The OneView Healthcare plc (ASX:ONE) stock price is up over 150% since S3 Consortium, trading as StocksDigital, began promoting its Oneview stock report to retail investors. In turn, StocksDigital appears to have paid websites such as Macrobusiness, TheBull.com.au, FNArena and AussieStocks Forum to email their subscribers the same Oneview Stock Report, this morning.

The result is that potentially hundreds of thousands of retail investors received a report from “The Next Investors” declaring OneView Healthcare to be its “2021 Tech Stock Pick of the Year”.

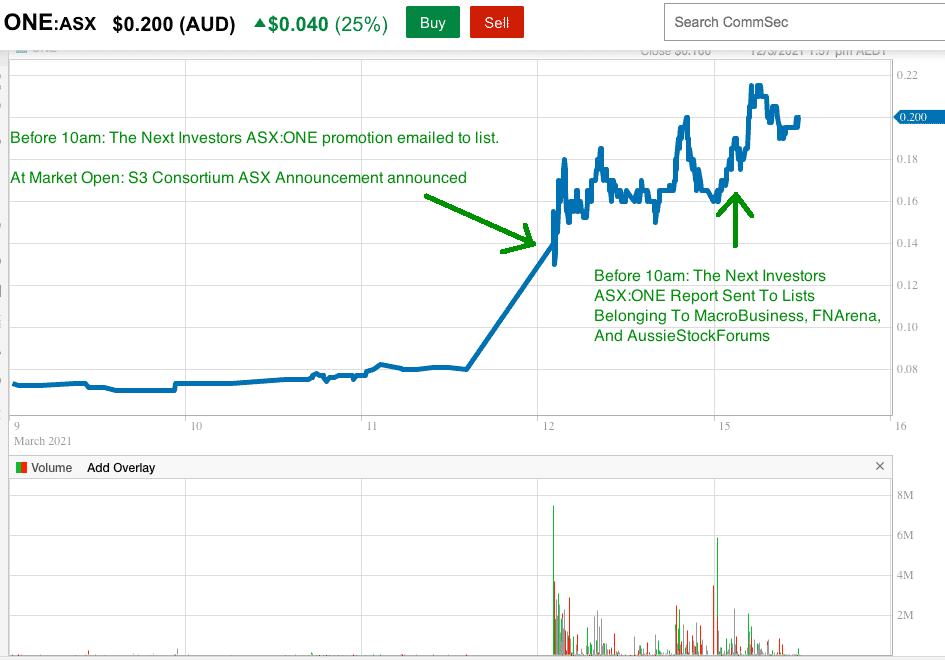

You can see the approximate timeline of events in the chart above. Below, I chronical the key events that I believe have driven this epic 150% share price run. Please note these times are based on the emails forwarded to us from our readers, and may vary if some senders staggered the send to large lists.

First Mass Email (From Next Investors)

Date: 12 March 2021 at 09:24:45 AEST

From: Next Investors <[email protected]>

Subject: FINALLY – Our New 2021 Tech Pick of the Year

ASX Announcement Describing Deal Between OneView and S3 Consortium

Date: 12 March 2021 at 010:21 AEST

Subject: OneView Healthcare and Stocks Digital Agreement

Content Summary:

- OneView to issue S3 6,250,000 shares to S3 “in lieu of $375,000” as consideration for S3 using StocksDigital (aka The Next Investors) to “share its research, commentary and investment thesis on the company.”

- S3 Consortium and Other Investors in the S3 Consortium Network to buy 16,666,666 shares at a price of 6 cents per share (against the prior share price of 8c). This is a $1m investment in total.

Second Mass Email (From Aussie Stock Forums)

Date: Mon, 15 Mar 2021, 08:26

From: Aussie Stock Forums <[email protected]>

Subject: The Next Investors 2021 Tech Stock Pick of the Year

Third Mass Email (From FNArena)

Date: Mon, 15 Mar 2021, 09:08

From: FNArena [email protected]

Subject: The Next Investors 2021 Tech Stock Pick of the Year

Fourth Mass Email (From TheBull.com.au)

Date: Mar 15, 2021, 9:00 AM

From: The BULL <[email protected]>

Subject: The Next Investors 2021 Tech Stock Pick of the Year

Fifth Mass Email (From Macrobusiness)

Date: Mar 15, 2021, 9:31 AM

From: MacroBusiness.com.au <[email protected]>

Subject: The Next Investors 2021 Tech Stock Pick of the Year

Investors Buy Shares In Oneview (ASX:ONE) After Emails

Collectively, these emails would have probably reached hundreds of thousands of Australian investors. As a result, the OneView Healthcare PLC (ASX:ONE) share price has risen from 8 cents to 20 cents, in just 2 trading days. That’s a whopping gain of 150% thanks largely to a co-ordinated campaign of sending emails intended to promote the thesis for buying Oneview Healthcare stock.

In the 10 days prior to the promotion by StockDigital, fewer than 1.2 million shares in Oneview Healthcare traded per day; and mostly for less than 8 cents per share. Therefore less than $100,000 in shares were changing hands each day.

However, on the day that the promotion began (12 March) 255 million shares traded, and today, more than 78 million shares, worth over $14 million, have already changed hands at 1:38pm. That’s a truly stupendous increase and a testament to the large amount hot money chasing the stock, based on The Next Investors Oneview report.

OneView CEO James Fitter Performance Pay

Interestingly, the 2019 Oneview Annual Report discloses that the CEO of OneView will be paid up to 525,000 RSUs (restricted share units) based on the 5 year total shareholder return from 2016. That means that the recent rocketing Oneview Healthcare share price is very good news for him, personally. We don’t doubt the power of incentives!

AFSL Holders Giving Conflicted Advice On OneView Healthcare

One fact investors should be aware of is that the law permits AFSL holders to give advice even when there are conflicts of interest. For example, S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). In its promotions, it discloses that:

“…investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this article. Investors should consider this article as only a single factor in making any investment decision. The publishers of this article also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this article.”

Obviously, in this case we know that S3 doesn’t only hold stock but is intending to be paid in stock, for sharing its research with others. I’m awestruck at the intense possibility of making large amounts of money with this business model. But I also wonder how many people buying ASX:ONE shares at 20 cents realise that the people promoting the stock bought at 6 cents, and not the prevailing share price. That fact is not included in their report (though it is in the ASX Announcement).

We Have No View On The Oneview Stock Price

At A Rich Life, we strive to cover market developments in small-cap stocks that are often neglected by other news periodicals such as The Australian Financial Review.

At a share price of 8 cents, OneView Healthcare had a market capitalisation of about $32 million. Over two trading days, S3 Consortium emailed investors on its email list, and the lists belonging to at least three other publications. I don’t know the exact number of emails that were sent but my experience suggests that it would be extremely obvious that promoting the stock to so many people at the same time could drastically move the share price.

This article is not a view on the stock at all. The company itself seems to be attempting to turnaround its story after falling over 99% from a OneView share price of over $5 to a OneView share price of under $0.05.

This article is merely seeking to explain how S3 Consortium’s financial advice business model can cause extreme moves in the share prices of small listed companies.

I’m not quite sure what the implications of the Next Investors business model is. Essentially, it seems to me that rather than being paid by subscribers to send emails to its subscribers, S3 Consortium is paid by Oneview to send emails out to its subscribers (who do not pay anything). Given how profitable it would appear this business model is for S3, it would seem that we will get more players doing it.

While we do not suggest a scintilla of wrongdoing, we do think that this culture of mass promoting stock reports will lead to overpricing in the promoted securities (speaking generally, not specifically Oneview), and an unfortunate misallocation of capital. The extreme share price move in Oneview is a testament to the large number of people who will buy shares in response to stock promotions, even when the company itself is paying the AFSL holder to send those promotions.

As this trend plays out over time, a lot of these promoted stocks will trade at ridiculous prices, and someone will be left holding the bag.

And, dear reader; we hope that it is not you!

PS: Every time I write an article like this we get communications from shareholders labouring under the impression that I’m criticising their stock and it’s their job to defend it. So remember, none of this article is predicting the share price. I am just documenting why the share price rocketed over 150% in just two trading days. Prior to that the company’s share price had recovered from lows of around 4 cents to the 8 cents it was trading at when the promotion began.

Addendum 16 March: Sharesight shows that retail investors were piling into the stock.

Here’s the top 5 #ASX trades by Sharesight users on March 15 2021 pic.twitter.com/txaFuBRe2C

— Sharesight (@sharesight) March 15, 2021

This article documents some of the factors influencing a company’s share price, but the article is not intended financial advice, it is general in nature, and our disclaimer is here. The author has no position short or long in this company.

Edit: 15/03/2021 to include The Bull as an email sending organisation.