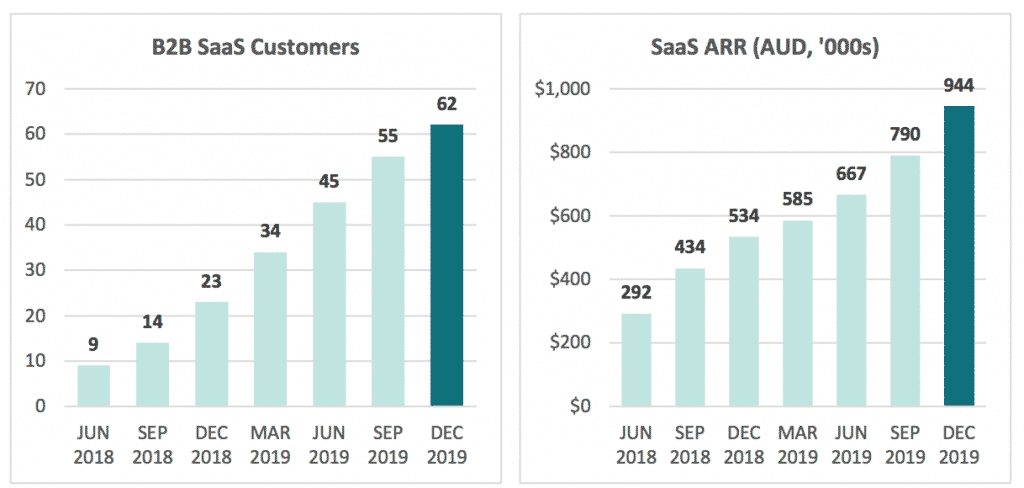

At the current share price of 13.5 cents, Open Learning has a market capitalisation of $24.4 million, which is 25 times its ARR. That’s normally very expensive, but as you can see below, the company was on-boarding new customers at a fast pace, before the coronavirus.

Importantly, when the company reported its results on February 28, it said:

“At present, OpenLearning has The Company is seeing increased demand and is in discussions with a number of higher education providers to design and deliver both non-accredited and accredited courses online as a result o recent disruptions in the higher education sector that have prevented a substantial number of international students from entering Australia before the start of the 2020 academic year.”

Additionally, the potential impact on higher education providers’ revenue from a potential decline in international students has led to renewed interest in diversifying their sources of revenue by offering short courses and micro-credentials to working professionals. OpenLearning is well placed to support higher education providers as they explore online learning as a means of delivering both accredited and non-accredited courses domestically in Australia, mainland China and around the world. “

This makes logical sense, since a pandemic requires social distancing in order to flatten the infection curve and stop healthcare systems being overwhelmed.

When I spoke to the CEO last week, he told me that UNSW, Newcastle, Charles Sturt, Western Sydney already use the platform to deliver accredited courses. When I checked Newcastle University courses on the platform, I could see that it does indeed use it to deliver the Graduate Certificate in Cyber Security, a postgraduate degree costing over $19,000 for international students. This is obviously only a drop in the ocean of what the university could use OpenLearning for, if it felt motivated to beef-up its online delivery capabilities.

I was hoping to find equally prestigious courses from the other universities mentioned, but I couldn’t. Of course that does not mean they don’t use the platform. Indeed, UNSW itself said back in 2017 that “5,000 on-campus UNSW students have already used OpenLearning over the past year and UNSW’s open public courses on OpenLearning have reached over 40,000 students worldwide.” I’m fairly confident that UNSW already delivers the Master of Engineering Science (Petroleum) Open Learning on the platform.

What I see, today, is what Nanosonics would call “improving fundamentals for adoption.” We have large prestigious Australian universities already using a platform that can solve a large pressing problem they have: delivering courses in an engaging way online. All they need to do is use resources to scale up their use of the platform, and OpenLearning will automatically benefit.

Finally, I would be remiss not to note that Regal Funds management have been selling out. Over the last few weeks rumours have been swirling that this fund is in acute distress and facing redemptions. On top of that, portfolio manager Julian Babarczy resigned after 14 years at the hedge fund in January. Changing managers can often lead to redemptions, and many people are wondering why he left. That would make them forced sellers. In mid January they only had about $1 million worth of stock. About that much has traded since then, so if they are the major seller, they may not have a whole lot of stock left.

Luckily for OpenLearning it currently has just over $7 million in the bank. When I spoke to the CEO, Adam Brimo, I put it to him that the company would need to raise more capital, but he maintained they did not, or if they did, it would not be for a while. He pointed to the fact that in the last quarter the company did negative free cash flow (cash burn) of $1 million, so they have more than a year’s worth of cash to spend.

This could turn out to be true, but I’ll be very worried if cash burn increases next quarter. The CEO was clear that the most recent quarter was a good guide to burn going forward (which should reduce as revenue grows).

3 Ways To Win

I see three ways to win with this stock:

- Chaos continues and the stock languishes but sales improve, and those new customers stick around, boosting growth rates. When the pandemic passes, ARR is much higher and growing quickly. The stock re-rates in a few years.

- Chaos continues but the narrative around OpenLearning flies and it becomes a hot “coronavirus stock”. The share price flies on hype and I sell.

- The pandemic is solved quickly and doesn’t boost OpenLearning much in the short term, but does put online teaching more on the forefront and accelerates the tailwind that is already blowing in that direction. The stock plods along for a while but is well managed and I make decent returns as markets in general improve.

For these reasons, I have been accumulating the stock at above current prices, paying 14c to 17c.

This article was originally published in the periodical published on March 13, delivered to Supporters on Friday evening. While we are not currently accepting new Supporters, you can join the waitlist to receive an invitation at the earliest moment available.

Please note that the author may buy or sell at any time and this is not in any way a recommendation. You should not act on any information contained herein and the author will not be buying above the price mentioned and may in fact sell.

The above post is out of date, you should not act on it and my latest thoughts can be found here.